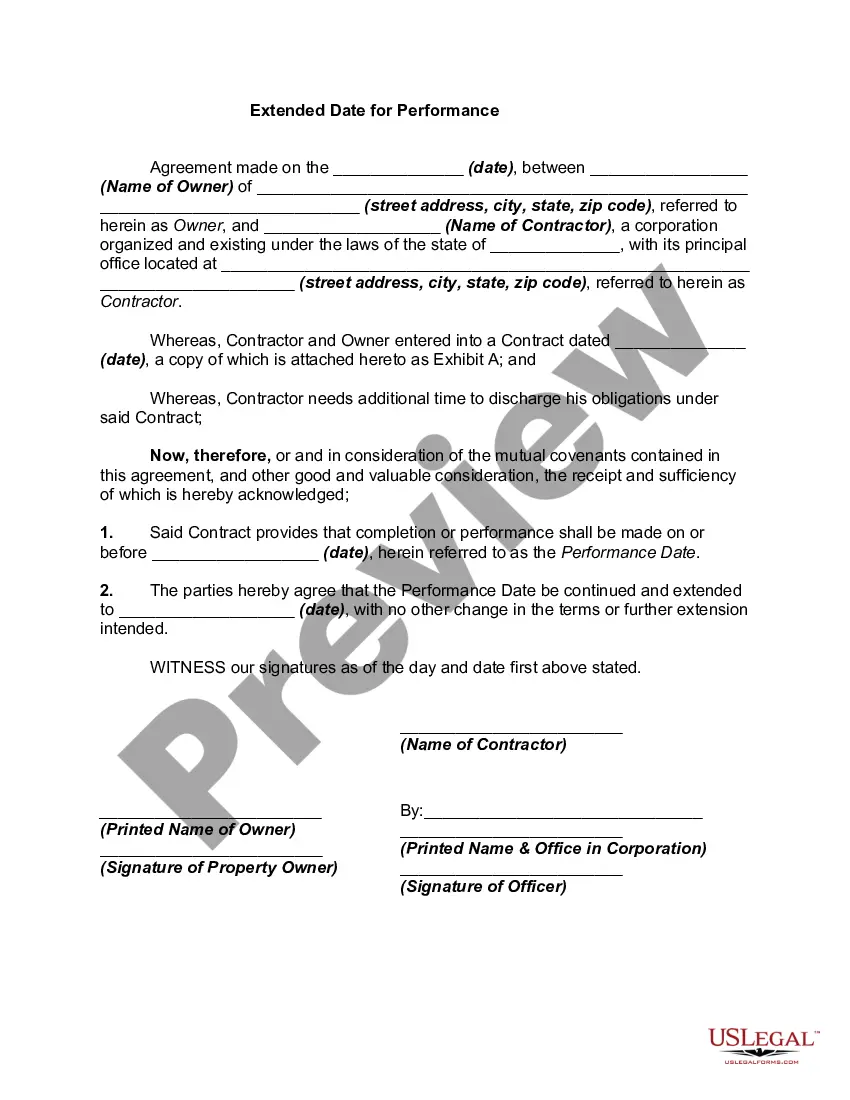

Illinois Extended Date for Performance

Description

How to fill out Extended Date For Performance?

It is feasible to spend time online searching for the authentic document template that complies with the state and federal requirements you need.

US Legal Forms provides thousands of authentic forms that are examined by professionals.

You can obtain or create the Illinois Extended Date for Performance from our services.

