An Illinois Indemnification Agreement for a Trust is a legal agreement that outlines the terms and conditions under which a trustee of a trust can be indemnified or protected from any legal or financial liability they may incur while fulfilling their duties. This agreement ensures that the trustee is safeguarded against any losses, costs, or damages that may arise as a result of their actions or decisions made in good faith. It is crucial for both the trustee and the trust beneficiaries to understand the provisions of the indemnification agreement, as it helps establish trust and encourages trustees to carry out their responsibilities diligently. The following are some key elements and relevant keywords that may be included in an Illinois Indemnification Agreement for a Trust: 1. Trustee's Role: Clearly define the responsibilities, powers, and limitations of the trustee within the trust. 2. Scope of Indemnification: Specify the situations or circumstances in which the trustee will be indemnified, such as legal actions, claims, or costs arising from their duties. 3. Standard of Conduct: Establish the standard of conduct expected from the trustee, including acting in good faith, in the best interests of the trust, and in accordance with applicable laws and regulations. 4. Definition of Expenses: Define the types of expenses that can be indemnified, such as legal fees, court costs, settlements, judgments, and other related costs. 5. Limitations on Indemnification: Clarify any exceptions or limitations to the indemnification agreement, such as instances of gross negligence, willful misconduct, or fraudulent actions by the trustee. 6. Advance Payment of Expenses: Address whether the trustee is entitled to receive advance payments of expenses related to indemnification, or if reimbursements will be made only after the resolution of the matter. 7. Insurance Coverage: Discuss the trustee's obligation to maintain appropriate liability insurance coverage and any requirements regarding reporting claims or changing insurers. 8. Procedure for Indemnification: Outline the process by which the trustee can seek indemnification, including providing timely notice of the claim, cooperating in investigations, and documenting expenses incurred. In Illinois, there may be different types of indemnification agreements depending on the specifics of the trust and the parties involved. Some variations may include: 1. General Indemnification Agreement: This is a standard indemnification agreement that applies to most trusts and provides protection to trustees under a broad range of circumstances. 2. Limited Indemnification Agreement: This type of agreement may limit the extent of indemnification available to the trustee, usually by excluding certain types of conduct or actions. 3. Trust-Specific Indemnification Agreement: In certain cases, a trust may require a customized indemnification agreement tailored to its unique circumstances, such as specific instructions or restrictions on indemnification provisions. It is essential for both trustees and trust beneficiaries to consult with legal professionals and understand the specific terms and conditions outlined in an Illinois Indemnification Agreement for a Trust. This safeguard ensures that all parties are aware of their rights, responsibilities, and the extent of protection provided within the bounds of the agreement.

