A bookkeeper is a person whose job is to keep the financial records for a business

Illinois Employment Agreement between Church and Bookkeeper

Description

How to fill out Employment Agreement Between Church And Bookkeeper?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse selection of legal document templates that you can download or print. By utilizing the website, you can access numerous forms for business and personal purposes, sorted by categories, states, or keywords.

You can obtain the latest versions of forms such as the Illinois Employment Agreement between Church and Bookkeeper in just a few minutes.

If you already have a monthly subscription, Log In and obtain the Illinois Employment Agreement between Church and Bookkeeper from your US Legal Forms library. The Download button will be available on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Make modifications. Complete, edit, print, and sign the downloaded Illinois Employment Agreement between Church and Bookkeeper.

Every template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, just navigate to the My documents section and click on the form you desire.

- If you are using US Legal Forms for the first time, here are some simple instructions to help you get started.

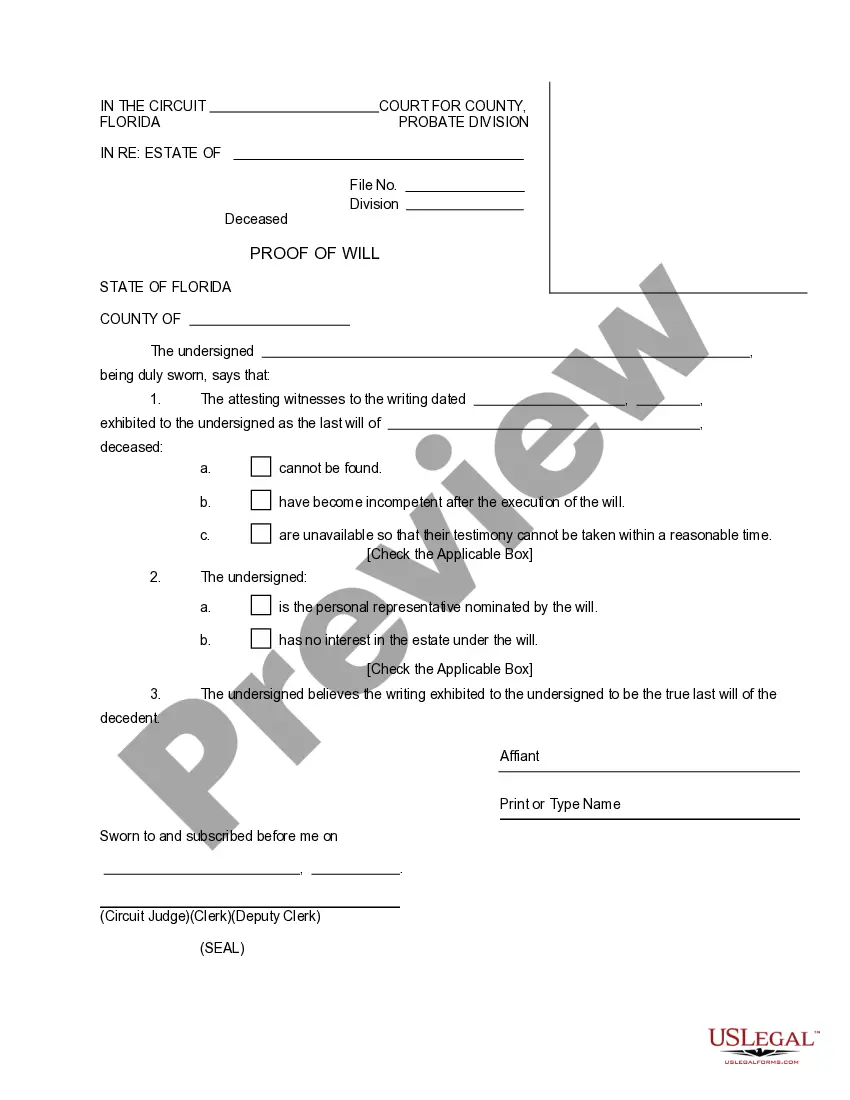

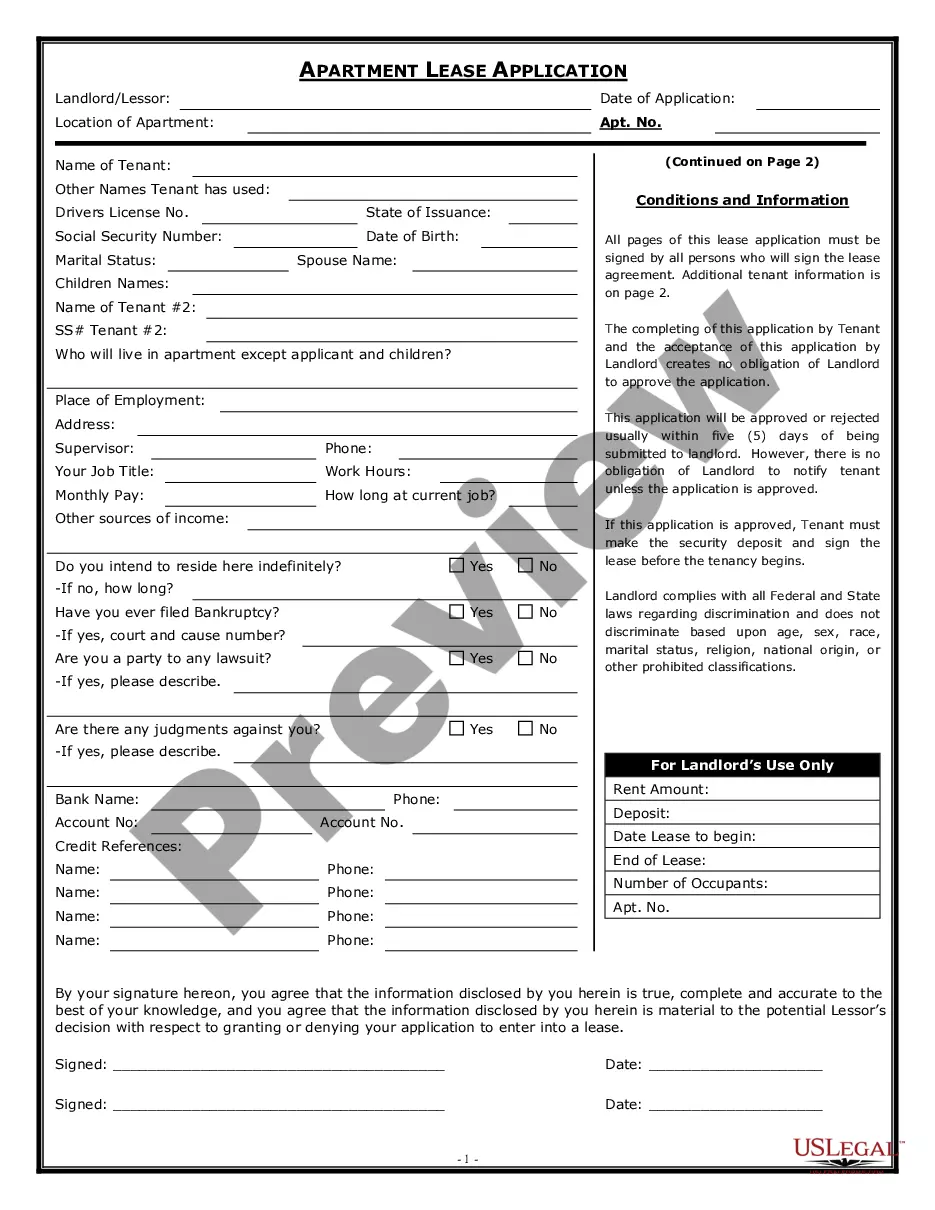

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's content. Check the form description to make sure you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the page to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select your preferred pricing plan and enter your details to sign up for an account.

- Complete the transaction. Use your credit card or PayPal account to finish the payment.

- Choose the format and download the form to your device.

Form popularity

FAQ

