A mobile home insurance policy is crucial for all Illinois residents who own or plan to own a mobile home. This comprehensive coverage ensures protection against unforeseen events that can cause damage to your valuable asset. Whether you own a mobile home in Chicago, Springfield, or any other city in Illinois, having a solid insurance policy safeguards your investment and provides peace of mind. When it comes to mobile home insurance policies in Illinois, there are various types available, tailored to meet specific needs. Here are some common types: 1. Standard Mobile Home Insurance Policy: A standard mobile home insurance policy in Illinois typically covers the structure of your mobile home, including walls, roof, and built-in appliances. It also provides coverage for attached structures such as decks or carports. Additionally, this policy offers liability coverage, protecting you against any injuries that may occur on your property. 2. Comprehensive Mobile Home Insurance Policy: A comprehensive mobile home insurance policy in Illinois offers enhanced protection and covers a broader range of perils. In addition to the coverage provided by a standard policy, it includes protection against non-standard perils like theft, vandalism, and natural disasters such as tornadoes or hailstorms. 3. Mobile Home Contents Insurance Policy: This type of policy focuses on protecting your personal belongings within the mobile home, such as furniture, electronics, appliances, and clothing. It ensures that you can recover financially in case of damage, theft, or loss of these items. Mobile home contents insurance policy is particularly beneficial for those who own fully furnished mobile homes. 4. Replacement Cost Coverage Policy: A replacement cost coverage policy provides financial reimbursement for the full replacement value of your mobile home in case of a covered loss, without taking into account any depreciation. This type of insurance policy ensures you can replace your mobile home with a similar one, even if the cost significantly exceeds the actual cash value of the damaged or destroyed home. 5. Actual Cash Value Policy: An actual cash value policy takes into account the depreciation of your mobile home. In the event of a covered loss, it provides reimbursement based on the current market value of the property. This policy is generally cheaper than replacement cost coverage but may not fully cover the cost of replacing your mobile home. Writing a detailed description of an Illinois sample letter for a mobile home insurance policy involves emphasizing the importance of protecting one's investment in a mobile home. Also, highlighting the different types of insurance policies available in Illinois, including standard policies, comprehensive policies, mobile home contents policies, replacement cost coverage policies, and actual cash value policies, will help potential policyholders choose the type that best suits their needs. Whether you reside in a bustling city or a serene rural area, having a mobile home insurance policy tailored to your requirements is essential to safeguard your property and belongings.

Illinois Sample Letter for Mobile Home Insurance Policy

Description

How to fill out Illinois Sample Letter For Mobile Home Insurance Policy?

