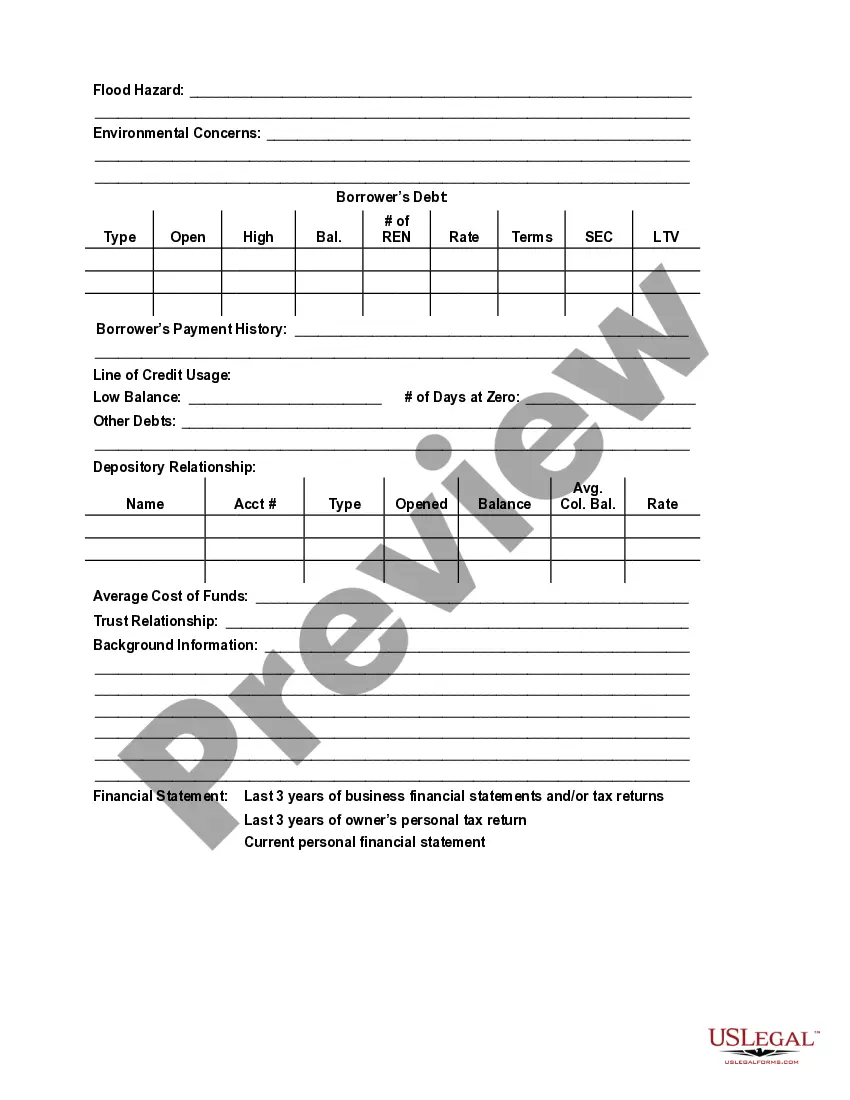

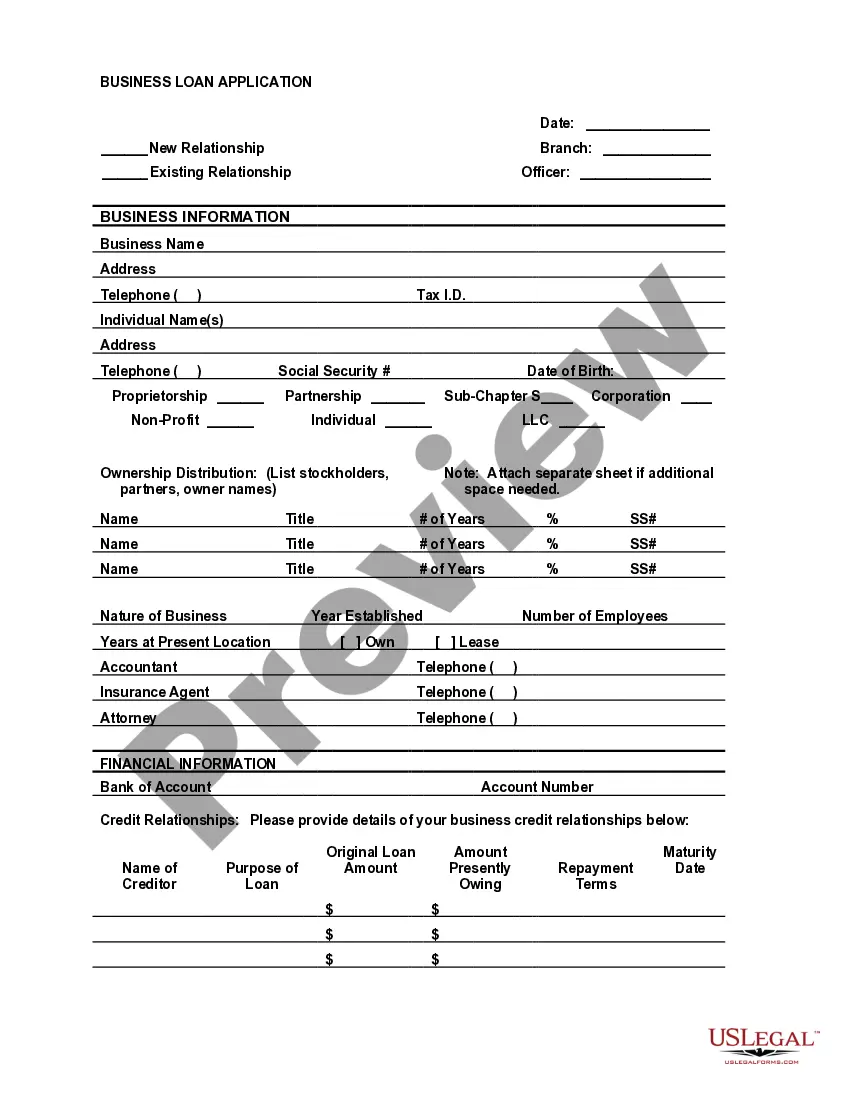

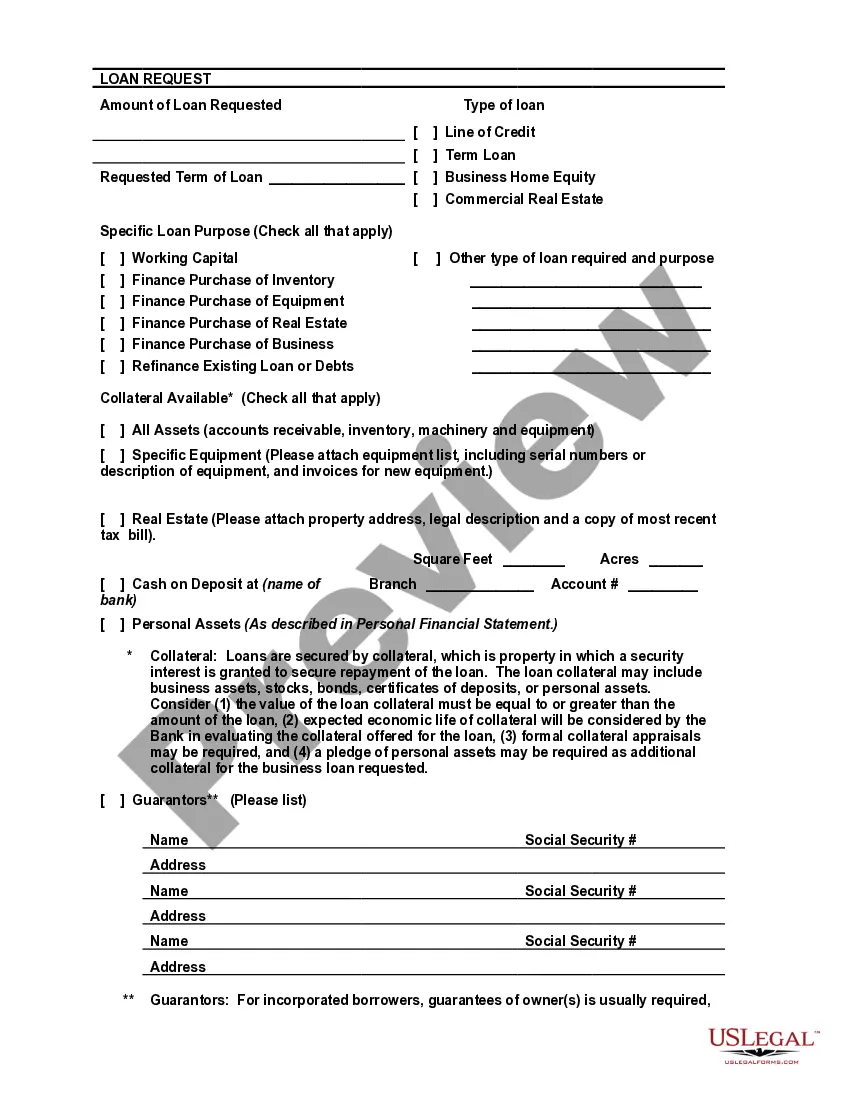

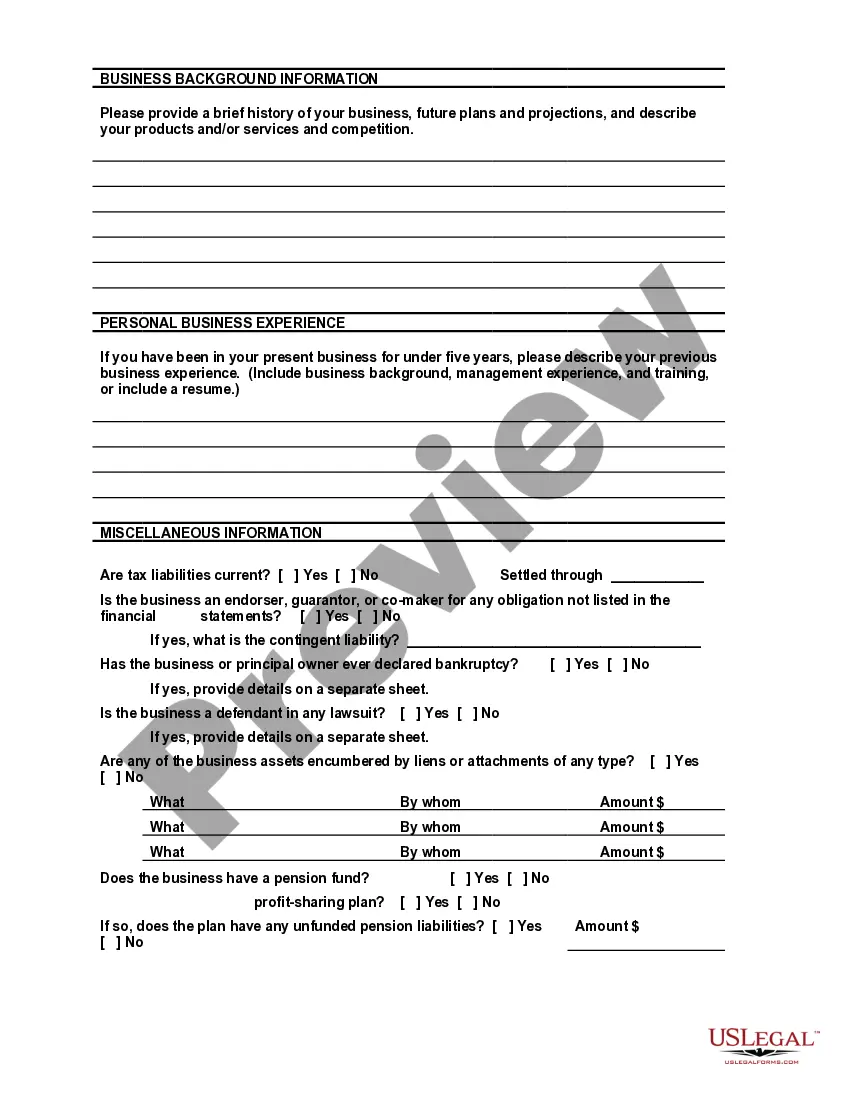

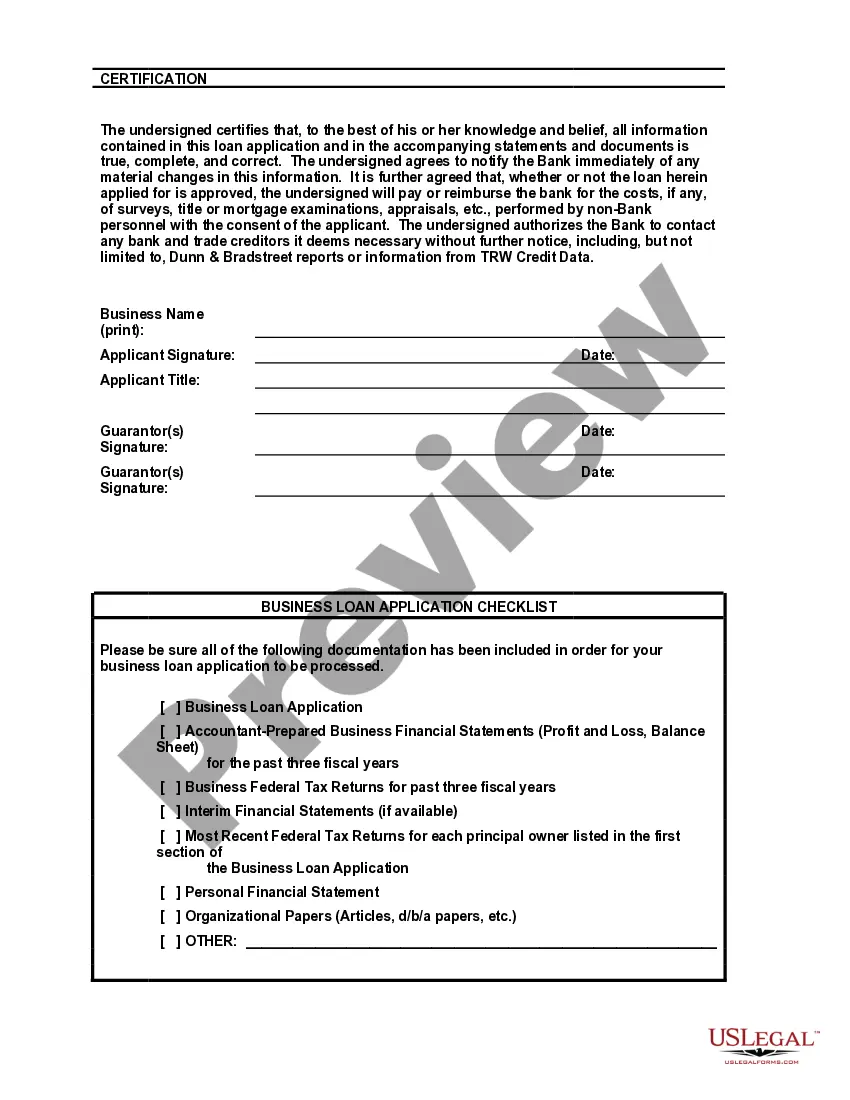

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

Illinois Bank Loan Application Form and Checklist - Business Loan

Description

How to fill out Bank Loan Application Form And Checklist - Business Loan?

If you want to total, obtain, or produce legal record templates, use US Legal Forms, the greatest variety of legal types, which can be found on the Internet. Utilize the site`s simple and easy convenient lookup to obtain the documents you need. Various templates for company and personal uses are categorized by types and states, or keywords and phrases. Use US Legal Forms to obtain the Illinois Bank Loan Application Form and Checklist - Business Loan in just a handful of click throughs.

When you are currently a US Legal Forms customer, log in in your account and click the Acquire option to find the Illinois Bank Loan Application Form and Checklist - Business Loan. Also you can accessibility types you earlier delivered electronically within the My Forms tab of your account.

