Illinois Investment Letter regarding Intrastate Offering is a document that provides detailed information about investment opportunities within the state of Illinois. This letter is aimed at potential investors who are interested in participating in intrastate offerings, which refer to investment opportunities available only to residents and businesses within the state. The Illinois Investment Letter regarding Intrastate Offering outlines the various types of investment opportunities within the state, such as local businesses, startups, real estate projects, and other ventures that require funding. It highlights the benefits of investing in intrastate offerings, including the potential for growth, job creation, and economic development within Illinois. Additionally, the letter explains the regulatory framework surrounding intrastate offerings, ensuring that investors understand the legal requirements and limitations associated with these investments. It may provide information about the Illinois Securities Act and the rules and regulations enforced by the Illinois Secretary of State's office. There might be different types of Illinois Investment Letter regarding Intrastate Offering, depending on the nature of the offerings. These may include: 1. Illinois Real Estate Investment Letter: Focusing exclusively on intrastate real estate investment opportunities within Illinois, this letter provides in-depth information about local real estate markets, trends, and potential projects that offer investment prospects. 2. Illinois Startups Investment Letter: This letter targets investors interested in early-stage startups located within the state. It showcases promising Illinois-based startups seeking funding and provides insights into the local startup ecosystem, entrepreneurial support networks, and success stories. 3. Illinois Small Business Investment Letter: Specifically tailored for investors looking to support and invest in small businesses operating within the state, this letter highlights the importance of local businesses and offers detailed information about various intrastate investment opportunities. 4. Illinois Economic Development Investment Letter: This type of letter focuses on larger-scale investment options that contribute to the overall economic development of Illinois. It showcases infrastructure projects, large-scale real estate developments, and other initiatives aimed at driving economic growth within the state. Overall, the Illinois Investment Letter regarding Intrastate Offering serves as a comprehensive guide for investors, providing essential information on available investment opportunities, potential risks, legal requirements, and the benefits of participating in intrastate offerings within the state of Illinois.

