The Illinois Personal Financial Information Organizer is a valuable tool for individuals seeking to organize and manage their personal financial records effectively. This comprehensive organizer helps users gather and track essential financial information, ensuring that everything is in one central and easily accessible location. With the Illinois Personal Financial Information Organizer, individuals can maintain a clear overview of their financial situation. This organizer includes sections for various types of financial information, such as banking details, investment accounts, insurance policies, retirement plans, and debts. By providing specific fields for each category, the organizer helps users provide accurate and complete information. This essential tool not only assists in organizing financial records but also aids in identifying any gaps or areas that may require attention. Users can note any outstanding or upcoming bills, outstanding debts, or important financial deadlines using the provided spaces, ensuring that nothing goes unnoticed. Moreover, the Illinois Personal Financial Information Organizer includes sections for documenting personal information, such as social security numbers, birth certificates, passports, and other identification documents. These sections provide a secure location to store such sensitive details, reducing the risk of misplacing or losing critical information. In addition to personal financial records, this organizer also offers sections for maintaining an inventory of valuable assets, such as real estate, vehicles, jewelry, and other possessions. Users can note the value, purchase date, and any relevant supporting documents to keep a comprehensive and up-to-date inventory. The Illinois Personal Financial Information Organizer is available in different types to cater to various needs. These include digital versions that can be maintained on a computer or mobile device for easy access and updating. There are also printable formats for those who prefer physical copies or want to have a backup in case of technology failures. Overall, the Illinois Personal Financial Information Organizer is a powerful tool that streamlines financial record-keeping, helps users stay organized, and provides peace of mind knowing that all critical financial information is in one secure place. Whether in digital or printable form, this organizer is a valuable resource for anyone seeking effective financial management and organization.

Illinois Personal Financial Information Organizer

Description

How to fill out Illinois Personal Financial Information Organizer?

US Legal Forms - one of several greatest libraries of authorized types in the USA - gives a variety of authorized record themes it is possible to download or printing. Utilizing the website, you will get a large number of types for enterprise and person uses, categorized by classes, suggests, or key phrases.You can find the latest types of types such as the Illinois Personal Financial Information Organizer in seconds.

If you have a monthly subscription, log in and download Illinois Personal Financial Information Organizer from the US Legal Forms catalogue. The Down load option will appear on every type you see. You gain access to all in the past acquired types from the My Forms tab of your respective accounts.

If you would like use US Legal Forms the first time, listed here are simple directions to help you get began:

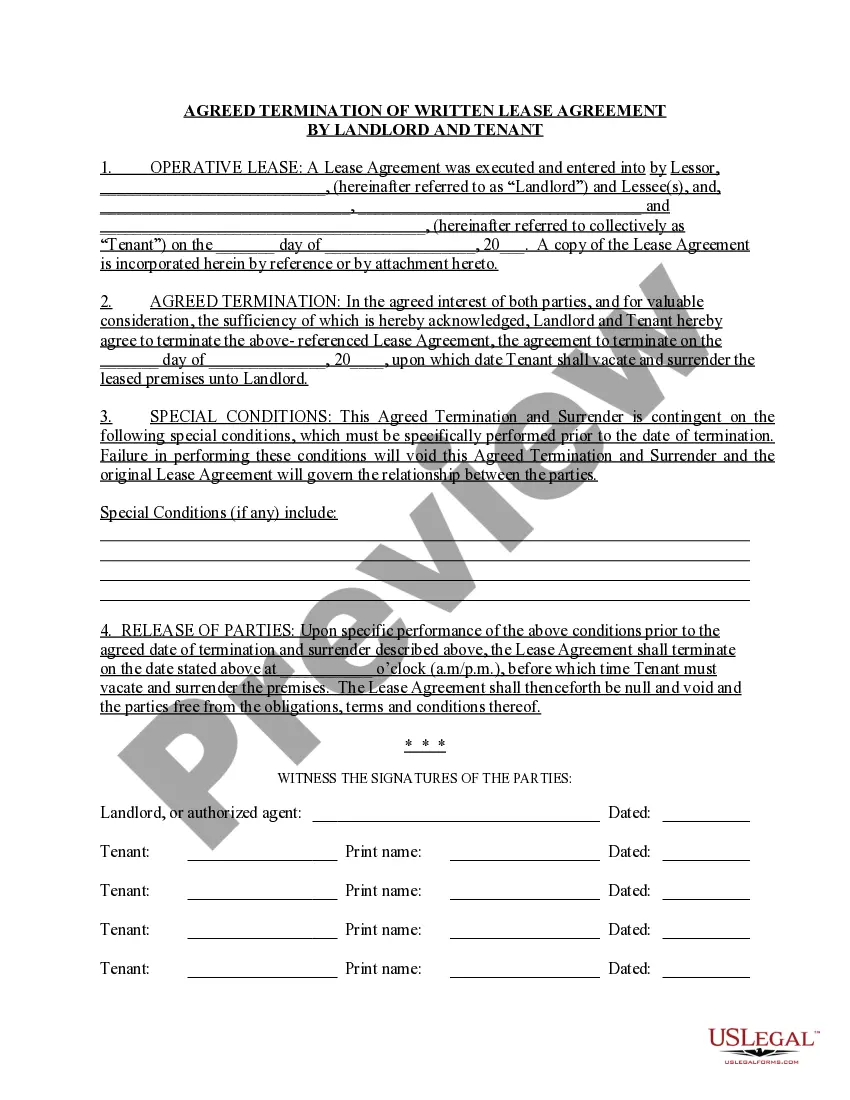

- Ensure you have picked out the correct type to your city/area. Click the Preview option to analyze the form`s content material. See the type information to ensure that you have chosen the appropriate type.

- If the type does not fit your demands, take advantage of the Lookup field near the top of the screen to obtain the one which does.

- When you are content with the form, verify your choice by clicking on the Get now option. Then, opt for the prices plan you prefer and provide your references to register on an accounts.

- Process the financial transaction. Make use of your credit card or PayPal accounts to finish the financial transaction.

- Select the formatting and download the form on your own product.

- Make changes. Complete, edit and printing and indicator the acquired Illinois Personal Financial Information Organizer.

Every single design you included with your account does not have an expiration time and is your own property permanently. So, if you would like download or printing one more duplicate, just go to the My Forms segment and then click in the type you want.

Get access to the Illinois Personal Financial Information Organizer with US Legal Forms, the most comprehensive catalogue of authorized record themes. Use a large number of expert and status-specific themes that meet your small business or person needs and demands.

Form popularity

FAQ

Put hard-to-replace documents in a water-tight container and/or fire-safe box. Place these records in a lockable cabinet. Create a folder for receipts and place in an easy-to-reach spot. At the end of every day, organize your receipts, either by date or type of purchase.

Which financial documents should you keep on file?Organization will help you, your advisors2026 and even, your heirs.One large file cabinet may suffice.Investment statements.Bank statements.Credit card statements.Mortgage documents, mortgage statements, and HELOC statements.More items...?

You could go the traditional route and use a simple set of labeled folders in a file drawer. More important documents should be kept in a fire-resistant file cabinet, safe, or safe-deposit box. If space is tight and you need to reduce clutter, you might consider electronic storage for some of your financial records.

Which financial documents should you keep on file?Organization will help you, your advisors2026 and even, your heirs.One large file cabinet may suffice.Investment statements.Bank statements.Credit card statements.Mortgage documents, mortgage statements, and HELOC statements.More items...?

You really should keep things like titles, deeds, mortgage statements and even insurance policies for as long as you own your property (or the life of the loan).

5 Steps to Organize Your Loved One's Financial RecordsStep 1: Get access. You or the person holding durable power of attorney will need access to computer accounts and financial records.Step 2: Find and sort.Step 3: Store for safekeeping.Step 4: Create a binder.Step 5: Keep track of receipts and money.

Financial DocumentsRetirement savings statements: Keep monthly statements until year-end statement arrives. Keep year-end statement for at least six years. IRA contributions: Store permanently to prove you have paid taxes on this money. Stocks, bonds and security statements: Keep for six years after you sell them.

You could go the traditional route and use a simple set of labeled folders in a file drawer. More important documents should be kept in a fire-resistant file cabinet, safe, or safe-deposit box. If space is tight and you need to reduce clutter, you might consider electronic storage for some of your financial records.