A Trust is an entity which owns assets for the benefit of a third person (the beneficiary). A Living Trust is an effective way to provide lifetime and after-death property management and estate planning. When you set up a Living Trust, you are the Grantor. Anyone you name within the Trust who will benefit from the assets in the Trust is a beneficiary. In addition to being the Grantor, you can also serve as your own Trustee. As the Trustee, you can transfer legal ownership of your property to the Trust. A revocable living trust does not constitute a gift, so there are no gift tax consequences in setting it up.

Illinois Revocable Trust Agreement Regarding Coin Collection

Description

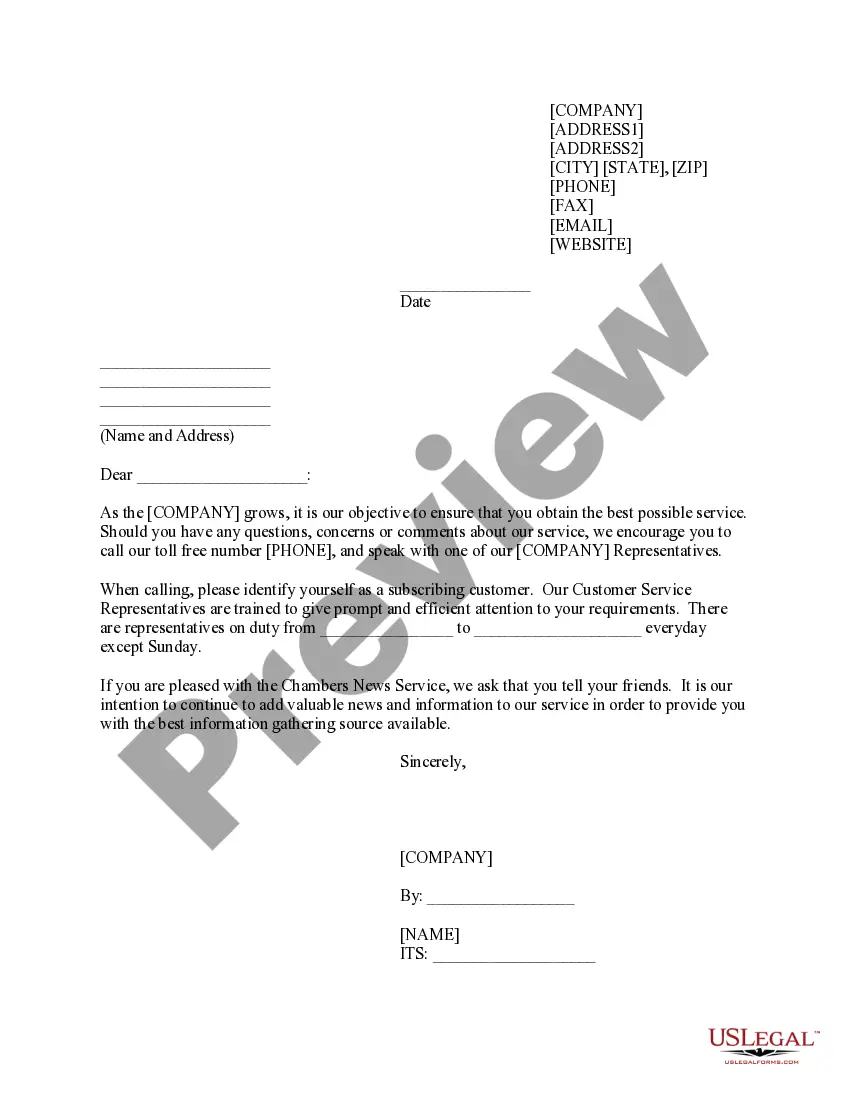

How to fill out Revocable Trust Agreement Regarding Coin Collection?

Finding the correct official document template can be a challenge.

Naturally, there are numerous templates accessible online, but how can you find the official document you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Illinois Revocable Trust Agreement Concerning Coin Collection, which can be utilized for business and personal needs.

First, ensure you have selected the correct document for your city/state. You can review the form using the Review option and check the form description to confirm it is the right one for you.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Illinois Revocable Trust Agreement Concerning Coin Collection.

- Use your account to access the legal documents you have previously purchased.

- Navigate to the My documents section of your account and obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

Form popularity

FAQ

Yes, credit card companies can pursue assets in a trust if the trust is revocable. Under the Illinois Revocable Trust Agreement Regarding Coin Collection, assets remain susceptible to claims by creditors, including credit card companies, after your death. This vulnerability underscores the importance of careful estate planning, as trust assets do not offer immunity from debt collection. Consulting with professionals can help you strategize appropriately.

Generally, a revocable trust does not protect your assets from creditors. The Illinois Revocable Trust Agreement Regarding Coin Collection allows you to manage your assets during your lifetime, but it does not shield them from creditor claims. Since you retain control over the trust assets, they remain part of your estate and can be claimed by creditors if necessary. Therefore, individuals looking for asset protection may want to explore other options.

Yes, creditors can access assets held in a revocable trust after your death. This is because the Illinois Revocable Trust Agreement Regarding Coin Collection does not provide the same protections against creditors as an irrevocable trust. Upon your passing, the assets in the trust may become part of your estate, making them subject to creditor claims during probate. It is essential to consider this when planning your estate.

To avoid inheritance tax with a trust, consider setting up an Illinois Revocable Trust Agreement Regarding Coin Collection, which can help in estate planning. By transferring assets into the trust, you may reduce their value for estate tax purposes. Consulting with legal professionals can further enhance your strategies and ensure your trust structure aligns with tax laws.

In Illinois, trust documents do not require notarization to be valid, but various legal experts recommend having them notarized to add an extra layer of security. Proper execution of an Illinois Revocable Trust Agreement Regarding Coin Collection, including having witnesses or a notary, can help prevent disputes in the future. Consider consulting legal services to ensure your documents meet all requirements.

Yes, an irrevocable trust is subject to the 5 year rule. This rule can impact the transfer of assets and their eligibility for government support. It's vital to understand how your Illinois Revocable Trust Agreement Regarding Coin Collection is structured, as it can affect your financial planning and potential tax implications.

The 5 year rule for trusts refers to the time period during which certain transactions might affect a beneficiary's eligibility for government assistance programs. In the context of an Illinois Revocable Trust Agreement Regarding Coin Collection, this period often concerns assets transferred to the trust. It's essential to plan accordingly to ensure compliance and protect your assets.

To obtain a copy of a trust document in Illinois, you can contact the trustee named in the Illinois Revocable Trust Agreement Regarding Coin Collection. The trustee is responsible for managing the trust and can provide you with the necessary documents. If you are not the trustee, you may need to show your interest or relation to the trust to gain access to the document.

Filing a trust in Illinois isn't a standard requirement since trusts generally do not get filed with the court. To formalize an Illinois Revocable Trust Agreement Regarding Coin Collection, simply create the document, sign it, and then fund it with your assets. You may want to inform your beneficiaries and maintain organized records. If you face complexities or have questions about the process, consider using platforms like uslegalforms, which offer resources and templates to guide you.

Generally, a trust, including an Illinois Revocable Trust Agreement Regarding Coin Collection, does not need to be filed with the court. This allows for privacy, as the terms of the trust remain confidential. However, if the trust involves estate matters or becomes irrevocable upon your passing, it may need to be integrated into the probate process. Consulting with a qualified attorney can provide clarity on specific needs related to filing trusts in Illinois.