Illinois Investment Letter regarding Intrastate Offering

Description

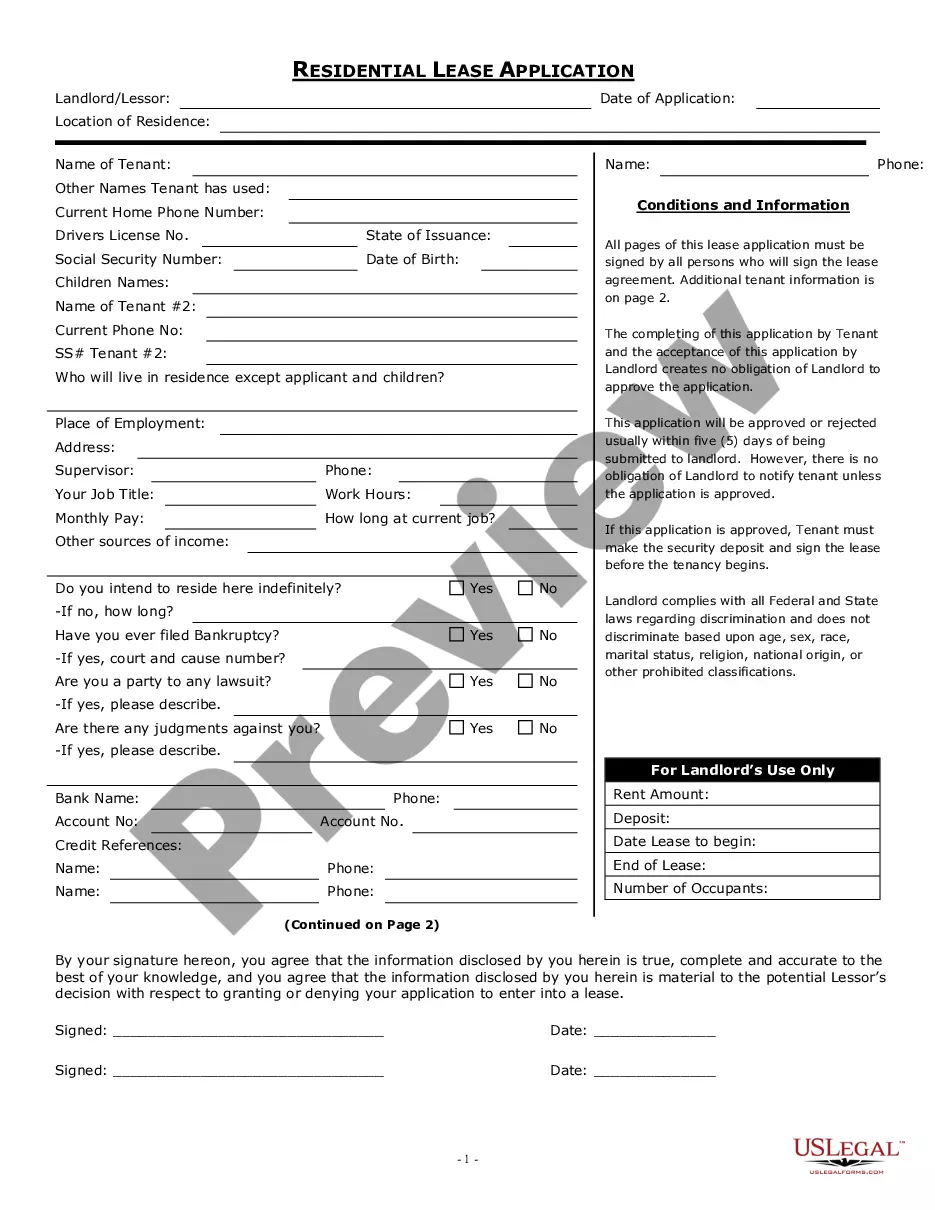

How to fill out Investment Letter Regarding Intrastate Offering?

If you require to complete, download, or print lawful document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site’s straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After locating the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your information to sign up for an account.

Step 5. Complete the purchase. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to discover the Illinois Investment Letter concerning Intrastate Offering in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Illinois Investment Letter regarding Intrastate Offering.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/region.

- Step 2. Use the Review option to examine the content of the form. Don’t forget to read the description.

- Step 3. If you are unhappy with the form, use the Search area at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

Certain offerings may be exempt from Blue Sky Laws, including small business investments and specific intrastate offerings that meet defined criteria. These exemptions often enable companies to raise capital without facing extensive regulatory hurdles. Understanding these exemptions is essential for effectively preparing an Illinois Investment Letter regarding Intrastate Offering, ensuring that your investment is compliant while maximizing opportunities.

In Illinois, the Blue Sky Law aims to protect investors by requiring thorough disclosures and regulating securities transactions. These laws encompass guidelines for issuing securities, including exemptions for certain intrastate offerings. When crafting an Illinois Investment Letter regarding Intrastate Offering, it’s crucial to navigate these regulations to ensure compliance and transparency.

The two primary types of Blue Sky Laws are anti-fraud provisions and registration requirements. Anti-fraud provisions protect investors from deceitful practices, while registration requirements mandate that securities offerings file necessary documentation with state authorities. In Illinois, compliance with these regulations is vital when drafting an Illinois Investment Letter regarding Intrastate Offering.

'Blue sky' refers to the idea of a clear, unobscured view, which relates to transparency in investments. This term is used to indicate that companies must provide full disclosure about their financial health and investment risks. Thus, when preparing an Illinois Investment Letter regarding Intrastate Offering, it is crucial to ensure all required information is clearly presented.

Blue Sky Laws primarily regulate the sale of securities to protect investors from fraud. These laws ensure that companies offer detailed information about their investment opportunities, including risks and potential rewards. In Illinois, understanding how these regulations apply is essential for creating an Illinois Investment Letter regarding Intrastate Offering, which helps investors receive necessary disclosures.

Rule 147 focuses on exempting intrastate offerings from federal registration requirements, primarily for initial fundraising efforts. In contrast, Rule 144 provides a framework for the resale of restricted securities after holding them for a specified period. Understanding these distinctions is crucial for businesses considering the Illinois Investment Letter regarding Intrastate Offering as a means to raise capital effectively.

As stated earlier, Rule 147 allows for intrastate offerings that exempt local issuers from federal registration when selling securities solely within their state. This rule encourages investment within communities and supports local businesses. Leveraging the Illinois Investment Letter regarding Intrastate Offering ensures that businesses comply with both state and federal guidelines.

Yes, intrastate offerings under Rule 147 are exempt from federal registration requirements, provided they meet the necessary criteria. This exemption allows companies to focus on raising funds locally without the complexity of federal regulations. Using the Illinois Investment Letter regarding Intrastate Offering can further streamline your fundraising efforts and ensure compliance with local laws.

The limited offering exemption in Illinois allows companies to raise a specific amount of capital without undergoing full registration. This exemption typically benefits small businesses and startups, enabling them to attract local investors. By leveraging the Illinois Investment Letter regarding Intrastate Offering, issuers can comply with state rules while effectively accessing necessary funds.

To qualify under Rule 147, a company must conduct a significant portion of its business within Illinois and sell a majority of its securities to state residents. Additionally, the issuer needs to maintain required records and use an Illinois Investment Letter regarding Intrastate Offering. Meeting these criteria ensures a smoother fundraising process while protecting both the investors and the company.