Illinois Sample Letter for Revised Promissory Note: A revised promissory note is a legal document used in Illinois to modify the terms and conditions of an existing promissory note. It provides a written record of any changes made to the original agreement between the lender and the borrower. The purpose of a revised promissory note is to ensure that both parties are on the same page regarding payments, interest rates, and other relevant details. Here is a detailed description of what an Illinois Sample Letter for Revised Promissory Note may include: 1. Heading: Start the letter with a heading that includes the lender's name and contact information, such as mailing address, phone number, and email address. Use a professional and easily identifiable format. 2. Date: Right below the heading, mention the date on which the letter is being written. This helps in maintaining a clear timeline of communications. 3. Borrower's Information: Include the borrower's name, address, contact number, and any other relevant identification details. This ensures clarity and accuracy while addressing the letter. 4. Current Promissory Note Details: Provide detailed information about the existing promissory note, including the original loan amount, interest rate, repayment terms, and other pertinent information. This allows both parties to understand the context of the revision. 5. Reason for Revision: Clearly state the purpose behind the revision of the promissory note. It could be a modification in loan repayment schedule, altering interest rates, extending or reducing the loan duration, or any other mutually agreed-upon change. Explain the rationale behind the revision in a concise yet detailed manner. 6. Revised Terms and Conditions: Specify the revised terms and conditions in a clear and comprehensive manner. This may include changes to the interest rate, installment amount, due dates, grace period, prepayment conditions, or any other relevant clauses. Ensure that the revised terms align with both parties' expectations and are legally sound. 7. Legal Language: The letter should include language that emphasizes the binding nature of the revised promissory note and highlights that it supersedes any previous agreements. This can provide legal protection to both parties and ensure that the new terms are enforceable. 8. Signature and Notarization: At the end of the letter, provide space for both the lender and the borrower to sign and date the document. Consider getting the revised promissory note notarized to add a layer of authenticity and legal validity. Types of Illinois Sample Letter for Revised Promissory Note: 1. Revised Promissory Note for Loan Modification: This type of letter is used when the lender and the borrower agree to modify the terms of the loan, such as changing the interest rate, extending the loan duration, or adjusting the repayment schedule. 2. Revised Promissory Note for Interest Rate Change: This letter is used specifically for revising the interest rate specified in the original promissory note. It clarifies the new interest rate, any compound interest calculations, and its implications on the loan repayment. 3. Revised Promissory Note for Extension or Early Repayment Options: This type of letter is employed when the parties agree to extend or shorten the loan duration, offering flexibility in terms of early repayment options. By using an Illinois Sample Letter for Revised Promissory Note, both lenders and borrowers can ensure transparency, clear communication, and legally binding modifications to their original loan agreements.

