Illinois Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

Description

How to fill out Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by categories, states, or keywords. You can find the latest forms such as the Illinois Sale of Assets of Corporation without the requirement to adhere to Bulk Sales Laws in just a few seconds.

If you hold a subscription, Log In and download Illinois Sale of Assets of Corporation without the need to comply with Bulk Sales Laws from your US Legal Forms library. The Download option will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Make adjustments. Fill out, modify, print, and sign the downloaded Illinois Sale of Assets of Corporation without the requirement to adhere to Bulk Sales Laws.

Each document you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- If you are using US Legal Forms for the first time, here are concise instructions to assist you in getting started.

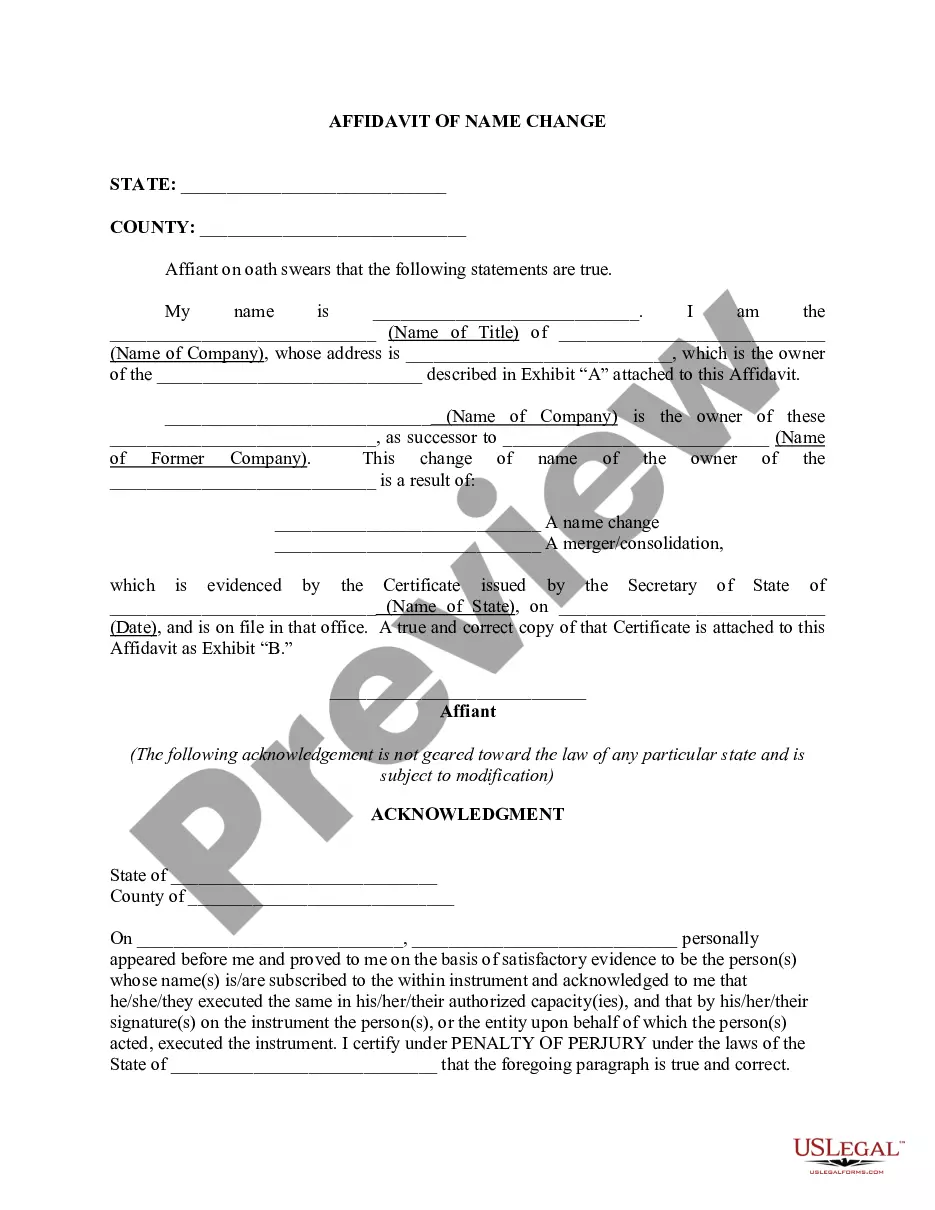

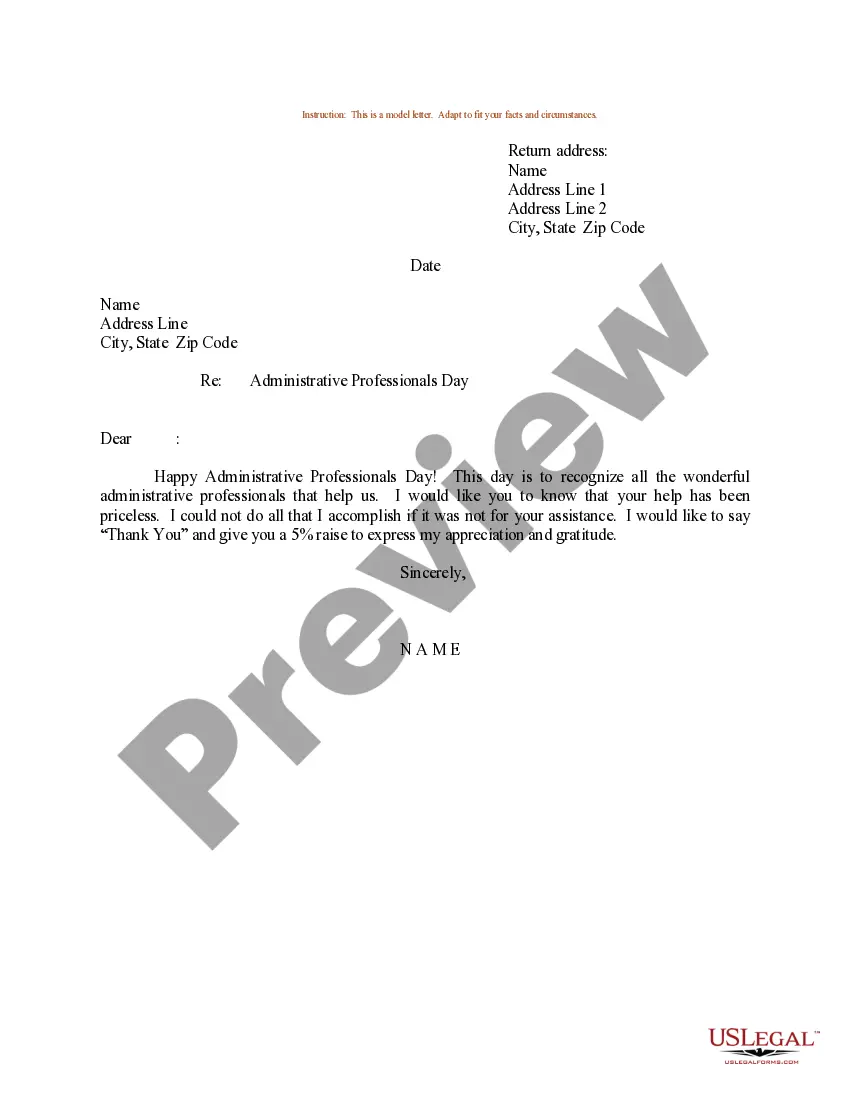

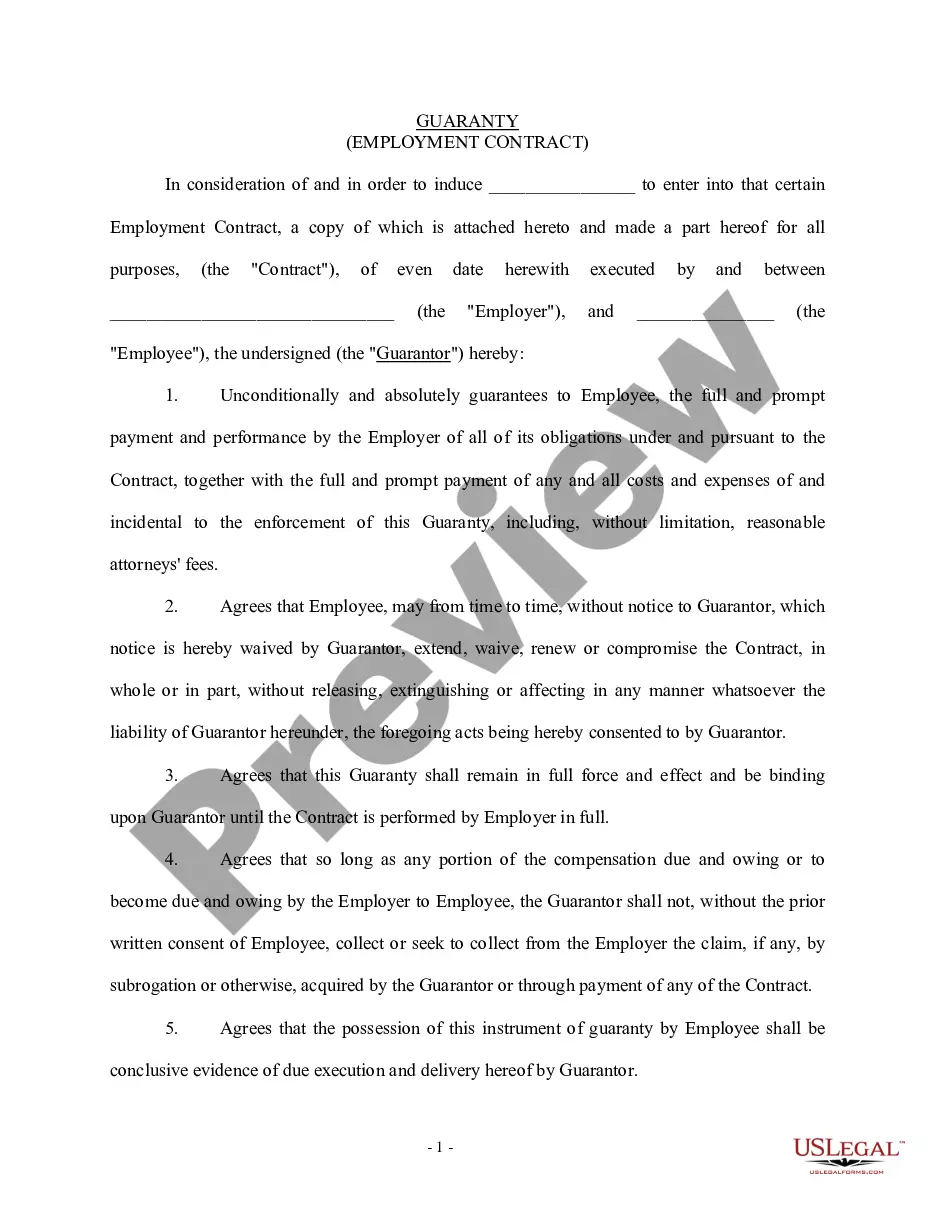