If Your Accounting Firm is Organized as a Partnership, the IRS Requires 1099s for Fees Paid. The IRS requires businesses, self-employed individuals, and not-for-profit organizations to issue Form 1099-MISC for professional service fees of $600 or more paid to accountants who are not corporations.

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

The average price of outsourcing your bookkeeping needs ranges from $500 to $2,500 a month depending on the number of transactions and complexity of services required.

Accountants and their clients often use Accounting Contracts as a means of defining the scope and payment terms for work to be done. Signed by the client and the accountant, this essential document can help each party to set expectations and reduce the risk of disagreements.

How do I know if I'm an independent contractor or an employee in California?You are paid by the hour.You work full-time for the company.You are closely supervised by the company.You received training from the company.You receive employee benefits.Your company provides the tools and equipment needed to work.More items...

The average hourly wage for a bookkeeper in the U.S. is $22 per hour. CPAs typically charge $200 $250 per hour. Top bookkeepers in major cities may charge $500 per hour (or more).

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

The average hourly rate for freelance bookkeepers ranges from $29.21 to $43.40 per hour. Depending on your geographic location, this amount will be more or less than the average national rate of $37 per hour.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

What are the duties and responsibilities of a Bookkeeper? On a day-to-day basis, Bookkeepers complete data entry, collect transactions, track debits and maintain and monitor financial records. They also pay invoices, complete payroll, file tax returns and even maintain office supplies.