Illinois General Form of Amendment to Partnership Agreement

Description

How to fill out General Form Of Amendment To Partnership Agreement?

Are you currently in a situation where you need documents for business or personal purposes on a daily basis.

There are numerous legal document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the Illinois General Form of Amendment to Partnership Agreement, designed to meet federal and state requirements.

Once you find the correct form, click on Buy now.

Choose the pricing plan you require, fill in the necessary information to create your account, and make the payment using PayPal or a credit card. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Illinois General Form of Amendment to Partnership Agreement at any time if needed. Just follow the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and prevent mistakes. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Illinois General Form of Amendment to Partnership Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and make sure it is for the correct region/state.

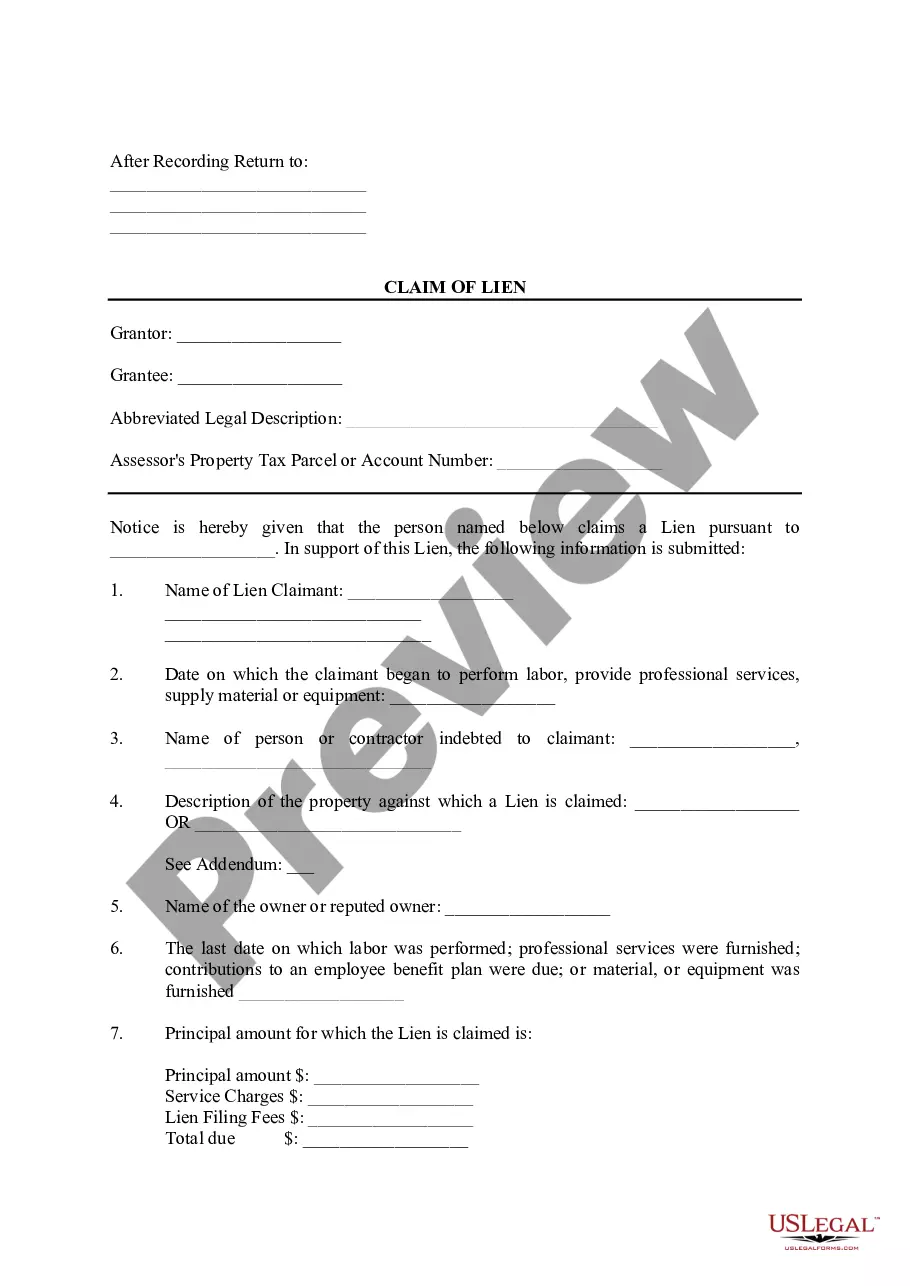

- Utilize the Preview button to examine the form.

- Review the description to confirm you have selected the right form.

- If the form does not match your requirements, use the Search field to find the form that fits your needs.

Form popularity

FAQ

To effectively fill out the articles of amendment, start with the Illinois General Form of Amendment to Partnership Agreement, which guides you through necessary sections. Ensure you accurately state each revised clause and detail any significant changes. After completion, check for completeness and compliance with state requirements, as these articles must align with the legal standards in Illinois.

Writing an amendment format involves clearly identifying the partnership and the specific aspects you wish to amend. Use a straightforward structure that includes a title, date, and the exact language you want to modify. The Illinois General Form of Amendment to Partnership Agreement provides a reliable template to help you ensure that all necessary information is included and correctly stated.

An example of an amendment could include changing the name of a partner within the partnership agreement or altering the profit-sharing structure among the partners. The Illinois General Form of Amendment to Partnership Agreement will allow you to officially document such changes. Essentially, any modification that impacts the partnership’s operations or structure qualifies as an amendment.

To fill out the Illinois General Form of Amendment to Partnership Agreement, you should start by gathering all required information about the partnership, such as the original partnership agreement and any pertinent details regarding the amendment. Then, clearly specify the changes you are making, ensuring each amendment is comprehensive yet concise. After drafting, review the document carefully to confirm accuracy before submitting it to the appropriate state agency.

Every partnership that operates in Illinois must file a partnership return, irrespective of whether the partnership is registered or not. This return details the income, deductions, and credits associated with the partnership. Ensuring that your partnership agreement accurately reflects any changes is where the Illinois General Form of Amendment to Partnership Agreement becomes essential.

Yes, if you are forming an LLC or a corporation, you must register your business with the Secretary of State in Illinois. This step protects your business name and establishes your entity legally. If your partnership structure changes, using the Illinois General Form of Amendment to Partnership Agreement helps you maintain compliance with state requirements.

The articles of amendment for an LLC are documents that record changes to the original formation documents, such as the name, purpose, or management structure. This is crucial to ensure that any alterations comply with state regulations. If you need to update your partnership agreement, the Illinois General Form of Amendment to Partnership Agreement is an ideal tool.

Not all states require partnerships to file articles of partnership, but having a written document is advisable. This document outlines the terms and conditions agreed upon by the partners, enhancing clarity and reducing conflicts. Utilizing the Illinois General Form of Amendment to Partnership Agreement can facilitate any necessary changes as partnerships evolve.

Removing a member from an LLC in Illinois generally involves following the procedures outlined in the operating agreement. If your partnership agreement includes an amendment clause, you can use the Illinois General Form of Amendment to Partnership Agreement to document and formalize the change. It is important to ensure all actions are compliant with state laws and the LLC's internal rules.

No, a general partnership is typically not considered a registered organization. Unlike corporations or limited liability companies, general partnerships often do not require formal registration with the state. However, utilizing the Illinois General Form of Amendment to Partnership Agreement can help manage changes within the partnership structure effectively.