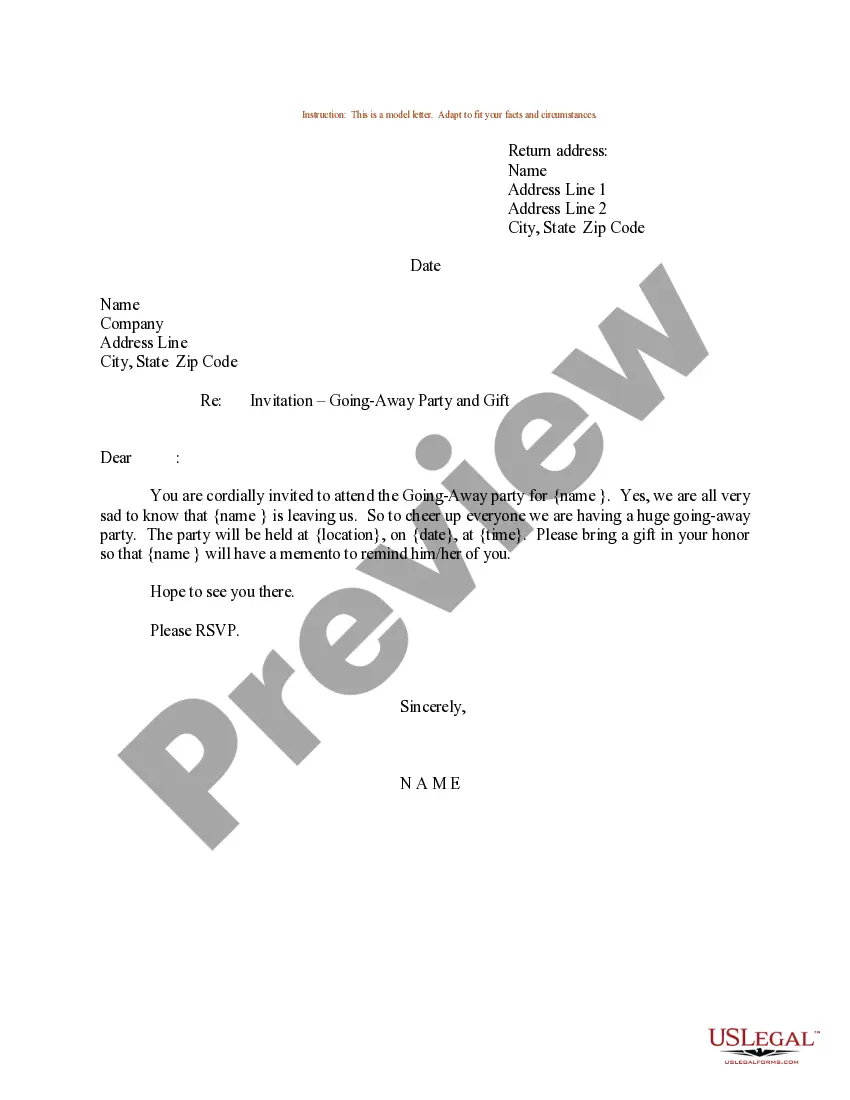

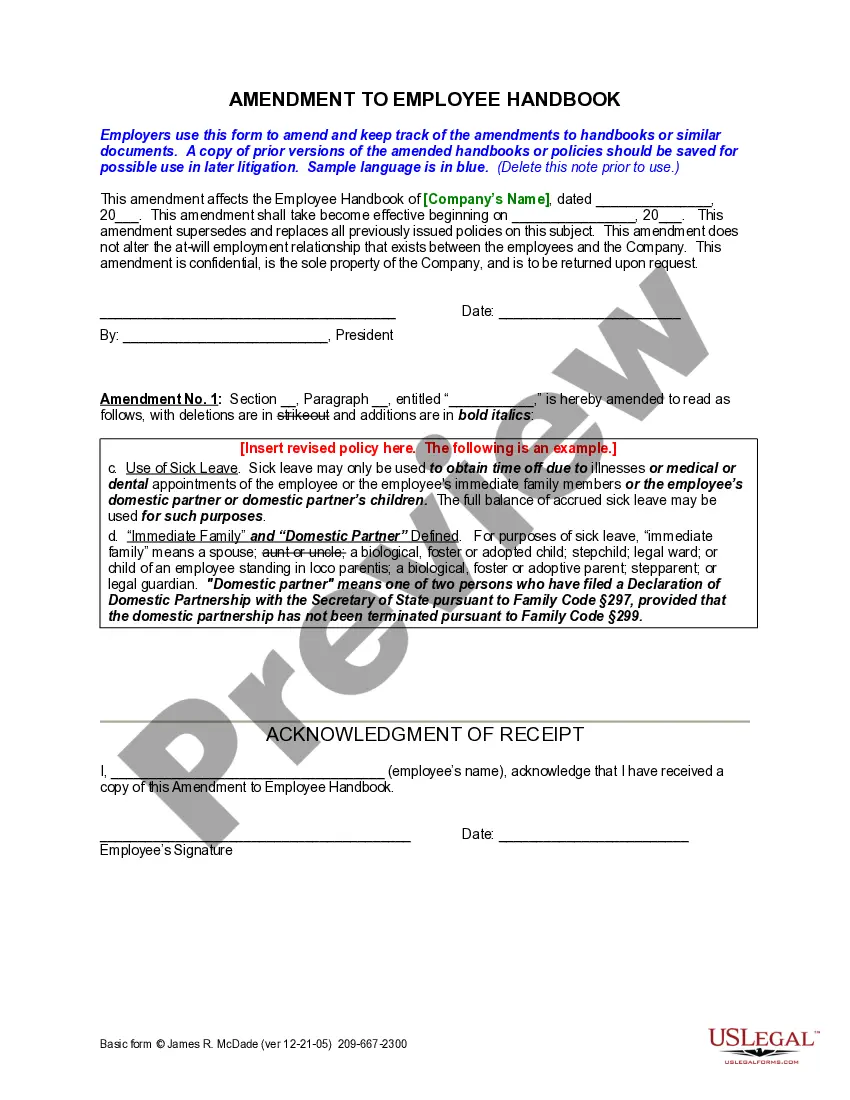

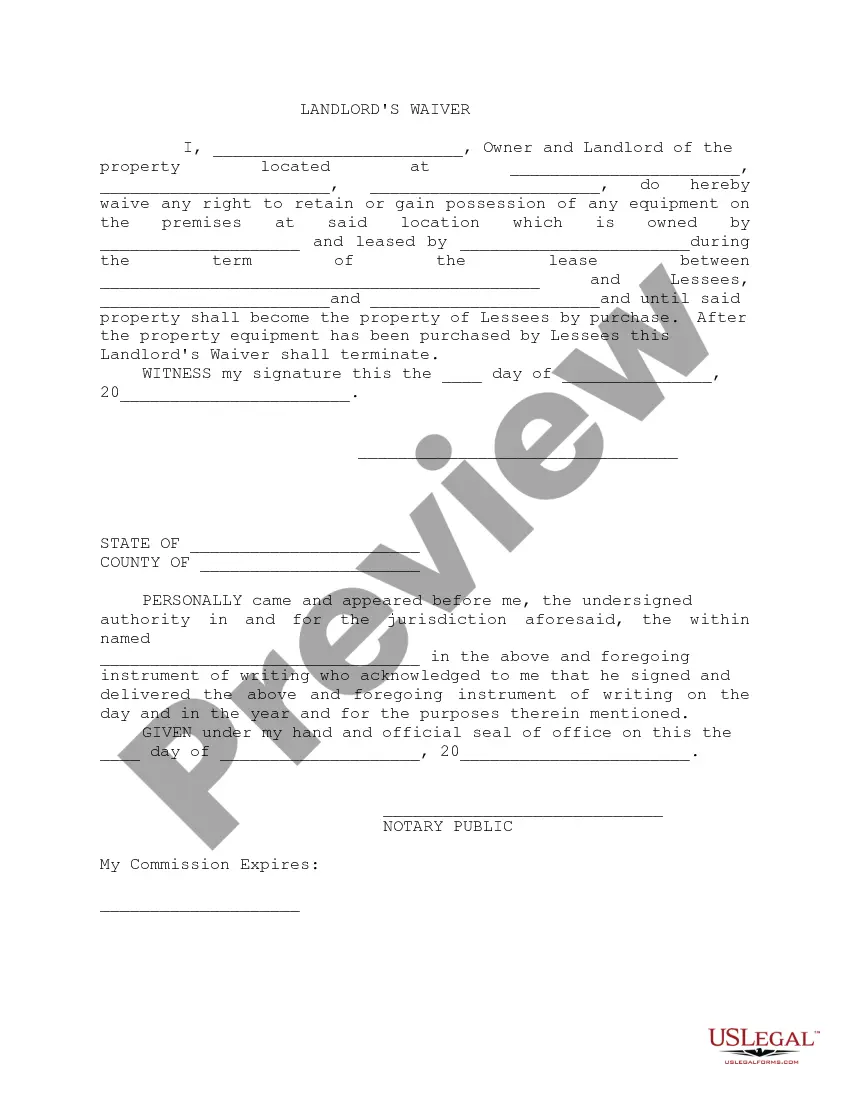

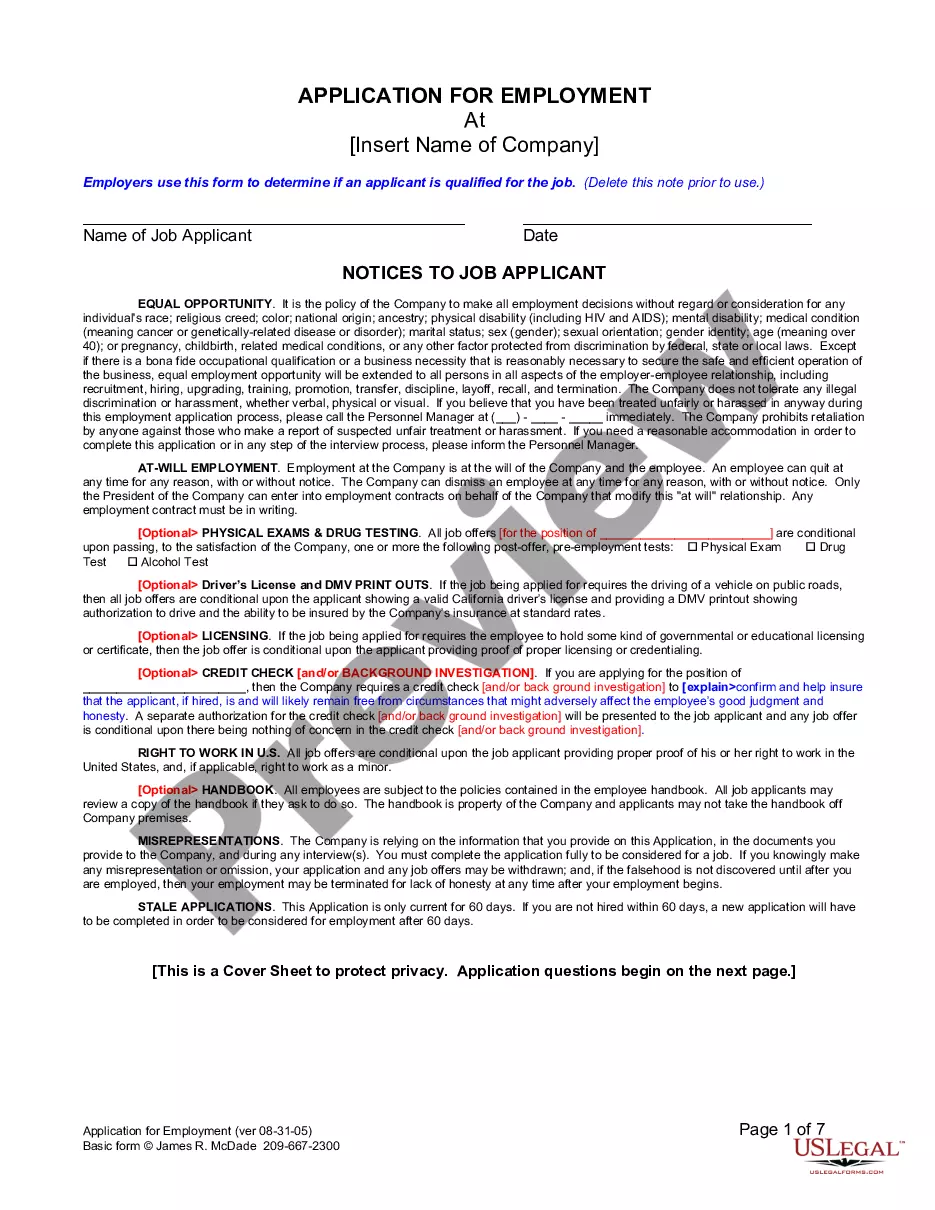

If you want to comprehensive, down load, or print legitimate document layouts, use US Legal Forms, the most important assortment of legitimate forms, which can be found online. Take advantage of the site`s easy and practical search to obtain the paperwork you want. Various layouts for business and specific purposes are sorted by categories and claims, or search phrases. Use US Legal Forms to obtain the Illinois Sample Letter for Mobile Home Insurance Policy in just a handful of mouse clicks.

If you are previously a US Legal Forms customer, log in for your accounts and click the Obtain switch to find the Illinois Sample Letter for Mobile Home Insurance Policy. You can also entry forms you formerly acquired in the My Forms tab of the accounts.

If you work with US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for your right city/land.

- Step 2. Take advantage of the Preview option to look through the form`s content material. Never forget about to read through the information.

- Step 3. If you are not happy with all the develop, utilize the Search area on top of the monitor to get other versions from the legitimate develop design.

