The Illinois Comprehensive Commercial Deed of Trust and Security Agreement is a legally binding document used in commercial real estate transactions to secure a loan. This agreement is specifically designed for properties located in Illinois and provides a comprehensive framework for lenders and borrowers to protect their interests. Keywords: Illinois, Comprehensive Commercial Deed of Trust, Security Agreement, commercial real estate transactions, loan, properties, lenders, borrowers. This agreement includes various terms and conditions, outlining the rights and responsibilities of both the lender (also known as the beneficiary) and the borrower (also known as the trust or). It serves as a security measure for the lender, providing assurance that their loan will be repaid in the event of default or foreclosure on the property. The Illinois Comprehensive Commercial Deed of Trust and Security Agreement typically entails the following key components: 1. Property Description: The agreement begins with a detailed description of the property that is being used as collateral for the loan. This includes the address, legal description, and any other relevant information necessary for identification. 2. Parties Involved: The agreement clearly identifies the lender and borrower, including their legal names, addresses, and contact information. It may also include information about any additional parties involved, such as guarantors. 3. Loan Terms: This section outlines the specific terms of the loan, including the loan amount, interest rate, repayment schedule, and any other pertinent details. It ensures that both parties are aware of the agreed-upon terms and prevents misunderstandings or disputes. 4. Security Interest: The agreement establishes the lender's security interest in the property, which allows them to take possession or sell the property to recover their investment if the borrower defaults on the loan. It also includes provisions for any additional collateral or assets provided by the borrower to secure the loan. 5. Default and Remedies: This section details the events that would be considered a default, such as missed payments or violation of other terms mentioned in the agreement. It outlines the remedies available to the lender, including foreclosure proceedings, the appointment of a receiver, or other legal actions. 6. Additional Provisions: The Illinois Comprehensive Commercial Deed of Trust and Security Agreement may contain various additional provisions, depending on the specific needs and requirements of the parties involved. These provisions may include clauses regarding insurance, taxes, maintenance responsibilities, and restrictions on property use. Different types or variations of the Illinois Comprehensive Commercial Deed of Trust and Security Agreement may exist, depending on the specific circumstances of the transaction. These variations could include agreements for different property types, loan purposes, or special provisions tailored to specific industries or financing arrangements. Overall, the Illinois Comprehensive Commercial Deed of Trust and Security Agreement is crucial for protecting the interests of lenders and borrowers in commercial real estate transactions. It establishes a legal framework that ensures transparency, clear expectations, and appropriate remedies in case of default or other unforeseen events.

Illinois Comprehensive Commercial Deed of Trust and Security Agreement

Description

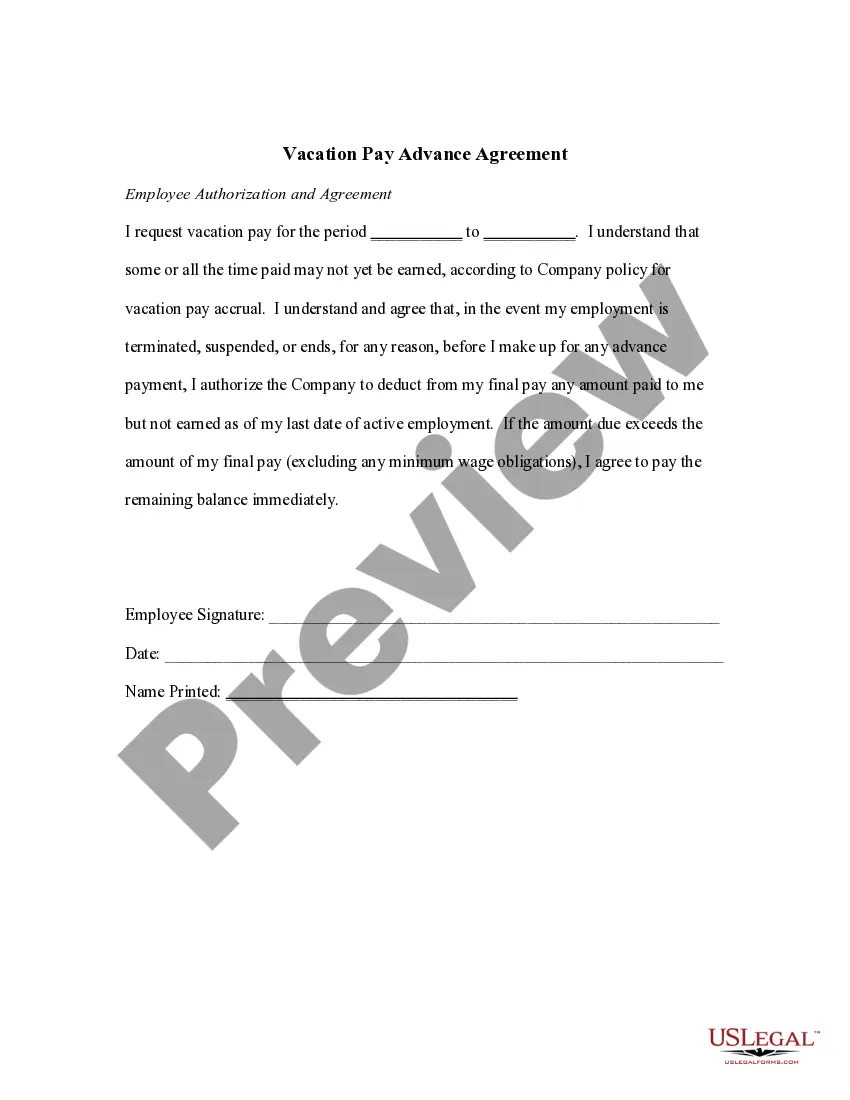

How to fill out Illinois Comprehensive Commercial Deed Of Trust And Security Agreement?

If you wish to total, download, or produce legal papers web templates, use US Legal Forms, the largest variety of legal varieties, which can be found on the web. Take advantage of the site`s simple and convenient look for to find the paperwork you want. Different web templates for organization and person reasons are categorized by types and suggests, or search phrases. Use US Legal Forms to find the Illinois Comprehensive Commercial Deed of Trust and Security Agreement in just a couple of mouse clicks.

In case you are previously a US Legal Forms consumer, log in to the accounts and click the Download key to find the Illinois Comprehensive Commercial Deed of Trust and Security Agreement. You can also gain access to varieties you formerly downloaded inside the My Forms tab of your own accounts.

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have chosen the shape for your appropriate city/nation.

- Step 2. Use the Preview option to examine the form`s information. Don`t forget about to read the description.

- Step 3. In case you are unsatisfied together with the type, take advantage of the Look for field at the top of the display to locate other types from the legal type format.

- Step 4. Upon having located the shape you want, click the Purchase now key. Select the prices plan you like and put your accreditations to sign up for the accounts.

- Step 5. Procedure the financial transaction. You should use your bank card or PayPal accounts to complete the financial transaction.

- Step 6. Select the format from the legal type and download it in your device.

- Step 7. Total, revise and produce or indication the Illinois Comprehensive Commercial Deed of Trust and Security Agreement.

Each legal papers format you purchase is yours permanently. You possess acces to each type you downloaded inside your acccount. Click the My Forms segment and pick a type to produce or download once more.

Be competitive and download, and produce the Illinois Comprehensive Commercial Deed of Trust and Security Agreement with US Legal Forms. There are many professional and express-distinct varieties you may use to your organization or person needs.