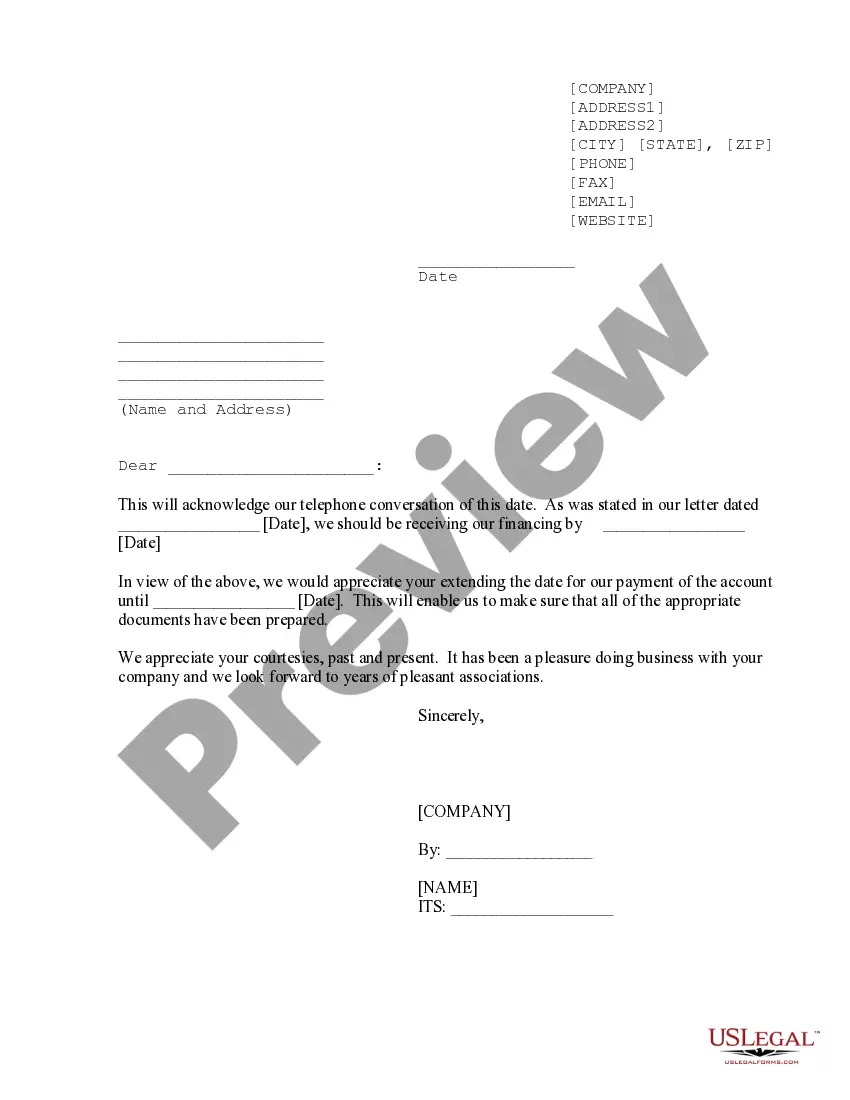

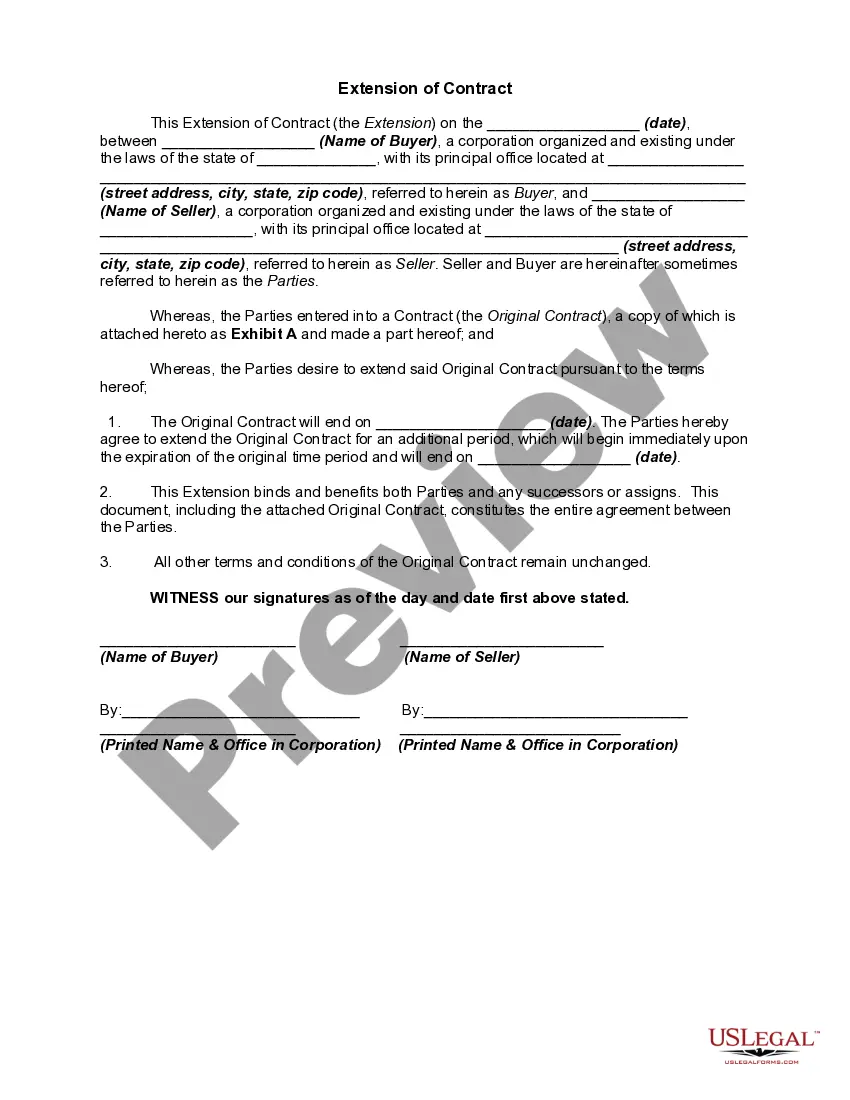

If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click on the Obtain button.

- Afterward, you can complete, modify, create, or sign the Illinois Extended Date for Performance.

- Each authentic document template you purchase is yours indefinitely.

- To retrieve another copy of a purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have chosen the correct document template for the state/city of your selection.

- Read the form description to confirm you have selected the right type.

Form popularity

FAQ

Filing an extension after the deadline is not straightforward, but options exist. You may need to submit late forms along with any taxes owed to avoid penalties. For guidance, consider using uslegalforms, which can help you navigate the complexities of late filings and ensure you maintain compliance.

Yes, if you receive a federal extension, Illinois automatically grants you an extension for state taxes. This streamlines the process for taxpayers, enabling them to enjoy the Illinois extended date for performance without additional paperwork. However, always verify your eligibility to ensure seamless compliance.

To file an extension in Illinois, complete Form IL-505-I and submit it to the Illinois Department of Revenue by the original tax deadline. This process allows you to benefit from the Illinois extended date for performance. You can file this form online or via mail, depending on your preference.

In Illinois, you do not need to attach your federal return when filing your state return. However, maintaining complete records is essential, especially if you are utilizing the Illinois extended date for performance. Always refer to the Illinois Department of Revenue for the most accurate information on documentation requirements.