Illinois Indemnification Agreement for a Trust

Description

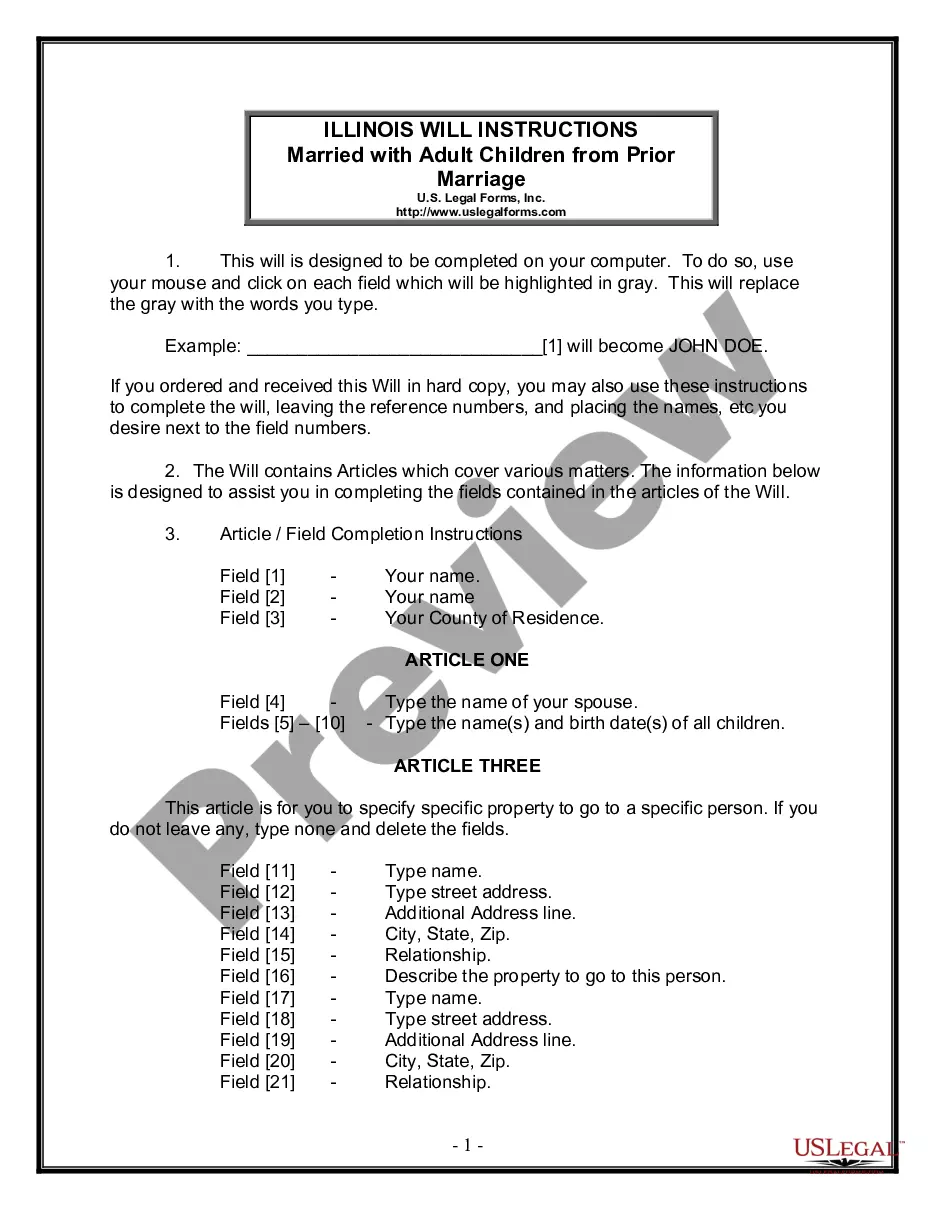

How to fill out Illinois Indemnification Agreement For A Trust?

It is possible to invest time online trying to find the authorized file template which fits the state and federal specifications you want. US Legal Forms provides thousands of authorized types that are reviewed by pros. You can easily download or produce the Illinois Indemnification Agreement for a Trust from our support.

If you already possess a US Legal Forms profile, you can log in and click the Acquire button. Next, you can total, change, produce, or sign the Illinois Indemnification Agreement for a Trust. Every authorized file template you acquire is the one you have for a long time. To get one more version for any acquired develop, go to the My Forms tab and click the corresponding button.

If you use the US Legal Forms web site the first time, follow the simple directions under:

- First, make sure that you have chosen the right file template for the state/city of your liking. See the develop explanation to ensure you have chosen the appropriate develop. If accessible, make use of the Preview button to look through the file template also.

- If you would like find one more edition of your develop, make use of the Research field to get the template that meets your requirements and specifications.

- Once you have discovered the template you desire, simply click Get now to proceed.

- Pick the prices strategy you desire, type your credentials, and register for a merchant account on US Legal Forms.

- Complete the purchase. You can utilize your charge card or PayPal profile to fund the authorized develop.

- Pick the format of your file and download it in your product.

- Make adjustments in your file if required. It is possible to total, change and sign and produce Illinois Indemnification Agreement for a Trust.

Acquire and produce thousands of file web templates using the US Legal Forms web site, which offers the largest selection of authorized types. Use specialist and state-specific web templates to deal with your business or specific demands.

Form popularity

FAQ

Some of the most common reasons trusts are invalid include: Legal formalities were not followed when executing the trust instrument. The trust was created or modified through forgery or another type of fraud. The trust maker was not mentally competent when they created or modified the trust.

Revocable Trust: In Illinois, a revocable trust does not need to be witnessed or notarized to be effective. Healthcare Power of Attorney: Illinois law requires a healthcare power of attorney to be signed before one witness.

It helps to remember that a Trust is a separate legal entity. The Trustees and beneficiaries are not personally liable for debts owed by the Trust. The Trustee is acting in a fiduciary capacity.

One of the most important things to keep in mind is that a trust must be funded. As the Illinois State Bar Association (ISBA) notes in a writing, a trust controls only the assets which are registered in its name. This means that you must be proactive about transferring assets into the trust over time.

Indemnity/indemnification:A trustee is entitled to reasonable compensation for her services. The amount payable can either come from the trust agreement itself or be fixed by the court (taking into account the trustee's skill level and actual duties performed) or state statute.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

A living trust might be especially useful in Illinois because the state does not use the Uniform Probate Code. This means that a living trust has the potential to save time and money for your family. When it comes to creating a living trust, you can do it yourself or work with an attorney.

When the assets are transferred into the trust, they are no longer legally owned by the person creating the trust. Instead the trust is considered to be a separate legal entity for probate purposes.

What are the Disadvantages of a Trust?Costs. When a decedent passes with only a will in place, the decedent's estate is subject to probate.Record Keeping. It is essential to maintain detailed records of property transferred into and out of a trust.No Protection from Creditors.