Illinois Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife is a type of trust that is established in Illinois state law. This particular trust is designed to provide financial security and support for the surviving spouse (wife) during her lifetime, while also ensuring that any remaining assets are safeguarded and passed on to the children when the wife passes away. The primary objective of this testamentary trust is to ensure the wife's welfare and financial stability in the event of the husband's death. It allows for the distribution of a portion of the estate's residue to the wife, providing her with a dependable source of income, and potentially covering various expenses such as housing, healthcare, education, and other necessary costs. Upon the wife's death, the trust continues to operate for the benefit of the children. At this point, the remaining assets are allocated to the children according to the instructions laid out in the trust document. This ensures that the children receive their rightful inheritance while still benefiting from the wealth management and asset protection provided by the trust structure. It is important to note that there may be variations or different types of this trust, depending on the specific circumstances and requirements of the estate. Some common variations include: 1. Testamentary Trust with Spendthrift Provisions: This type of trust includes specific provisions to protect the trust assets from creditors and potential financial mismanagement by the beneficiaries. 2. Testamentary Trust with Income-Only Distributions: In this variation, the trust is structured to provide only income distributions to the wife during her lifetime, with the principal balance being preserved for the benefit of the children after her passing. 3. Testamentary Trust with Discretionary Distributions: This type of trust grants the trustee discretion in determining the timing and amount of distributions to the wife and children, based on their individual needs and circumstances. In conclusion, the Illinois Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife is a significant estate planning tool tailored to protect the surviving spouse while preserving assets for the benefit of future generations.

