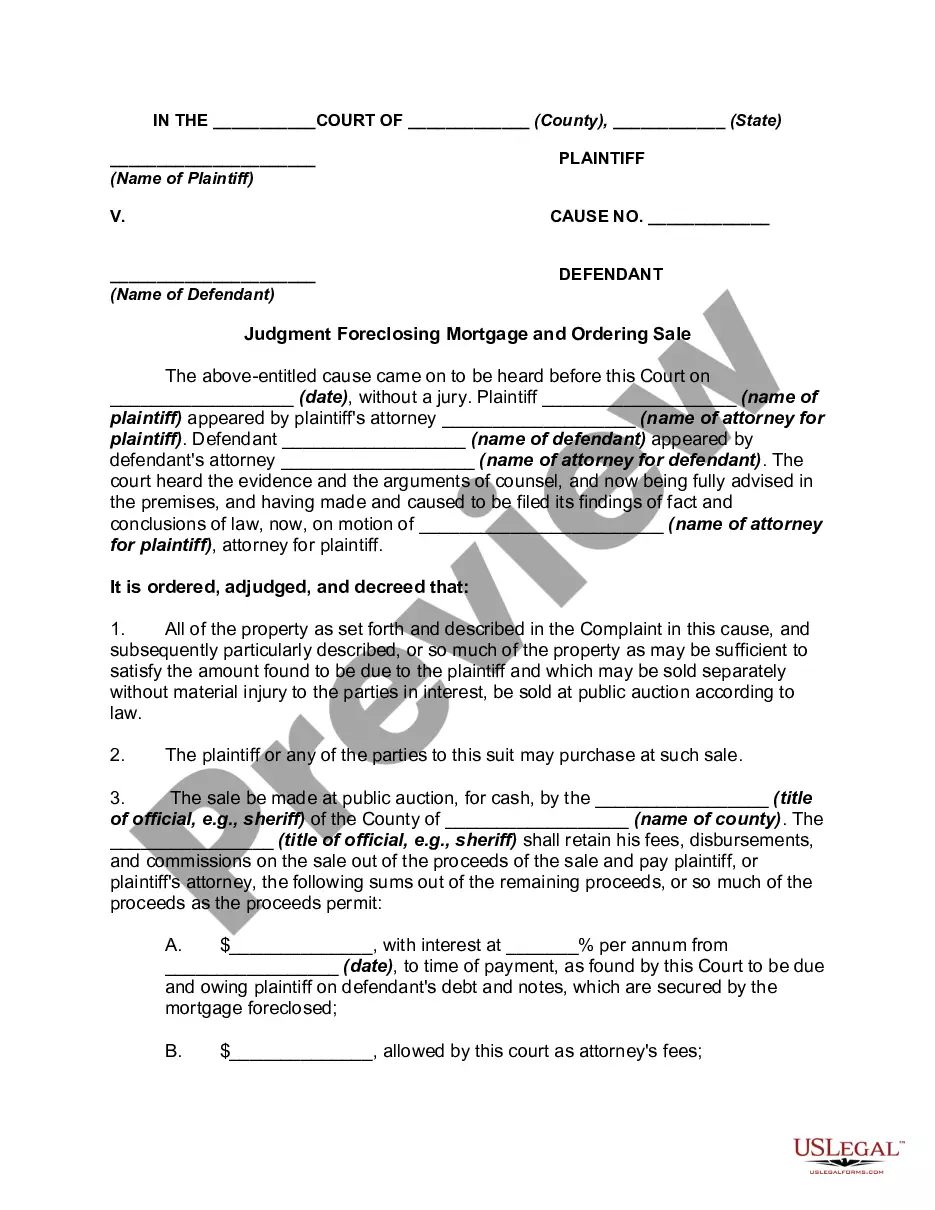

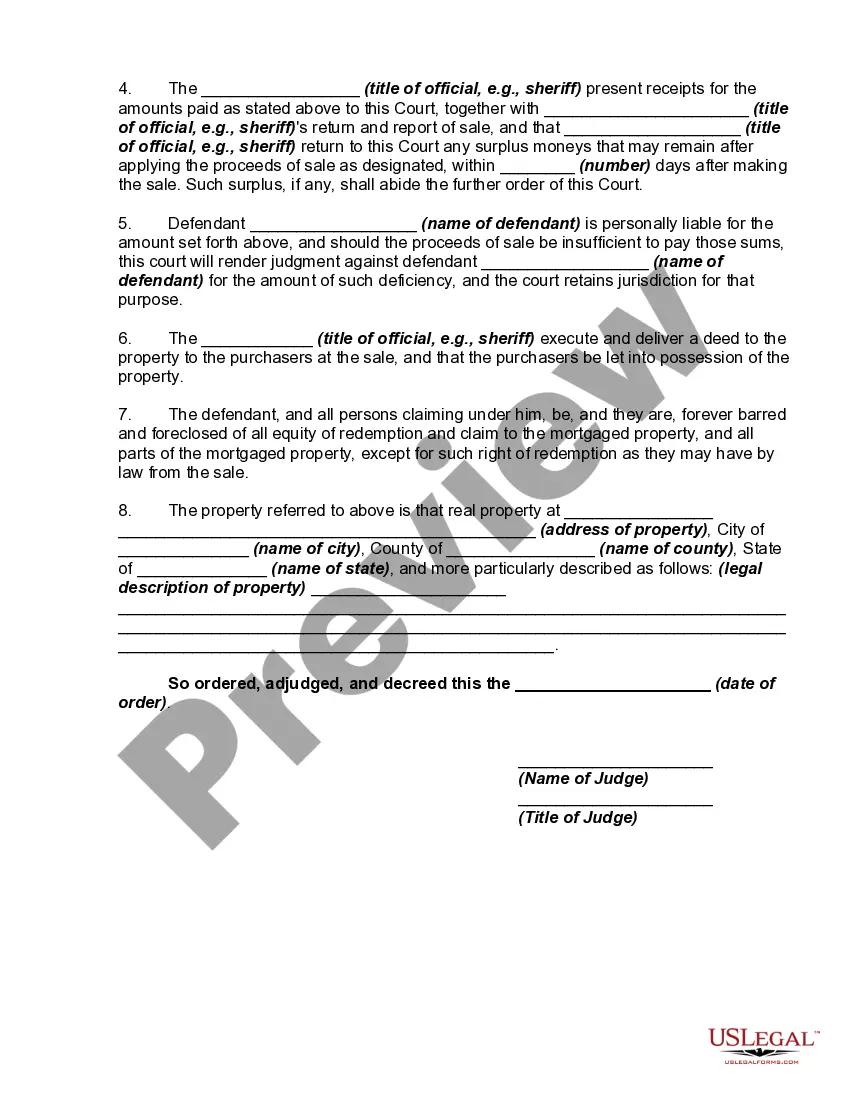

Illinois Judgment Foreclosing Mortgage and Ordering Sale is a legal process initiated by a lender to recover the outstanding debt secured by a mortgage on a property located in the state of Illinois. This procedure allows the lender to foreclose on the property and sell it in order to obtain the necessary funds to repay the outstanding debt. Keywords: Illinois, judgment, foreclosing mortgage, ordering sale, legal process, lender, outstanding debt, secured, property, sell, repay. Different types of Illinois Judgment Foreclosing Mortgage and Ordering Sale: 1. Strict Foreclosure: In this type of foreclosure, the property is awarded to the lender without a public sale. The ownership of the property is transferred directly to the lender to satisfy the outstanding debt. 2. Judicial Sale: This type of foreclosure involves a public auction where the property is sold to the highest bidder to repay the debt. The lender files a lawsuit, obtains a judgment, and then proceeds with the sale. 3. Foreclosure by Advertisement: This non-judicial foreclosure process does not require filing a lawsuit. Instead, the lender publishes a notice of sale in the local newspaper for a specified time period. The property is then sold at a public auction to satisfy the debt. 4. Consent Foreclosure: In this scenario, both the lender and the borrower agree to a foreclosure proceeding to sell the property. The terms of the sale and distribution of proceeds are agreed upon between the parties. 5. Deed in Lieu of Foreclosure: This option allows the borrower to voluntarily transfer the property title to the lender, avoiding the formal foreclosure process. It requires the agreement of both parties, and the lender may forgive the remaining debt. 6. Equitable Redemption: This type of foreclosure allows the borrower to redeem the property by clearing the debt even after the foreclosure judgment has been issued. The borrower must pay the full outstanding debt, including interest and costs, to regain ownership. In summary, Illinois Judgment Foreclosing Mortgage and Ordering Sale is a legal process that allows lenders in Illinois to reclaim unpaid debts secured by a mortgage by foreclosing on the property and selling it. Depending on the specific circumstances and agreements between the parties, various types of foreclosures may be employed, such as strict foreclosure, judicial sale, foreclosure by advertisement, consent foreclosure, deed in lieu of foreclosure, and equitable redemption.

