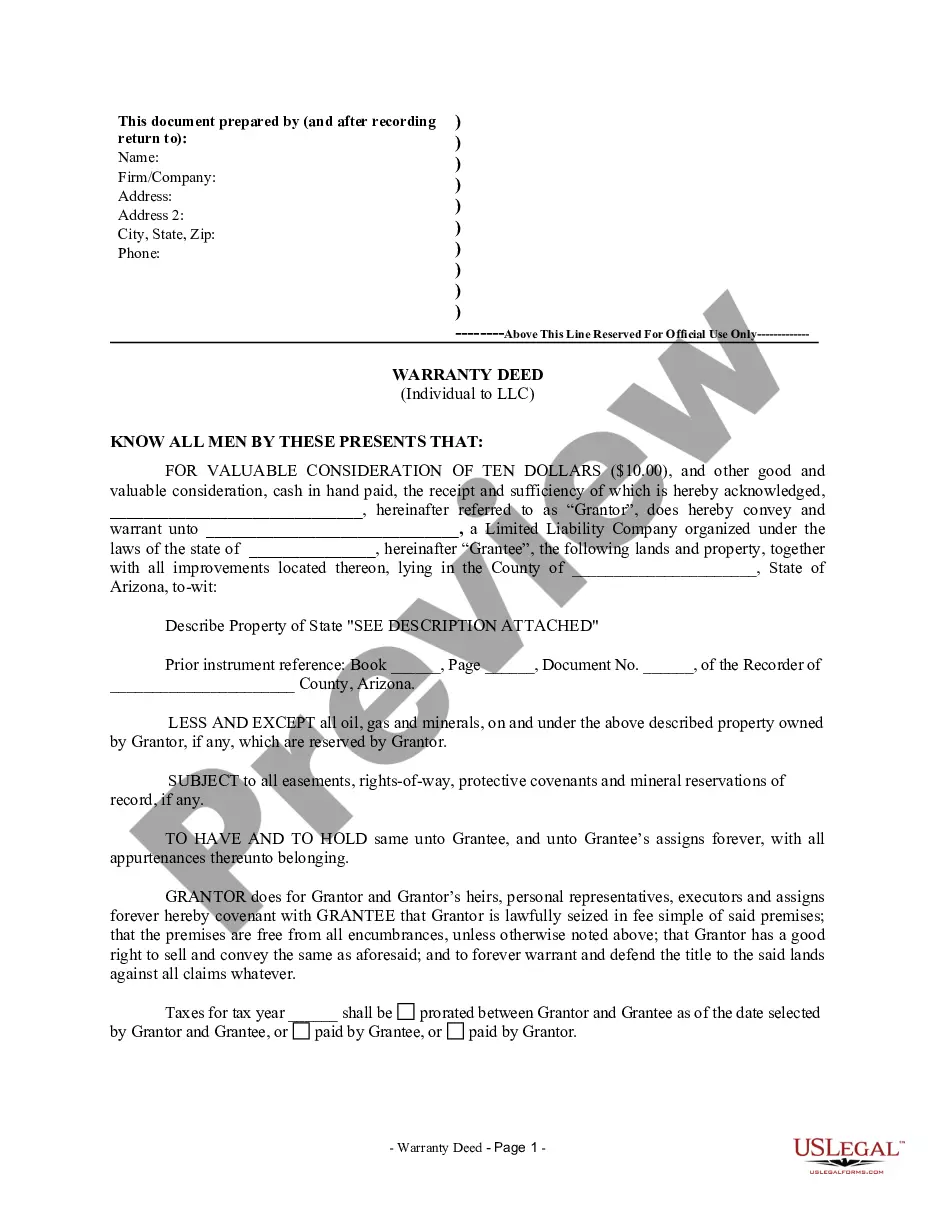

Title: Illinois Sample Letter for Corporate Tax Return: A Comprehensive Guide Introduction: The state of Illinois requires corporations to file annual tax returns, providing crucial financial information to the Illinois Department of Revenue (IDOL). This article aims to provide a detailed description of an Illinois Sample Letter for Corporate Tax Returns, outlining the key components and relevant instructions. Below, we discuss different types of Illinois Sample Letters for Corporate Tax Returns and highlight essential keywords. 1. General Information: — Explanation of the purpose and importance of filing corporate tax returns. — Brief overview of tax laws and regulations specific to Illinois. — Mention of the Illinois Department of Revenue (IDOL) as the authority responsible for processing tax returns. 2. Components of an Illinois Sample Letter for Corporate Tax Return: — Taxpayer Information: Include company name, address, federal tax identification number (EIN), and fiscal year details. — Income Calculation: Specify the reporting of income earned within Illinois and income apportionment for multi-state corporations. — Deductions and Credits: List deductible expenses and tax credits eligible for Illinois corporations. — Calculation of Tax Liability: Describe how to calculate corporate tax liability, including any applicable tax rates and schedules. — Disclosure and Attachments: Instruct on providing supporting documentation such as financial statements, schedules, and any other attachments required. — Filing and Submission: Guide on how to submit the completed tax return to the IDOL, including the filing deadline and acceptable methods. 3. Different Types of Illinois Sample Letters for Corporate Tax Returns: — Illinois Form IL-1120: Standard tax return form for corporations that offers multiple schedules to report specific types of income and deductions. — Illinois Form IL-1120-ST: For Small Business Corporation Replacement Tax Return specifically designed for qualifying S Corporations. — Illinois Form IL-1023-C: Short Form Corporation Income and Replacement Tax Return, applicable for corporations with lower income levels. — Illinois Form IL-990-T-EX: Form for state tax-exempt organizations to report unrelated business taxable income. Conclusion: Filing taxes accurately and on time is crucial for all corporations operating in Illinois. The Illinois Sample Letter for Corporate Tax Return described above provides a detailed understanding of the necessary components and guidelines for filing tax returns to the state. By following these instructions and utilizing the appropriate form, corporations can ensure compliance with Illinois tax laws while maximizing deductions and credits. For further assistance, consult the Illinois Department of Revenue or professional tax advisors.

Illinois Sample Letter for Corporate Tax Return

Description

How to fill out Illinois Sample Letter For Corporate Tax Return?

US Legal Forms - one of many largest libraries of authorized types in the USA - provides a wide range of authorized papers themes it is possible to download or produce. Utilizing the internet site, you can find a huge number of types for enterprise and individual uses, categorized by groups, states, or search phrases.You can find the most recent versions of types much like the Illinois Sample Letter for Corporate Tax Return in seconds.

