Illinois Renunciation of Legacy

Description

How to fill out Renunciation Of Legacy?

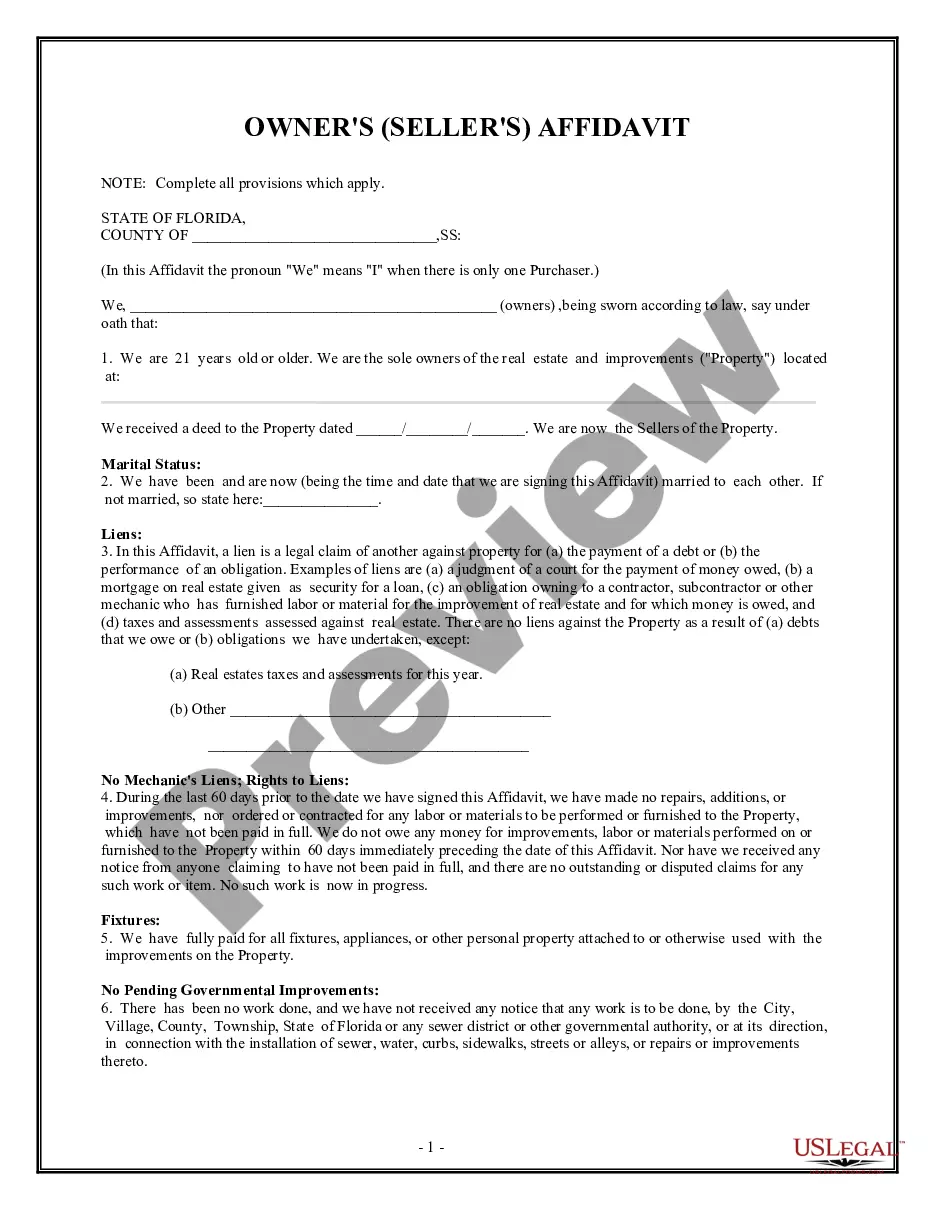

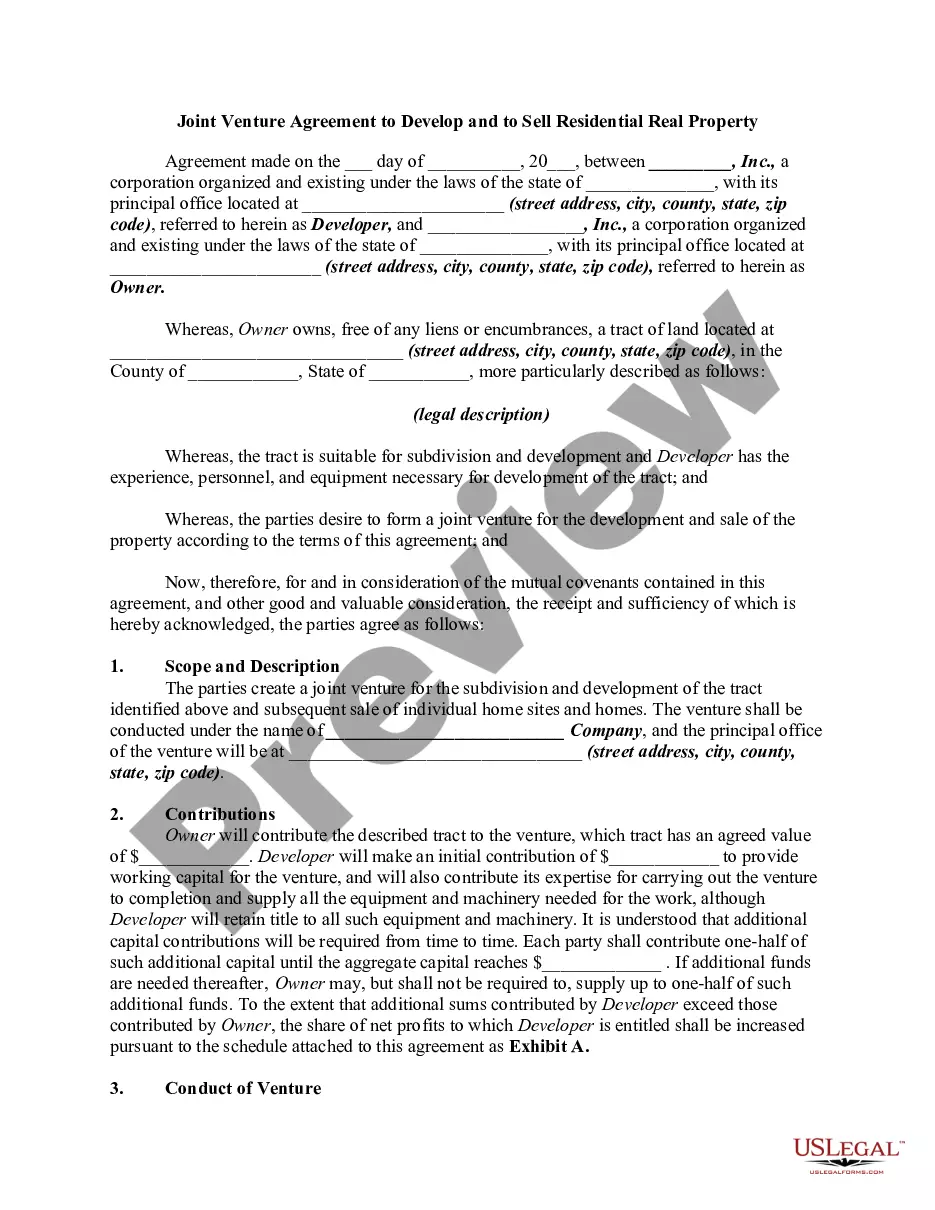

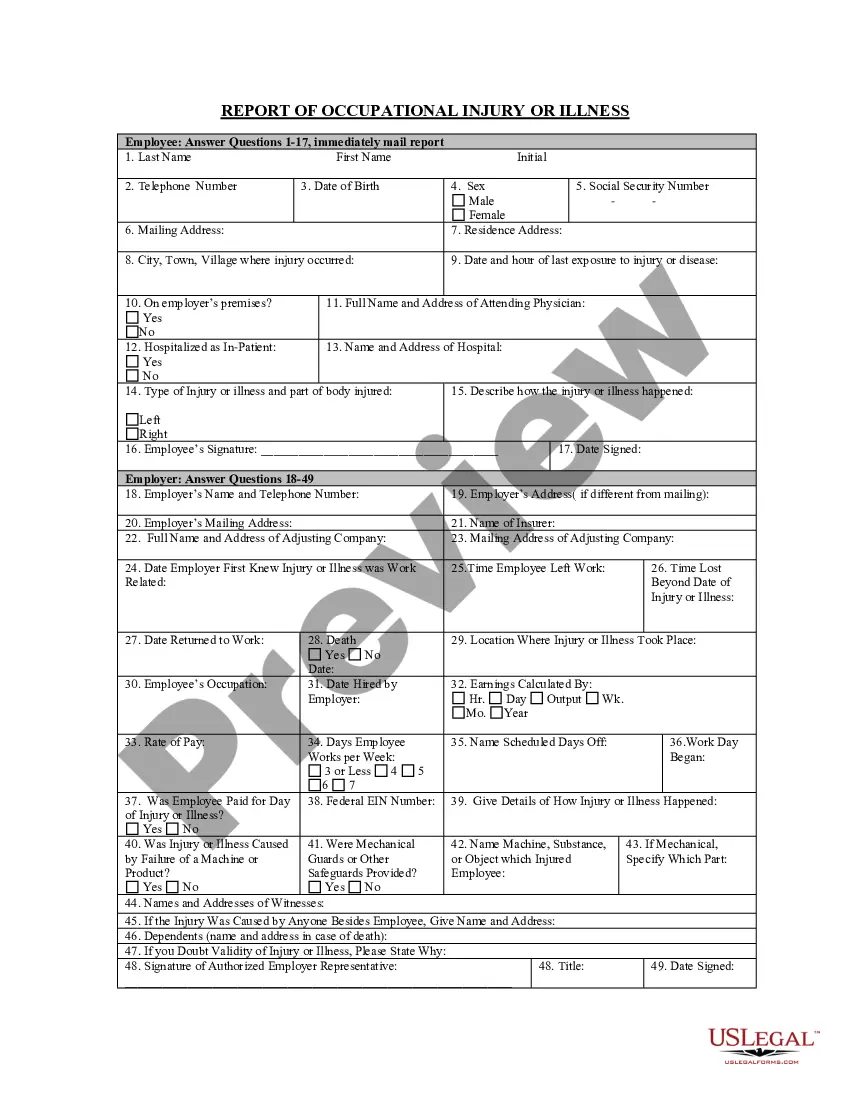

Finding the right legal record template can be quite a battle. Obviously, there are plenty of layouts available on the Internet, but how will you find the legal type you want? Use the US Legal Forms site. The services gives a large number of layouts, for example the Illinois Renunciation of Legacy, that can be used for organization and personal demands. All of the kinds are inspected by specialists and meet state and federal specifications.

If you are currently signed up, log in for your profile and then click the Obtain button to get the Illinois Renunciation of Legacy. Make use of your profile to check with the legal kinds you have purchased formerly. Proceed to the My Forms tab of the profile and obtain yet another copy of the record you want.

If you are a new user of US Legal Forms, allow me to share simple instructions so that you can adhere to:

- Initially, make certain you have selected the appropriate type to your metropolis/region. You may look through the form utilizing the Preview button and read the form outline to make certain it will be the best for you.

