Illinois General Form of Agreement to Incorporate

Description

How to fill out General Form Of Agreement To Incorporate?

You might spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can download or print the Illinois General Form of Agreement to Incorporate from our platform.

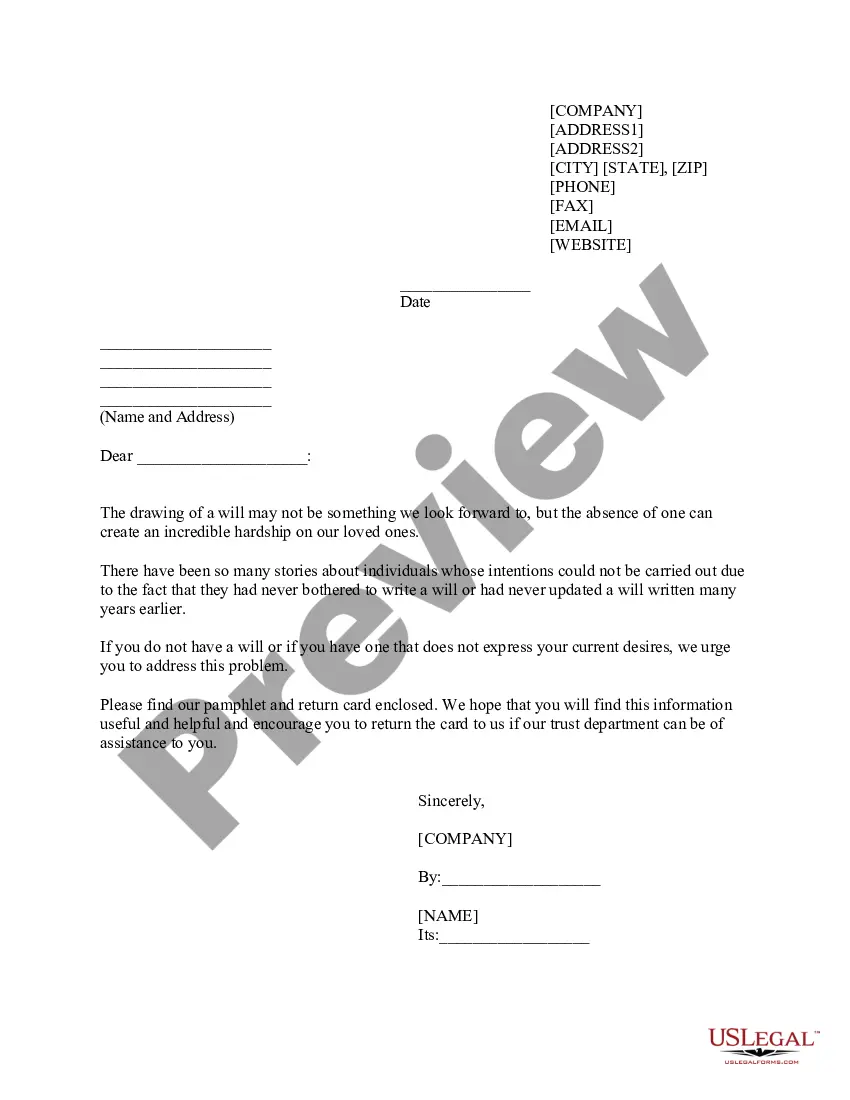

If available, use the Preview button to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Get button.

- Subsequently, you can fill out, alter, print, or sign the Illinois General Form of Agreement to Incorporate.

- Each legal document template you obtain is yours forever.

- To retrieve another copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your selected area/town.

- Review the form details to confirm you have chosen the right one.

Form popularity

FAQ

No, the state of Illinois does not require LLCs to have an operating agreement. However, crafting one is a smart decision for establishing operational guidelines and member duties. With the Illinois General Form of Agreement to Incorporate, you can easily create an agreement that fits your needs, thereby ensuring that your business operates smoothly and efficiently.

An operating agreement is not mandatory in Illinois; however, it is extremely beneficial. It provides clarity on the management structure, member responsibilities, and financial arrangements. By utilizing the Illinois General Form of Agreement to Incorporate, you can create an effective operating agreement that minimizes disputes and sets your business up for success.

If you don't have an operating agreement for your LLC, you may face internal conflicts and unclear procedures on how decisions are made. It can leave your business operations vulnerable to state default rules, which may not align with your goals. Using the Illinois General Form of Agreement to Incorporate can prevent these uncertainties and establish a clear framework for your LLC.

To start a general partnership in Illinois, you need to choose a business name and partner with individuals who share your vision. While not required by law, it’s wise to create a partnership agreement to outline roles and responsibilities. This agreement can be based on the Illinois General Form of Agreement to Incorporate to ensure clarity and accountability among partners.

The first steps to incorporating your business in Illinois include choosing a unique business name and selecting a registered agent. Next, you must file the articles of incorporation with the Secretary of State. After filing, consider drafting an operating agreement using the Illinois General Form of Agreement to Incorporate, which will structure your LLC's management and operations effectively.

To obtain an article of incorporation in Illinois, you need to file the form with the Secretary of State. This document is crucial for legally establishing your business entity. You can also find helpful resources and templates for the Illinois General Form of Agreement to Incorporate on our platform, which can guide you through the filing process efficiently.

Illinois does not legally require LLCs to have an operating agreement. However, creating one is highly recommended, as it acts as the guiding document for your operations. With the Illinois General Form of Agreement to Incorporate, you can establish clear terms for decision-making and profit distribution among members. This proactive step can help your LLC run smoothly.

Yes, you can write your own operating agreement for your LLC in Illinois. However, it’s important to ensure that it complies with the Illinois General Form of Agreement to Incorporate. A well-crafted operating agreement outlines member duties and responsibilities, helping prevent disputes in the future. Using our platform can simplify the process and provide you with a solid template.

To fill out a business operating agreement, begin by stating the name of the LLC and its principal address. Specify the roles and responsibilities of members, including management structure and profit distribution. It is beneficial to use the Illinois General Form of Agreement to Incorporate from US Legal Forms, which offers a clear framework, ensuring your agreement meets state requirements and protects your interests.

Filling out a certificate of Incorporation requires careful attention to detail. Start by providing the business name, which must adhere to Illinois regulations. Next, include information about the corporation's purpose, address, and the number of shares authorized. For further assistance, consider using the Illinois General Form of Agreement to Incorporate available on US Legal Forms, which simplifies the process with guidance tailored for your needs.