If you already possess a subscription, log in and download Illinois Sample Letter for Corporate Tax Return in the US Legal Forms catalogue. The Obtain switch will show up on every single type you perspective. You gain access to all formerly acquired types in the My Forms tab of the profile.

If you would like use US Legal Forms initially, listed here are easy guidelines to help you get started out:

- Be sure to have selected the best type for your metropolis/county. Click on the Review switch to review the form`s information. Browse the type description to ensure that you have chosen the appropriate type.

- If the type doesn`t suit your specifications, make use of the Research area on top of the display to obtain the the one that does.

- When you are pleased with the shape, validate your selection by visiting the Buy now switch. Then, select the pricing plan you favor and supply your credentials to register for an profile.

- Method the transaction. Make use of bank card or PayPal profile to complete the transaction.

- Find the file format and download the shape on the system.

- Make changes. Complete, modify and produce and indication the acquired Illinois Sample Letter for Corporate Tax Return.

Every design you put into your account does not have an expiration day and it is the one you have forever. So, if you wish to download or produce an additional duplicate, just check out the My Forms portion and then click on the type you want.

Gain access to the Illinois Sample Letter for Corporate Tax Return with US Legal Forms, by far the most considerable catalogue of authorized papers themes. Use a huge number of specialist and status-particular themes that meet up with your organization or individual requirements and specifications.

Form popularity

FAQ

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

An Illinois resident who worked in Iowa, Kentucky, Michigan, or Wisconsin, you must file Form IL-1040 and include as Illinois income any compensation you received from an employer in these states. Compensation paid to Illinois residents working in these states is taxed by Illinois.

Mailing Addresses AreaAddressIL-1120-ST, Small Business Corporation Replacement Tax ReturnWithout Payment PO BOX 19032 SPRINGFIELD IL 62794-9032 With Payment PO BOX 19053 SPRINGFIELD IL 62794-90536 more rows

Illinois business income tax The business income tax rate is 7% of your net income. S corporations, partnerships, standard LLCs, and sole proprietorships don't pay Illinois business income tax.

Use MyTax Illinois to electronically file your original Individual Income Tax Return. It's easy, free, and you will get your refund faster.

Illinois Tax Rates, Collections, and Burdens Illinois has a flat 4.95 percent individual income tax rate. Illinois also has a 9.50 percent corporate income tax rate.

Make business tax payments online with MyTax Illinois.

File Using MyTax Illinois MyTax Illinois is a centralized location on our website where taxpayers may register a new business or electronically file tax returns, make payments, and manage their tax accounts.