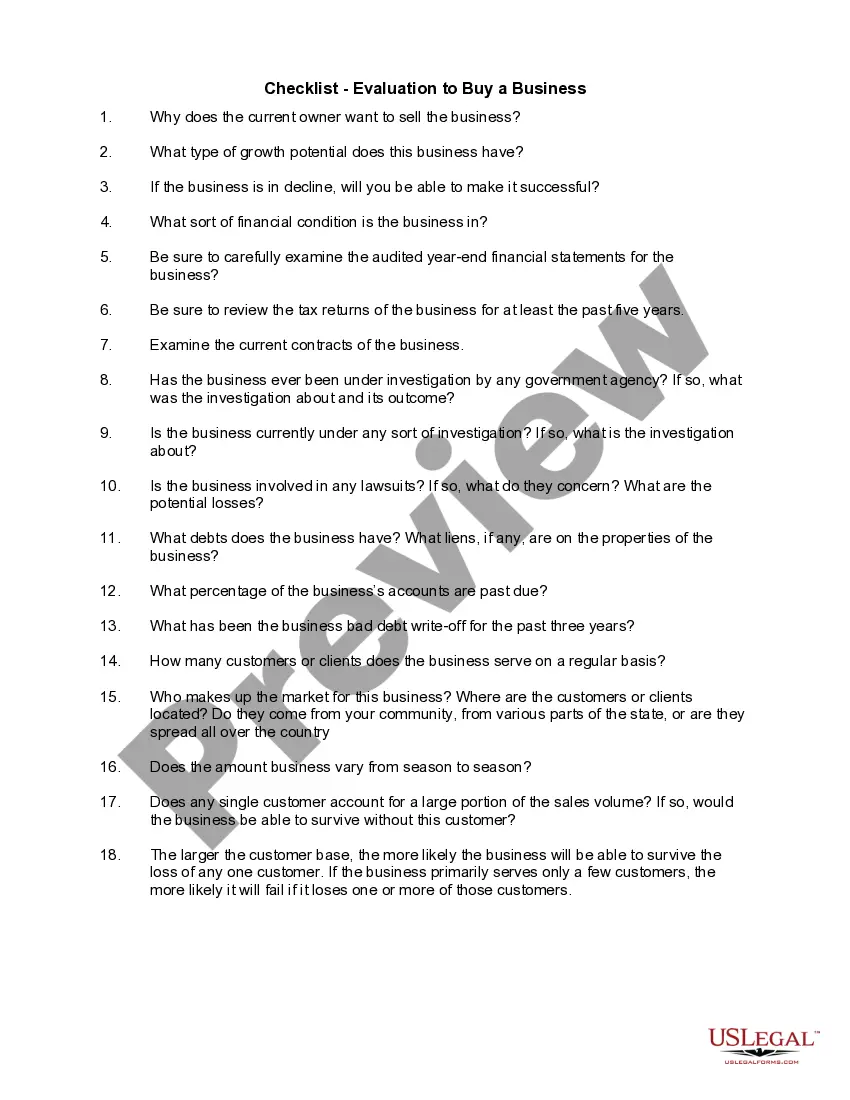

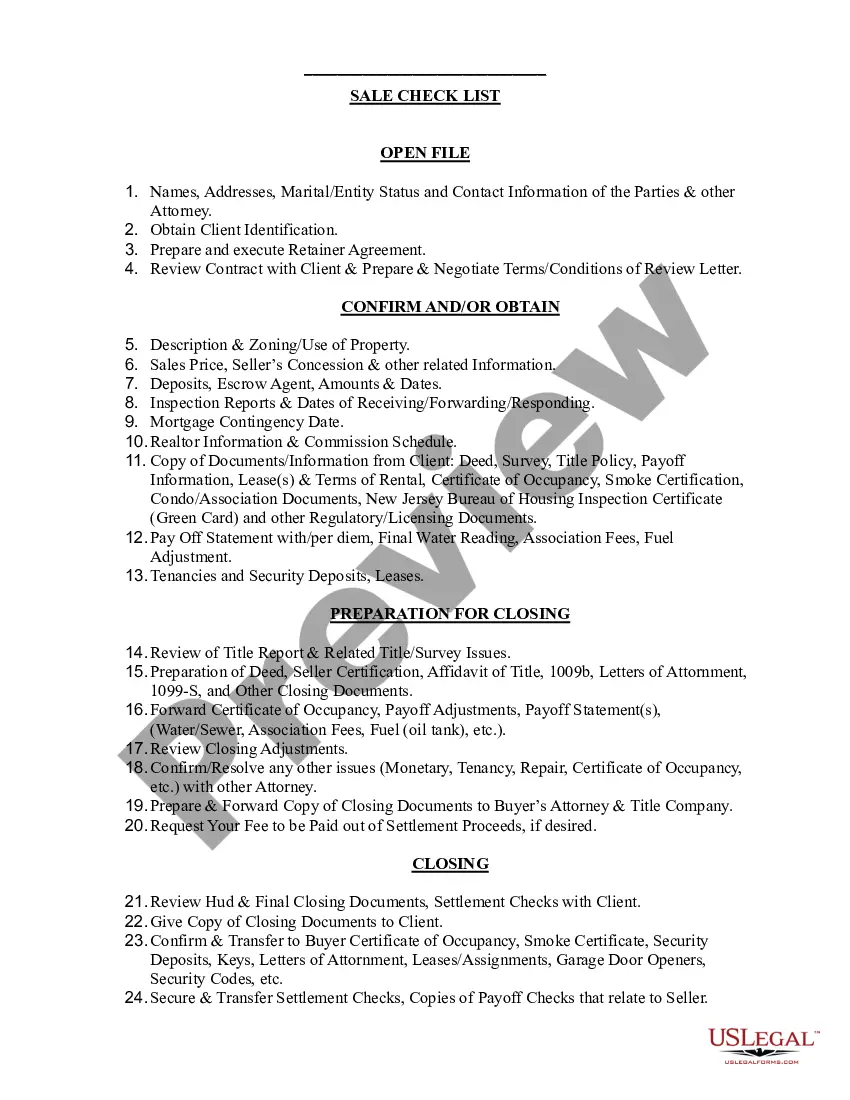

