Illinois Agreement to Compromise Debt is a legal document that outlines the terms and conditions of a settlement agreement between a debtor and a creditor to resolve a debt dispute. This agreement is a way for both parties to come to a mutual agreement and avoid the need for litigation. The Illinois Agreement to Compromise Debt is a binding contract that must be signed by both the debtor and the creditor. It specifies the amount of the debt, the terms of the repayment plan, and any other conditions agreed upon by both parties. This agreement can be used for various types of debts, such as credit card debt, personal loans, medical bills, or any other debt dispute that arises in the state of Illinois. There are different types of Illinois Agreement to Compromise Debt, depending on the specific circumstances and nature of the debt. Some common types include: 1. Personal Debt Agreement: This type of agreement is usually used for personal debts, such as credit card bills or personal loans. It outlines a repayment plan that the debtor agrees to follow in order to settle the debt. 2. Business Debt Agreement: This agreement is tailored for businesses that have outstanding debts. It allows the debtor to propose a repayment plan that takes into account the financial situation of the business and offers a compromise to the creditor. 3. Medical Debt Agreement: Unpaid medical bills can quickly accumulate, and a medical debt agreement provides a way for individuals to negotiate a settlement with healthcare providers or collection agencies. This agreement often includes provisions for reduced or discounted payment options. 4. Mortgage Debt Agreement: This type of agreement is specific to mortgage debts, where the debtor and the mortgage lender can negotiate a compromise to avoid foreclosure. It may involve postponing payments, reducing interest rates, or other restructuring options. 5. Student Loan Debt Agreement: With the rising burden of student loans, this type of agreement offers a way for borrowers to negotiate a settlement with their lenders. It may involve reduced monthly payments, lower interest rates, or forgiveness of a portion of the debt. In conclusion, an Illinois Agreement to Compromise Debt is a legally binding contract used to settle debt disputes between a debtor and a creditor. It provides a platform for both parties to negotiate and reach an agreement that is acceptable to both sides. Whether its personal debt, business debt, medical debt, mortgage debt, or student loan debt, this agreement can be customized to suit the specific circumstances of the debt.

