Illinois Subrogation Agreement between Insurer and Insured

Description

How to fill out Subrogation Agreement Between Insurer And Insured?

Have you been in a place where you need papers for either business or person reasons nearly every time? There are tons of authorized file layouts available on the net, but locating kinds you can depend on is not simple. US Legal Forms gives 1000s of form layouts, just like the Illinois Subrogation Agreement between Insurer and Insured, that happen to be composed to satisfy state and federal needs.

Should you be already acquainted with US Legal Forms web site and possess a merchant account, just log in. After that, you may down load the Illinois Subrogation Agreement between Insurer and Insured design.

If you do not provide an bank account and would like to start using US Legal Forms, abide by these steps:

- Discover the form you require and ensure it is to the right metropolis/county.

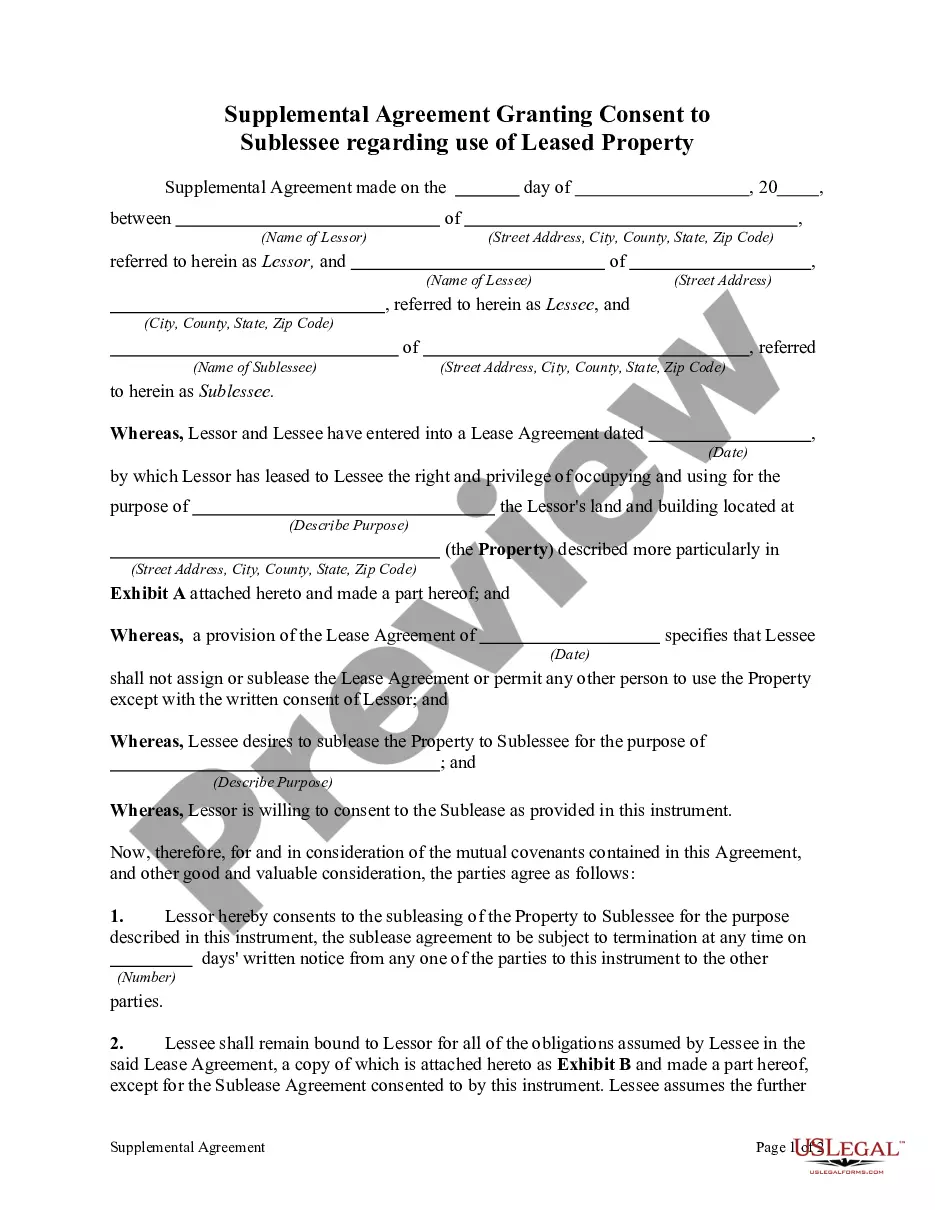

- Make use of the Preview button to examine the form.

- Browse the explanation to actually have selected the proper form.

- If the form is not what you are looking for, take advantage of the Lookup area to get the form that meets your needs and needs.

- Whenever you get the right form, click on Buy now.

- Opt for the costs strategy you would like, fill out the specified info to produce your account, and pay money for your order utilizing your PayPal or bank card.

- Select a practical file format and down load your copy.

Get every one of the file layouts you have bought in the My Forms menus. You can obtain a more copy of Illinois Subrogation Agreement between Insurer and Insured whenever, if necessary. Just click the necessary form to down load or print out the file design.

Use US Legal Forms, probably the most extensive selection of authorized varieties, to save time and prevent blunders. The service gives expertly manufactured authorized file layouts that can be used for a variety of reasons. Create a merchant account on US Legal Forms and begin creating your daily life a little easier.

Form popularity

FAQ

Illinois Applies the Anti-Subrogation Rule to Require a Landlord's Subrogating Property Insurer to Defend a Third-Party Complaint Against Tenants. In Sheckler v. Auto-Owners Ins. Co, 2021 IL App (3d) 190500, 2021 Ill.

Illinois Laws on Subrogation For example, Illinois state courts may still enforce subrogation rights even if you do not receive full compensation for your injuries. Additionally, insurance companies may pursue a lawsuit if they do not receive reimbursement from upfront payments.

An insurance company may not subrogate against its own insured or a co-insured. However, when a party claiming to be a co-insured is merely a loss payee to which no liability coverage is afforded, subrogation is permissible.

Generally, in most subrogation cases, an individual's insurance company pays its client's claim for losses directly, then seeks reimbursement from the other party's insurance company. Subrogation is most common in an auto insurance policy but also occurs in property/casualty and healthcare policy claims.

The rule of subrogation known as the ?Sutton Rule? states that a tenant and landlord are automatically considered ?co-insureds? under a fire insurance policy as a matter of law and, therefore, the insurer of the landlord who pays for the fire damage caused by the negligence of a tenant may not sue the tenant in ...

Subrogation refers to the right of an insurance company to recover money it paid to or on behalf of its insureds due to the actions of at-fault third parties.

When you file a claim, your insurer can try to recover costs from the person responsible for your injury or property damage. This is known as subrogation. For example: Your insurance company pays your doctor for your treatment following an auto accident that someone else caused.

An insurer may attempt to subrogate against an additional insured for completed operations injuries caused by the insured if the additional insured endorsement provides coverage only for ongoing operations injuries.