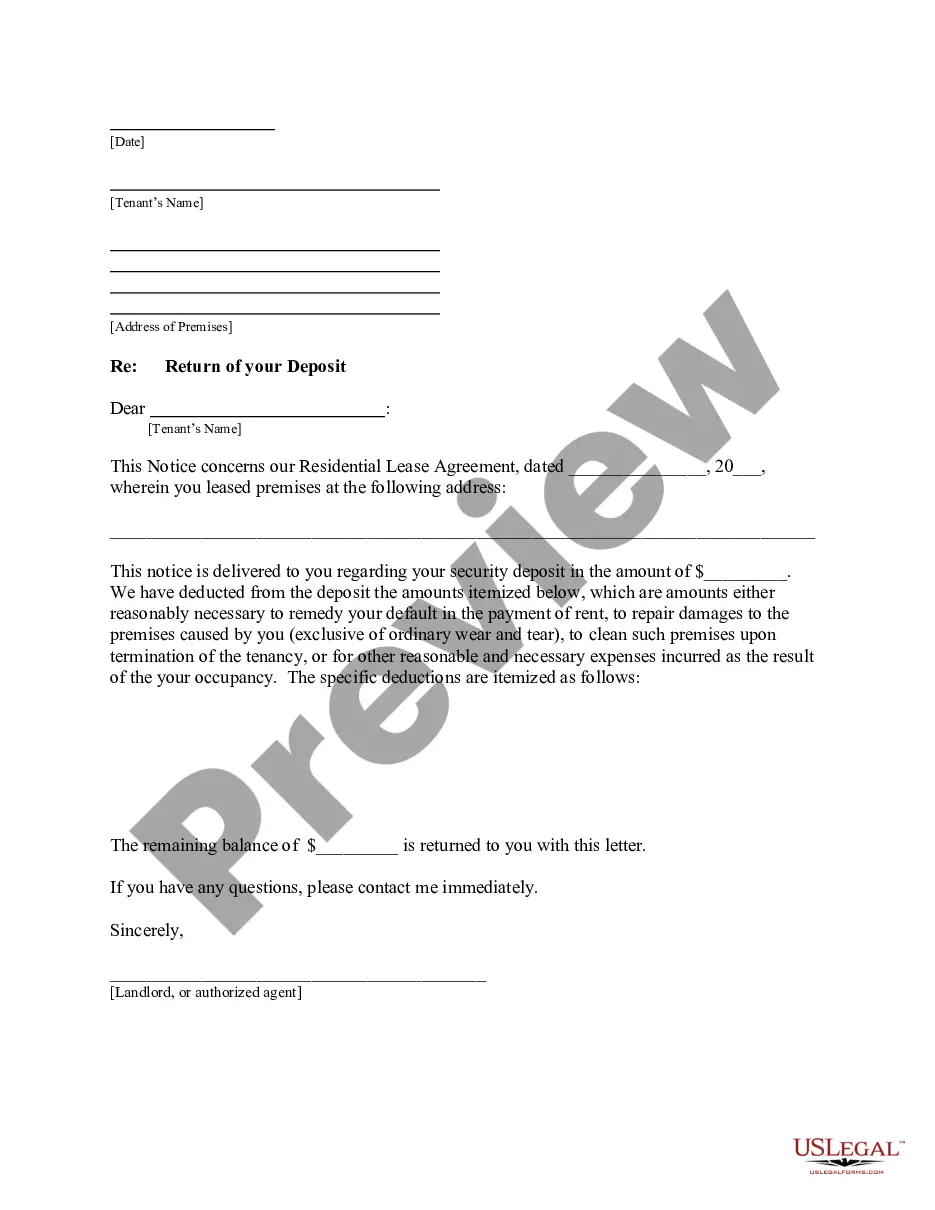

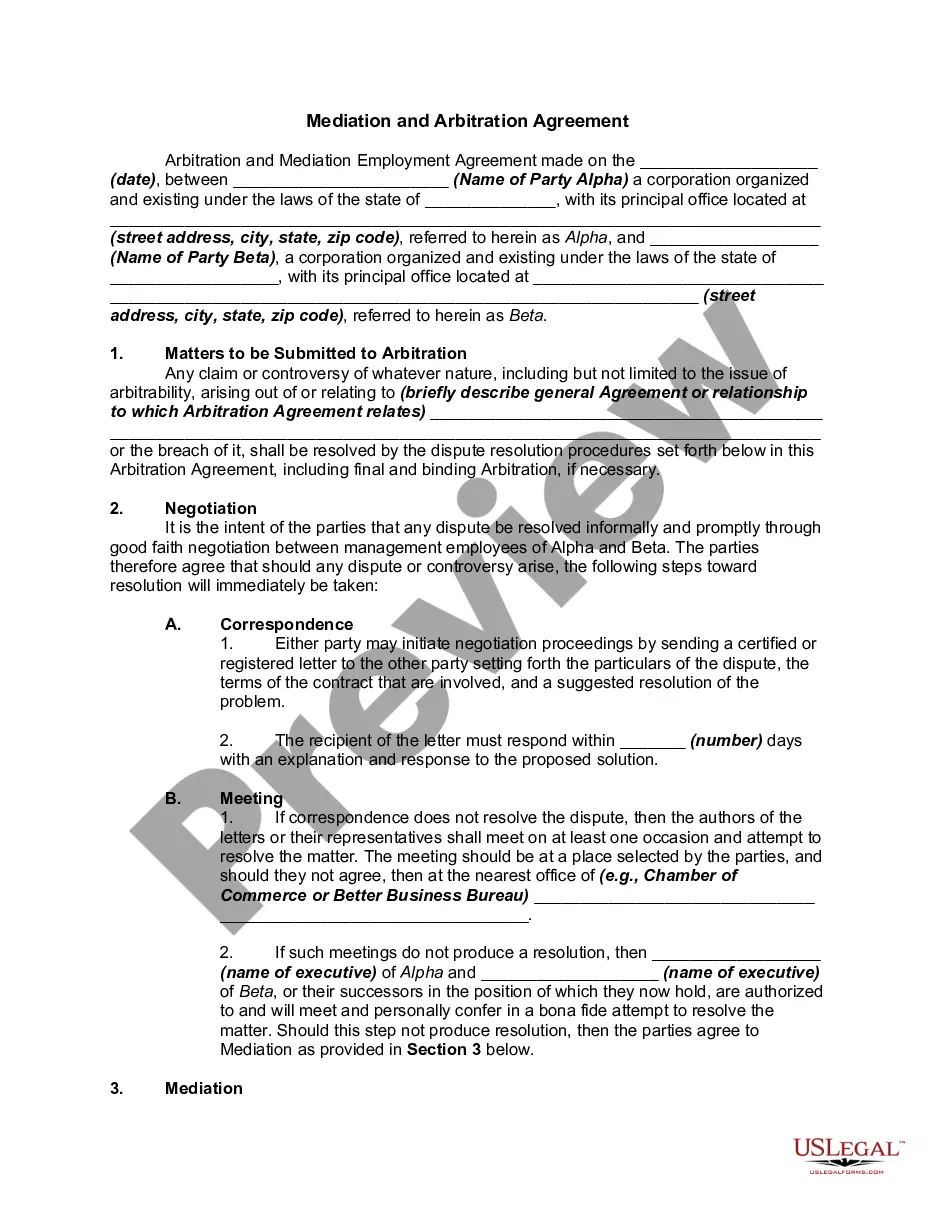

Illinois Checklist - Sale of a Business

Description

How to fill out Checklist - Sale Of A Business?

