The Illinois Financial Record Storage Chart is a comprehensive guide that provides detailed information and instructions on the storage and retention of financial records in the state of Illinois. This vital resource aims to assist individuals, businesses, and organizations in understanding the proper handling, duration, and disposal of financial documents. The chart outlines different types of financial records commonly generated by various entities, such as tax returns, bank statements, invoices, receipts, payroll records, ledgers, and more. It categorizes them based on their nature and highlights the recommended retention periods specified by the state's laws, regulations, or best practices. One prominent type of Illinois Financial Record Storage Chart is the Personal Financial Record Storage Chart. This specific chart primarily caters to individuals and households, guiding them on the management of their personal financial documents. It covers crucial areas like checking and savings account records, mortgage and loan statements, credit card statements, investment records, utility bills, insurance policies, and estate planning documents. For businesses and organizations, there is the Business Financial Record Storage Chart. This variant is designed to help enterprises maintain financial records efficiently. It outlines record categories like financial statements, employee records, sales and purchase records, tax documents, contracts and agreements, licenses and permits, and other essential financial paperwork. Additionally, the Illinois Financial Record Storage Chart may include specialized charts tailored to specific industries or sectors. For example, it might have a Healthcare Financial Record Storage Chart, which addresses medical billing records, patient records, insurance claims, and related financial documents unique to the healthcare industry. Prominent keywords associated with the Illinois Financial Record Storage Chart may include financial records, retention periods, storage guidelines, document handling, Illinois regulations, personal finance, business finance, tax records, record categories, record management, legal compliance, archival procedures, document disposal, industry-specific record storage. Overall, the Illinois Financial Record Storage Chart provides an invaluable resource for anyone seeking clarity on proper financial record management, ensuring legal compliance, and facilitating organized and secure document storage in various contexts.

