Illinois Subordination Agreement Subordinating Existing Mortgage to New Mortgage

Description

How to fill out Subordination Agreement Subordinating Existing Mortgage To New Mortgage?

If you have to full, down load, or printing legitimate document web templates, use US Legal Forms, the biggest selection of legitimate varieties, which can be found on-line. Take advantage of the site`s simple and practical research to discover the files you need. A variety of web templates for company and specific functions are sorted by categories and claims, or keywords. Use US Legal Forms to discover the Illinois Subordination Agreement Subordinating Existing Mortgage to New Mortgage in a couple of mouse clicks.

If you are currently a US Legal Forms buyer, log in to the profile and click on the Down load option to get the Illinois Subordination Agreement Subordinating Existing Mortgage to New Mortgage. You may also accessibility varieties you in the past delivered electronically in the My Forms tab of the profile.

Should you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for the correct area/nation.

- Step 2. Use the Review option to look through the form`s content. Do not forget about to see the explanation.

- Step 3. If you are not happy with all the form, take advantage of the Lookup industry near the top of the display to find other models in the legitimate form web template.

- Step 4. When you have identified the form you need, click on the Get now option. Choose the prices strategy you choose and add your qualifications to sign up to have an profile.

- Step 5. Procedure the deal. You can utilize your charge card or PayPal profile to accomplish the deal.

- Step 6. Pick the structure in the legitimate form and down load it on your product.

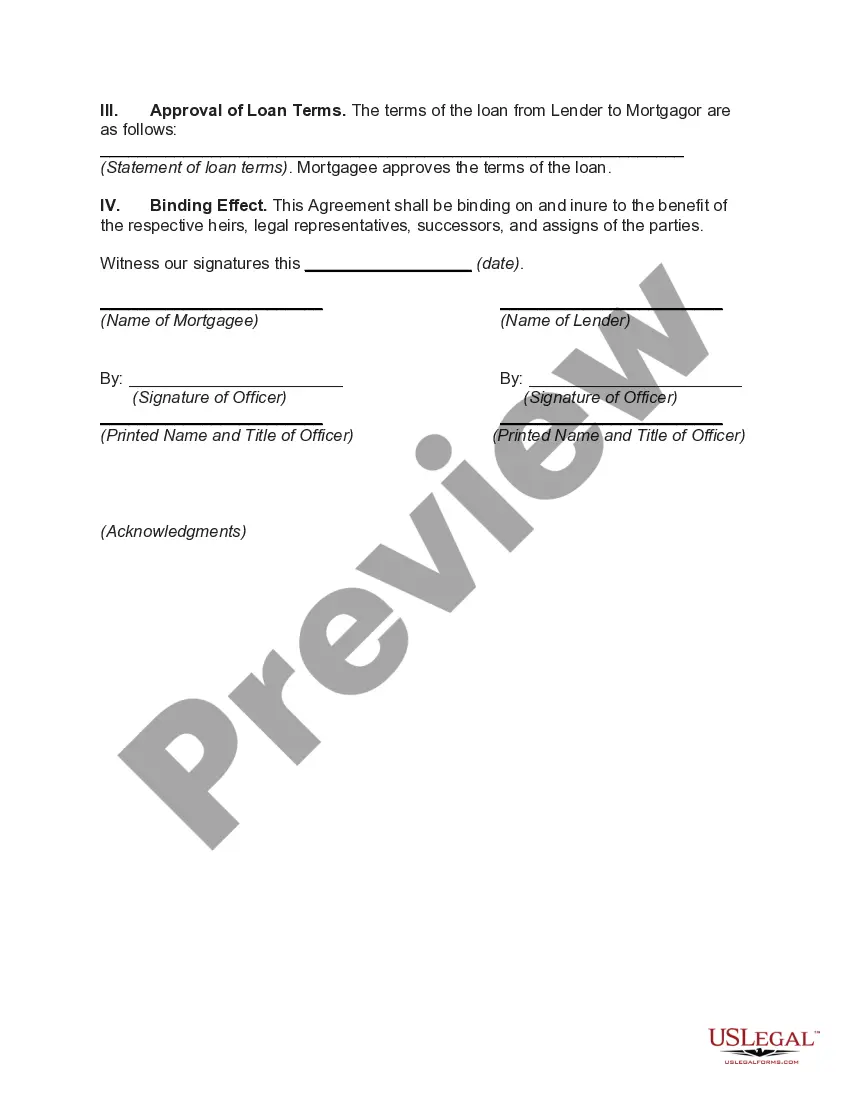

- Step 7. Full, change and printing or sign the Illinois Subordination Agreement Subordinating Existing Mortgage to New Mortgage.

Every single legitimate document web template you purchase is your own eternally. You have acces to every single form you delivered electronically with your acccount. Click on the My Forms portion and decide on a form to printing or down load yet again.

Be competitive and down load, and printing the Illinois Subordination Agreement Subordinating Existing Mortgage to New Mortgage with US Legal Forms. There are many professional and state-distinct varieties you can utilize for the company or specific needs.

