Illinois Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

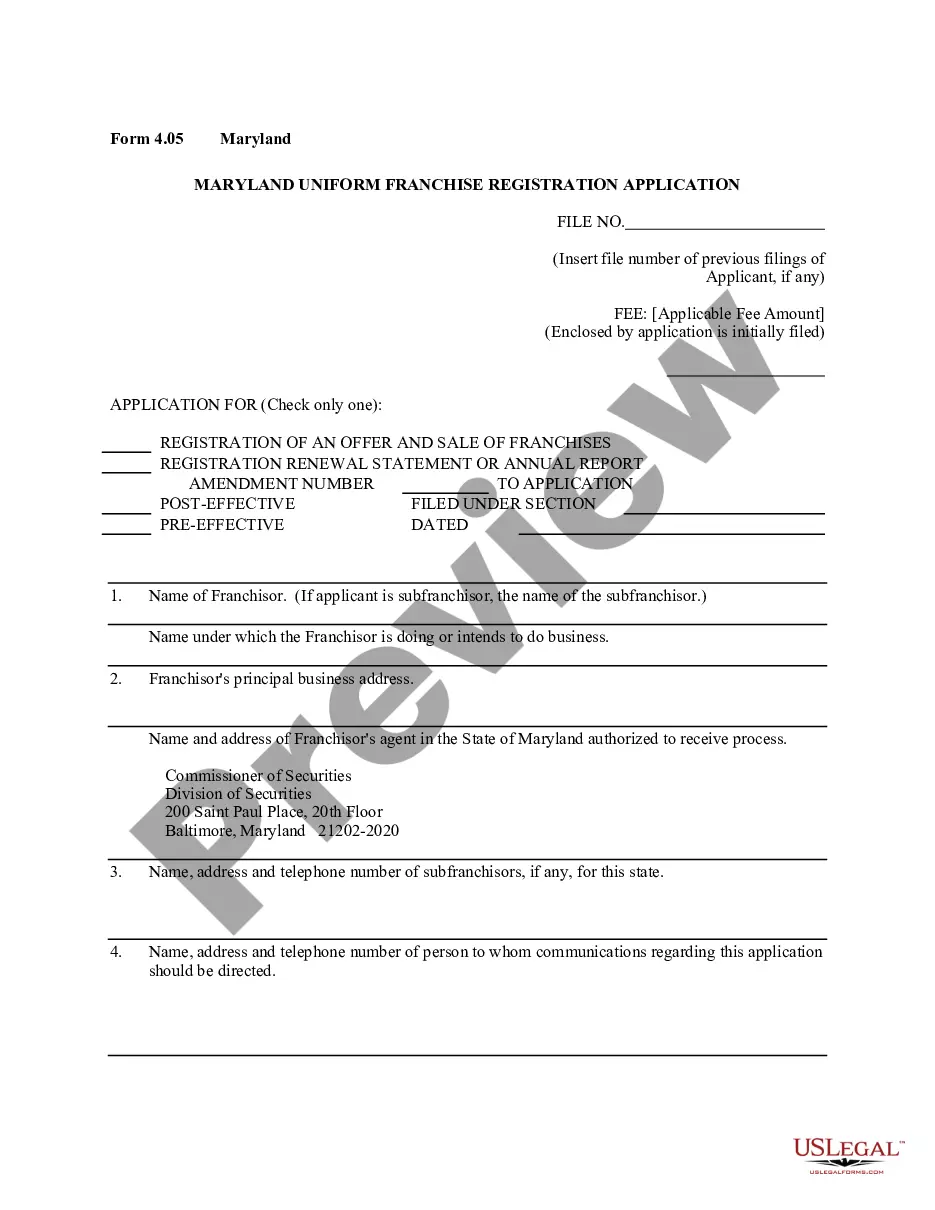

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Choosing the best legitimate file design could be a battle. Naturally, there are a variety of templates accessible on the Internet, but how would you discover the legitimate develop you require? Make use of the US Legal Forms site. The assistance gives a huge number of templates, like the Illinois Articles of Incorporation, Not for Profit Organization, with Tax Provisions, that you can use for organization and personal needs. All of the kinds are checked by specialists and meet up with state and federal specifications.

When you are presently listed, log in for your profile and then click the Acquire button to find the Illinois Articles of Incorporation, Not for Profit Organization, with Tax Provisions. Make use of your profile to appear through the legitimate kinds you might have ordered formerly. Check out the My Forms tab of your profile and acquire an additional version from the file you require.

When you are a new end user of US Legal Forms, allow me to share straightforward recommendations that you should adhere to:

- First, be sure you have chosen the right develop for your metropolis/region. It is possible to look over the form while using Review button and read the form outline to make certain it will be the best for you.

- In case the develop is not going to meet up with your requirements, use the Seach discipline to get the right develop.

- When you are certain the form is proper, go through the Buy now button to find the develop.

- Choose the pricing strategy you need and type in the required information. Design your profile and buy the order using your PayPal profile or credit card.

- Select the data file formatting and down load the legitimate file design for your gadget.

- Total, revise and produce and indicator the acquired Illinois Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

US Legal Forms is the greatest library of legitimate kinds that you can find different file templates. Make use of the service to down load skillfully-manufactured papers that adhere to status specifications.

Form popularity

FAQ

To apply for an Illinois sales tax exemption number, your organization should submit Form STAX-1, Application for Sales Tax Exemption, or Apply for or Renew a Sales Tax Exemption online using MyTax Illinois.

Contrary to popular belief, neither nonprofit incorporation nor federal 501c (3) tax status makes an Illinois nonprofit corporation automatically eligible for property tax exemption. Under Illinois law, every property owner is responsible for paying taxes until it proves that it is entitled to an exemption.

Most homeowners are eligible for this exemption if they own and occupy the property as their principal place of residence. Once this exemption is applied, the Assessor's Office auto-renews it for you each year. This exemption provides savings by reducing the equalized assessed value of an eligible property.

In order to qualify for a property tax exemption, your organization must be exclusively beneficent and charitable, religious, educational, or governmental and own the property that is used exclusively for charitable, religious, educational, or governmental purposes and not leased or used for profit.

In California, certain real property and personal property used for nonprofit purposes may be eligible for a property tax exemption. Some common exemptions include the Welfare Exemption, the most general of all exemptions, the Religious Exemption, the Church Exemption, the College Exemption, and the Cemetery Exemption.

Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois. The exemption allows an organization to buy items tax-free. In addition, their property may be exempt from property taxes.

DIRECTORS: Pursuant to section 108.10 of the General Not For Profit Corporation Act, the board of directors of a not for profit corporation shall consist of three or more directors. You can list between three and seven directors on the on-line articles of incorporation.

A 501(c)(3) operating in Illinois may not have to pay Illinois sales tax and it may be exempt from real estate taxes on property it owns. Both the Illinois sales tax and property tax exemptions are not automatic based on the 501(c)(3)'s income tax-exempt status. You must apply for both additional exemptions separately.