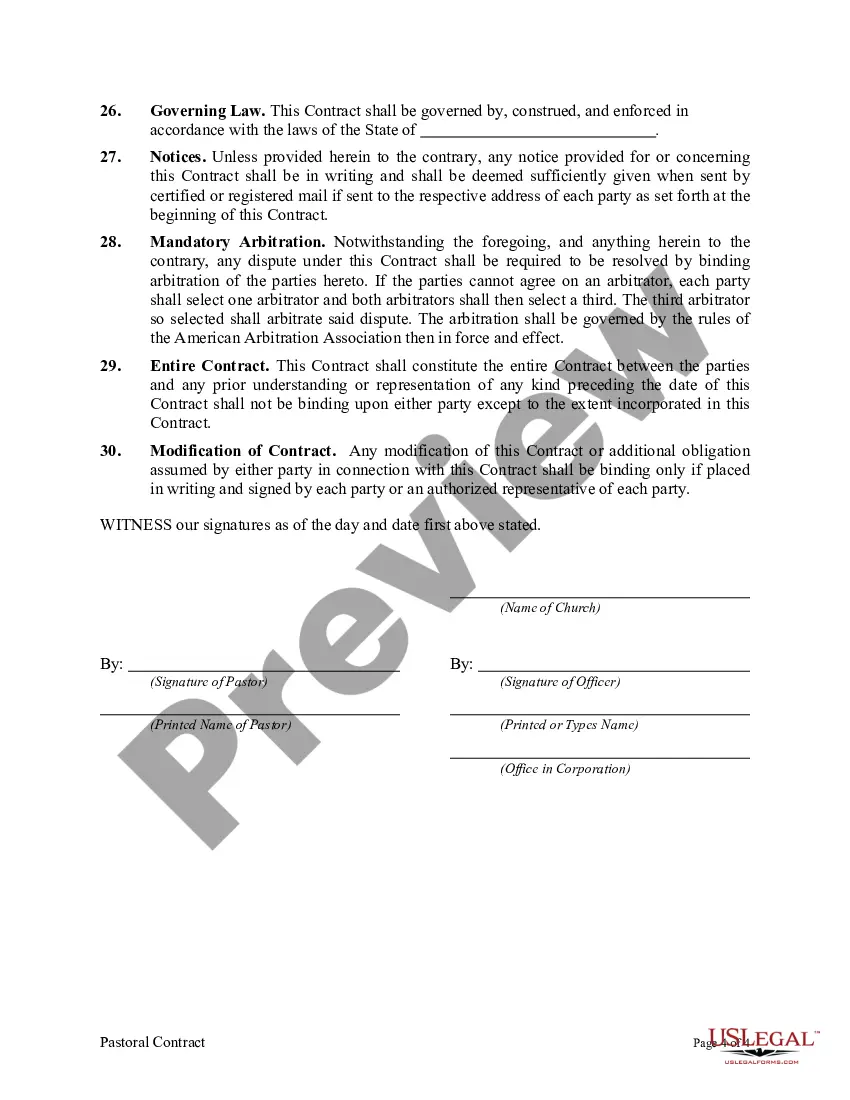

This is a contract between a pastor and a church which is a non-profit corporation. A non-profit corporation is a group organized for purposes other than generating profit and in which no part of the organization's income is distributed to its members, directors, or officers. Non-profit entities are organized under state law. For non-profit corporations, many states have adopted the Revised Model Non-Profit Corporation Act (1986). For federal tax purposes, an organization is exempt from taxation if it is organized and operated exclusively for religious, charitable, scientific, public safety, literary, educational, prevention of cruelty to children or animals, and/or to develop national or international sports.

Illinois Pastoral Contract

Description

How to fill out Pastoral Contract?

Have you found yourself in a situation where you require documents for both professional or personal purposes almost every day.

There is a plethora of legal document templates available online, but finding forms you can trust is not simple.

US Legal Forms offers thousands of template forms, including the Illinois Pastoral Agreement, designed to comply with state and federal regulations.

Select a convenient document format and download your copy.

Access all of the document templates you have purchased in the My documents section. You can download an additional copy of the Illinois Pastoral Agreement at any time, if needed. Just click on the necessary form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Illinois Pastoral Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Get the document you need and ensure it is for your correct state/region.

