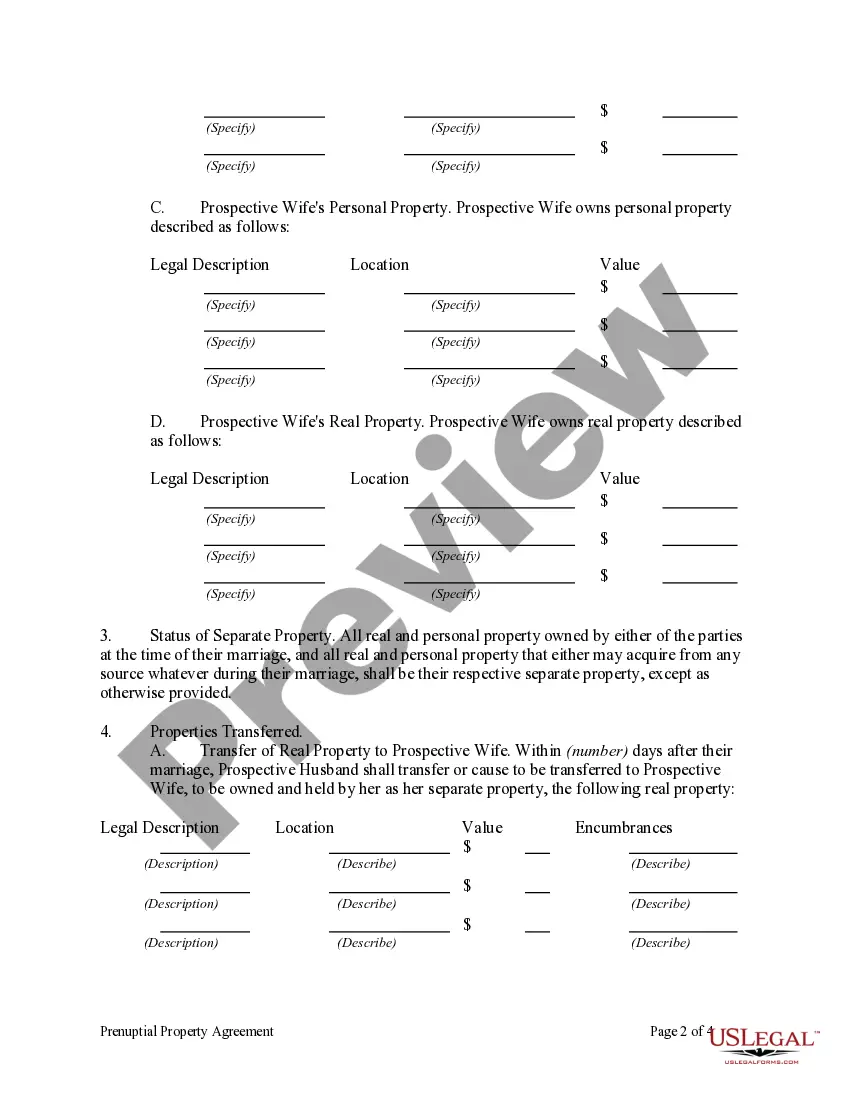

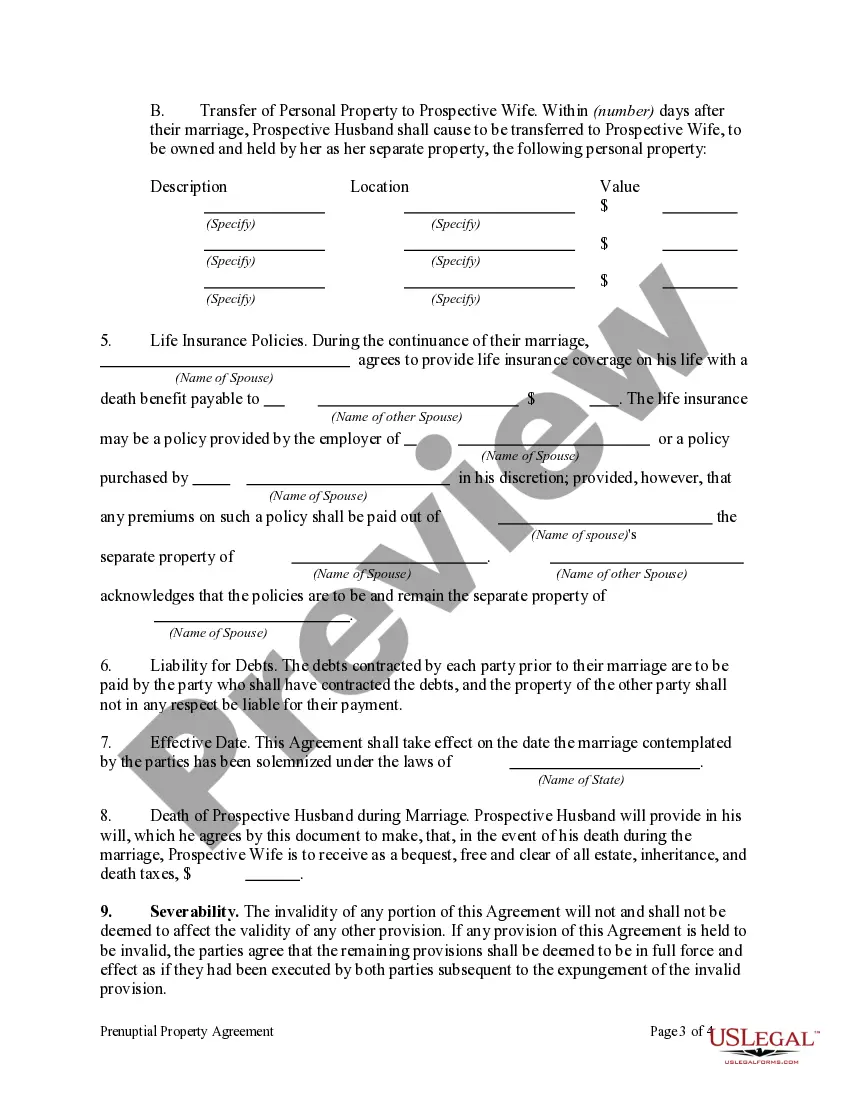

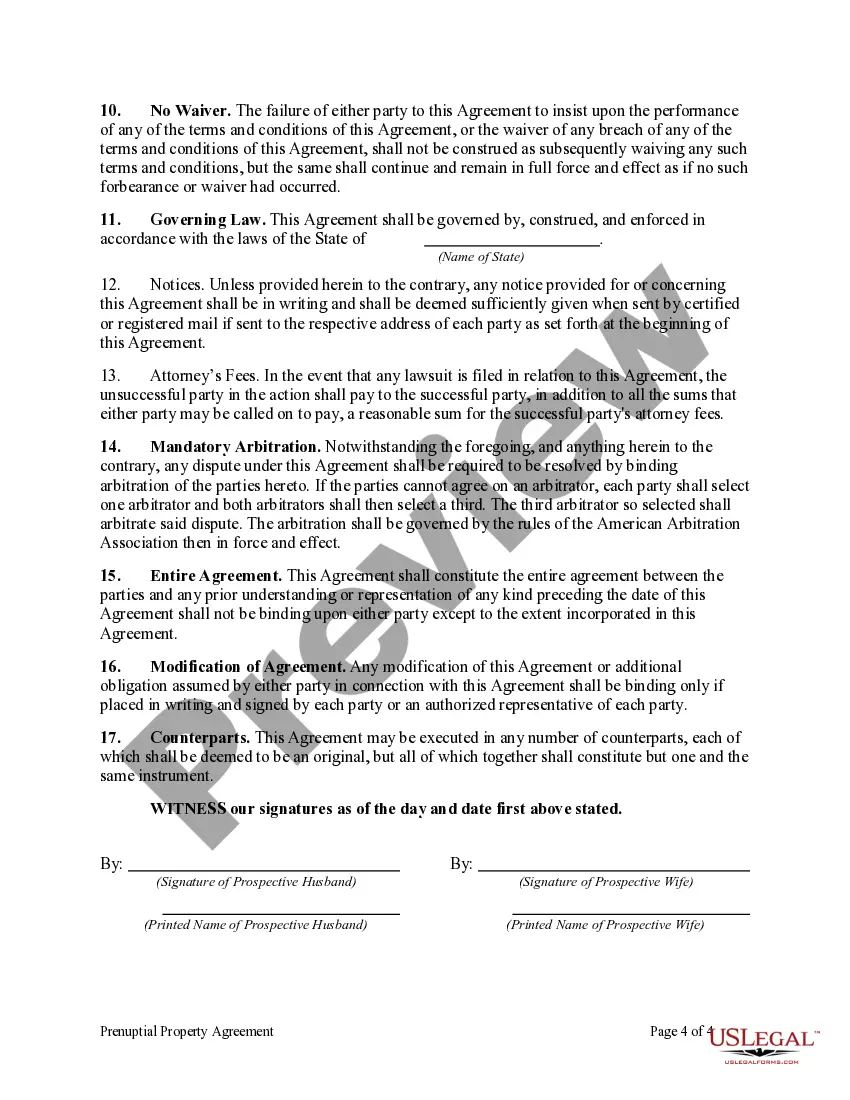

Illinois Prenuptial Property Agreement: A Comprehensive Guide A prenuptial property agreement, also known as a prenuptial agreement or prenup, is a legally binding contract entered into by a couple before they get married or enter into a civil union. In the state of Illinois, these agreements are governed by the Illinois Uniform Premarital Agreement Act (IUPAC). A well-drafted prenuptial property agreement can provide individuals with greater control over their property rights in the event of divorce, separation, or death. There are different types of prenuptial property agreements recognized and enforceable in Illinois. Here are some of the most common variations: 1. Traditional Prenuptial Property Agreement: This type of agreement outlines rights and obligations of each spouse regarding their respective premarital property, including real estate, investments, financial assets, and personal belongings. It also addresses how joint assets acquired during the marriage would be divided if the marriage ends in divorce. 2. Alimony or Spousal Support Agreement: Some prenuptial property agreements focus on determining the amount and duration of spousal support or alimony payments in the event of a divorce. Illinois law allows couples to waive or modify their right to receive alimony, provided it is fair and reasonable at the time it is entered into. 3. Business Interests Agreement: Prenuptial property agreements can also address the ownership and division of business interests acquired before and during the marriage. If one spouse owns a business or anticipates the acquisition of ownership in a company, the agreement can specify how the business will be evaluated and divided if the marriage ends. 4. Property