Illinois Release from Liability under Guaranty

Description

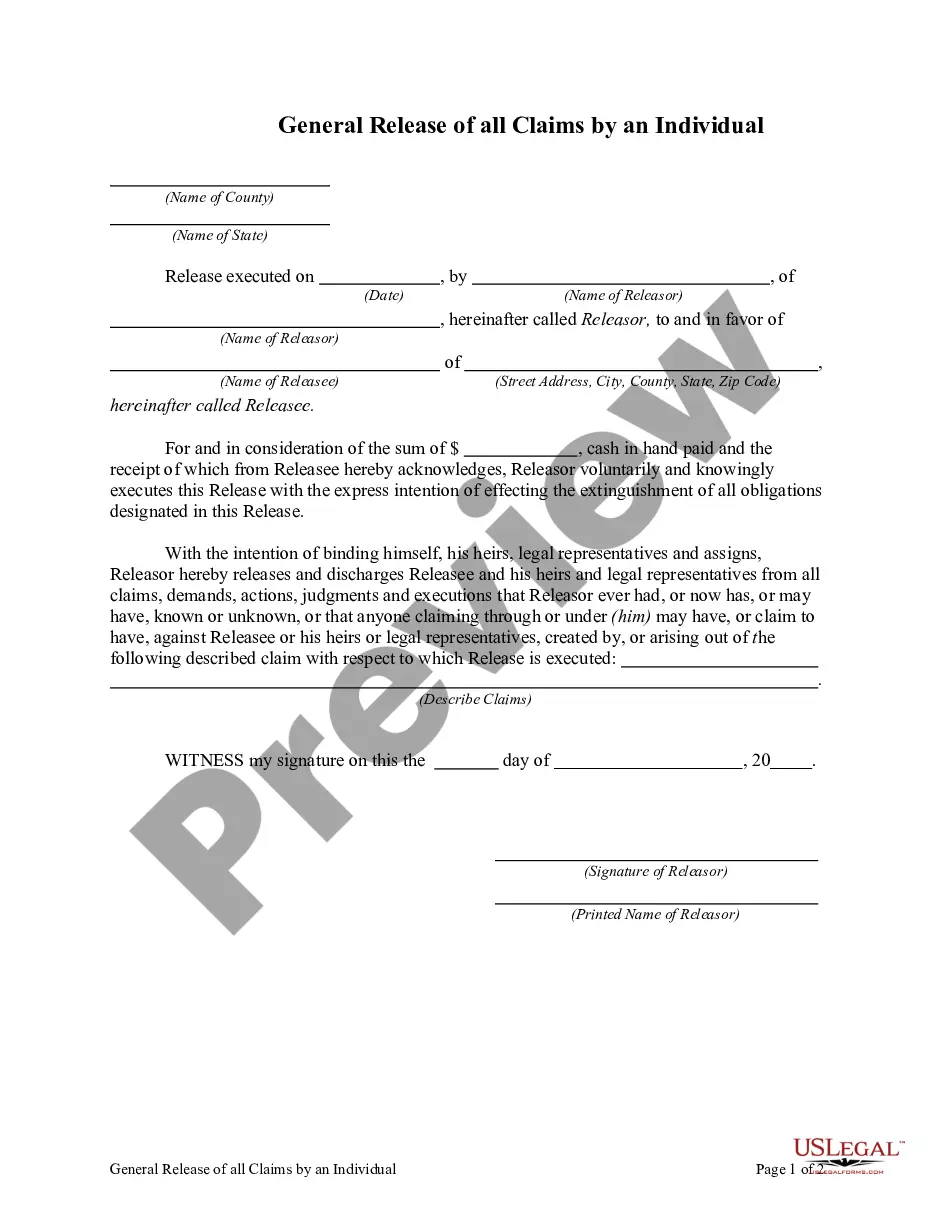

How to fill out Release From Liability Under Guaranty?

You might spend time online looking for the valid document template that fulfills the state and federal requirements you seek.

US Legal Forms offers a plethora of valid forms that are examined by experts.

You can easily obtain or print the Illinois Release from Liability under Guaranty from our service.