Are you presently in a position where you require documentation for possible business or personal purposes nearly every day.

There are numerous authentic document templates accessible online, but finding versions that you can rely on isn't straightforward.

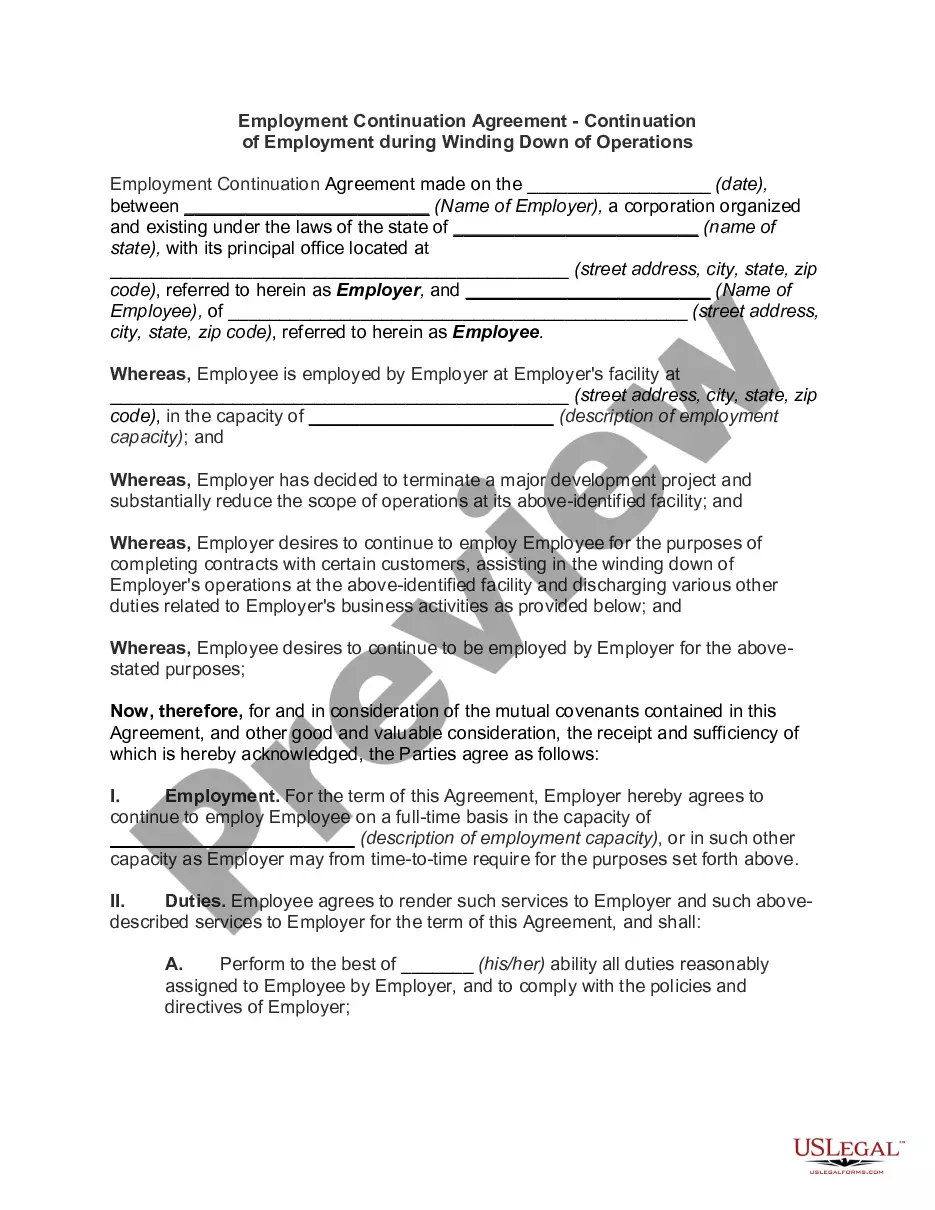

US Legal Forms offers a multitude of template options, such as the Illinois Checklist - Sale of a Business, which can be tailored to meet both state and federal regulations.

Once you find the right form, just click Buy now.

