Illinois Agreement to Partners to Incorporate Partnership

Description

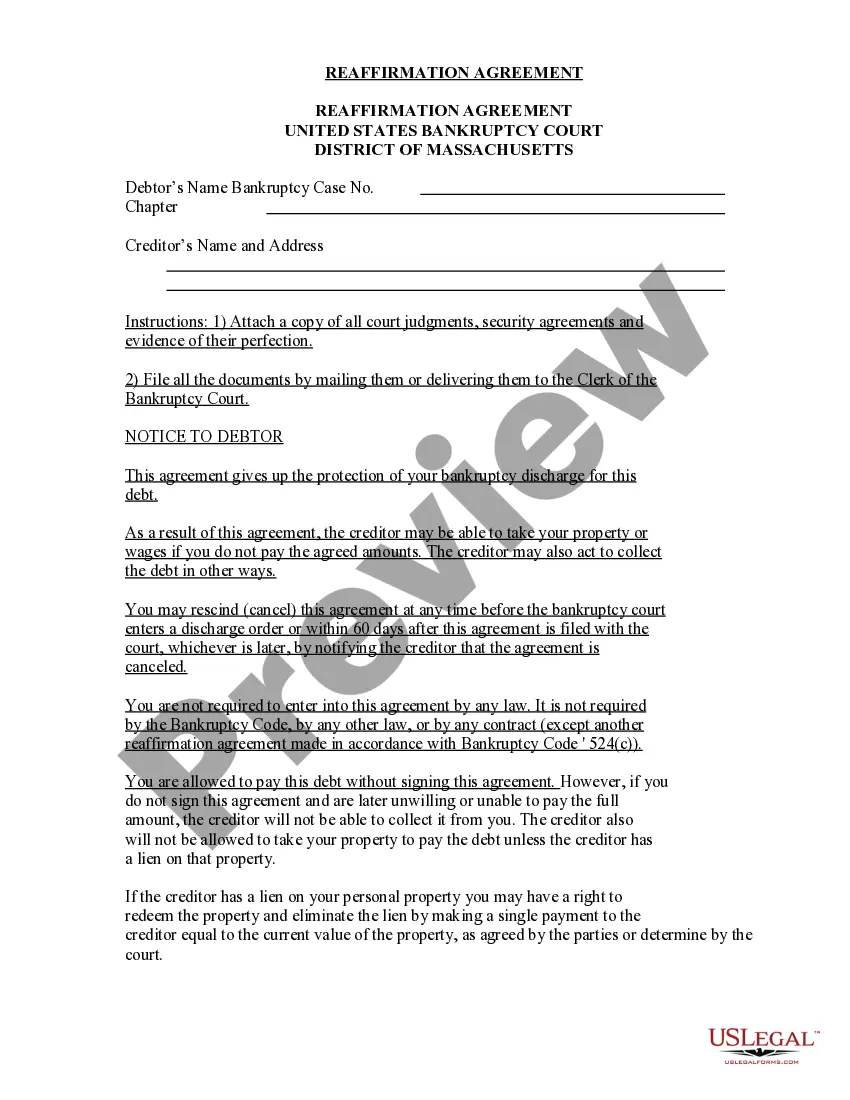

The articles of incorporation is a document that must be filed with a state in order to incorporate. Information typically required to be included are the name and address of the corporation, its general purpose and the number and type of shares of stock to be issued.

How to fill out Agreement To Partners To Incorporate Partnership?

Selecting the appropriate legal document template can be a challenge.

Of course, there are numerous templates accessible online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Illinois Agreement to Partners to Establish Partnership, which can be utilized for both business and personal requirements.

If the form does not meet your requirements, use the Search bar to find the correct form. Once you are confident that the form is accurate, click the Purchase now button to acquire the form. Choose the pricing plan you desire and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the obtained Illinois Agreement to Partners to Establish Partnership. US Legal Forms is the largest collection of legal forms where you can find a wide array of document templates. Take advantage of the service to obtain professionally crafted paperwork that adheres to state requirements.

- All forms are verified by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the Illinois Agreement to Partners to Establish Partnership.

- Use your account to review the legal forms you have previously purchased.

- Go to the My documents tab in your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure you have selected the correct form for your city/state. You can browse the form using the Preview button and review the form details to confirm it is the right one for you.

Form popularity

FAQ

The agreement between two partners is called a partnership agreement. This document serves as the foundation for the partnership, outlining the various aspects of the business relationship. It helps prevent misunderstandings and legally binds the partners to their commitments. Using the Illinois Agreement to Partners to Incorporate Partnership can ensure you capture all the necessary details in your agreement.

To register a partnership in Illinois, you need to file the necessary documents with the Illinois Secretary of State. This process includes completing a registration form and paying any associated fees. Once registered, you should obtain an Employer Identification Number (EIN) from the IRS for tax purposes. Consider creating an Illinois Agreement to Partners to Incorporate Partnership as part of your registration preparations.

The legal document of a partnership agreement identifies the essential terms of a business partnership. It defines the nature of partnership contributions, profit-sharing, and the management structure. This document serves as a blueprint for how the partnership operates legally. Utilizing the Illinois Agreement to Partners to Incorporate Partnership can help you draft a comprehensive and enforceable agreement.

To legalize a partnership agreement, both parties must sign the document in the presence of a witness or notary public. This process often requires you to register the agreement with local or state authorities, depending on your jurisdiction. It is advisable to consult an attorney to ensure compliance with laws and regulations. The Illinois Agreement to Partners to Incorporate Partnership is a helpful resource for this process.

The legal agreement between a boyfriend and girlfriend is often referred to as a cohabitation agreement. This document establishes the rights and responsibilities of each partner concerning shared assets and obligations. While not specifically an Illinois Agreement to Partners to Incorporate Partnership, it can be essential for clarifying expectations in a romantic relationship, particularly for shared finances and property.

To write a business agreement between two partners, start by clearly defining each partner's roles and contributions. Next, outline the financial arrangements, including how profits and responsibilities will be shared. Provide guidelines for resolving disputes and adding new partners in the future. Using the Illinois Agreement to Partners to Incorporate Partnership can streamline this process and ensure you cover all critical elements.

The legal document that outlines the relationship between partners is known as a partnership agreement. This vital document details the roles, responsibilities, profit-sharing, and decision-making processes of each partner. It serves to protect each party’s interests and clarify expectations. Creating an Illinois Agreement to Partners to Incorporate Partnership will solidify these terms legally and effectively.

The written agreement between partners is generally referred to as a partnership agreement. This document lays out the terms and conditions under which the partnership operates. It is essential to have a clear partnership agreement in place to avoid misunderstandings and ensure that all partners are on the same page. Utilizing the Illinois Agreement to Partners to Incorporate Partnership can help you establish this important document.

A partnership agreement should include the partnership’s name, all partners’ names, each partner’s contribution and responsibility, and how profits and losses will be shared. Additionally, addressing dispute resolution and exit strategies can prevent future conflicts. Utilizing the Illinois Agreement to Partners to Incorporate Partnership from uslegalforms provides a comprehensive framework to cover all necessary topics.

Writing a simple partnership agreement involves clearly defining the names of the partners, the partnership's business purpose, and how the profits and losses will be shared. It’s important to address each partner's contributions and responsibilities to ensure accountability. Our Illinois Agreement to Partners to Incorporate Partnership template can help streamline this process, making it straightforward and efficient.