Illinois Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

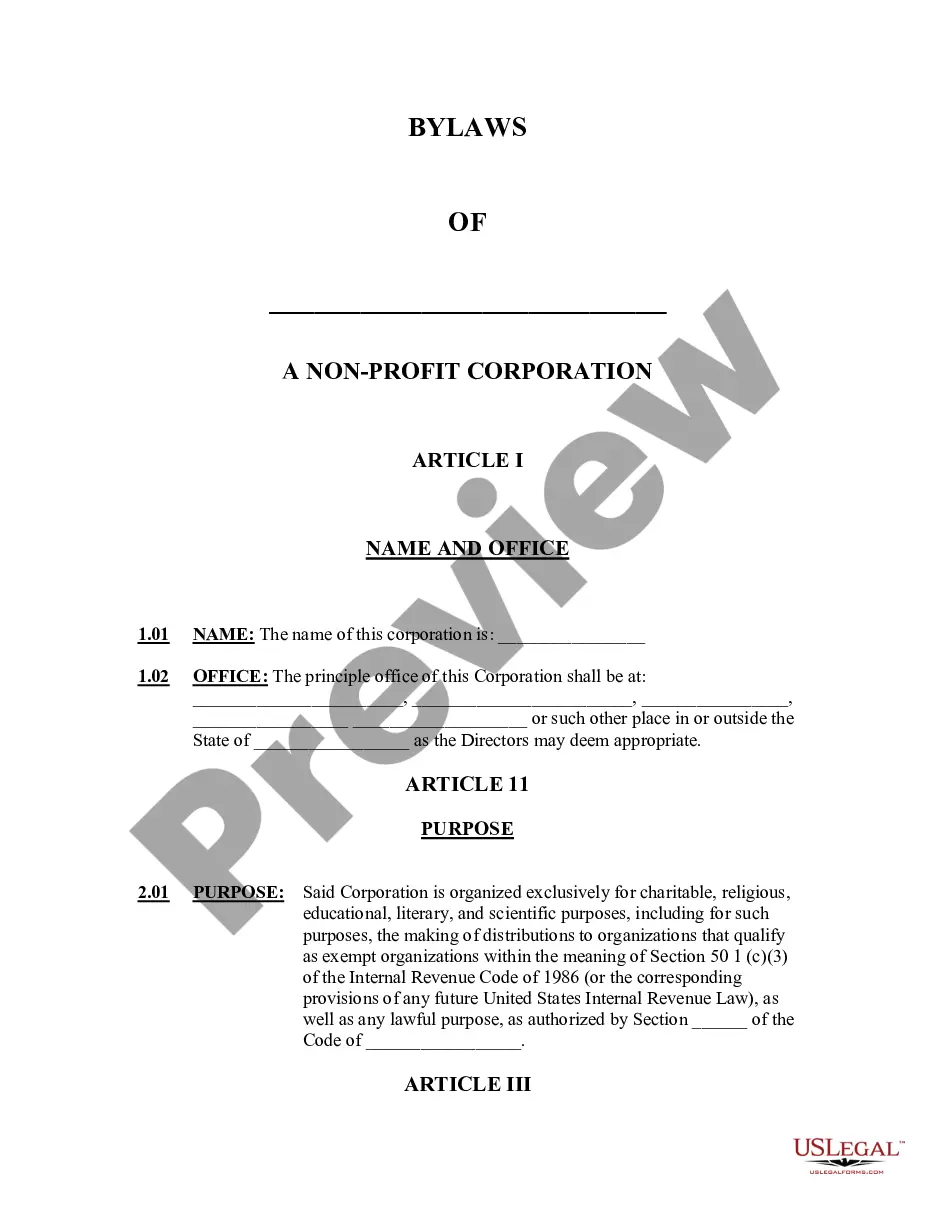

How to fill out Testamentary Trust Of The Residue Of An Estate For The Benefit Of A Wife With The Trust To Continue For Benefit Of Children After The Death Of The Wife?

Choosing the best legitimate file format could be a have difficulties. Of course, there are a variety of web templates accessible on the Internet, but how would you get the legitimate type you want? Take advantage of the US Legal Forms web site. The assistance gives a huge number of web templates, including the Illinois Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife, that can be used for business and personal needs. Each of the forms are checked by specialists and meet up with federal and state needs.

Should you be currently signed up, log in to your bank account and click on the Download switch to get the Illinois Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife. Use your bank account to appear with the legitimate forms you possess acquired in the past. Proceed to the My Forms tab of your respective bank account and obtain another version from the file you want.

Should you be a whole new consumer of US Legal Forms, allow me to share easy directions so that you can adhere to:

- Initially, make sure you have selected the correct type for your area/state. You are able to check out the form utilizing the Preview switch and look at the form description to guarantee this is basically the right one for you.

- When the type does not meet up with your requirements, utilize the Seach industry to get the correct type.

- When you are certain the form would work, select the Purchase now switch to get the type.

- Choose the prices prepare you want and enter in the necessary details. Make your bank account and buy your order with your PayPal bank account or credit card.

- Opt for the document formatting and obtain the legitimate file format to your product.

- Complete, change and produce and indicator the attained Illinois Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife.

US Legal Forms will be the most significant collection of legitimate forms where you can discover different file web templates. Take advantage of the service to obtain skillfully-produced files that adhere to state needs.

Form popularity

FAQ

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

Can a successor trustee change a trust? Generally, no. Most living or revocable trusts become irrevocable upon the death of the trust's maker or makers. This means that the trust cannot be altered in any way once the successor trustee takes over management of it.

Under typical circumstances, the surviving spouse would become the sole trustee after the death of one spouse. The surviving spouse would control the shared property, and the personal property of the deceased spouse would be distributed to the beneficiaries.

A SLAT is an irrevocable trust where the spouse is a permitted beneficiary. It allows married clients to take advantage of the high gift tax exemption amount while also allowing for continued access to the gifted trust assets, if needed, while removing any appreciation on the gift from each spouse's taxable estate.

If you're married with kids, naming a spouse as a primary beneficiary is the go-to for most people. This way, your partner can use the proceeds of the policy to help provide for your kids, pay the mortgage, and ease economic hardship that your death may bring. This is true even if one spouse is a stay-at-home parent.

Any beneficiary can also request a full copy of the trust instrument unless the trust instrument provides otherwise.

Under typical circumstances, the surviving spouse would become the sole trustee after the death of one spouse. The surviving spouse would control the shared property, and the personal property of the deceased spouse would be distributed to the beneficiaries.

Most A Trusts are actually also QTIP Trusts. However, for it to be a QTIP Trust, only the surviving spouse can be the beneficiary of the trust during his or her lifetime, and the trust is required to pay all income generated by the trust (e.g. dividends and interest) to the surviving spouse at least annually.

If you created a revocable living trust with your spouse, you can change the whole trust or part of the trust following the his or her death. A living trust allows to you make any changes to the terms by creating amendments or by creating a new trust entirely.

Key Takeaway. If you are married, you'll want to consider naming your spouse as the primary beneficiary of your life insurance, but you should also think about naming your revocable living trust as the primary beneficiary so the proceeds will transfer to a trust to benefit your surviving spouse.