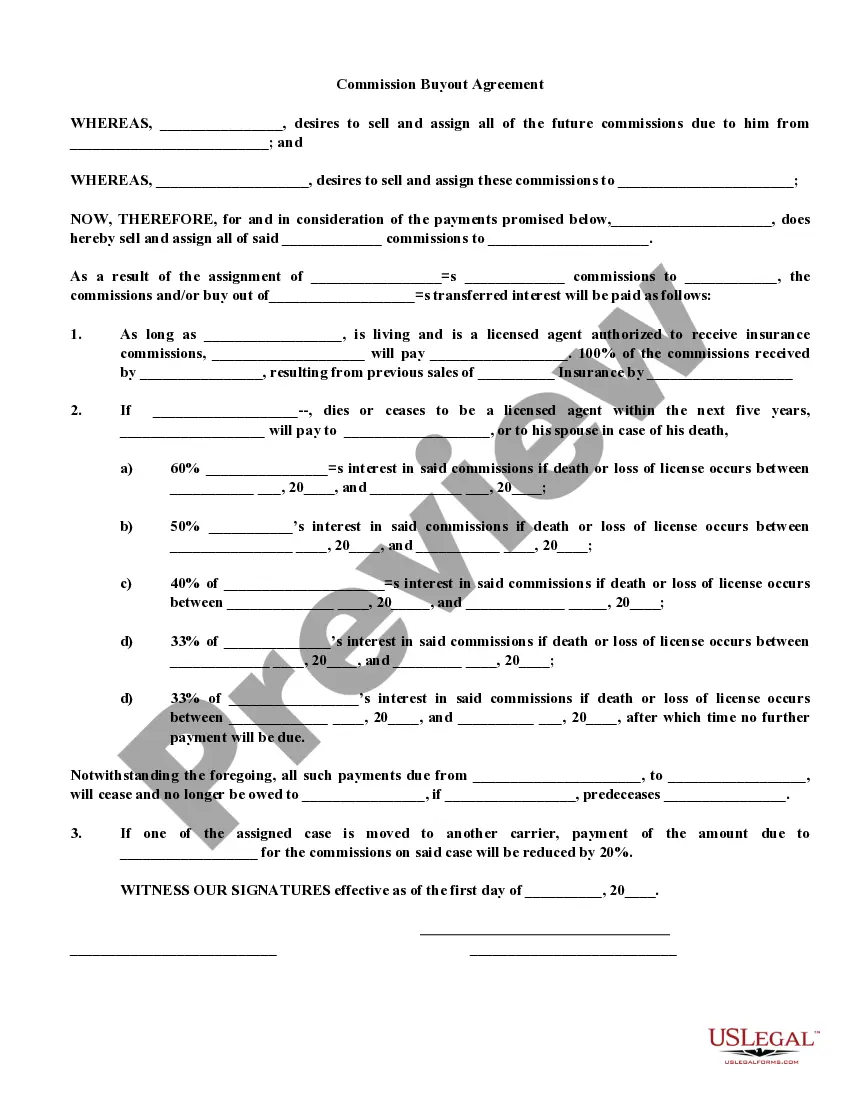

Title: Illinois Commission Buyout Agreement Insurance Agent: Overview and Types Introduction: An Illinois Commission Buyout Agreement Insurance Agent acts as a professional intermediary between insurance policyholders and insurance companies, specializing in facilitating commission buyout agreements in Illinois. These agents play a critical role in helping policyholders surrender their existing insurance policies in exchange for a lump-sum payout. Keywords: Illinois Commission Buyout Agreement, Insurance Agent, commission buyout, policyholder, insurance company, lump-sum payout. Detailed Description: An Illinois Commission Buyout Agreement Insurance Agent is a licensed professional equipped with extensive knowledge of the insurance industry and expertise in commission buyout processes. Their primary responsibility is to assist policyholders in making an informed decision when considering surrendering their existing insurance policy. Types of Illinois Commission Buyout Agreement Insurance Agents: 1. Life Insurance Commission Buyout Agents: These agents specialize in commission buyouts for life insurance policies. They guide policyholders through the surrender process, providing crucial information on policy cash values, surrender charges, and any potential tax implications. Life insurance commission buyout agents are well-versed in the specific regulations governing such agreements in Illinois. 2. Annuity Commission Buyout Agents: Annuity commission buyouts involve surrendering annuity contracts in exchange for a lump-sum payout. Agents specializing in annuity commission buyouts offer expert advice and assist policyholders in analyzing the annuity contract, considering possible surrender charges, tax implications, and evaluating alternative investment options. 3. Property and Casualty Commission Buyout Agents: These agents cater to policyholders holding property and casualty insurance policies. When policyholders decide to give up their coverage in exchange for immediate funds, property and casualty commission buyout agents guide them through the surrendering process, ensuring they understand the potential consequences and alternatives available. Responsibilities of Illinois Commission Buyout Agreement Insurance Agents: 1. Consultation and Evaluation: Agents consult with policyholders, thoroughly evaluating their insurance policies to determine if a commission buyout is suitable. They consider factors like policy premiums, cash values, surrender charges, and implications on existing benefits. 2. Explanation of Agreement Terms: Agents explain the terms and conditions of the commission buyout agreement, providing policyholders with an in-depth understanding of the process, potential financial gains, and losses before making a decision. 3. Paperwork and Documentation: Once policyholders decide to proceed with the commission buyout agreement, agents handle the necessary paperwork, ensuring all documentation is properly completed and submitted to the insurance company and other relevant authorities in compliance with Illinois regulations. 