The Illinois Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law is a legal document used when a sole proprietor is selling their business in the state of Illinois. This agreement ensures all legal requirements, including compliance with the Bulk Sales Law, are met throughout the transaction. Here is a detailed description of what this agreement entails: 1. Introduction: The agreement begins with an introductory section that includes the names and addresses of the seller (sole proprietor) and the buyer. It also establishes the effective date of the agreement and states the purpose of the document. 2. Purchase Price and Terms: This section outlines the details regarding the purchase price of the business and the payment terms agreed upon by both parties. It includes the total purchase price, any agreed-upon down payment, and the schedule of future payments. 3. Assets and Liabilities: Here, the agreement specifies the assets and liabilities included in the sale. This may include physical assets such as equipment, inventory, and property, as well as intangible assets like trademarks, licenses, and customer lists. The seller ensures that all assets are free of any liens or encumbrances that could affect their transfer to the buyer. 4. Representations and Warranties: Both the seller and the buyer provide representations and warranties regarding the authenticity, accuracy, and completeness of the information provided. This section helps protect the buyer by ensuring they have a clear understanding of the business's financial and legal standing. 5. Closing and Escrow: In compliance with the Bulk Sales Law, the agreement requires the closing of the sale to occur in escrow. This section outlines the process and responsibilities of the escrow agent, who acts as a neutral third party responsible for handling the funds and ensuring a smooth transaction. 6. Contingencies: The agreement may include contingencies that must be met for the sale to proceed successfully. These may include obtaining necessary permits or licenses, landlord approval, or financing arrangements. 7. Confidentiality and Non-Compete: The agreement may include clauses regarding the confidentiality of sensitive business information and a non-compete provision, restricting the seller from competing with the buyer's business for a specified period of time. 8. Governing Law and Dispute Resolution: This section specifies that the agreement is governed by Illinois law and outlines the preferred method of dispute resolution, such as arbitration or mediation. Different types of Illinois Agreements for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law may vary in terms of specific clauses, contingencies, or special provisions included based on the unique requirements of the business being sold. However, the overall structure and purpose of the agreement remain consistent.

Illinois Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Closing In Escrow To Comply With Bulk Sales Law?

US Legal Forms - one of the largest collections of legal documents in the nation - provides a vast selection of legal document templates that you can download or print.

On the website, you can find countless documents for business and personal purposes, categorized by type, state, or keywords. You can access the latest versions of documents such as the Illinois Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law in just a few minutes.

If you already have a monthly subscription, Log In to download the Illinois Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law from the US Legal Forms library. The Download button will appear on every document you view. You have access to all previously saved documents within the My documents section of your account.

Make modifications. Fill out, edit, print, and sign the downloaded Illinois Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law.

Every template you add to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the document you need.

Access the Illinois Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law through US Legal Forms, one of the most comprehensive legal document libraries. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are a first-time user of US Legal Forms, here are simple steps to get started:

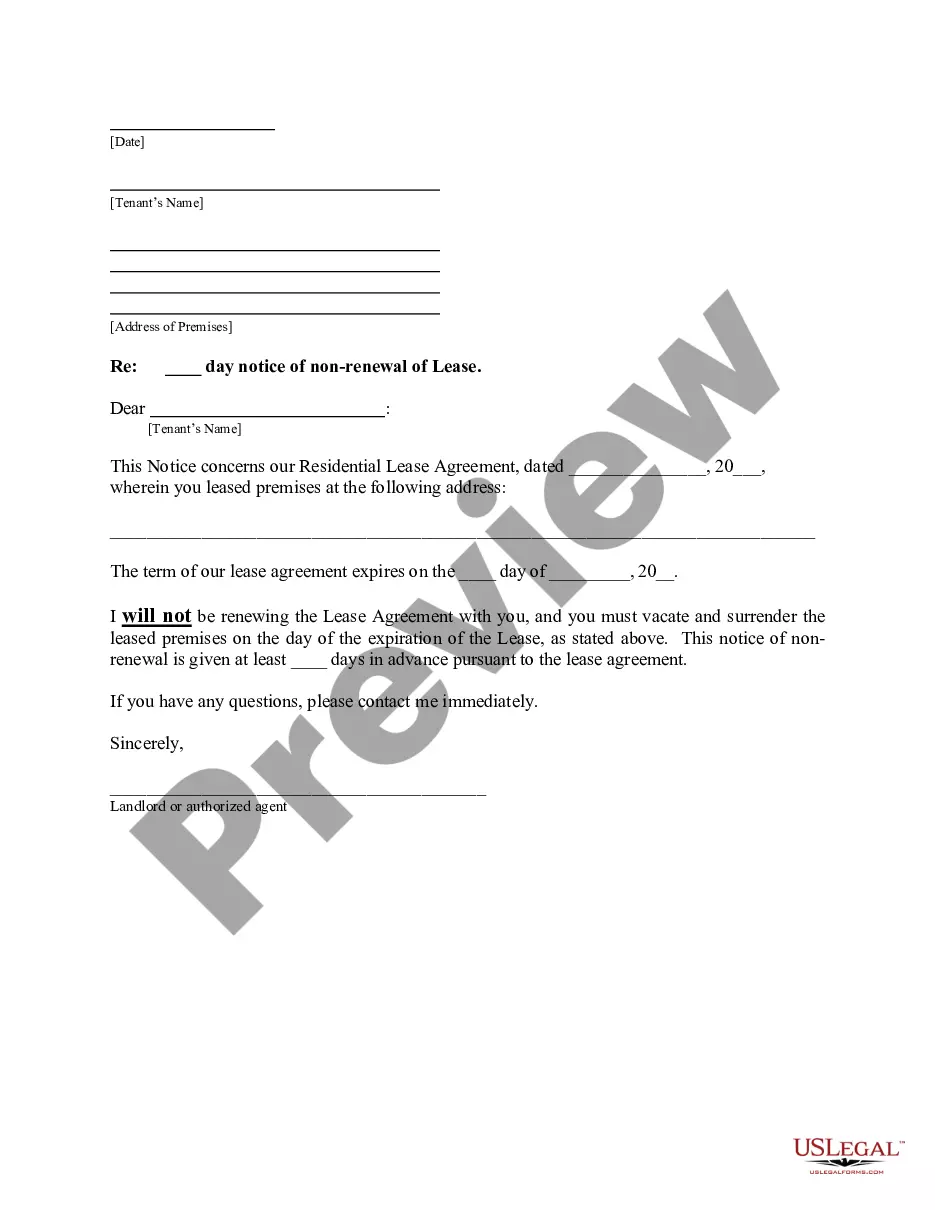

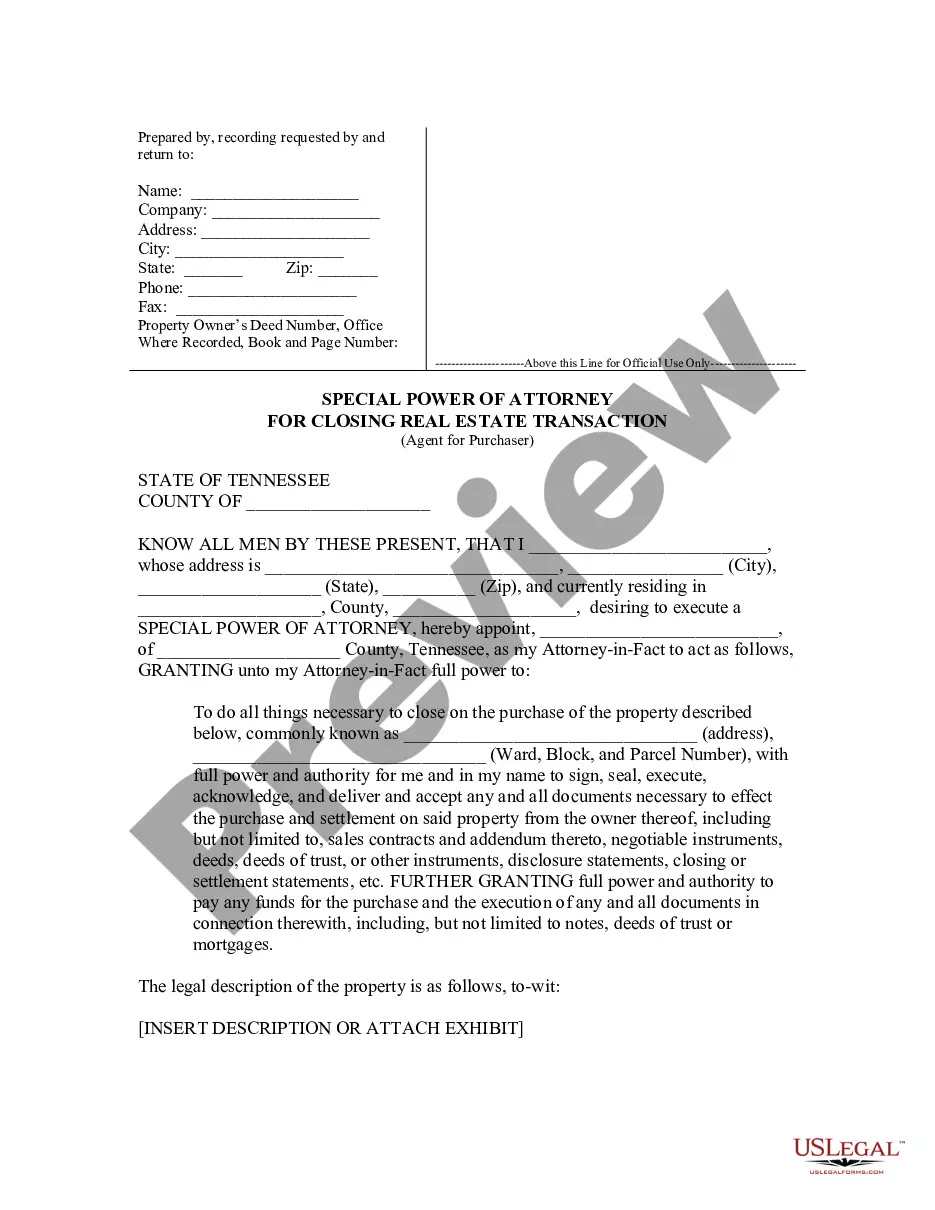

- Ensure you have selected the correct document for your area/state. Click the Review button to examine the content of the document. Check the document summary to confirm you have chosen the appropriate document.

- If the document does not meet your needs, utilize the Search field at the top of the page to find the one that does.

- If you are satisfied with the document, confirm your selection by clicking the Get now button. Then, choose the payment plan that suits you and provide your details to create an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

- Select the format and download the document to your device.

Form popularity

FAQ

In the context of selling, 'bulk' refers to the transfer of a significant portion of a seller’s inventory or assets as a single transaction, rather than piecemeal sales. This can have implications for creditors and tax obligations. Knowing the details of the Illinois Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law will empower you to navigate these sales effectively, meeting all necessary legal requirements.

In Illinois, the notice to creditors of a bulk sale must be recorded before the sale occurs. This step is crucial to protect both buyers and sellers and is a requirement under the Illinois Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law. By filing this notice in a timely manner, businesses can ensure transparency and compliance with applicable regulations.

So the answer to "Can a seller back out on a deal?" is simple: Yes; but without fault on the buyer's part, that breach of contract is going to cost the seller dearly.