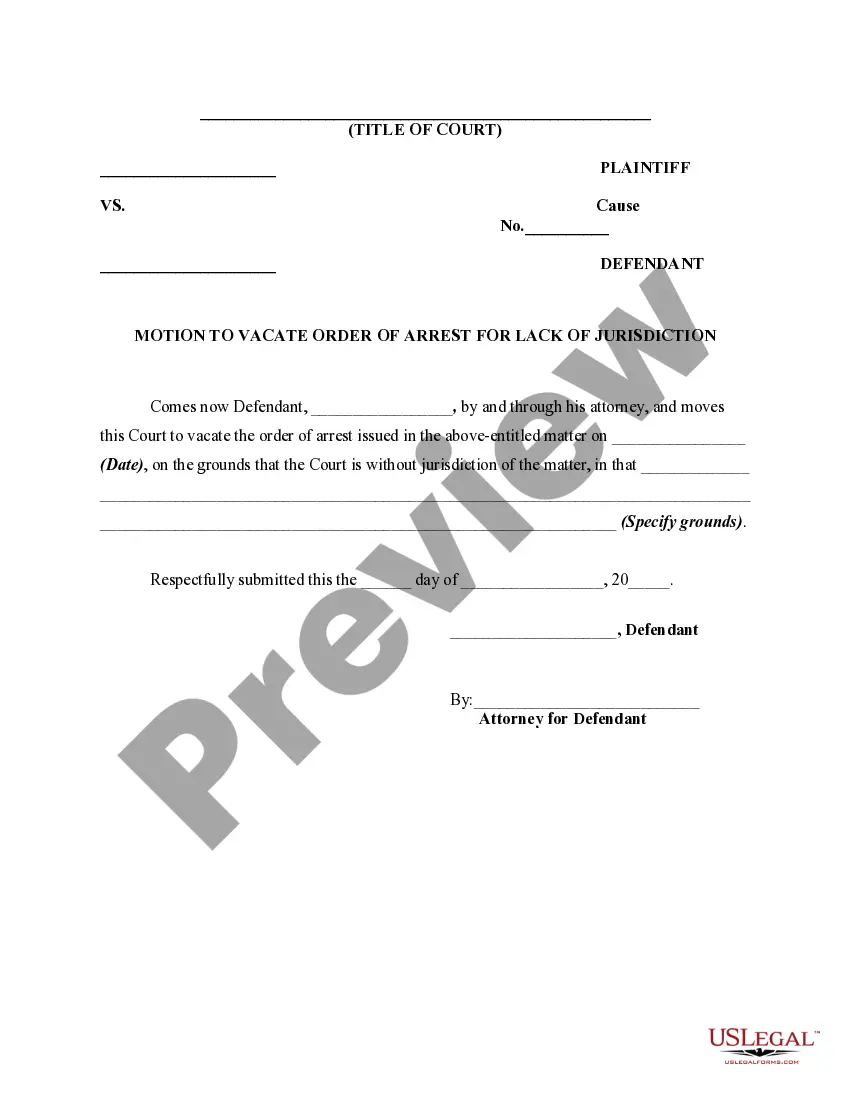

- Ensure you have selected the correct form for your city/state. Choose the Preview option to review the content of the form. Check the description of the form to confirm that you have selected the appropriate form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, validate your choice by clicking on the Purchase now button. Then, select the pricing plan you prefer and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

The bulk transfer law is designed to prevent a merchant from defrauding his or her creditors by selling the assets of a business and neglecting to pay any amounts owed the creditors. The law requires notice so that creditors may take whatever legal steps are necessary to protect their interests.

Under California law, a bulk sale is defined as a sale of more than half of a business' inventory and equipment, as measured by fair market value, that is not part of the seller's ordinary course of business. In order for the law to apply, the seller has to be physically located in California.

