Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code Meeting Name: Special Meeting of the Board of Directors Corporation Name: [Name of Corporation] Objective: Adoption of Stock Ownership Plan under Section 1244 of the Internal Revenue Code Keywords: Illinois, Minutes, Special Meeting, Board of Directors, Adopt, Stock Ownership Plan, Section 1244, Internal Revenue Code 1. Introduction The Illinois Minutes of Special Meeting serve as an official record of the proceedings held by the Board of Directors of [Name of Corporation]. The purpose of this specific meeting is to discuss and adopt a Stock Ownership Plan under Section 1244 of the Internal Revenue Code. 2. Opening of the Meeting The Special Meeting of the Board of Directors commences on [Date] at [Time], at the designated location specified in the notice of the meeting. 3. Attendance The minutes will include a list of directors present at the meeting, along with any absence or remote attendance arrangements made. 4. Call to Order The Chairman of the Board (or acting chair) calls the meeting to order, ensuring a quorum is present as required by the corporation's bylaws. 5. Adoption of Agenda The agenda for the meeting is presented and duly adopted by the Board of Directors. 6. Purpose of the Meeting The Chairman addresses the purpose of the meeting, emphasizing the importance of adopting a Stock Ownership Plan under Section 1244 of the Internal Revenue Code. 7. Presentation of Stock Ownership Plan A comprehensive presentation is made by a designated representative, outlining the key elements of the proposed Stock Ownership Plan. This may include tax benefits, potential implications, eligibility criteria, treatment of stock, and other relevant details. 8. Questions and Discussion Directors are given the opportunity to raise questions, seek clarifications, and engage in a thorough discussion concerning the proposed Stock Ownership Plan. 9. Resolution and Voting A resolution is presented to the Board of Directors, formally proposing the adoption of the Stock Ownership Plan under Section 1244 of the Internal Revenue Code. Each director in attendance casts their vote, and the results are recorded in the minutes. 10. Approval and Adoption If the resolution receives the necessary majority vote, it is approved, and the Stock Ownership Plan is adopted by the Board of Directors. This decision and outcome are documented in the minutes. 11. Adjournment Once the objectives of the meeting have been accomplished, the Chairman declares the meeting adjourned, noting the time accordingly. 12. Closing Statement A closing statement is included in the minutes, expressing gratitude to the participants for their attendance, input, and active participation. Please note that variations of Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code may arise based on the specific circumstances, structure, and requirements of each corporation. It is advisable to consult legal professionals or adapt the content as necessary to suit the corporation's unique situation.

Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

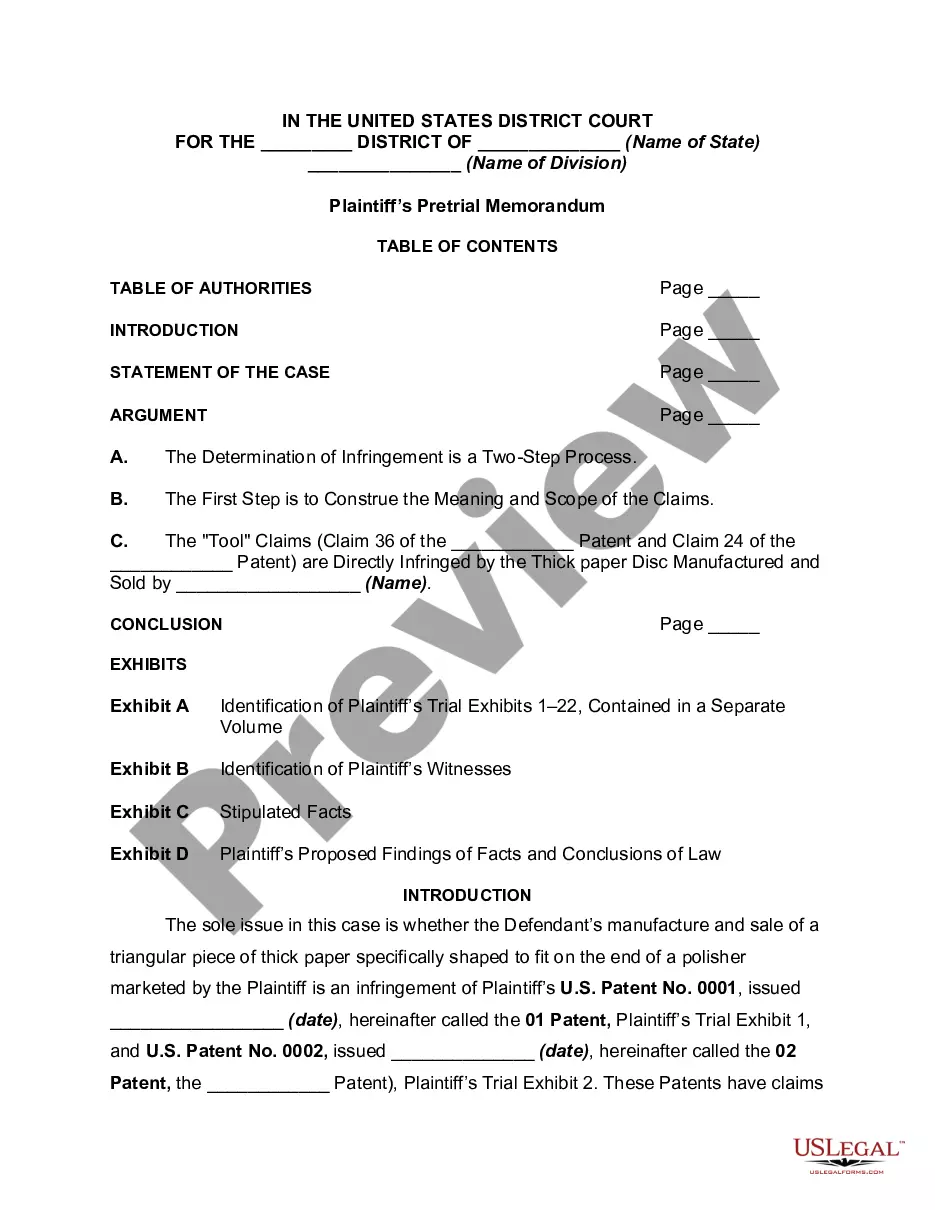

How to fill out Illinois Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

US Legal Forms - one of the most significant libraries of authorized kinds in America - provides an array of authorized file layouts you are able to down load or produce. Using the web site, you can find 1000s of kinds for enterprise and individual reasons, categorized by classes, states, or key phrases.You can get the most up-to-date variations of kinds like the Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code within minutes.

If you already possess a registration, log in and down load Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code from your US Legal Forms catalogue. The Download button will show up on every single form you view. You gain access to all previously downloaded kinds from the My Forms tab of the bank account.

If you want to use US Legal Forms initially, allow me to share straightforward directions to get you started out:

- Be sure to have selected the best form for your personal city/area. Click the Preview button to examine the form`s content. Read the form description to ensure that you have selected the correct form.

- When the form doesn`t match your demands, utilize the Research discipline on top of the screen to obtain the one which does.

- Should you be content with the form, verify your decision by visiting the Buy now button. Then, select the pricing prepare you want and offer your credentials to sign up for the bank account.

- Procedure the purchase. Utilize your credit card or PayPal bank account to perform the purchase.

- Pick the file format and down load the form on your own product.

- Make adjustments. Load, change and produce and signal the downloaded Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

Every template you added to your account does not have an expiration day and it is the one you have eternally. So, in order to down load or produce an additional backup, just go to the My Forms portion and click on on the form you will need.

Gain access to the Illinois Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code with US Legal Forms, the most extensive catalogue of authorized file layouts. Use 1000s of expert and status-distinct layouts that fulfill your small business or individual requirements and demands.

Form popularity

FAQ

To qualify under Section 1244, these five requirements must be adhered to:The stock must be acquired in exchange for cash or property contributed to the corporation.The corporation must issue the stock directly to the investors.The corporation must be an actual, operating company.More items...?

1244(b)). Any loss in excess of the limit is a capital loss, subject to the capital loss rules. Thus, if the potential loss exceeds the $50,000 (or $100,000) limit, the stock should be disposed of in more than one year to maximize the ordinary loss treatment.

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

An ordinary loss from the sale or worthlessness of Section 1244 stock is reported on Form 4797, and if the total loss exceeds the maximum amount that can be treated as an ordinary loss for the year, the transaction should also be reported on Form 8949.

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

In order to qualify as §1244 stock, the stock must be issued, and the consideration paid by the shareholder must consist of money or other property, not services. Stock and other securities are not "other property" for this purpose.

1244 stock is available only to individuals and partners in partnerships. The ruling held that if IRC Sec. 1244 stock is issued to S corporations, such corporations and their shareholders may not treat losses on such stock as ordinary losses. This is so notwithstanding IRC Sec.

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

Corporations, trusts, estates and trustees in bankruptcy are not eligible to claim a Section 1244 loss. A Section 1244 loss can be claimed only by an individual or partnership to whom the stock was issued and who has continuously held the stock until it is sold or is determined to be worthless.