Illinois Amended Uniform commercial code security agreement

Description

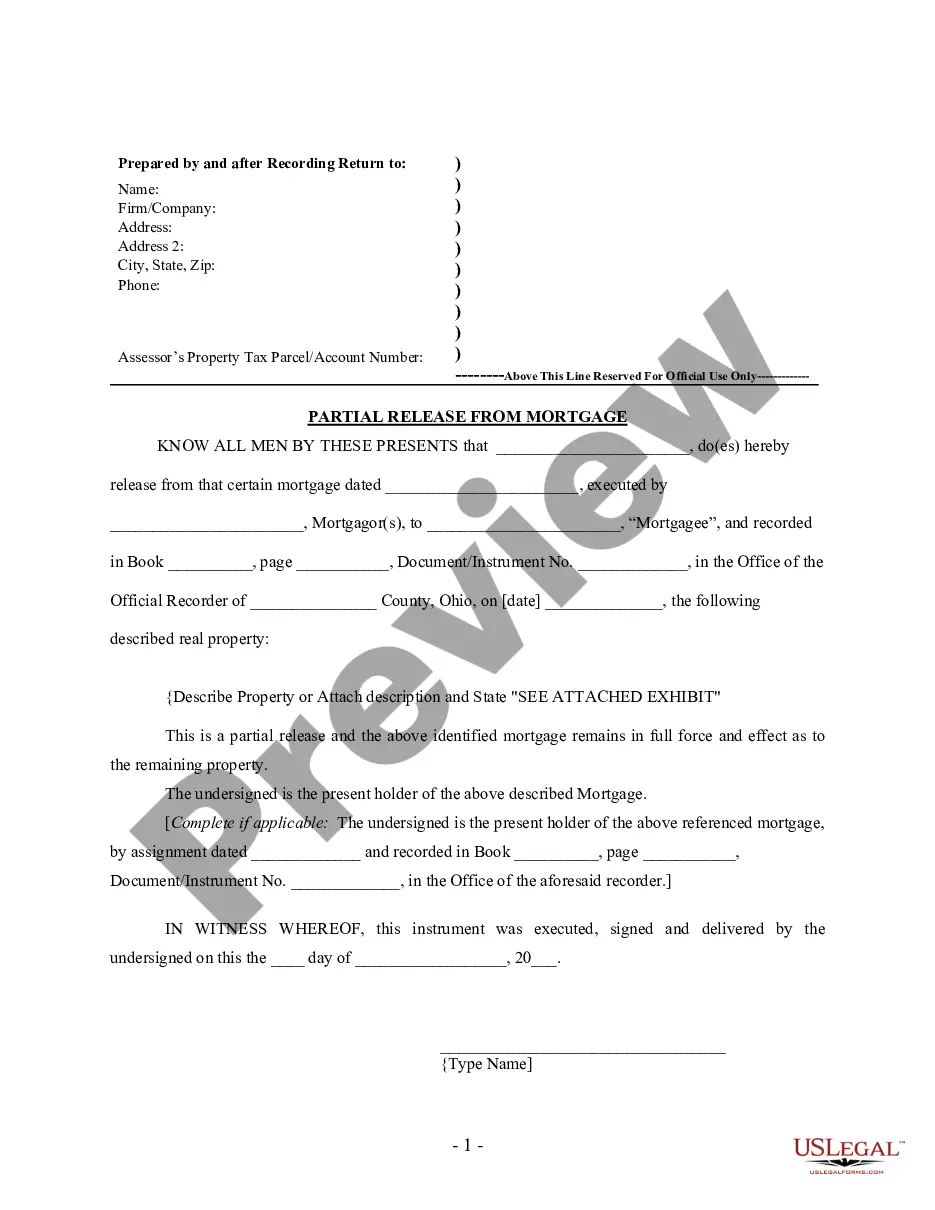

How to fill out Amended Uniform Commercial Code Security Agreement?

If you want to complete, obtain, or printing lawful file templates, use US Legal Forms, the greatest assortment of lawful forms, that can be found on the Internet. Take advantage of the site`s basic and hassle-free lookup to obtain the files you will need. Various templates for company and personal reasons are categorized by types and claims, or key phrases. Use US Legal Forms to obtain the Illinois Amended Uniform commercial code security agreement in just a handful of click throughs.

Should you be previously a US Legal Forms consumer, log in in your accounts and click on the Download button to get the Illinois Amended Uniform commercial code security agreement. You may also access forms you earlier acquired in the My Forms tab of your own accounts.

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the shape for the right city/nation.

- Step 2. Utilize the Review method to look over the form`s information. Don`t forget to learn the description.

- Step 3. Should you be not satisfied with all the form, make use of the Research industry near the top of the screen to locate other models of the lawful form design.

- Step 4. Once you have found the shape you will need, select the Acquire now button. Choose the rates program you like and put your accreditations to sign up for the accounts.

- Step 5. Approach the purchase. You can use your credit card or PayPal accounts to perform the purchase.

- Step 6. Choose the structure of the lawful form and obtain it on your own product.

- Step 7. Full, edit and printing or signal the Illinois Amended Uniform commercial code security agreement.

Every single lawful file design you acquire is the one you have for a long time. You might have acces to each and every form you acquired with your acccount. Go through the My Forms portion and decide on a form to printing or obtain again.

Be competitive and obtain, and printing the Illinois Amended Uniform commercial code security agreement with US Legal Forms. There are thousands of professional and status-certain forms you can use to your company or personal requires.

Form popularity

FAQ

A security agreement creates the security interest, making it enforceable between the secured party and the debtor. A UCC-1 financing statement neither creates a security interest nor does it alter its scope; it only gives notice of the security interest to third parties.

A security agreement normally will contain a clear statement that the debtor is granting the secured party a security interest in specified goods. The agreement also must provide a description of the collateral.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

At a minimum, a valid security agreement consists of a description of the collateral, a statement of the intention of providing security interest, and signatures from all parties involved. Most security agreements, however, go beyond these basic requirements.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...

UCC § 1-201(35) defines a ?Security Interest? as ?an interest in personal property or fixtures that secures payment or performance of an obligation.? In the context of suretyship, the security agreement is usually found in the Indemnity Agreement.

Illinois has adopted the following Articles of the UCC: Article 3: Negotiable instruments: UCC Article 3 applies to negotiable instruments.

A security agreement creates the security interest, making it enforceable between the secured party and the debtor. A UCC-1 financing statement neither creates a security interest nor does it alter its scope; it only gives notice of the security interest to third parties.