Some states, including Illinois, allow individuals to carry over a federal extension for state tax purposes. However, it's crucial to check state-specific regulations, as some states may have different requirements. For example, states like Arkansas or California may not recognize federal extensions, leading you to file separate state extension forms.

Yes, you can file an extension form online through the IRS website or various tax preparation platforms. Filing online is efficient and helps you manage your Illinois extended date for performance effectively. Ensure that you receive confirmation that your extension request was submitted successfully.

To file an extension, start by gathering all necessary information, including personal details and estimated tax figures. Once this information is ready, you can complete your extension request online or via paper forms. Platforms like UsLegalForms provide valuable resources to ensure an accurate and timely submission.

The IL-505-I automatic extension payment is a specific payment required when you request an Illinois Extended Date for Performance. This payment acts as a prepayment of your estimated tax liability, ensuring you remain compliant while requesting an extension. It's crucial to understand this payment to avoid any unexpected issues.

Filing an extension in Illinois involves obtaining the correct forms and submitting them to the state. You can choose to file online or through traditional mail methods. UsLegalForms offers a comprehensive solution that simplifies the entire filing procedure, providing clarity on requirements and helping you avoid common pitfalls.

To file an extension for Illinois, you need to complete the appropriate forms and submit them to the Illinois Department of Revenue. You can do this online or via mail, depending on your preferences. If you opt for UsLegalForms, you will find step-by-step guidance that makes the process straightforward and efficient.