4. Negotiation and Advocacy: Agents act as advocates for policyholders during negotiations with insurance companies, aiming to secure the most favorable terms and maximize the lump-sum payout. Conclusion: Illinois Commission Buyout Agreement Insurance Agents offer vital support and guidance to policyholders seeking to surrender their insurance policies in exchange for a lump-sum payout. Their expertise helps policyholders navigate complex regulations, make informed decisions, and achieve the best possible outcomes. Whether specializing in life insurance, annuities, or property and casualty policies, these agents play an essential role in facilitating commission buyout agreements in Illinois.

Illinois Commission Buyout Agreement Insurance Agent

Description

How to fill out Illinois Commission Buyout Agreement Insurance Agent?

Are you currently in a placement the place you need to have documents for both enterprise or personal functions virtually every time? There are plenty of legitimate document templates available on the net, but finding versions you can trust isn`t simple. US Legal Forms gives a large number of form templates, just like the Illinois Commission Buyout Agreement Insurance Agent, that happen to be created to satisfy state and federal needs.

If you are presently knowledgeable about US Legal Forms web site and have a merchant account, basically log in. Following that, you are able to down load the Illinois Commission Buyout Agreement Insurance Agent design.

Unless you offer an accounts and need to begin to use US Legal Forms, abide by these steps:

- Discover the form you require and make sure it is for the appropriate town/region.

- Take advantage of the Review option to examine the form.

- Look at the explanation to ensure that you have chosen the proper form.

- In the event the form isn`t what you are looking for, use the Search industry to get the form that fits your needs and needs.

- When you get the appropriate form, click Get now.

- Pick the prices strategy you want, complete the desired information to create your bank account, and pay money for your order utilizing your PayPal or charge card.

- Choose a hassle-free data file format and down load your backup.

Locate all the document templates you have purchased in the My Forms food selection. You can aquire a additional backup of Illinois Commission Buyout Agreement Insurance Agent whenever, if necessary. Just click the essential form to down load or produce the document design.

Use US Legal Forms, probably the most comprehensive assortment of legitimate types, to conserve time as well as steer clear of faults. The assistance gives skillfully made legitimate document templates that can be used for an array of functions. Produce a merchant account on US Legal Forms and begin making your lifestyle a little easier.