Illinois Sample Letter for Request for IRS not to Off Set against Tax Refund

Description

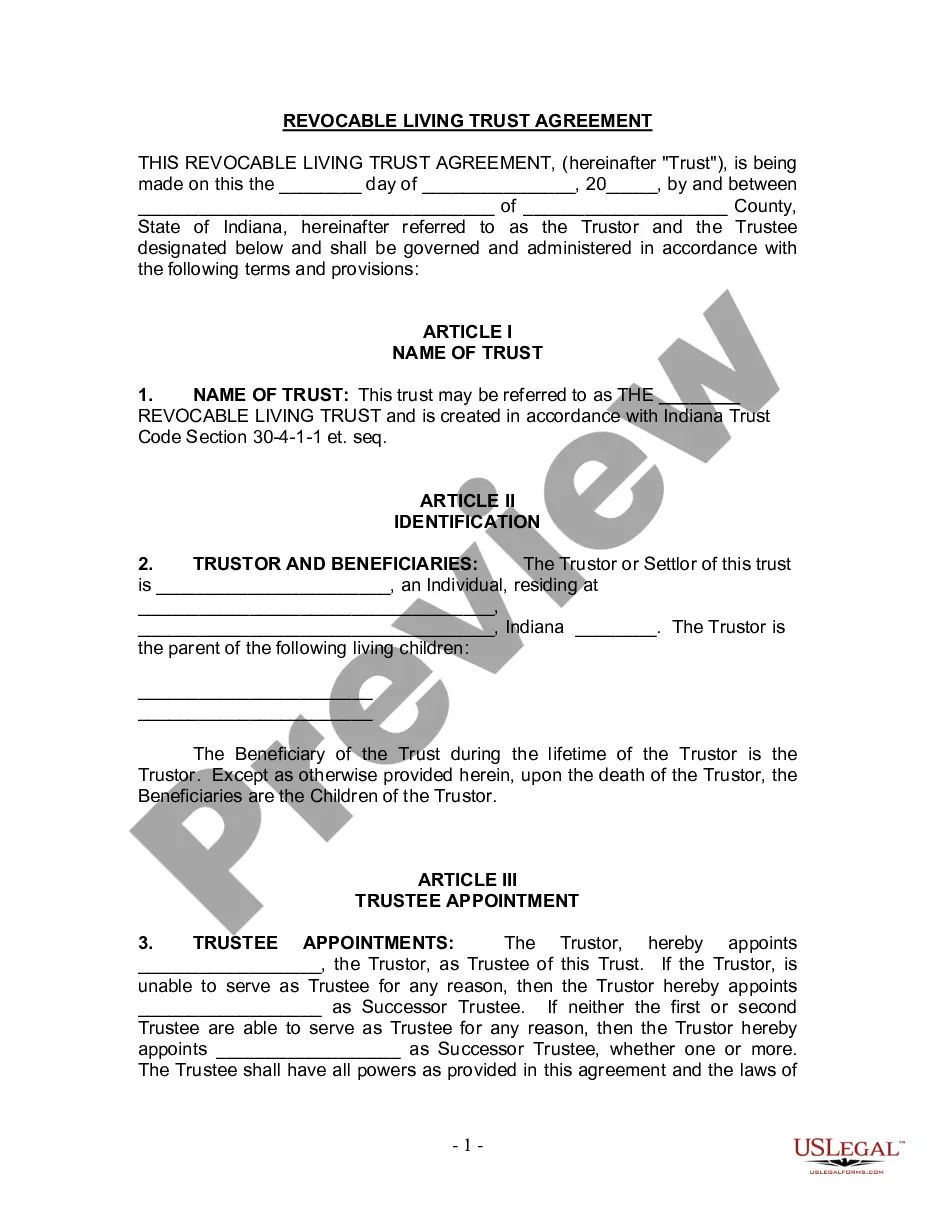

How to fill out Sample Letter For Request For IRS Not To Off Set Against Tax Refund?

Discovering the right legitimate file design could be a struggle. Needless to say, there are a lot of themes available online, but how do you discover the legitimate type you need? Utilize the US Legal Forms internet site. The services offers 1000s of themes, including the Illinois Sample Letter for Request for IRS not to Off Set against Tax Refund, which you can use for company and personal requirements. All of the varieties are checked by professionals and meet up with state and federal needs.

When you are previously signed up, log in in your profile and click on the Obtain button to have the Illinois Sample Letter for Request for IRS not to Off Set against Tax Refund. Make use of your profile to appear with the legitimate varieties you might have ordered formerly. Proceed to the My Forms tab of your respective profile and have another backup of your file you need.

When you are a brand new customer of US Legal Forms, allow me to share straightforward instructions so that you can adhere to:

- Initially, be sure you have chosen the correct type for your personal area/county. You may check out the shape making use of the Preview button and study the shape information to ensure this is basically the best for you.

- If the type is not going to meet up with your expectations, make use of the Seach industry to discover the appropriate type.

- Once you are sure that the shape is suitable, go through the Get now button to have the type.

- Select the pricing strategy you would like and enter the needed details. Design your profile and buy your order making use of your PayPal profile or bank card.

- Choose the submit structure and acquire the legitimate file design in your gadget.

- Total, revise and printing and sign the obtained Illinois Sample Letter for Request for IRS not to Off Set against Tax Refund.

US Legal Forms is the largest catalogue of legitimate varieties that you can discover numerous file themes. Utilize the service to acquire expertly-manufactured files that adhere to status needs.

Form popularity

FAQ

Instead, you should try to be polite and professional. You should also include your name, contact information, and the reason for writing. You can also include any relevant documents that support your request such as transcripts or income tax filings.

If your return was rejected because your Prior Year Adjusted Gross Income (AGI) doesn't match the Prior Year AGI on the Illinois Department of Revenue (IDOR) production file, it may mean there is no prior year return on file with IDOR, or a change or correction to the prior year return was made by the taxpayer or IDOR ...

Sincerely,[Name of Tax Authority Representative] Subject: Notice of Income Tax Obligations Dear [Recipient's Name], I am writing to inform you of your income tax obligations for the tax year [year]. ing to our records, your taxable income for the year was [amount].

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

The IRS does not accept tax-related questions by email.

Write a brief subject line indicating the purpose of the letter. For example: ?Request for Income Tax Refund.? Address the appropriate authority with the proper salutation. In the body of the letter, clearly state the purpose of your letter.

The 3176c notice is a letter that says IRS determined you filed a frivolous tax return, and it gives you 30 days to file a correct tax return or you'll get fined $5k.

Always use a secure method, such as certified mail return receipt requested, when you're sending returns and other documents to the IRS. This will provide confirmation that the IRS has actually received your documents or payment.