Select the pricing plan you prefer, fill in the required information for payment, and purchase your order using PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents list. You can retrieve an additional copy of the Illinois Checklist - Sale of a Business at any time if necessary. Click on the desired form to download or print the document template. Utilize US Legal Forms, the largest collection of legitimate forms, to save time and avoid errors. This service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are currently acquainted with the US Legal Forms website and have an account, just Log In.

- After that, you can retrieve the Illinois Checklist - Sale of a Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is relevant to your specific city/region.

- Utilize the Preview button to examine the form.

- Review the details to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

Debit the cash account in a new journal entry in your double-entry accounting system by the amount for which you sold the business property. A debit increases the cash account, which is an asset account. For example, assume you sold equipment for $40,000. Debit cash for $40,000 in a new journal entry.

Pricing a business for sale requires evaluating its cash flowanother name for a business's earnings before interest, taxes, depreciation, amortization and owner's compensation are subtracted.

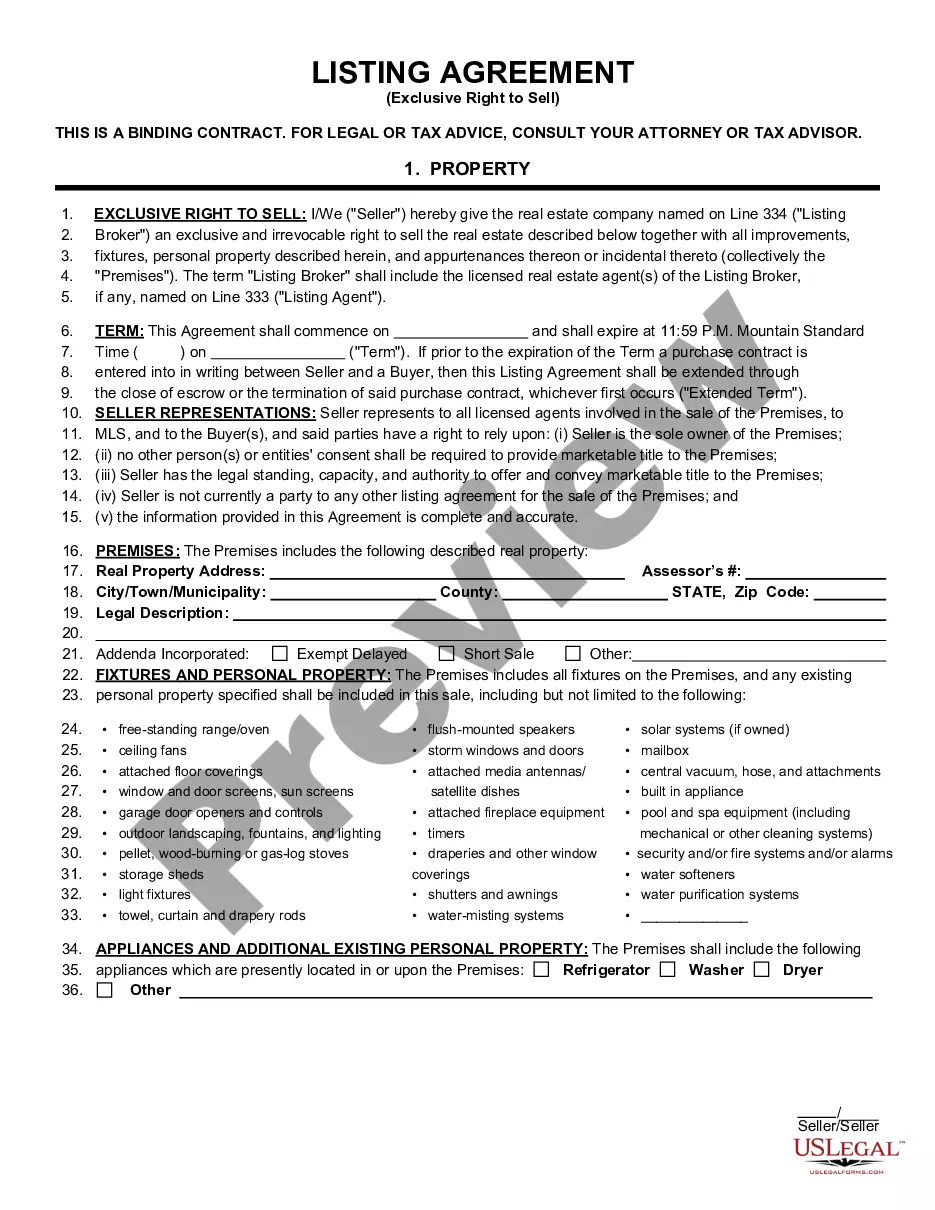

A bulk sale, sometimes called a bulk transfer, is when a business sells all or nearly all of its inventory to a single buyer and such a sale is not part of the ordinary course of business.

