Title: Illinois Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed Keywords: Illinois, Letter, Creditor, Agreement, Monthly Payments, Temporarily Postponed Description: An Illinois letter to a creditor confirming an agreement that monthly payments be temporarily postponed is a formal correspondence that outlines the borrower's request for a temporary suspension of regular payment obligations to their creditor. It serves as a written agreement between the debtor and creditor regarding the postponement of monthly payments for a specified period and documents the mutual understanding reached between the parties involved. In Illinois, there may be different types of letters to creditors confirming the agreement to temporarily postpone monthly payments depending on the specific circumstances. Some notable variations include: 1. Illinois Letter to Creditor for Temporary Financial Hardship: This type of letter is utilized when the borrower is facing temporary financial hardship due to reasons beyond their control (e.g., unexpected medical expenses, job loss, natural disasters). It explains the situation to the creditor, requests a temporary suspension of monthly payments, and provides relevant supporting documentation if available. 2. Illinois Letter to Creditor due to COVID-19 Impact: Amid the COVID-19 pandemic, many individuals and businesses in Illinois faced financial challenges. This specific letter acknowledges the pandemic's impact on the borrower's ability to make regular payments and requests a temporary postponement until their financial situation stabilizes. 3. Illinois Letter to Creditor for Business Interruption: Business owners who experience unexpected disruptions or interruptions in their operations may need to temporarily postpone payments to meet other essential business obligations. This letter explains the operational limitations or interruptions faced by the business and seeks an agreement with the creditor for a temporary cessation of monthly payments. 4. Illinois Letter to Creditor for Personal Emergency: In case of personal emergencies such as serious illness, injury, or other critical situations, individuals may request a temporary postponement of debt repayment. This letter outlines the nature of the emergency, its impact on the debtor's financial circumstances, and seeks the creditor's understanding and agreement to suspend monthly payments temporarily. Regardless of the specific type, an Illinois letter to a creditor confirming the agreement to temporarily postpone monthly payments should include essential elements such as the borrower's and creditor's details, the agreement's effective dates, the length of the suspension period, and any additional terms or conditions mutually agreed upon. Note: It is advisable to consult a legal professional or financial advisor when drafting such letters to ensure accuracy and adherence to relevant laws and regulations.

Illinois Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

How to fill out Illinois Letter To Creditor Confirming Agreement That Monthly Payments Be Temporarily Postponed?

If you need to total, obtain, or print lawful papers templates, use US Legal Forms, the largest assortment of lawful forms, that can be found on the Internet. Use the site`s simple and handy search to discover the paperwork you want. Numerous templates for enterprise and personal purposes are categorized by types and claims, or search phrases. Use US Legal Forms to discover the Illinois Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed within a number of mouse clicks.

Should you be previously a US Legal Forms consumer, log in in your bank account and click on the Down load switch to have the Illinois Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed. You can also accessibility forms you formerly downloaded inside the My Forms tab of the bank account.

If you are using US Legal Forms initially, refer to the instructions listed below:

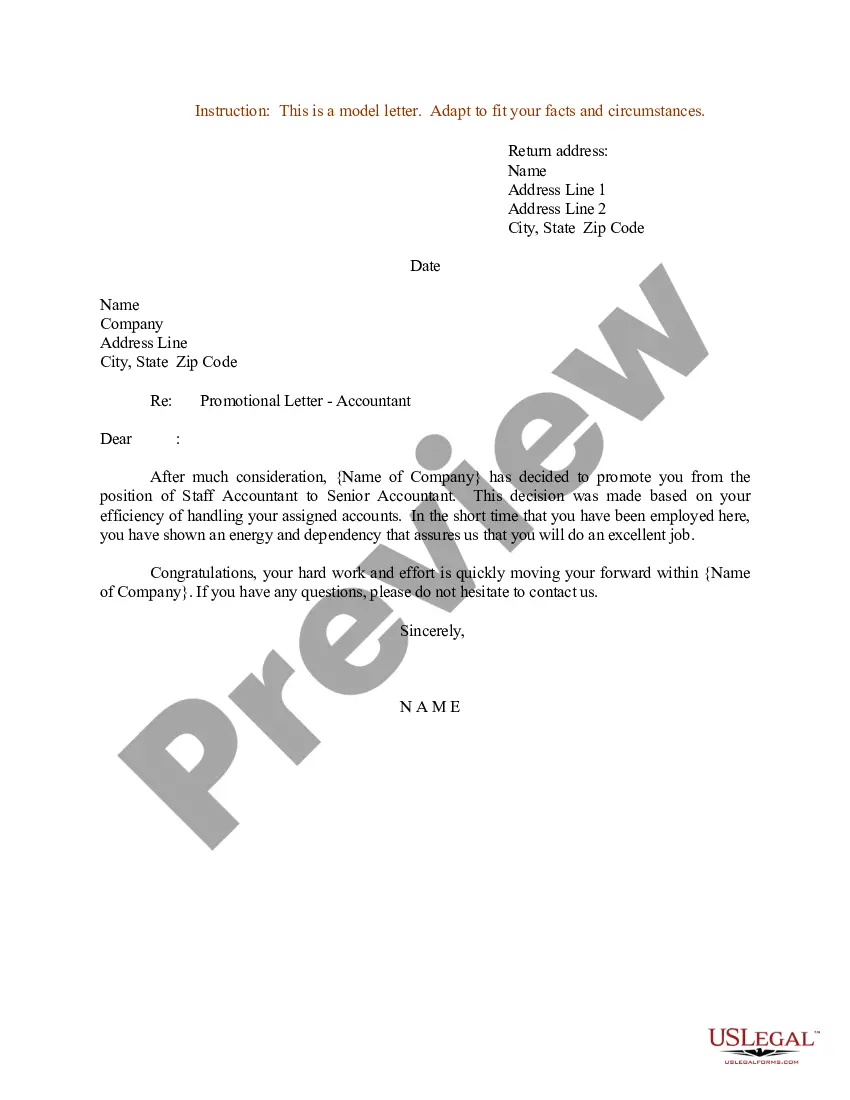

- Step 1. Be sure you have chosen the shape for that correct metropolis/land.

- Step 2. Utilize the Review method to check out the form`s information. Don`t neglect to read the outline.

- Step 3. Should you be unhappy together with the type, make use of the Lookup area at the top of the display to find other variations from the lawful type format.

- Step 4. Upon having found the shape you want, click on the Buy now switch. Choose the prices prepare you prefer and include your qualifications to sign up on an bank account.

- Step 5. Process the financial transaction. You should use your credit card or PayPal bank account to finish the financial transaction.

- Step 6. Pick the file format from the lawful type and obtain it on the product.

- Step 7. Comprehensive, edit and print or signal the Illinois Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed.

Each and every lawful papers format you acquire is your own forever. You have acces to each and every type you downloaded with your acccount. Click the My Forms portion and select a type to print or obtain yet again.

Compete and obtain, and print the Illinois Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed with US Legal Forms. There are millions of specialist and condition-specific forms you can utilize for your personal enterprise or personal needs.