- Step 4. After you have located the shape you want, select the Buy now switch. Pick the rates strategy you like and put your accreditations to sign up on an accounts.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal accounts to complete the financial transaction.

- Step 6. Choose the format from the legitimate develop and down load it on your device.

- Step 7. Comprehensive, revise and print or indicator the Illinois Sample Letter for Mobile Home Insurance Policy.

Every single legitimate document design you get is the one you have eternally. You might have acces to each and every develop you acquired within your acccount. Click the My Forms area and choose a develop to print or down load once more.

Remain competitive and down load, and print the Illinois Sample Letter for Mobile Home Insurance Policy with US Legal Forms. There are thousands of professional and status-distinct forms you may use to your business or specific needs.

Form popularity

FAQ

In order to write a successful insurance claim letter, start with an introduction who you are, why you are writing, contact information and the details on your property. This will help the insurance adjuster understand the most important details and how to get in touch with you when there are questions.

I am very dissatisfied with how I have been treated by agents of my insurance company. I have felt intimidated and harassed by the insurer's investigators. I am very dissatisfied with how I have been treated by assessors from my insurance company. I do not believe the assessment has been fair or transparent.

Explain what happened. Next, explain why the claim was made. Include details such as the cause of the accident, the extent of damage, and any other relevant information. If you know the detailed information include that too.

An insurance claim is a formal request to your insurance provider for reimbursement against losses covered under your insurance policy. Insurance is a financial agreement between you and your insurer. You have to pay a fixed premium.

Writing Super-Effective Insurance Sales Email Templates: 101 Know your audience. Before writing your email, you must understand who you are writing to. ... Grab Their Attention. The subject line is your recipient's first sentence. ... Personalize Your Message Body. ... Provide value. ... Call to action.

Sample Template Date:________ From. Name of the Insurance Claiming Person. Address __________ ... Dear Sir/ Madam, SUBJECT: DIRECT CLAIM LETTER. ... I hope to hear from you soon regarding payment of my amount. I will appreciate an effort from your end to avoid any more problems in the future.