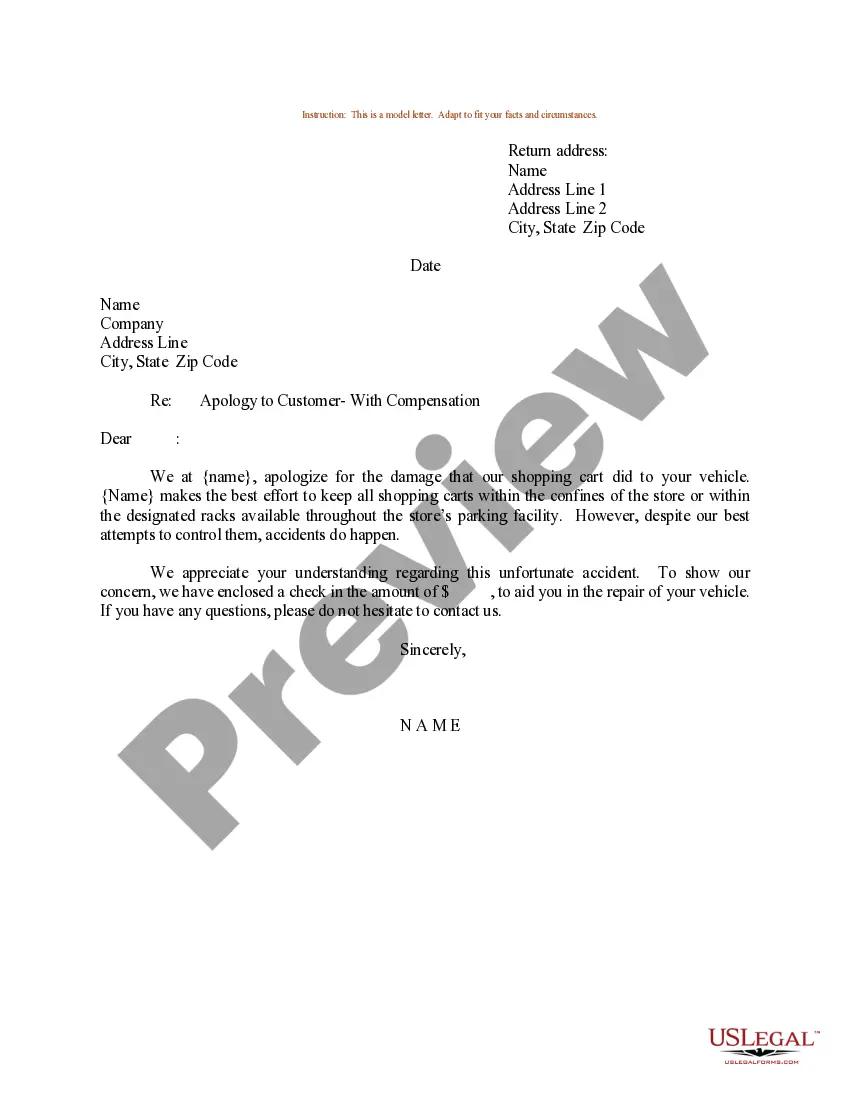

Check the form details to ensure you have chosen the appropriate form. If available, use the Review button to look through the document template as well.

- If you have an existing US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can fill out, modify, print, or sign the Illinois Release from Liability under Guaranty.

- Every valid document template you obtain is yours permanently.

- To get another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the county/city of your choice.

Form popularity

FAQ

Discharge of Guarantor by Release of Principal Debtor: Section 134 of the ICA provides that the guarantor shall stand discharged from its liabilities under a contract of guarantee in case of any agreement arrived at between the creditor and the principal debtor, by which the principal debtor is released.

A Release of Guarantee Form is a document that allows a guarantor to free themselves from being financially and/or legally bound to a contract. This is common for loan agreements and lease documents after expiration or when the contract has been fully satisfied.

The essence of a continuing guarantee is that it covers a series of transactions and each transaction is a separate transaction which creates a liability on the surety till it is repaid. The liability of the surety changes with every further advance by the creditor to the debtor.

With an unlimited personal guarantee, guarantors are liable for any part of the loan balance that is unpaid after the lender auctions off other collateral securing the loan.

The basis of the principle that a guarantor is discharged by an agreement between the creditor and the principal debtor which has the effect of varying the guarantee, is that it is the clearest and most evident equity not to carry on any transaction without the privity (knowledge) of the guarantor, who must

A guarantee for future transactions can be revoked at any time by notification to the debtors. However, for transactions entered before such cancellation of the guarantee the liability of a guarantor shall not be reduced.

A guarantor may be discharged if the lender and the borrower enter into a binding agreement to extend the time for performance by the borrower of its obligations under the principal contract. An absolute release of the borrower by the lender will release the guarantor.

A guarantee can be released by agreementeither be made as a deed or be supported by sufficient consideration. In some cases, when a guarantee is released, the guaranteed party will return the guarantee document to the guarantor.

Under the Indian Contract Act 1872, a contract can be terminated by the parties involved by giving legitimate reasons like frustration, repudiatory breach, termination by prior agreement, rescission, or on completion. Such termination may occur by the mutual consent of the parties or by law.

Unless a business is a sole proprietorship, personal guarantees can only be discharged by filing an individual bankruptcy. A business bankruptcy will not eliminate a personal guarantee. Likewise, the Chapter 13 co-debtor stay only applies to consumer debts and personal guarantees are usually considered business debts.