Illinois Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

Description

How to fill out Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

You can invest hrs on the web attempting to find the lawful document template that fits the state and federal needs you want. US Legal Forms provides 1000s of lawful kinds that happen to be examined by professionals. It is simple to down load or print out the Illinois Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan from the support.

If you already have a US Legal Forms profile, it is possible to log in and click the Obtain option. Afterward, it is possible to total, change, print out, or indication the Illinois Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan. Each and every lawful document template you purchase is your own for a long time. To get yet another duplicate associated with a acquired type, visit the My Forms tab and click the related option.

If you use the US Legal Forms site the first time, follow the easy recommendations below:

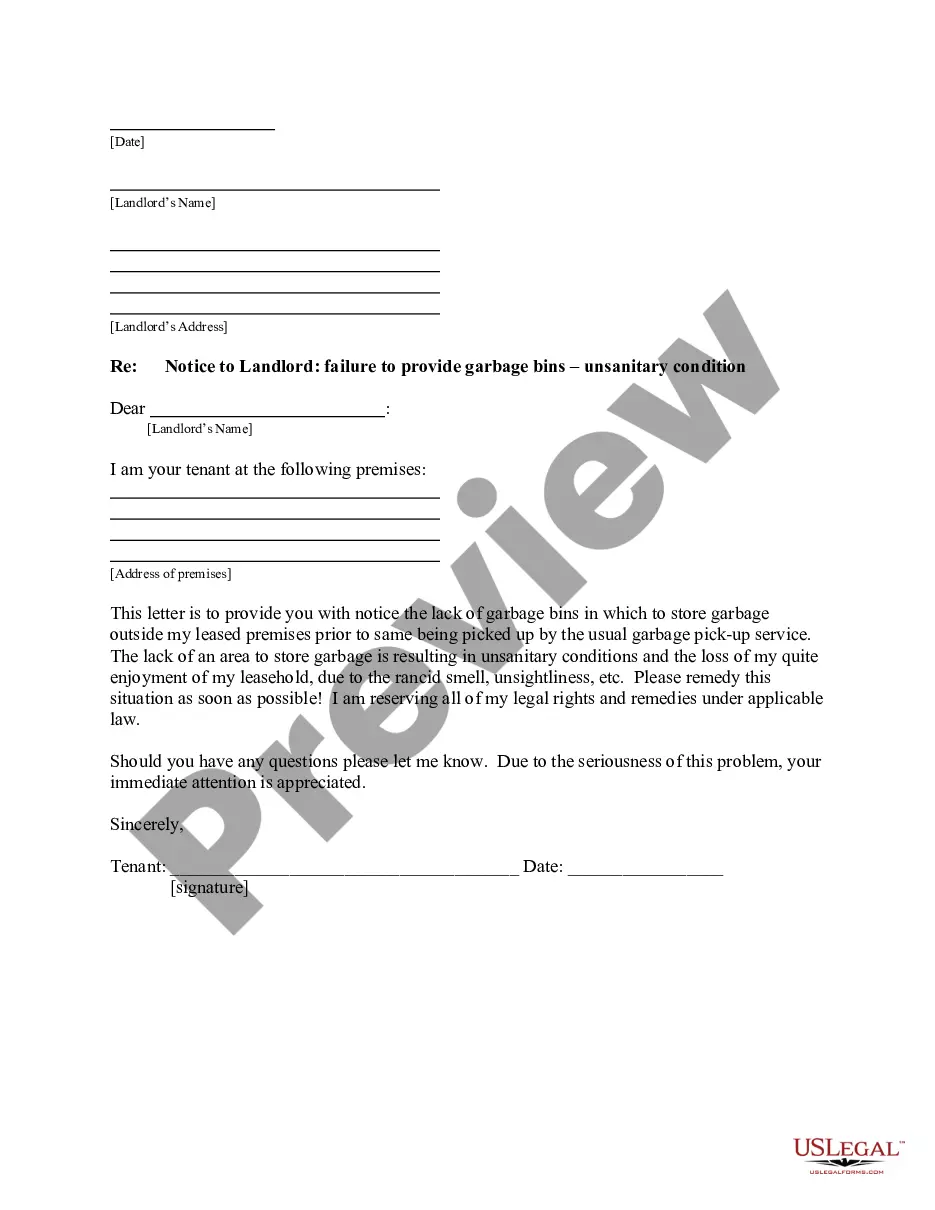

- First, make certain you have selected the best document template for your area/city of your choice. See the type explanation to make sure you have picked the appropriate type. If available, make use of the Review option to appear from the document template as well.

- In order to find yet another model of the type, make use of the Search area to find the template that meets your requirements and needs.

- After you have found the template you need, just click Buy now to continue.

- Pick the prices strategy you need, enter your accreditations, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You may use your Visa or Mastercard or PayPal profile to purchase the lawful type.

- Pick the formatting of the document and down load it to your device.

- Make alterations to your document if needed. You can total, change and indication and print out Illinois Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan.

Obtain and print out 1000s of document web templates utilizing the US Legal Forms web site, that provides the largest collection of lawful kinds. Use professional and condition-particular web templates to handle your small business or individual requirements.

Form popularity

FAQ

(a) A person commits theft when he or she knowingly obtains the temporary use of property, labor or services of another which are available only for hire, by means of threat or deception or knowing that such use is without the consent of the person providing the property, labor or services.

Let's consider an example. Credit transactions involving large ticket items, such as cars, homes or appliances, are usually secured. When I bought my new car, I borrowed money from my bank for my car loan. My loan is a secured transaction.

Security agreement is ?an agreement that creates or provides for a security interest.? It is the contract that sets up the debtor's duties and the creditor's rights in event the debtor defaults. Uniform Commercial Code, Section 9-102(a)(73).

(1) the security interest is a purchase-money security interest; (2) the interest of the encumbrancer or owner arises before the goods become fixtures; and. (3) the security interest is perfected by a fixture filing before the goods become fixtures or within 20 days thereafter.

Security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Secured party is a lender, seller, or other person in whose favor a security interest exists.

Interests in personal property (any property other than land) include motor vehicles, boats, inventories and accounts.

Security Interest: An interest in personal property or fixtures -- i.e., improvements to real property -- which secures payment or performance of an obligation.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...