Illinois Loan Agreement for Car

Description

How to fill out Loan Agreement For Car?

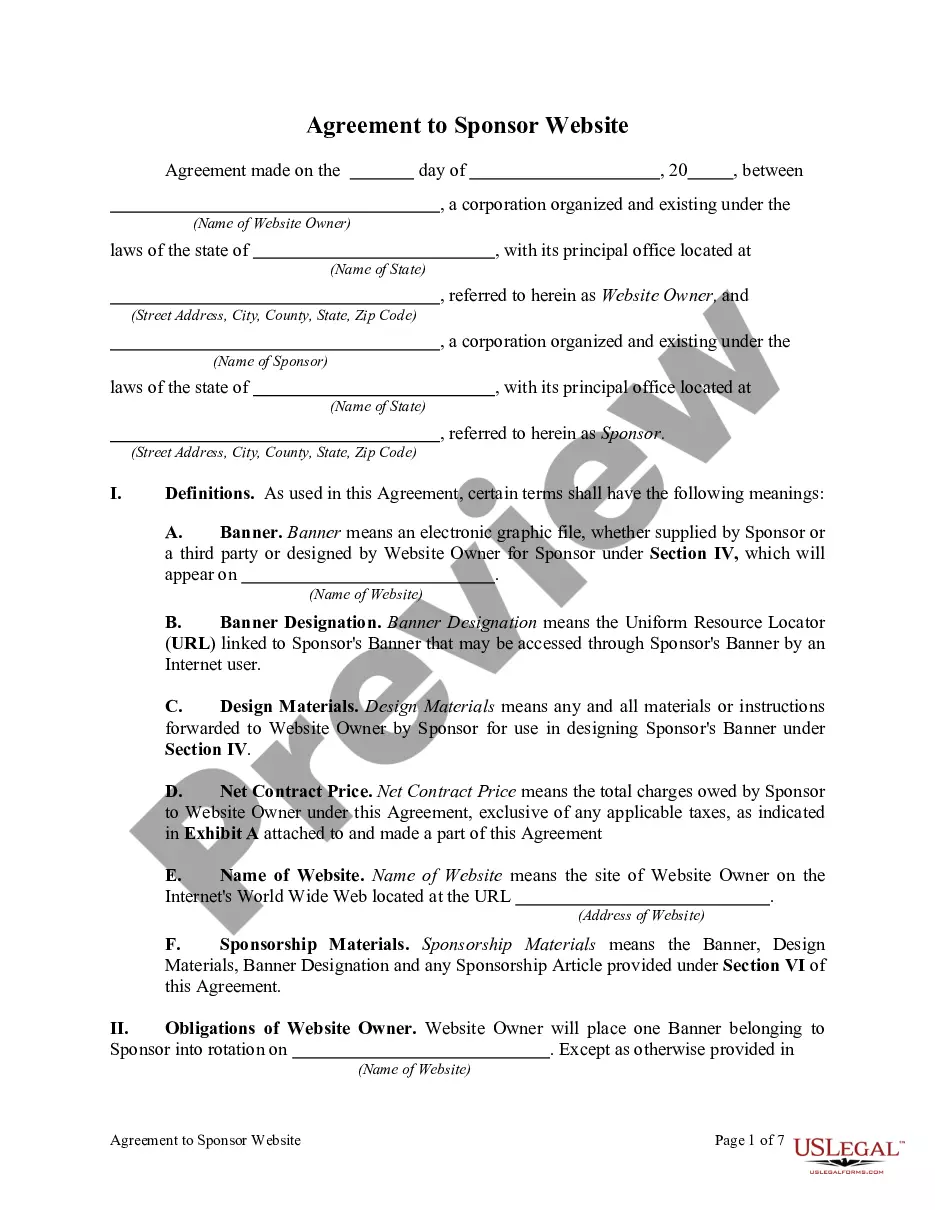

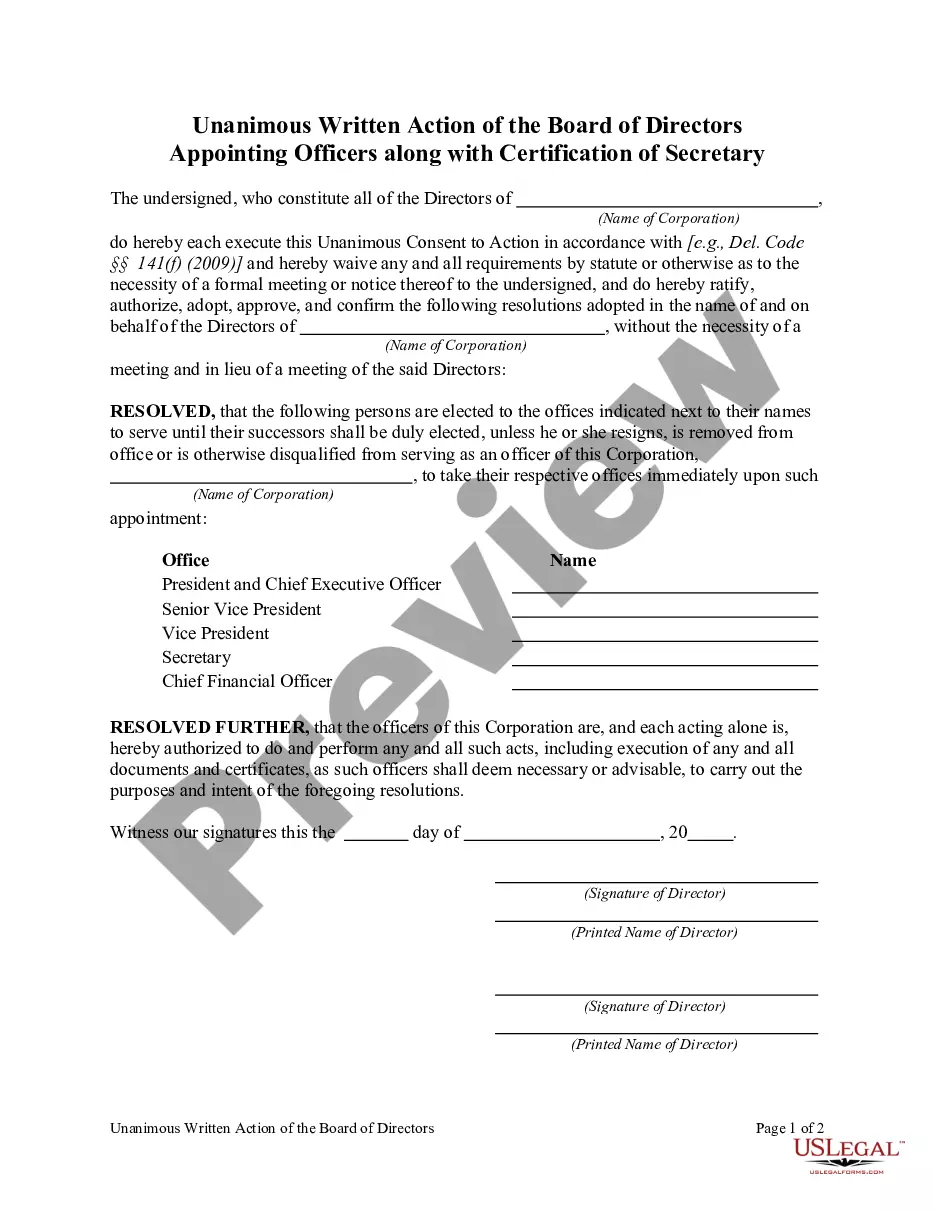

Choosing the right authorized document template can be a battle. Naturally, there are plenty of layouts accessible on the Internet, but how can you find the authorized kind you need? Utilize the US Legal Forms website. The services gives 1000s of layouts, such as the Illinois Loan Agreement for Car, which can be used for organization and personal needs. Each of the forms are checked by pros and fulfill state and federal requirements.

Should you be currently signed up, log in to your bank account and then click the Obtain switch to have the Illinois Loan Agreement for Car. Use your bank account to look through the authorized forms you might have purchased previously. Check out the My Forms tab of your bank account and have one more duplicate in the document you need.

Should you be a new customer of US Legal Forms, allow me to share basic recommendations that you should follow:

- Very first, be sure you have selected the proper kind for your personal town/county. You can look over the form while using Review switch and read the form outline to guarantee this is basically the best for you.

- In the event the kind fails to fulfill your preferences, make use of the Seach field to find the right kind.

- Once you are positive that the form is suitable, go through the Acquire now switch to have the kind.

- Select the pricing prepare you want and enter in the necessary information and facts. Create your bank account and purchase the order with your PayPal bank account or credit card.

- Choose the document formatting and acquire the authorized document template to your device.

- Comprehensive, modify and printing and indicator the acquired Illinois Loan Agreement for Car.

US Legal Forms will be the greatest catalogue of authorized forms for which you will find numerous document layouts. Utilize the company to acquire expertly-produced paperwork that follow state requirements.

Form popularity

FAQ

(3) 1% of the total loan amount if the prepayment is made within the third 12-month period following the date the loan was made, if the fixed rate period extends 3 years.

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates.

Here's a step-by-step on writing a simple Loan Agreement with a free Loan Agreement template. Step 1 ? Name the Parties. ... Step 2 ? Write Down the Loan Amount. ... Step 3 ? Specify Repayment Details. ... Step 4 ? Choose How the Loan Will Be Secured (Optional) ... Step 5 ? Provide a Guarantor (Optional) ... Step 6 ? Specify an Interest Rate.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

A payment agreement should always be in writing and include information regarding the type of payment to be given, when it should be given, how it will be paid, and what happens should the borrower default on the terms specified in the agreement.

Car Promissory Note With a ca promissory note, a borrower promises to make payments on a car loan in exchange for a vehicle. The borrower typically makes even payments throughout the car loan term but often makes an initial lmp sum down payment.