Should you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape to the right town/region.

- Step 2. Use the Review method to check out the form`s information. Never overlook to read through the description.

- Step 3. When you are not satisfied together with the develop, utilize the Lookup area at the top of the screen to locate other types in the legal develop web template.

- Step 4. When you have discovered the shape you need, click the Purchase now option. Select the prices strategy you prefer and include your credentials to sign up to have an account.

- Step 5. Process the financial transaction. You may use your Мisa or Ьastercard or PayPal account to accomplish the financial transaction.

- Step 6. Choose the structure in the legal develop and obtain it on your device.

- Step 7. Comprehensive, change and produce or indicator the Illinois Bank Loan Application Form and Checklist - Business Loan.

Each and every legal record web template you purchase is yours for a long time. You have acces to every single develop you delivered electronically inside your acccount. Click the My Forms section and choose a develop to produce or obtain once more.

Remain competitive and obtain, and produce the Illinois Bank Loan Application Form and Checklist - Business Loan with US Legal Forms. There are millions of skilled and state-particular types you can use for the company or personal demands.

Form popularity

FAQ

These documents are used by the lenders to evaluate whether or not they will provide you with a loan. Loan documents are necessary to initiate a loan approval process by a lender. Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income.

Financial documents Up to one year of business bank account statements. Personal and business tax returns from the most recent three years. Most recent and projected balance sheets. Income statement and cash flow statement.

KYC documents - Any government-issued KYC document such as an Aadhaar card, PAN card, passport or driving licence. Your employee ID card. Salary slips for the last three months. Bank account statements of your salary account for the previous three months.

Get your financials in order. To this end, you should generally try to have three years' worth of business and personal tax returns on hand as well as year-to-date profit and loss figures, balance sheets, accounts receivable aging reports, and inventory breakdowns, if possible.

In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Normally, businesses must meet SBA size standards, be able to repay, and have a sound business purpose. Even those with bad credit may qualify for startup funding.

Creditagreement_300ps. jpg Loan Application Form. Forms vary by program and lending institution, but they all ask for the same information. ... Resumes. ... Business Plan. ... Business Credit Report. ... Income Tax Returns. ... Financial Statements. ... Accounts Receivable and Accounts Payable. ... Collateral.

Some of the documents you'll be asked to provide include, copies of your state- or government-issued ID, copies of paystubs, tax returns or bank statements. Having these documents on hand will not only make the application process smoother but will increase your chances of getting approved in a timely manner.

How to apply for a business loan in 7 steps Prepare documentation. ... Review your credit score. ... Gather financial documents. ... Create a business plan. ... Consider your collateral. ... Consider which loan to apply for. ... Assemble and submit your application.