Form popularity

FAQ

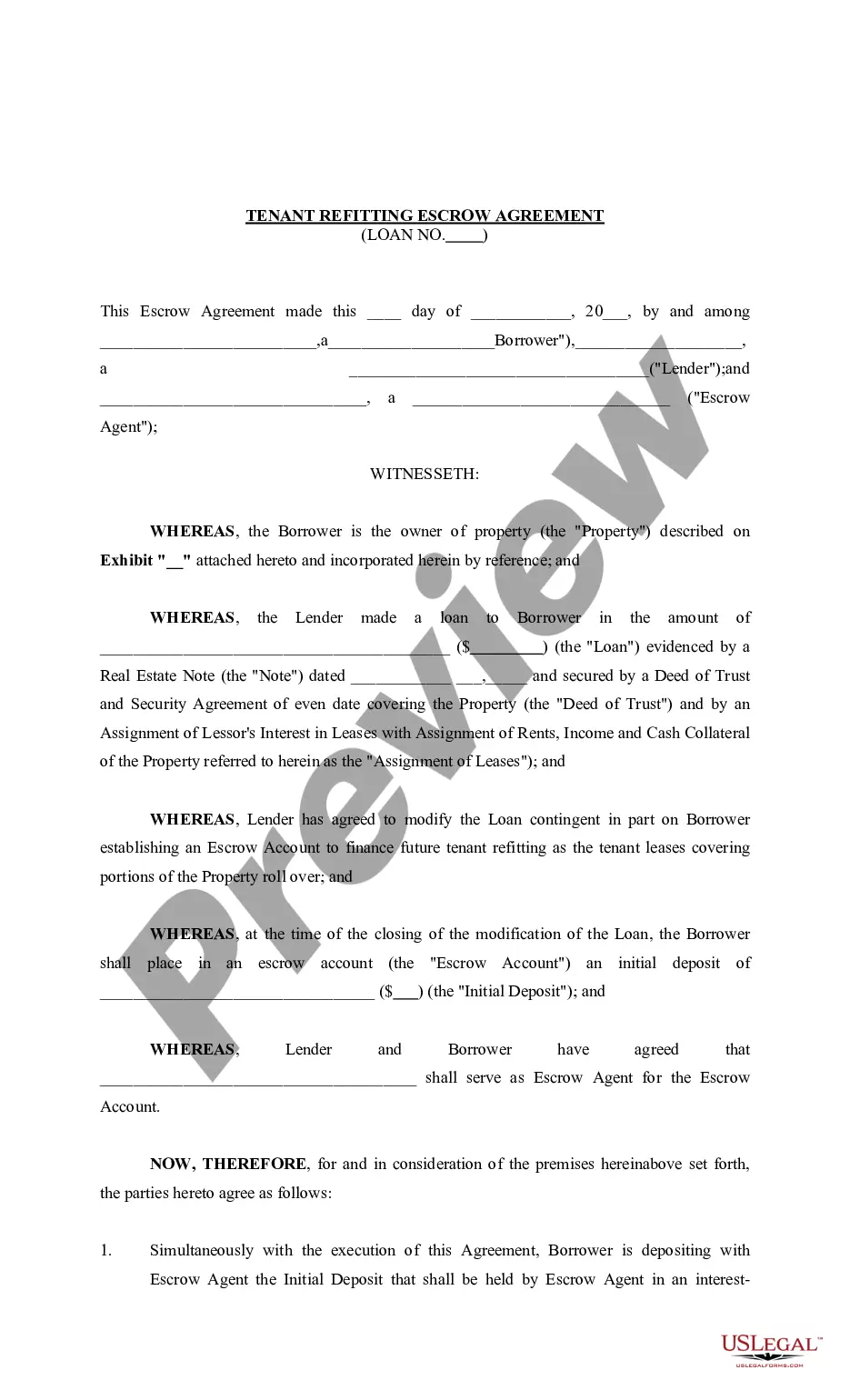

Subordination agreements are used to legally establish the order in which debts are to be repaid in the event of a foreclosure or bankruptcy. In return for the agreement, the lender with the subordinated debt will be compensated in some manner for the additional risk.

Subordination means increased risk for the subordinated lender since it will have less access to the borrower's assets than senior lenders. Lenders may accept this risk if they are compensated for doing so. Consequently, interest rates on subordinated debt are higher than on senior debt. Subordination | Practical Law - Thomson Reuters thomsonreuters.com ? ... thomsonreuters.com ? ...

It also benefits the lender as they get the assurance that the borrower will repay their loan on a priority basis. Furthermore, through subordination agreements in real estate, the homeowners get a lower interest on their property. Therefore, it is a common practice in the lending industry. Subordination Agreement - What It Is, Explained, Examples ... WallStreetMojo ? subordination-agree... WallStreetMojo ? subordination-agree...

Getting A Second Mortgage A second mortgage will become a subordinate loan. If you repay the primary loan within the term of the second mortgage, the second mortgage can take its place as the primary loan.

Many people have a subordinate mortgage in the form of a home equity line of credit or home equity loan. A subordinate mortgage is secured by your property but sits in second position, if you have a primary mortgage, for getting paid in the event you default.

A subordination clause serves to protect the lender if a homeowner defaults. If this happens, the lender then has the legal standing to repossess the home and cover their loan's outstanding balance first. If other subordinate mortgages are involved, the secondary liens will take a backseat in this process. What To Know About A Subordinate Mortgage rocketmortgage.com ? learn ? mortgage-sub... rocketmortgage.com ? learn ? mortgage-sub...

Who Benefits from a Subordination Clause? A subordination clause is meant to protect the interests of the primary lender. A primary mortgage usually covers the cost of purchasing the home; however, if there is a secondary mortgage, the clause ensures that the primary lender retains the number one priority. Subordination Clause Definition - Real Estate License Wizard realestatelicensewizard.com ? subordination-clause realestatelicensewizard.com ? subordination-clause

Again, if you're refinancing your first mortgage and the property also has a subordinate mortgage, the refinancing lender will usually handle the process of getting the necessary subordination agreement. But you need to ensure that the required subordination agreement is completed before the new loan's closing date.