DEFINITIONS1. bought or sold in large quantities. large companies that buy and sell in bulk.

There are several formalities required by the Bulk Sales Law: The sale in bulk to be accompanied by sworn statement of the vendor/mortgagor listing the names and addresses of, and amounts owing to, creditors; The sworn statement shall be furnished to the buyer, the seller is required to prepare an inventory of stocks

THE BULK SALES LAW (as amended) AN ACT TO REGULATE THE SALE, TRANSFER, MORTGAGE OR ASSIGNMENT OF GOODS, WARES, MERCHANDISE, PROVISIONS OR MATERIALS, IN BULK, AND PRESCRIBING PENALTIES FOR THE VIOLATION OF THE PROVISIONS THEREOF. Section 1. This Act shall be known as "The Bulk Sales Law." Sec.

Where the statute requires the vendor, transferor, mortgagor or assignor to notify personally or by registered mail every creditor "at least ten days before transferring possession" of any stock of goods, wares, merchandise, provisions or materials, in bulk, it is sufficiently complied with by sending notice by

The bulk transfer law is designed to prevent a merchant from defrauding his or her creditors by selling the assets of a business and neglecting to pay any amounts owed the creditors. The law requires notice so that creditors may take whatever legal steps are necessary to protect their interests.

In Illinois, various "Bulk Sales Acts" impose an obligation on purchasers of a business or a major portion of the assets of a business, which can include the transfer of real estate, for certain unpaid taxes and even debts for which the seller of such property was responsible.

The bulk transfer law is a law to protect business creditors. It provides that if a buyer of a business notifies the creditors of the seller in advance that it is buying the seller's assets, then the buyer will not be liable to those creditors for the debts and obligations of the seller.

A bulk sale, sometimes called a bulk transfer, is when a business sells all or nearly all of its inventory to a single buyer and such a sale is not part of the ordinary course of business.