If you need to hire some extra help for a limited period of time, a Temporary Employment Contract is a good way to get the help you need without taking on any additional risk. Whether you need to staff up for a busy time, or you need to replace someone who's going on leave, a Temporary Employment Contract sets out the conditions of the temporary position, and defines the duties of the newly hired employee, how and when they'll be paid. Unlike an Employment Contract, there are no expectations of benefits or other perks. Using a Temporary Employment Contract can provide a company with legal protection when hiring a short-term employee by making clear that the position is strictly temporary. This stipulation permits an employer to avoid the legal obligations that come with hiring a permanent employee.

Illinois Temporary Contract of Employment

Description

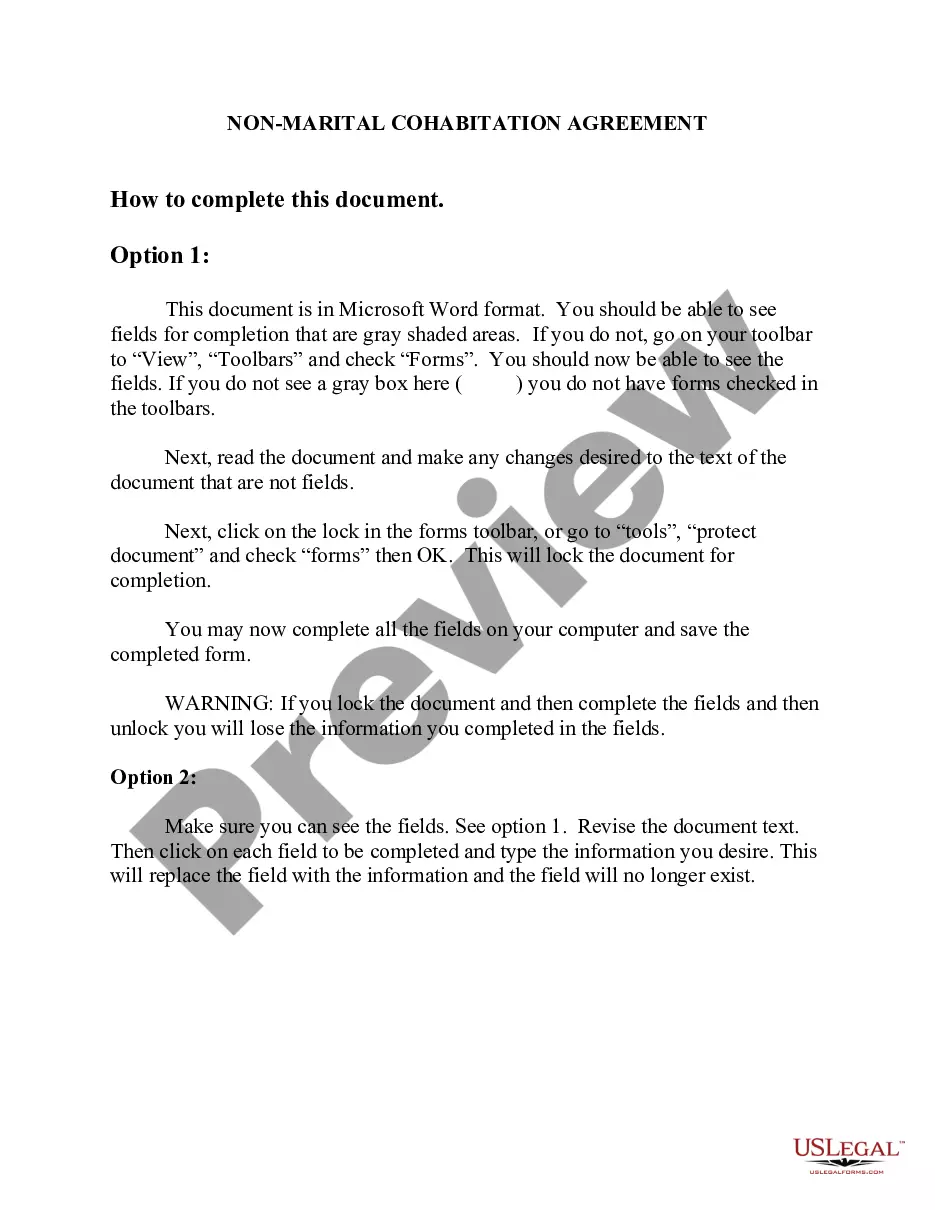

How to fill out Temporary Contract Of Employment?

Are you situated in an area where you require documents for either business or personal purposes every day.

There are numerous legal document templates accessible online, but finding versions you can depend on is challenging.

US Legal Forms provides thousands of form templates, including the Illinois Temporary Employment Contract, which are designed to meet state and federal regulations.

When you find the correct form, click Get now.

Choose the pricing plan you prefer, provide the necessary information to set up your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- Then, you can download the Illinois Temporary Employment Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you require and ensure it is for the correct city/county.

- Use the Preview option to examine the form.

- Check the description to ensure you have selected the appropriate form.

- If the form is not what you need, utilize the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

Section 3401(c) and 26 CFR 31.3401(c)-l. With regard to tax withholding, the Illinois Department of Revenue defines the term employee as either: a person who performs services subject to the legal control and direction of an employer, or an Illinois resident who receives payments on which federal income tax is

1099 Worker DefinedA 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

The Day and Temporary Labor Services Act:Creates duties and responsibilities of day and temporary labor agencies and third party clients,Creates registration fees for agencies,Prohibits excessive deductions for meal and equipment charges,Regulates the transportation of workers,More items...

How do I know if I'm an independent contractor or an employee in California?You are paid by the hour.You work full-time for the company.You are closely supervised by the company.You received training from the company.You receive employee benefits.Your company provides the tools and equipment needed to work.More items...

As an independent contractor, you may have more freedom to choose how you complete your work, but you are responsible for paying your own taxes, getting your own health insurance, and paying into unemployment and workers comp funds if you wish to access those benefits.

Illinois defines a workweek as a fixed and regularly recurring period of 168 hours seven (7) consecutive 24-hour periods. A workweek does not need to coincide with the calendar week and may begin on any calendar day and at any hour of the day.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

If a company needs a specific service that its own staff doesn't perform, it may hire a temporary employee. This could be a contract position for a freelance writer or graphic designer needed for a one-time project or an office assistant in a legal firm.