Title: Understanding the Illinois Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse Introduction: In Illinois, a unique type of deed exists that allows individuals to donate their condominium unit to a charity while retaining a life tenancy for themselves and their spouse. This arrangement not only allows donors to support charitable causes but also provides them with a place to live for the rest of their lives. In this article, we will explore the specifics of the Illinois Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse, highlighting its benefits and types. Keywords: Illinois Deed Conveying Condominium Unit, Charity, Life Tenancy, Donor, Spouse 1. Understanding the Illinois Deed Conveying Condominium Unit to Charity: — Explore the concept of conveying ownership of a condominium unit to a charitable organization. — Explain the motivations behind donating one's property to charity. 2. The Reservation of Life Tenancy: — Define the term "life tenancy" and its implications in the context of property ownership. — Highlight the benefits of retaining the right to live in the condominium unit for the donor and their spouse. 3. The Role of Charity: — Discuss the significance of charitable organizations in accepting donations of properties. — Explain how such donations contribute to the objectives and missions of charities. 4. Types of Illinois Deed Conveying Condominium Unit to Charity: a) Absolute Deed Conveyance with Reservation of Life Tenancy: — Explain the complete transfer of ownership to the charity while reserving the right to live in the condominium unit. b) Partial Deed Conveyance with Reservation of Life Tenancy: — Discuss scenarios where donors transfer a portion of ownership to the charity, allowing them to retain a fractional interest. 5. Benefits of Donating a Condominium Unit with Reservation of Life Tenancy: — Outline the advantages for donors, such as potential tax benefits and continued use of the property. — Discuss how charities benefit from these donations through potential future sales or leases of the property. 6. Legal Considerations: — Highlight the importance of seeking legal advice to ensure compliance with Illinois laws and regulations. — Address possible challenges and legal nuances associated with this type of deed conveyance. 7. Eligibility and Requirements: — Explain the criteria donors must meet to execute an Illinois Deed Conveying Condominium Unit to Charity. — Provide an overview of the necessary documentation and steps involved in the process. Conclusion: The Illinois Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse presents a unique opportunity for individuals to donate their property while securing housing for themselves during their lifetime. By understanding the different types of such deeds and the legal considerations involved, potential donors can make informed decisions that benefit both themselves and the chosen charity. Seek professional guidance to ensure compliance with all relevant laws and requirements before proceeding with such a donation.

Illinois Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse

Description

How to fill out Illinois Deed Conveying Condominium Unit To Charity With Reservation Of Life Tenancy In Donor And Donor's Spouse?