Illinois Judgment Foreclosing Mortgage and Ordering Sale

Description

How to fill out Judgment Foreclosing Mortgage And Ordering Sale?

You may invest hours on the web trying to find the authorized file format that suits the state and federal requirements you require. US Legal Forms supplies thousands of authorized varieties that happen to be examined by specialists. You can actually obtain or print the Illinois Judgment Foreclosing Mortgage and Ordering Sale from the service.

If you already have a US Legal Forms profile, you are able to log in and click on the Acquire button. Afterward, you are able to full, modify, print, or sign the Illinois Judgment Foreclosing Mortgage and Ordering Sale . Every single authorized file format you buy is the one you have permanently. To get an additional copy of the bought kind, go to the My Forms tab and click on the related button.

If you use the US Legal Forms site initially, adhere to the easy instructions beneath:

- Very first, make sure that you have selected the right file format for your state/town of your liking. Browse the kind information to ensure you have selected the correct kind. If accessible, use the Review button to check with the file format too.

- If you want to discover an additional variation from the kind, use the Lookup discipline to obtain the format that meets your needs and requirements.

- Once you have found the format you need, simply click Buy now to continue.

- Select the prices prepare you need, type in your references, and sign up for a free account on US Legal Forms.

- Comprehensive the financial transaction. You should use your credit card or PayPal profile to cover the authorized kind.

- Select the file format from the file and obtain it for your gadget.

- Make modifications for your file if necessary. You may full, modify and sign and print Illinois Judgment Foreclosing Mortgage and Ordering Sale .

Acquire and print thousands of file layouts while using US Legal Forms site, which provides the most important variety of authorized varieties. Use expert and status-distinct layouts to tackle your business or specific requires.

Form popularity

FAQ

15-1208. Mortgagee. "Mortgagee" means (i) the holder of an indebtedness or obligee of a non-monetary obligation secured by a mortgage or any person designated or authorized to act on behalf of such holder and (ii) any person claiming through a mortgagee as successor.

In Illinois, you can redeem your home until the later of: seven months after you receive the summons of the foreclosure action (or are served by publication if the lender is unable to serve you the foreclosure papers personally) or. three months after the date that the court enters the judgment of foreclosure. (735 Ill ...

15-1209. Mortgagor. "Mortgagor" means (i) the person whose interest in the real estate is the subject of the mortgage and (ii) any person claiming through a mortgagor as successor. Where a mortgage is executed by a trustee of a land trust, the mortgagor is the trustee and not the beneficiary or beneficiaries.

30 days after the confirmation of the foreclosure sale (see #8), the purchaser of the property has the right to take possession of the property and evict the tenants.

Redemption. Subject to a few limited exceptions, you have 7 months from the date you are served to pay off your loan in full, either by refinancing the loan or by selling the house or by other means. This is called your right to redeem, and the 7-month period is called the redemption period.

After a property is sold by judicial sale, the court will confirm that the sale of the property was completed ing to Illinois law. The court will also enter an eviction order, meaning the former homeowner could be ordered to leave the property as soon as 30 days after the confirmation of the sale.

In Illinois, your mortgage loan will automatically default after 90 days without payment. At this point, your lender will send a Notice of Default (NOD), which serves the purpose of informing you of their intent to foreclose on your property due to lack of payment.