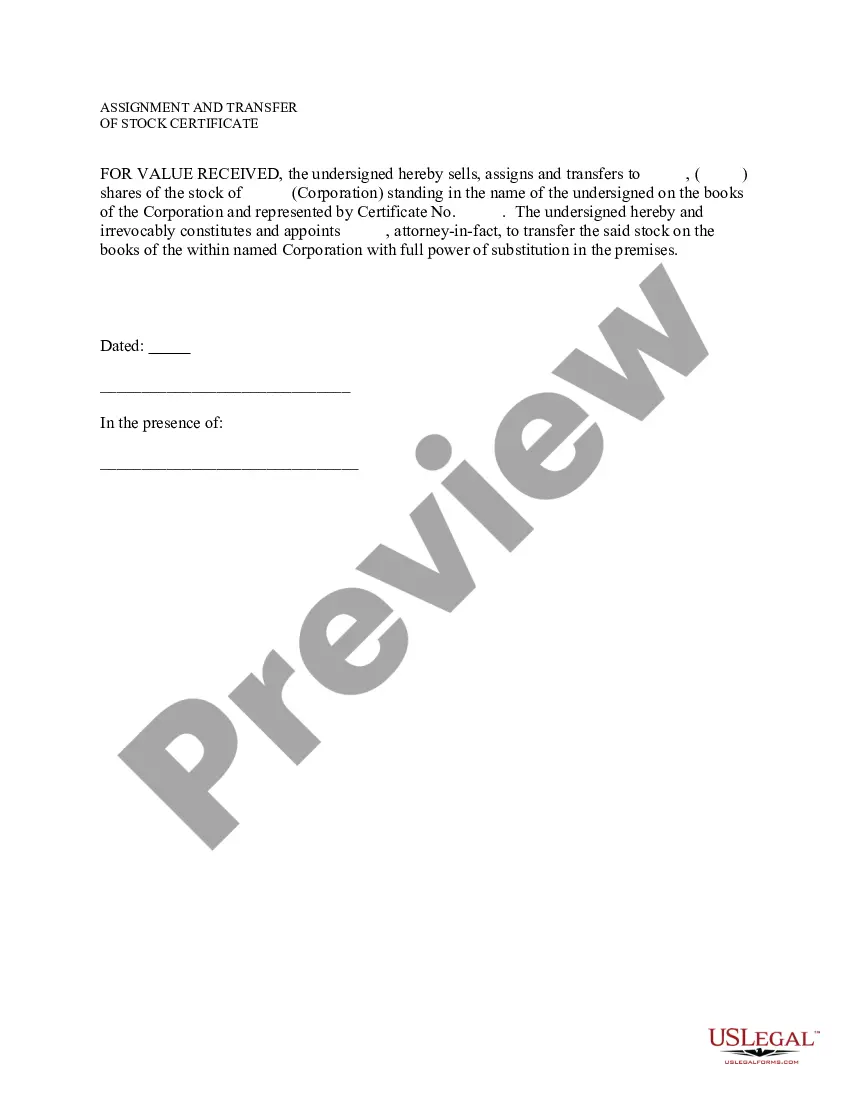

Title: Illinois Sample Letter for Assignment and Transfer of Stock Certificate — Detailed Description and Types Description: When you need to transfer ownership or assign stocks in the state of Illinois, a well-crafted Sample Letter for Assignment and Transfer of Stock Certificate is essential. This letter serves as a formal document supporting the transfer of stock ownership from one party to another, providing legal clarity and maintaining accurate records. Below, you will find a detailed overview of this process, its importance, and different types of assignment and transfer letters for stock certificates in the state of Illinois. 1. Importance of the Sample Letter for Assignment and Transfer of Stock Certificate: Transferring stock ownership requires a formal process to ensure legal compliance. The Sample Letter for Assignment and Transfer of Stock Certificate acts as a written agreement that protects the interests of both parties involved. It solidifies the transaction, aids in record-keeping, and avoids any future dispute over ownership. By utilizing this letter, you can confidently proceed with the stock transfer process in Illinois. 2. Components of the Sample Letter for Assignment and Transfer of Stock Certificate: — Sender's Information: Include the sender's full name, address, contact details, and any relevant company information, if applicable. — Recipient's Information: Mention the recipient's full name, address, contact information, and any necessary details. — Stock Certificate Details: Clearly state the stock certificate number, the number of shares being transferred, and any specific class or series of the stock. — Transfer Agreement: Use clear language to outline the details of the transfer, including the transferor's affirmation to assign the stock and the transferee's acceptance of the ownership transfer. — Effective Date: Specify the intended effective date for the transfer of ownership. — Signatures: Add spaces for both the transferor and transferee to sign and date the letter, along with mentioning their printed names beneath the signatures. 3. Types of Illinois Sample Letter for Assignment and Transfer of Stock Certificate: — Standard Stock Transfer: This type of letter is used when one individual or entity transfers stock ownership to another party, be it an individual or an organization. Interviewsos Transfer: This type of letter is employed when the transfer of stock ownership occurs between living individuals, typically for personal reasons rather than corporate transactions. — Testamentary Transfer: This type of letter is utilized in cases where the transfer of stock ownership happens due to inheritance or bequest upon the death of the original stockholder. It ensures the smooth transfer of ownership to the designated inheritors. Remember, it is crucial to consult legal professionals or financial advisors specialized in stock transfers to ensure compliance with Illinois' laws, regulations, and specific requirements. Note: Do keep in mind that this is a generic description, and it is advisable to consult or obtain an attorney's assistance for specific guidance related to your unique circumstances.

Illinois Sample Letter for Assignment and Transfer of Stock Certificate

Description

How to fill out Illinois Sample Letter For Assignment And Transfer Of Stock Certificate?

Are you currently inside a place that you require documents for possibly business or personal functions virtually every day? There are plenty of authorized record templates available on the net, but finding kinds you can rely isn`t simple. US Legal Forms delivers thousands of type templates, just like the Illinois Sample Letter for Assignment and Transfer of Stock Certificate, which can be created to satisfy state and federal needs.

If you are already acquainted with US Legal Forms site and possess an account, just log in. Following that, it is possible to download the Illinois Sample Letter for Assignment and Transfer of Stock Certificate web template.

Should you not provide an account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the type you want and make sure it is for your right city/county.

- Use the Preview key to examine the shape.

- Look at the outline to actually have selected the correct type.

- When the type isn`t what you are searching for, take advantage of the Lookup field to find the type that meets your requirements and needs.

- Once you discover the right type, simply click Get now.

- Pick the pricing plan you need, complete the necessary information to create your account, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Select a handy document structure and download your version.

Find each of the record templates you might have purchased in the My Forms food selection. You can aquire a further version of Illinois Sample Letter for Assignment and Transfer of Stock Certificate at any time, if needed. Just go through the necessary type to download or print the record web template.

Use US Legal Forms, the most comprehensive variety of authorized kinds, in order to save efforts and avoid errors. The support delivers skillfully produced authorized record templates that you can use for an array of functions. Produce an account on US Legal Forms and initiate creating your life easier.