Illinois Financial Record Storage Chart

Description

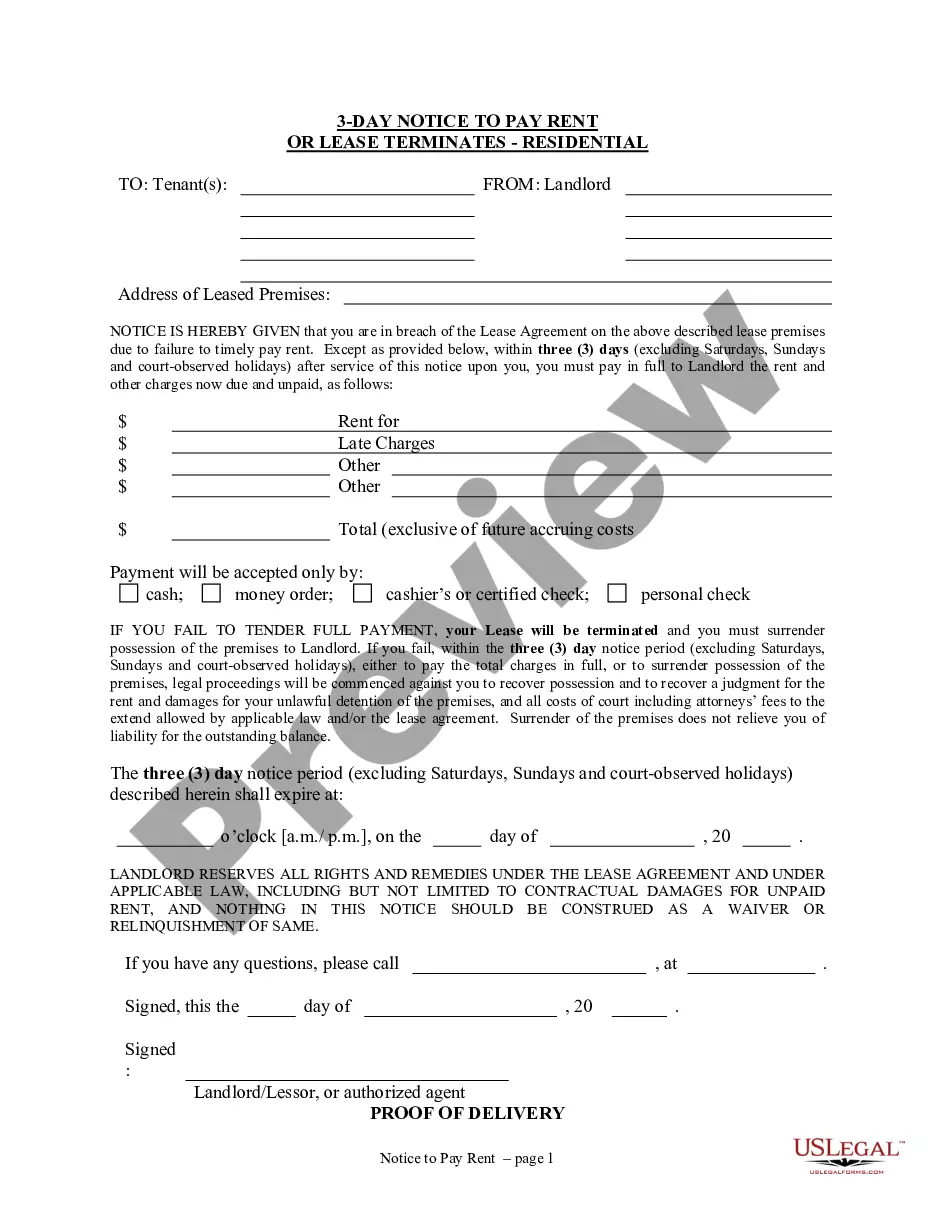

How to fill out Illinois Financial Record Storage Chart?

US Legal Forms - among the largest libraries of lawful varieties in the USA - delivers an array of lawful file layouts you may down load or produce. While using site, you will get thousands of varieties for business and personal reasons, categorized by categories, states, or keywords.You can find the most recent models of varieties such as the Illinois Financial Record Storage Chart within minutes.

If you currently have a registration, log in and down load Illinois Financial Record Storage Chart from the US Legal Forms collection. The Acquire option will show up on each kind you see. You have access to all in the past saved varieties from the My Forms tab of your respective bank account.

In order to use US Legal Forms for the first time, listed below are easy guidelines to help you started:

- Be sure you have picked the right kind for the metropolis/region. Click the Preview option to examine the form`s content. Browse the kind description to actually have chosen the right kind.

- If the kind does not suit your specifications, make use of the Lookup area at the top of the screen to obtain the one who does.

- If you are satisfied with the shape, validate your selection by clicking on the Purchase now option. Then, select the rates plan you prefer and offer your references to sign up on an bank account.

- Approach the deal. Make use of credit card or PayPal bank account to finish the deal.

- Select the structure and down load the shape on your own gadget.

- Make alterations. Fill up, modify and produce and sign the saved Illinois Financial Record Storage Chart.

Every single web template you put into your account does not have an expiry particular date and it is your own property eternally. So, if you wish to down load or produce one more backup, just go to the My Forms portion and click on the kind you will need.

Gain access to the Illinois Financial Record Storage Chart with US Legal Forms, the most extensive collection of lawful file layouts. Use thousands of skilled and state-distinct layouts that meet your small business or personal requirements and specifications.

Form popularity

FAQ

Health insurance policies and related documents are important to keep long term, too....Important papers to save forever include:Birth certificates.Social Security cards.Marriage certificates.Adoption papers.Death certificates.Passports.Wills and living wills.Powers of attorney.More items...?

Period of Limitations that apply to income tax returns Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return.

Seven Years or Longer When it comes to taxes, it's best to keep any tax records for at least seven years. The IRS statute of limitations for auditing is three years. However, there are circumstances where they can go back as far as six or seven years, for example, if you underreported income by 25% or more.

You need good records to prepare accurate financial statements. These include income (profit and loss) statements and balance sheets. These statements can help you in dealing with your bank or creditors and help you manage your business.

You must keep the following records for 7 years:minutes of board and committee meetings.written communications with shareholders, including emails.resolutions.certificates issued by directors.copies of all financial statements.a record of the assets and liabilities of the company.

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

Seven Years or Longer When it comes to taxes, it's best to keep any tax records for at least seven years. The IRS statute of limitations for auditing is three years. However, there are circumstances where they can go back as far as six or seven years, for example, if you underreported income by 25% or more.

Key Takeaways Most bank statements should be kept accessible in hard copy or electronic form for one year, after which they can be shredded. Anything tax-related such as proof of charitable donations should be kept for at least three years.