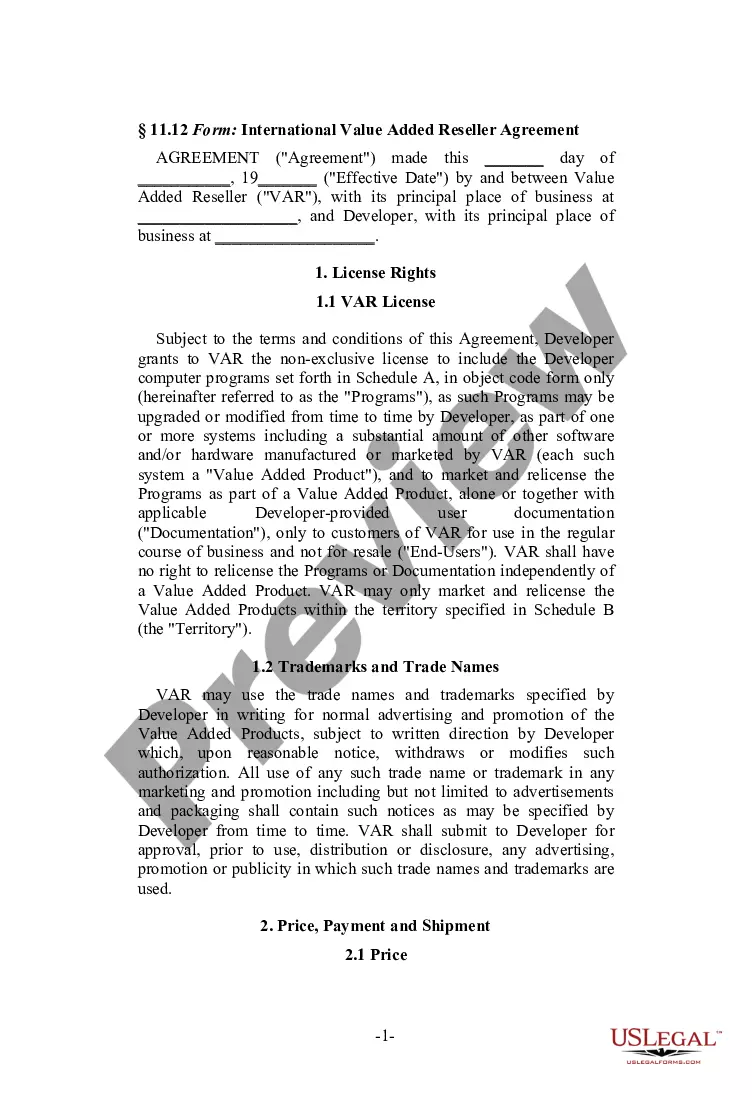

The acquired assets usually include all fixed assets (usually supported by a detailed list), all inventory, all supplies, tools, computers and related software, websites, all social media accounts used in connection with the Business, all permits, patents, trademarks, service marks, trade names (including but not

This type of sale involves selling different assets: Tangible: land, cash, investments, buildings, and inventory. Intangible: patents, copyrights, trademarks, and the goodwill of a business that has been built over the years.

Under California law, a bulk sale is defined as a sale of more than half of a business' inventory and equipment, as measured by fair market value, that is not part of the seller's ordinary course of business. In order for the law to apply, the seller has to be physically located in California.

1 (a) Purpose. Bulk Sales Act is designed to prevent the defrauding of creditors by the secret sale in bulk of substantially all of a merchant's stock of goods.

Updating your Business Informationelectronically through MyTax Illinois,by calling us at 217-785-3707,by email at REV.CentReg@illinois.gov, or.at one of our offices.

In Illinois, various "Bulk Sales Acts" impose an obligation on purchasers of a business or a major portion of the assets of a business, which can include the transfer of real estate, for certain unpaid taxes and even debts for which the seller of such property was responsible.

The following assets and liabilities are normally included in the sale:Working capital. Cash (but only the amount necessary to pay expenses for a reasonable period of time) Accounts receivable. Inventory. Work in progress. Prepaid expenses. Accounts payable. Wages payable.Furniture & fixtures.Equipment.Vehicles.