Illinois Agreement to Compromise Debt

Description

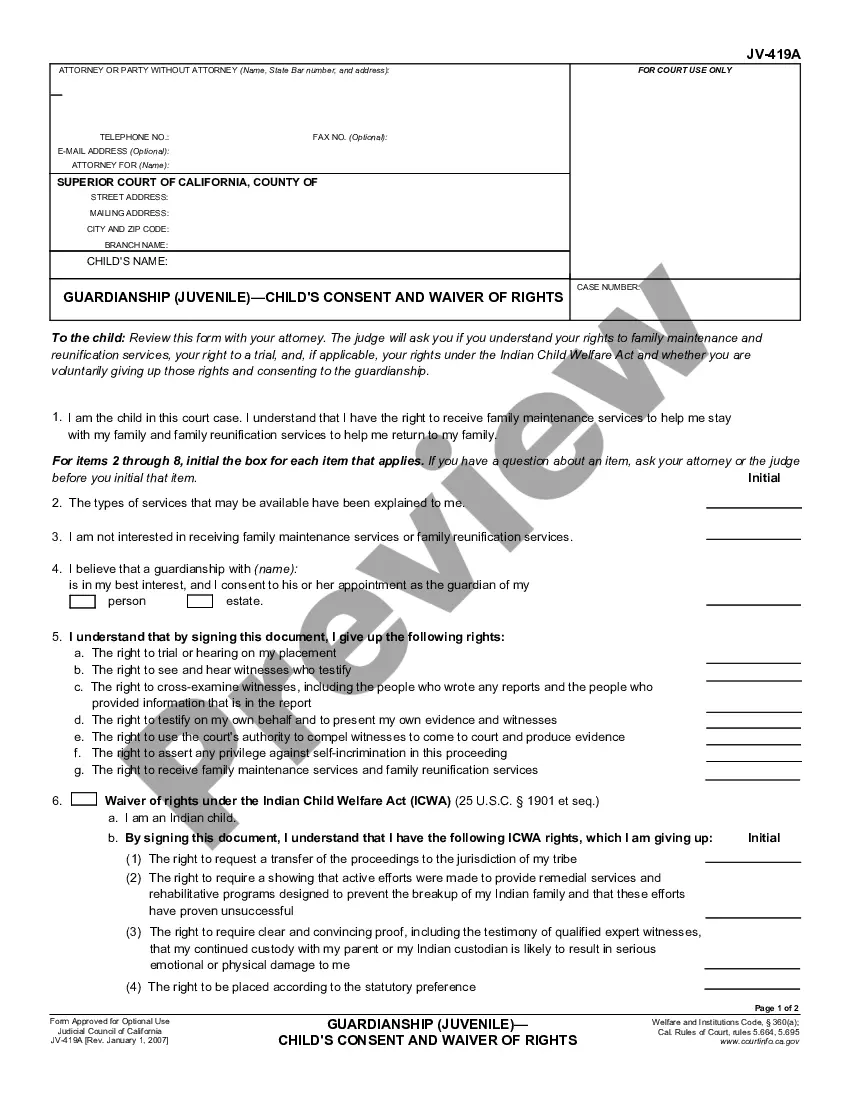

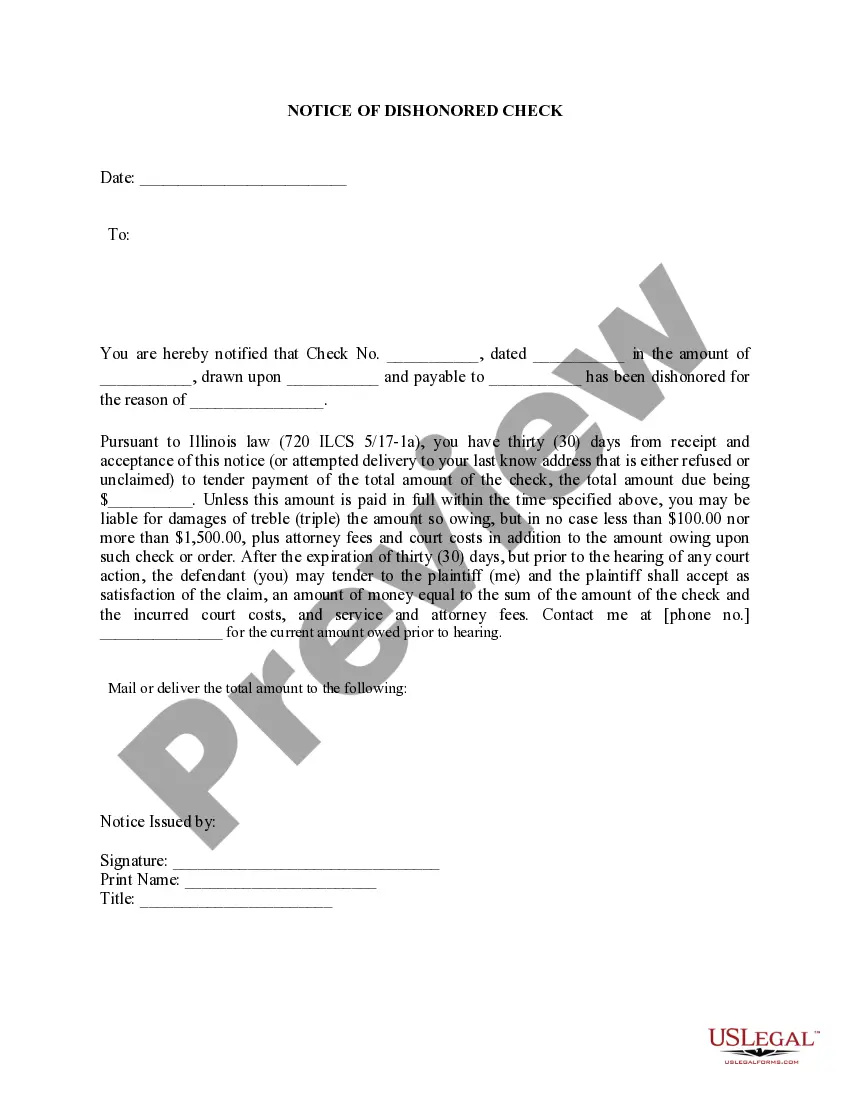

How to fill out Illinois Agreement To Compromise Debt?

If you want to complete, down load, or print out legitimate file themes, use US Legal Forms, the biggest assortment of legitimate kinds, that can be found on the Internet. Take advantage of the site`s simple and convenient look for to find the paperwork you require. Different themes for organization and individual uses are sorted by categories and claims, or search phrases. Use US Legal Forms to find the Illinois Agreement to Compromise Debt in a few mouse clicks.

When you are presently a US Legal Forms client, log in for your accounts and then click the Obtain key to find the Illinois Agreement to Compromise Debt. Also you can gain access to kinds you earlier downloaded from the My Forms tab of the accounts.

Should you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have chosen the form for that correct town/nation.

- Step 2. Take advantage of the Review choice to look through the form`s content. Don`t neglect to see the description.

- Step 3. When you are not happy using the develop, use the Lookup area near the top of the screen to discover other versions from the legitimate develop web template.

- Step 4. Once you have discovered the form you require, go through the Acquire now key. Choose the prices prepare you like and put your accreditations to register for an accounts.

- Step 5. Method the purchase. You can utilize your credit card or PayPal accounts to complete the purchase.

- Step 6. Pick the file format from the legitimate develop and down load it on your own device.

- Step 7. Full, edit and print out or indication the Illinois Agreement to Compromise Debt.

Each and every legitimate file web template you get is your own for a long time. You may have acces to every single develop you downloaded in your acccount. Click on the My Forms area and select a develop to print out or down load yet again.

Remain competitive and down load, and print out the Illinois Agreement to Compromise Debt with US Legal Forms. There are millions of professional and state-distinct kinds you can utilize for your organization or individual needs.

Form popularity

FAQ

Highlights: Most negative information generally stays on credit reports for 7 years. Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type. Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years.

According to Illinois law, the statute of limitations on credit card debt is five years. Statutes of limitations are used by all states to prevent legal action on claims that have become old or "stale." A state may have dozens of different statutes of limitations applying to hundreds of different types of claims.

Offer a specific dollar amount that is roughly 30% of your outstanding account balance. The lender will probably counter with a higher percentage or dollar amount. If anything above 50% is suggested, consider trying to settle with a different creditor or simply put the money in savings to help pay future monthly bills.

Your debt settlement proposal letter should contain the following:Your current financial situation.Debt settlement offer.Personal information.What you expect in return.Acceptance of the proposal.Acceptance of the proposal upon adjusting (negotiating) the amount to be paid.Rejection of the proposal.

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of amount (inclusive of interests and costs) as the full and final settlement of the above claim/debt.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

Typical debt settlement offers range from 10% to 50% of what you owe. The longer you allow debt to go unpaid, the greater your risk of being sued. Creditors are under no obligation to reduce your debt, even if you are working with a reputable debt settlement company.

On debts based on written contracts, the statute of limitation is 10 years. On unwritten contracts, it's 5 years.

On debts based on written contracts, the statute of limitation is 10 years. On unwritten contracts, it's 5 years.