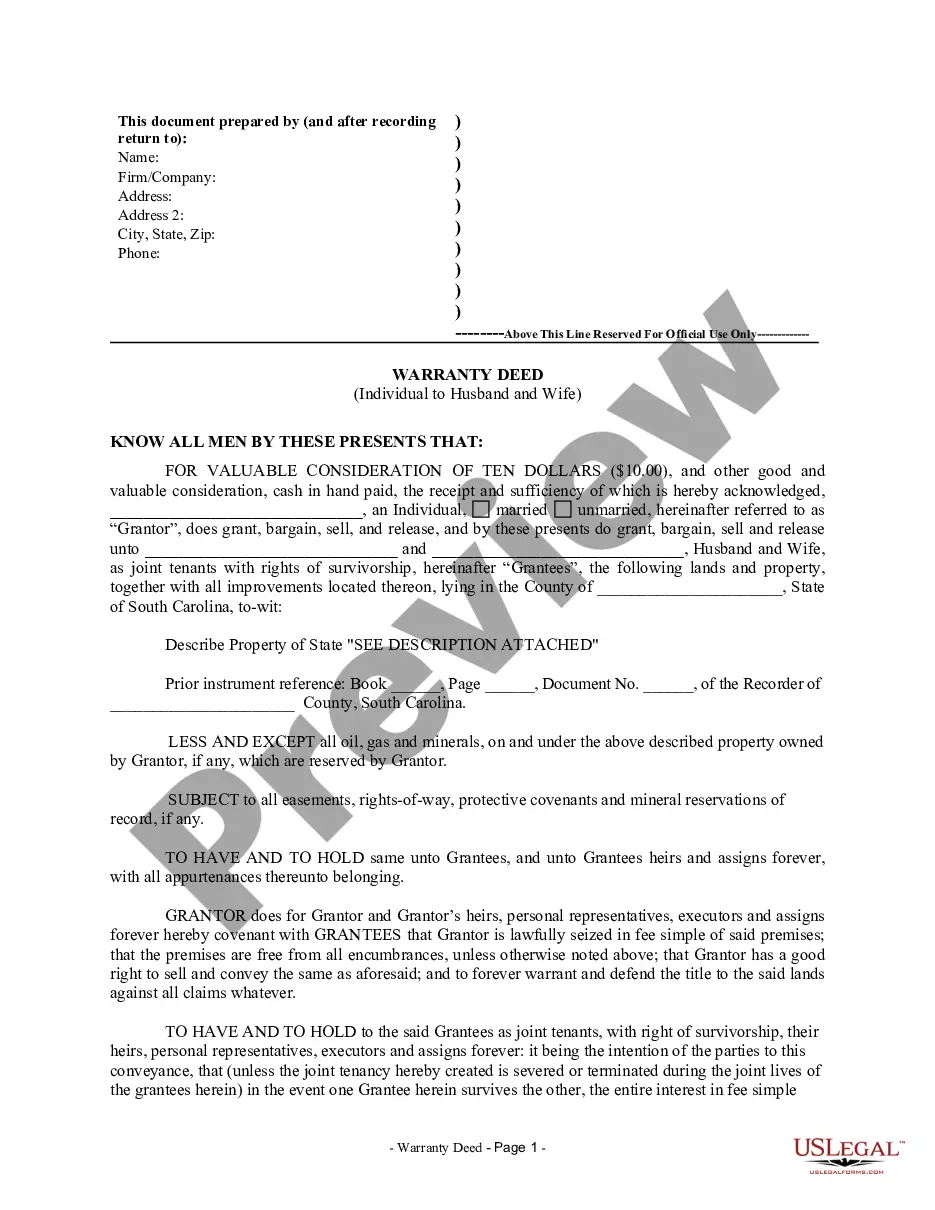

It is possible to invest several hours on the web looking for the authorized record design that fits the federal and state needs you want. US Legal Forms provides 1000s of authorized kinds which are evaluated by professionals. You can actually acquire or produce the Illinois Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse from your support.

If you already have a US Legal Forms bank account, you may log in and then click the Obtain key. Afterward, you may full, revise, produce, or indication the Illinois Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse. Each authorized record design you acquire is yours for a long time. To have an additional duplicate of the obtained kind, proceed to the My Forms tab and then click the related key.

If you work with the US Legal Forms web site initially, stick to the easy guidelines under:

- Initial, make certain you have chosen the best record design for that region/area of your liking. Look at the kind information to make sure you have chosen the correct kind. If offered, utilize the Review key to check through the record design at the same time.

- If you want to get an additional variation of your kind, utilize the Search industry to obtain the design that suits you and needs.

- Upon having located the design you would like, click Get now to move forward.

- Choose the costs prepare you would like, enter your credentials, and register for a merchant account on US Legal Forms.

- Total the financial transaction. You may use your Visa or Mastercard or PayPal bank account to cover the authorized kind.

- Choose the format of your record and acquire it in your gadget.

- Make alterations in your record if required. It is possible to full, revise and indication and produce Illinois Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse.

Obtain and produce 1000s of record templates making use of the US Legal Forms website, that provides the biggest collection of authorized kinds. Use expert and state-specific templates to deal with your small business or personal needs.