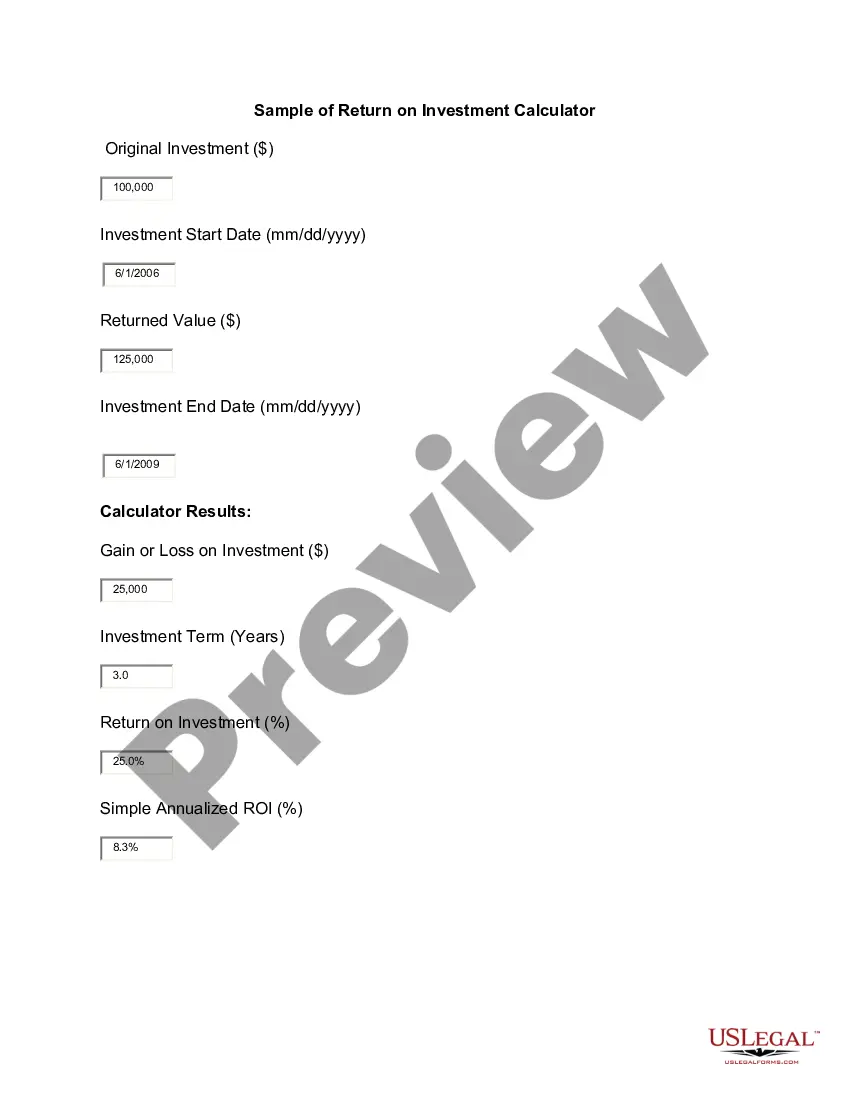

A return on investment (ROI) calculator can be used to figure out your gain or loss on an investment including the overall ROI as well as an annualized ROI. The calculator only requires three pieces of information, the original investment, the present or future value of the investment and time elapsed or term.

Illinois Sample of Return on Investment Calculator - ROI

Description

How to fill out Sample Of Return On Investment Calculator - ROI?

You might spend numerous hours online trying to locate the legal document template that fits the federal and state requirements you need.

US Legal Forms provides thousands of legal templates that are assessed by experts.

You can download or print the Illinois Sample of Return on Investment Calculator - ROI from our service.

To find another version of your form, use the Search area to discover the template that satisfies your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and select the Download option.

- After that, you can complete, modify, print, or sign the Illinois Sample of Return on Investment Calculator - ROI.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and select the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your region/area of choice.

- Review the form details to confirm you have chosen the right template.

Form popularity

FAQ

A good ROI ratio is generally considered to be , meaning for every dollar invested, three dollars in returns are expected. However, this can vary based on the investment's risk and market conditions. To gauge your ROI ratio accurately, the Illinois Sample of Return on Investment Calculator - ROI offers a detailed analysis tailored to your specific investments.

A reasonable ROI expectation varies by industry and investment type, but many aim for an ROI between 15% and 20%. This range is realistic for investments in growing markets. Utilizing the Illinois Sample of Return on Investment Calculator - ROI can help you set and meet these expectations effectively.

The rule of thumb for Return on Investment (ROI) suggests that a positive ROI indicates that the investment is yielding more than what was invested. Generally, a rule is that an ROI of 10% or higher is considered a good return. With the Illinois Sample of Return on Investment Calculator - ROI, you can easily evaluate your investments and make informed decisions.

A 30 percent return on an investment of $1,000 can be calculated easily. First, multiply your investment amount by 0.30, which results in a profit of $300. This means that, after one year, your total amount would rise to $1,300. Using an Illinois Sample of Return on Investment Calculator - ROI can help you visualize this growth effectively.

To calculate a 7% return on investment, begin by determining your initial investment amount. Multiply this figure by 0.07 to find your expected profit over one year. For instance, if your investment is $1,000, a 7% ROI would yield $70. Using an Illinois Sample of Return on Investment Calculator - ROI can simplify this process, providing quick insights into your potential profits.

An example of ROI return on investment might be investing $10,000 in a construction project that yields a profit of $25,000. The ROI would reflect a significant gain, calculated using the standard formula. Tools such as the Illinois Sample of Return on Investment Calculator - ROI can help clearly present these calculations for better understanding.

ROI reports summarize the financial returns gained from investments over a specified period. These reports provide detailed insights into what worked and what didn’t, allowing informed decision-making for future investments. You can create comprehensive ROI reports using the Illinois Sample of Return on Investment Calculator - ROI to make your analysis robust and clear.

A good example of ROI is evaluating a marketing campaign where you spend $5,000 and generate $15,000 in sales. By applying the ROI formula, you determine a 200% return. The Illinois Sample of Return on Investment Calculator - ROI can help visualize this example, demonstrating how investments translate into financial success.

Writing an ROI report involves presenting your findings in a structured format. Start with an introduction that outlines the purpose, then detail your calculations, followed by a summary of your conclusions and recommendations. The Illinois Sample of Return on Investment Calculator - ROI can assist you in ensuring accuracy and clarity in your report.