- Utilize the Preview button to review the document.

- Check the information to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search section to find the document that meets your needs and criteria.

- Once you find the correct form, click on Get now.

- Choose the pricing plan you prefer, submit the required information to create your account, and place an order using your PayPal or Visa or Mastercard.

Form popularity

FAQ

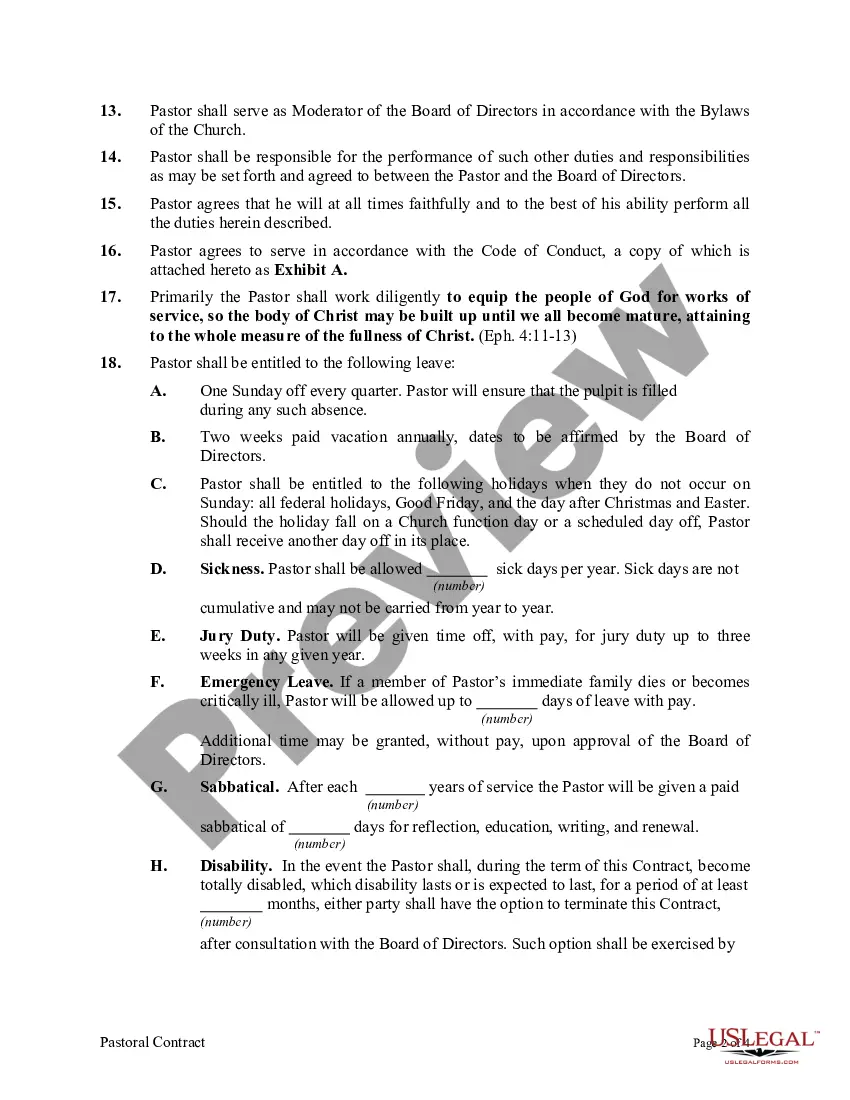

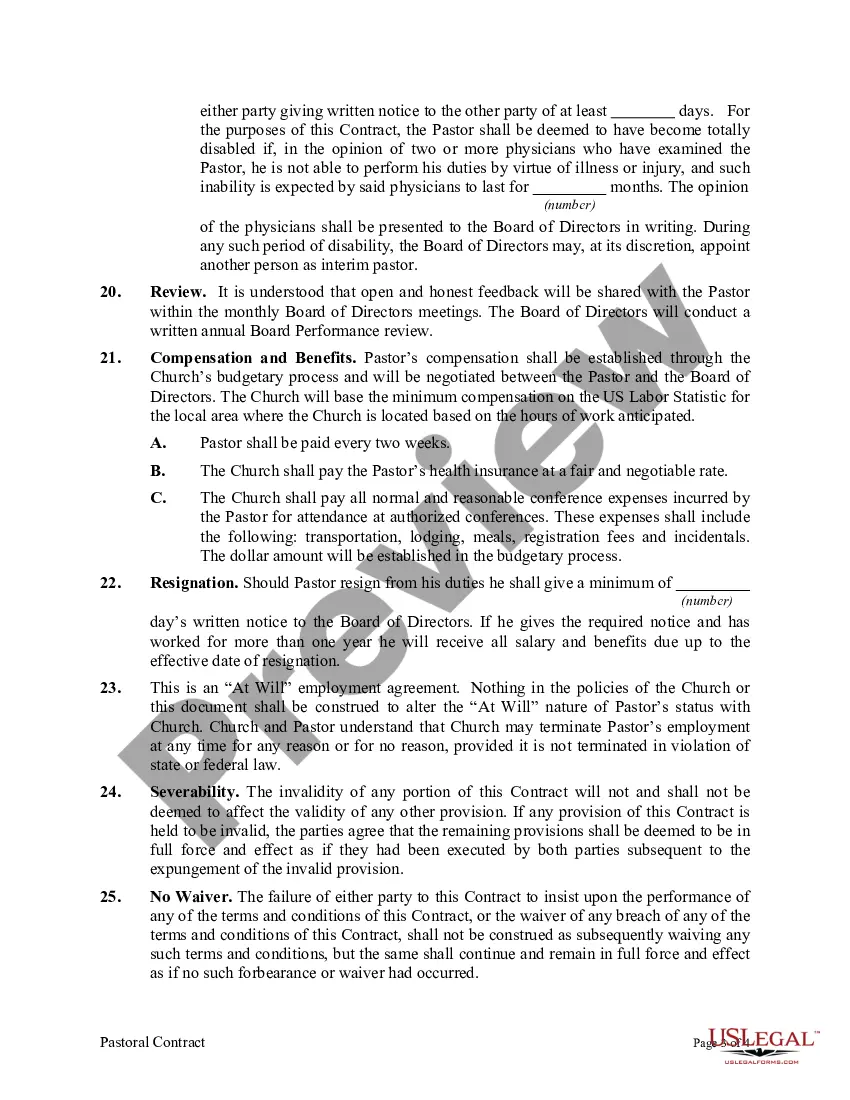

Cash compensation includes the pastor's cash salary and housing allowance, plus cash equivalents such as the Social Security offset. A benefits package often includes a retirement savings plan, life insurance, plus disability and health insurance. It can also include a paid sabbatical.

The average Pastor salary in California is $113,718 as of April 26, 2022, but the range typically falls between $93,465 and $128,887.

While a congregation may encourage a pastor to take 36 weeks of annual, paid vacation, a true Sabbatical is typically 34 months in duration and may last up to a year (as in the case described by Eugene Peterson in The Contemplative Pastor).

Nearly 80 percent of pastors serve in congregations with fewer than 200 people, and 55 percent have fewer than 100 people in their church. The median annual budget of churches surveyed was $125,000. 50 percent of pastors receive compensation under $50,000 per year, even though many of them have advanced degrees.

A pastor, in the role of a spiritual nurturer, is the one who actually performs pastoral care. Pastoral care involves the tending of the pastor to those within the same community of faith. Every aspect of a pastor's interactions with the people in the pastor's realm of influence is a part of pastoral care.

Most churches pay a pastor salary that is established by contract. The amount of salary varies based on the size of the church and the congregation. Mega-churches have congregations in excess of 5,000 members.

According to the Evangelical Covenant Church, a healthy congregation with a weekly average attendance of 150 people should spend 40 to 50 percent of their total budget on staff salary.

Clergy, considered as self-employed for Social Security purposes, must pay the current 15.3% (Schedule SE) on the cash salary plus housing allowance or fair market rental value of the parsonage with utilities.

Scripture makes it clear that those who proclaim the gospel should earn their living by the gospel (1 Corinthians ), and by extension this means that the church is responsible for supporting its pastor and ensuring he is free from worldly care and employment, (see the OPC Form of Government chs.

Cash compensation includes the pastor's cash salary and housing allowance, plus cash equivalents such as the Social Security offset. A benefits package often includes a retirement savings plan, life insurance, plus disability and health insurance. It can also include a paid sabbatical.