Illinois Loan Agreement for Equipment

Description

How to fill out Loan Agreement For Equipment?

US Legal Forms - one of the largest libraries of legal types in the USA - provides an array of legal document themes it is possible to acquire or produce. While using web site, you can get a huge number of types for business and person reasons, categorized by classes, claims, or keywords.You will find the most recent variations of types like the Illinois Loan Agreement for Equipment in seconds.

If you have a membership, log in and acquire Illinois Loan Agreement for Equipment from your US Legal Forms collection. The Obtain key can look on each and every develop you look at. You gain access to all in the past delivered electronically types from the My Forms tab of your respective profile.

If you want to use US Legal Forms for the first time, allow me to share basic instructions to help you started out:

- Make sure you have picked the correct develop for the town/area. Select the Preview key to check the form`s information. Look at the develop explanation to ensure that you have selected the correct develop.

- In the event the develop does not satisfy your demands, utilize the Research discipline on top of the monitor to discover the one which does.

- Should you be happy with the shape, confirm your decision by clicking the Get now key. Then, select the rates strategy you like and give your references to register to have an profile.

- Procedure the purchase. Utilize your credit card or PayPal profile to finish the purchase.

- Select the format and acquire the shape on your own product.

- Make adjustments. Fill up, revise and produce and signal the delivered electronically Illinois Loan Agreement for Equipment.

Each and every design you put into your account does not have an expiry date and is also your own property for a long time. So, if you want to acquire or produce one more backup, just visit the My Forms section and click on around the develop you will need.

Get access to the Illinois Loan Agreement for Equipment with US Legal Forms, probably the most considerable collection of legal document themes. Use a huge number of expert and status-particular themes that satisfy your company or person requirements and demands.

Form popularity

FAQ

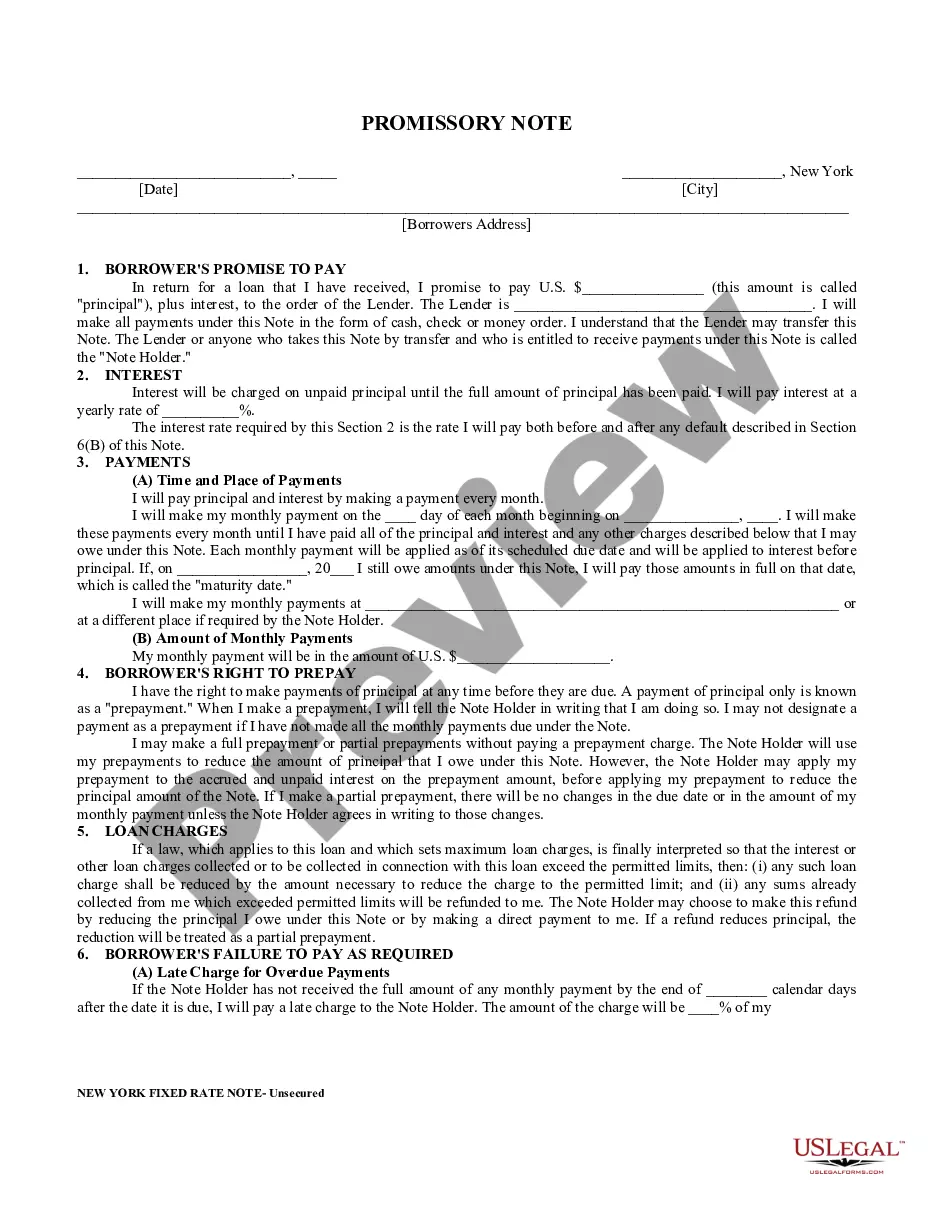

A promissory note is a written agreement between a borrower and a lender saying that the borrower will pay back the amount borrowed plus interest. The promissory note is issued by the lender and is signed by the borrower (but not the lender).

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

Promissory notes are legally binding documents that create a legal obligation for borrowers to repay the loan. This gives promissory notes the same legal force as a loan contract. As such, lenders can use a promissory note for payment assurance when issuing money to borrowers.

A term loan is usually meant for equipment, real estate, or working capital paid off between one and 25 years. A small business often uses the cash from a term loan to purchase fixed assets, such as equipment or a new building for its production process.

(1) Upon approval of a loan request and before shipment or issue of the materiel, the approving authority will complete a written loan agreement, DA Form 4881?R.

One of the benefits of equipment financing is that it's easier to qualify for than other loans. Each lender will set its own minimum credit score requirements, but a minimum of 575 or 600 isn't unusual. Keep in mind that credit score is just one factor lenders consider.