Inheritance Agreements: In some cases, couples may want to ensure that specific property, such as family heirlooms, remains within their respective families in case of divorce or death. A prenuptial property agreement can outline how inherited property is to be treated and protected. 5. Debt and Financial Obligations: Prenuptial property agreements in Illinois can also address the allocation of debt acquired before or during the marriage. These agreements can state which debts are considered separate or joint, and how they need to be divided if the marriage ends. It's important to note that Illinois law requires full and fair disclosure of assets, debts, income, and other relevant financial information by both parties when entering into a prenuptial property agreement. Additionally, the agreement must be in writing, signed voluntarily by both parties, and may be subject to judicial enforcement or modification if there is evidence of fraud, duress, or unconscionably. In conclusion, an Illinois prenuptial property agreement serves as an essential tool to protect the assets and interests of individuals entering into a marriage or civil union. From traditional property agreements to those focusing on business interests, debt allocation, and inheritance, there are various types of agreements that can be tailored to the specific needs of each couple. Seeking legal advice from a qualified family law attorney is crucial to drafting a comprehensive prenuptial property agreement that complies with Illinois laws and protects the rights of both parties involved.

Illinois Prenuptial Property Agreement

Description

How to fill out Illinois Prenuptial Property Agreement?

You can invest several hours on-line attempting to find the legitimate document design that fits the federal and state needs you will need. US Legal Forms offers a large number of legitimate types which are evaluated by specialists. You can easily down load or print out the Illinois Prenuptial Property Agreement from our support.

If you already possess a US Legal Forms accounts, you may log in and click the Download option. Afterward, you may full, change, print out, or signal the Illinois Prenuptial Property Agreement. Every single legitimate document design you buy is the one you have for a long time. To have an additional version associated with a obtained kind, visit the My Forms tab and click the corresponding option.

If you use the US Legal Forms web site initially, keep to the simple guidelines under:

- Initially, make certain you have chosen the proper document design for the county/town that you pick. Look at the kind information to ensure you have picked out the correct kind. If readily available, take advantage of the Review option to look with the document design also.

- If you wish to get an additional version of the kind, take advantage of the Research industry to find the design that meets your needs and needs.

- Upon having identified the design you desire, just click Purchase now to continue.

- Select the rates prepare you desire, key in your credentials, and register for a free account on US Legal Forms.

- Comprehensive the transaction. You should use your bank card or PayPal accounts to purchase the legitimate kind.

- Select the structure of the document and down load it to your system.

- Make changes to your document if needed. You can full, change and signal and print out Illinois Prenuptial Property Agreement.

Download and print out a large number of document layouts making use of the US Legal Forms Internet site, which offers the most important assortment of legitimate types. Use professional and condition-specific layouts to handle your organization or person requirements.