Illinois Sample Letter for Revised Promissory Note

Description

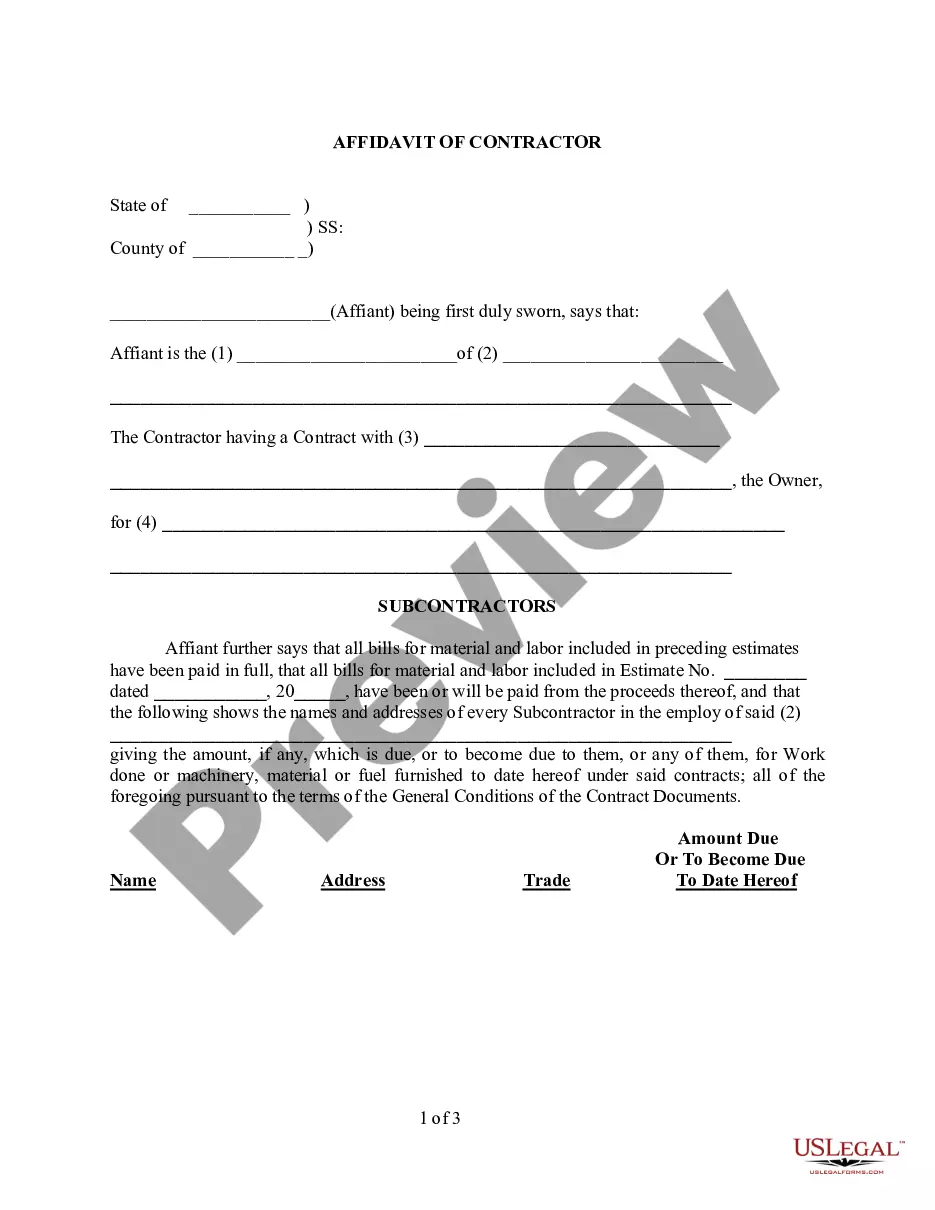

How to fill out Illinois Sample Letter For Revised Promissory Note?

Are you in a place that you will need documents for both enterprise or specific uses almost every day time? There are a lot of legal papers layouts accessible on the Internet, but finding versions you can depend on is not simple. US Legal Forms delivers thousands of type layouts, much like the Illinois Sample Letter for Revised Promissory Note, which are published to meet federal and state demands.

In case you are already familiar with US Legal Forms website and possess an account, basically log in. Following that, it is possible to download the Illinois Sample Letter for Revised Promissory Note web template.

If you do not have an accounts and wish to start using US Legal Forms, follow these steps:

- Get the type you will need and make sure it is to the appropriate area/area.

- Take advantage of the Preview switch to examine the shape.

- Browse the description to ensure that you have chosen the appropriate type.

- In case the type is not what you`re seeking, take advantage of the Look for discipline to get the type that suits you and demands.

- When you obtain the appropriate type, click on Purchase now.

- Opt for the costs strategy you desire, submit the desired info to create your money, and buy the transaction utilizing your PayPal or credit card.

- Select a hassle-free document format and download your copy.

Discover all of the papers layouts you might have purchased in the My Forms food selection. You may get a more copy of Illinois Sample Letter for Revised Promissory Note anytime, if required. Just click the essential type to download or print out the papers web template.

Use US Legal Forms, probably the most comprehensive variety of legal types, in order to save efforts and prevent mistakes. The service delivers expertly created legal papers layouts that you can use for an array of uses. Make an account on US Legal Forms and start producing your way of life a little easier.