Can you back out of an accepted offer? The short answer: yes. When you sign a purchase agreement for real estate, you're legally bound to the contract terms, and you'll give the seller an upfront deposit called earnest money.

There are several formalities required by the Bulk Sales Law: The sale in bulk to be accompanied by sworn statement of the vendor/mortgagor listing the names and addresses of, and amounts owing to, creditors; The sworn statement shall be furnished to the buyer, the seller is required to prepare an inventory of stocks

Once you've signed a legally binding contract, you don't get to just change your mind. It's rare to see a seller back out, adds Morales. The buyer can sue the seller to close. But then you have the cost of defending yourself in a legal situation.

Because it's a binding legal document, there may be repercussions if you want to back out of a purchase offer that the seller has already accepted. When you enter into this type of agreement, you are typically required to put down a deposit to demonstrate that you plan to follow through.

Therefore, if you want to cancel a sales contract, you should find a way to legally do so to avoid legal liability.Ask for a mutual rescission. Once you form a valid contract, the contract binds you to its terms.Find a way to unilaterally rescind the contract.Modify a service contract.Modify a sales contract.

The purpose of a sales agreement is to act as a legally binding contract between two parties involved in an exchange of money for goods, services, and/or property. One party is a buyer, while the other is a seller.

THE BULK SALES LAW (as amended) AN ACT TO REGULATE THE SALE, TRANSFER, MORTGAGE OR ASSIGNMENT OF GOODS, WARES, MERCHANDISE, PROVISIONS OR MATERIALS, IN BULK, AND PRESCRIBING PENALTIES FOR THE VIOLATION OF THE PROVISIONS THEREOF. Section 1. This Act shall be known as "The Bulk Sales Law." Sec.