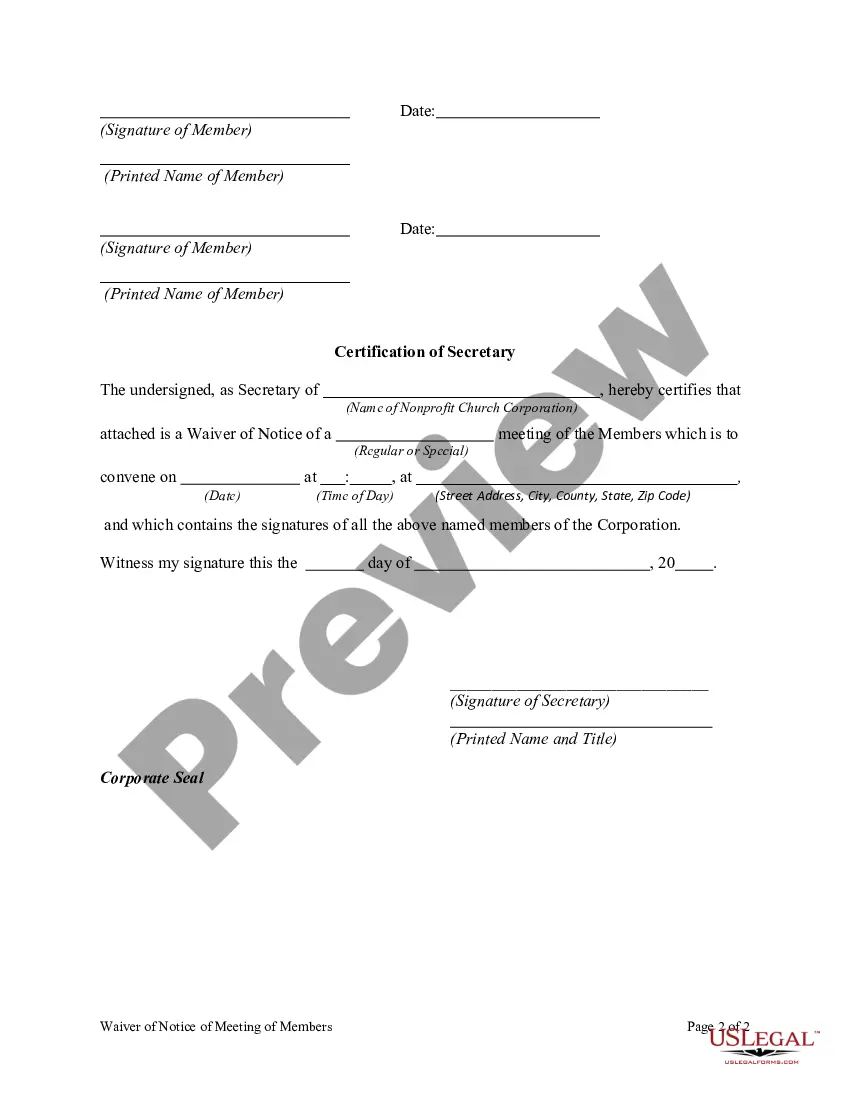

A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Illinois Waiver of Notice of Meeting of members of a Nonprofit Church Corporation

Description

How to fill out Waiver Of Notice Of Meeting Of Members Of A Nonprofit Church Corporation?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal paper templates that you can download or print.

By using this website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Illinois Waiver of Notice of Meeting of members of a Nonprofit Church Corporation in just seconds.

If you already have a monthly subscription, Log In and download the Illinois Waiver of Notice of Meeting of members of a Nonprofit Church Corporation from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

Complete the transaction. Use your Visa or MasterCard or PayPal account to finalize the purchase.

Choose the format and download the form to your device.

- If this is your first time using US Legal Forms, here are simple steps to get started.

- Ensure you have selected the correct form for your area/county. Click the Review button to examine the form's details.

- Read the description of the form to confirm that you have chosen the right one.

- If the form doesn't meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your credentials to sign up for an account.

Form popularity

FAQ

'Notice of presentation waived' means that members of an organization have opted out of receiving the standard notice regarding the presentation of certain materials or agenda items. By waiving this notice, members are indicating their consent to proceed with the meeting’s agenda without further notification. This concept aligns with the Illinois Waiver of Notice of Meeting of members of a Nonprofit Church Corporation, facilitating quicker decision-making when necessary.

The Internal Revenue Service (IRS) requires that all nonprofits registered at the federal level maintain a minimum of three members on the board of directors.

By identifying the problem or opportunity, developing and then evaluating alternatives, choosing and implementing the best alternative, and evaluating the decision, nonprofit organizations can make quality decisions which turn problems into opportunities and satisfy the mandate of their stakeholders while continuing to

The answer is yes, although most nonprofit corporation laws contain a requirement that one person is designated as the president. However, you could have bylaws that allow for two people to be co-presidents and share duties.

Practically speaking, the many organizations and businesses that use the term do so interchangeably, which indicates there is no real difference.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.

Your board of directors is the primary decision maker for your nonprofit and is responsible for overseeing its management. As a result, your board should approve any decision involving significant financial, legal, or tax issues, or any major program-related matter.

A nonprofit organization is not owned by the people who start it, nor their successors in leadership. These individuals operate in a position of trust and accountability for the public at large, who, via government, allow nonprofits to operate exempt from the taxes that for-profit businesses must pay.

Board of Directors: There must be at least three (3) directors on the board. Board members do not need to be residents of the State of Illinois. The board runs the organization, and no individual can receive any profits from organization revenues.

According to a study by Bain Capital Private Equity, the optimal number of directors for boards to make a decision is seven. Every added board member after that decreases decision-making by 10%. Nonprofits can use that as a starting metric before considering the organization's life cycle, mission and fundraising needs.