- If the type does not meet your preferences, take advantage of the Seach area to find the proper type.

- Once you are sure that the form is proper, select the Buy now button to get the type.

- Choose the rates prepare you desire and enter the needed info. Create your profile and purchase an order using your PayPal profile or Visa or Mastercard.

- Select the document structure and acquire the legal record template for your device.

- Total, revise and printing and indicator the received Illinois Renunciation of Legacy.

US Legal Forms is definitely the biggest collection of legal kinds for which you can find different record layouts. Use the service to acquire skillfully-created documents that adhere to state specifications.

Form popularity

FAQ

What is a surviving spouse entitled to in Illinois? The surviving spouse is entitled to 20,000 dollars or enough money to sustain them for nine months. This comes after any funeral costs. The exact amounts will be decided based on the circumstances of your finances.

(b) In order to renounce a will, the testator's surviving spouse must file in the court in which the will was admitted to probate a written instrument signed by the surviving spouse and declaring the renunciation.

Illinois law provides for the right of renunciation, also known as the elective share or the right of election. This is the right of a spouse to inherit from the estate of the decedent following the will's renunciation.

(a) A will may be revoked only (1) by burning, cancelling, tearing or obliterating it by the testator himself or by some person in his presence and by his direction and consent, (2) by the execution of a later will declaring the revocation, (3) by a later will to the extent that it is inconsistent with the prior will ...

What Is An Illinois Disclaimer of Interest? be received no later than 9 months after the transfer is made or the date of death. be in writing. declared a disclaimer. signed by the disclaimant or a legally authorized representative. describe the disclaimed property.

Whether a will must go through probate depends on the nature and value of the assets addressed in the will. Typically, probate proceedings are only needed if the decedent's assets are collectively valued at more than $100,000 or if the assets are owned solely rather than jointly.

Spouse and descendants: If the decedent dies leaving both a spouse and descendants half the decedent's assets go to the spouse and half to the descendants, per stirpes. Descendants only: If the decedent dies leaving only descendants, all assets go to descendants, per stirpes.