Illinois What To Do When Starting a New Business

Description

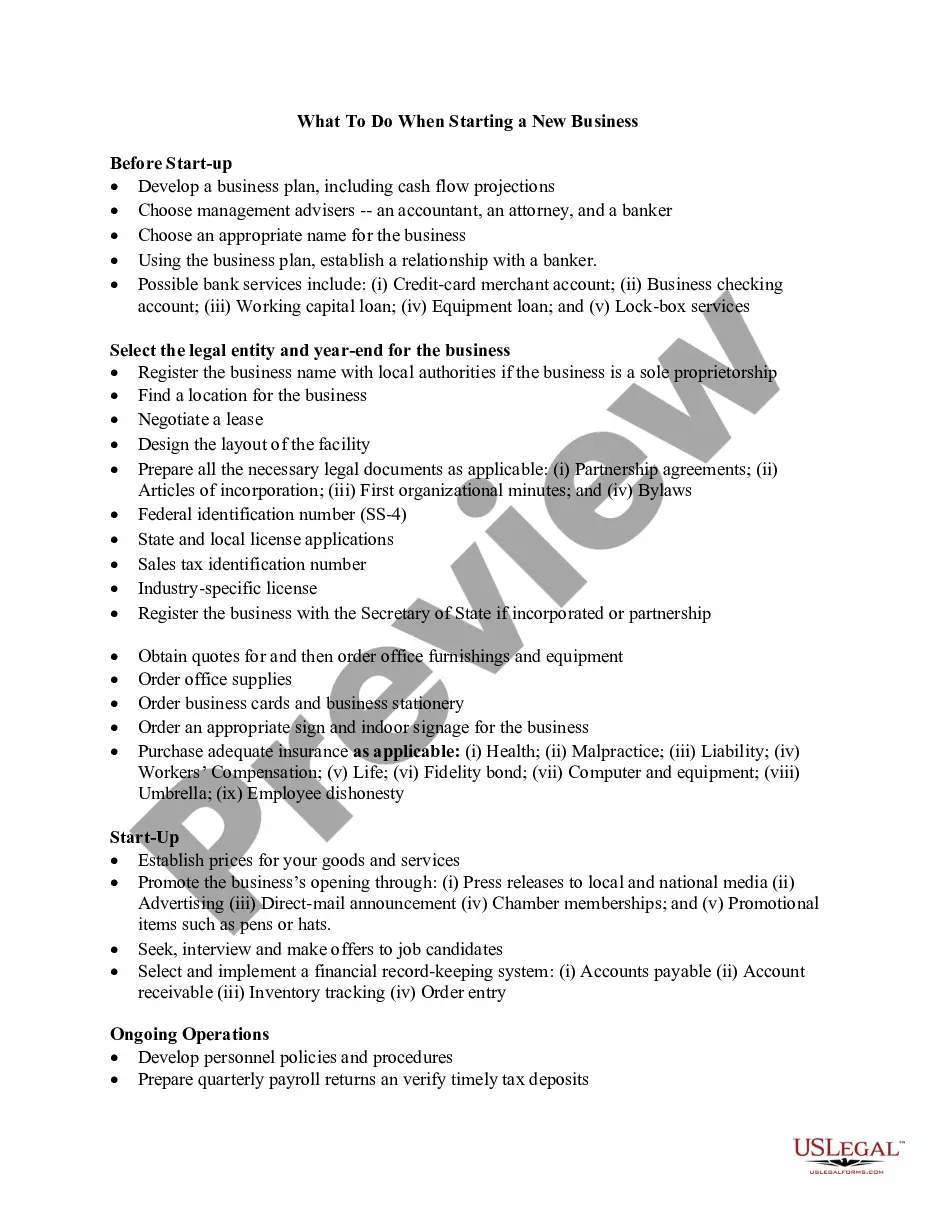

How to fill out What To Do When Starting A New Business?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a variety of legal document templates that you can download or print. By using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms like the Illinois What To Do When Starting a New Business in moments.

If you already have a membership, Log In and download the Illinois What To Do When Starting a New Business from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

To use US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your city/county. Click on the Review button to examine the form's content. Read the form summary to verify that you have chosen the right form. If the form does not meet your needs, use the Search box at the top of the screen to find the one that does. If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, select your preferred payment plan and provide your details to create an account. Process the transaction. Use a credit card or PayPal account to complete the transaction. Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Illinois What To Do When Starting a New Business.

- Each template added to your account has no expiration date and is yours permanently.

- If you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Illinois What To Do When Starting a New Business with US Legal Forms, the most comprehensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Easily navigate through various categories to find the documents that suit your needs.

Form popularity

FAQ

How to start a business in 10 stepsEvaluate your business goals.Start writing your business plan.Conduct market research.Business structure and logistics.Get funding for your small business.Design prototypes and get feedback.Put together your leadership team.Develop your product.More items...?

Conduct market research. Market research will tell you if there's an opportunity to turn your idea into a successful business.Write your business plan.Fund your business.Pick your business location.Choose a business structure.Choose your business name.Register your business.Get federal and state tax IDs.More items...

You must register with the Illinois Department of Revenue if you conduct business in Illinois, or with Illinois customers. This includes sole proprietors (individual or husband/wife/civil union), exempt organizations, or government agencies withholding for Illinois employees.

How to Start a Business in IllinoisChoose a Business Idea.Decide on a Legal Structure.Choose a Name.Create Your Business Entity.Apply for Licenses and Permits.Pick a Business Location and Check Zoning Regulations.Review Your Tax Registration and Reporting Requirements.Obtain Insurance.More items...

Here are the first five steps to starting your own business.Step 1: Develop Your Viable Business Idea.Step 2: Take Care of Branding.Step 3: Get Your Plans in Place.Step 4: Test It All Out.Step 5: Just Do It.

Quick ReferenceWhat Business Licenses and Permits are Needed in Illinois?General Business License.Building & Zoning Permits.Business Tax Number.Resale Certificate.Professional License.Employer Identification Number (EIN)Assumed Business Name Registration.

8 Steps to Starting a Small BusinessCome Up with a Viable Idea. Every great business started with a great idea.Write a Business Plan.Plan Your Finances and Budget.Decide on the Structure.Find and Set Up a Location.Create Your Brand.Build Your Team.Launch Your Small Business.

Illinois does not issue business licenses at the state-level, but you may have local requirements for licenses and permits, which may be enforced at the county, city, and local level. Contact your county, city, and/or town: You'll need to contact the county, city, and/or town where your LLC will be doing business.

Illinois Corporation Incorporation: $150 filing fee + franchise tax ($25 minimum) + optional $100 expedite fee. The expedite fee is required if you file online. Franchise tax is calculated as $1.50 per $1,000 on the paid-in capital represented in this state.

12 Steps to Starting a Small BusinessStep 2: Write a business plan.Step 3: Fund your business.Step 4: Determine your business structure.Step 5: Choose and register a business name.Step 6: Create a marketing plan.Step 7: Get a Tax Identification Number.Step 8: Open a business bank account.Step 9: Figure out your taxes.More items...?