Illinois Revocable Trust Agreement with Corporate Trustee

Description

How to fill out Revocable Trust Agreement With Corporate Trustee?

US Legal Forms - one of the most substantial collections of legal documents in the United States - offers a variety of legal template documents that you can download or create.

By utilizing the website, you can access countless forms for business and personal purposes, organized by categories, states, or keywords. You can retrieve the latest versions of forms such as the Illinois Revocable Trust Agreement with Corporate Trustee in just seconds.

If you have an account, Log In to download the Illinois Revocable Trust Agreement with Corporate Trustee from your US Legal Forms library. The Download option will be visible on every form you review. You can access all previously obtained forms in the My documents section of your account.

- Make sure to have selected the correct form for the city/region.

- Utilize the Review option to examine the form's content.

- Check the form details to confirm that you selected the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now option.

- Next, choose the pricing plan you prefer and provide your credentials to register for the account.

Form popularity

FAQ

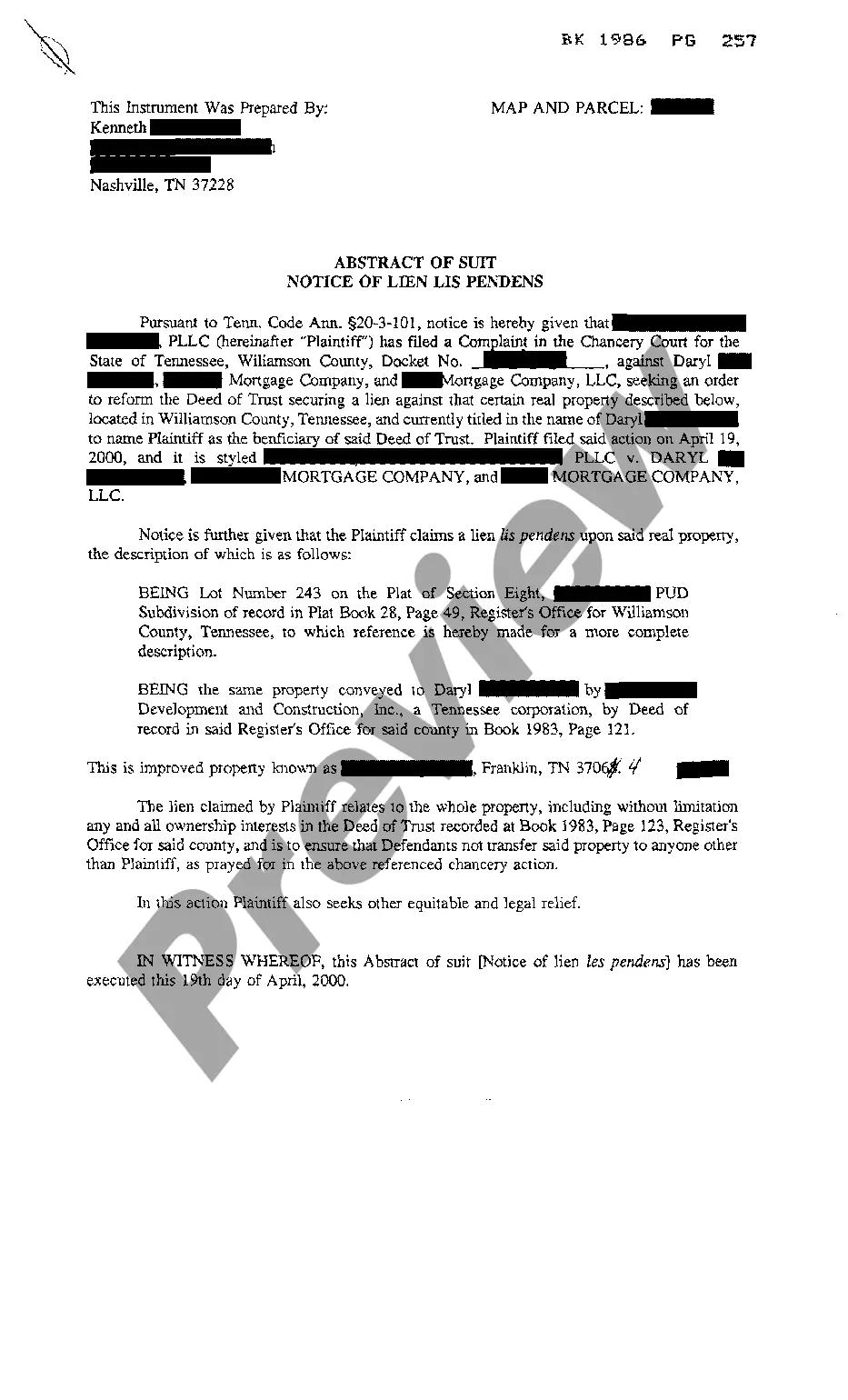

To distribute real estate held by a trust to a beneficiary, the trustee will have to obtain a document known as a grant deed, which, if executed correctly and in accordance with state laws, transfers the title of the property from the trustee to the designated beneficiaries, who will become the new owners of the asset.

Corporate trustees are departments at banks or other investment firms hired to build and manage a trust. People hire corporate trustees for their professional experience in trust matters that a family member or friend may not have.

Trustees have a duty to act jointly where more than one (and subject to the specific provisions of the Trust). Trustees have a duty to act gratuitously (subject to certain exceptions and the terms of the Trust, normally applying to professional Trustees).

Can a co-trustee act alone? The answer to this is No unless the Trust document states otherwise. In the case where the Trust does not explicitly state, the Trustee and the co-trustee should make all decisions unanimously to push the trust administration process forward.

Yes, a corporate trustee can be the beneficiary of the trust - as long as you include the trustee's name and their capacity.

If you're wondering can a trust own a corporation, the answer is yes, but only specific types of trusts qualify. As a legally separate entity, a trust manages and holds specific assets for a beneficiary's benefit.

The Code also makes clear that a beneficiary can act as trustee of a trust for his or her benefit and this will not cause creditors of the beneficiary to be able to reach the trust assets as long as the beneficiary/trustee can only make distributions based on an ascertainable standard.

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

Can a co-trustee act alone? The answer to this is No unless the Trust document states otherwise.

The trustee usually has the power to retain trust property, reinvest trust property or, with or without court authorization, sell, convey, exchange, partition, and divide trust property.