Illinois Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder

Description

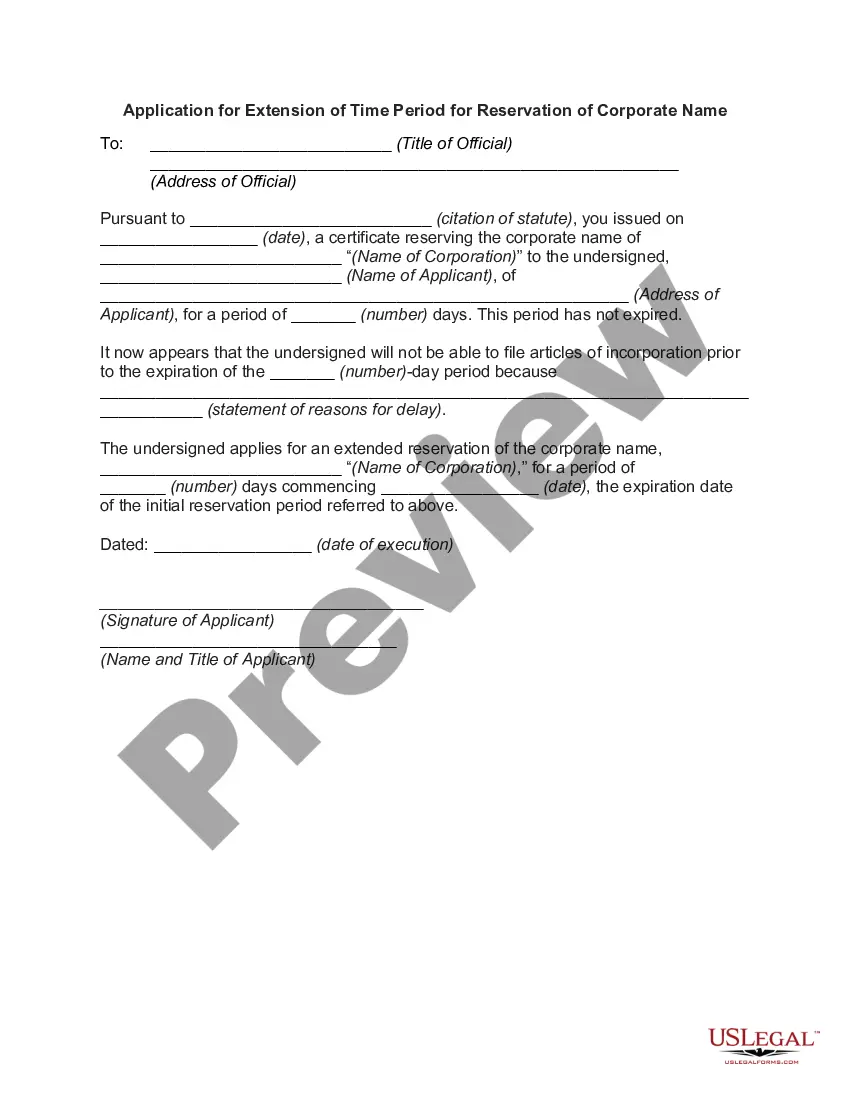

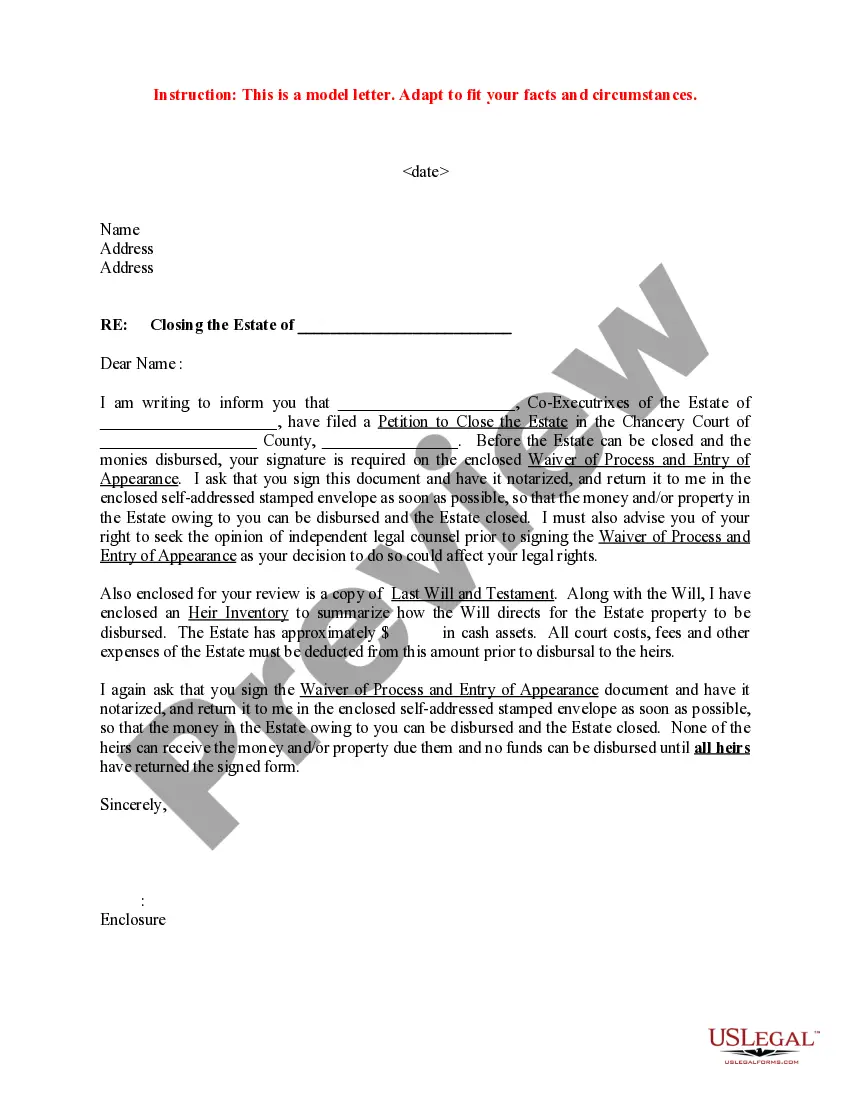

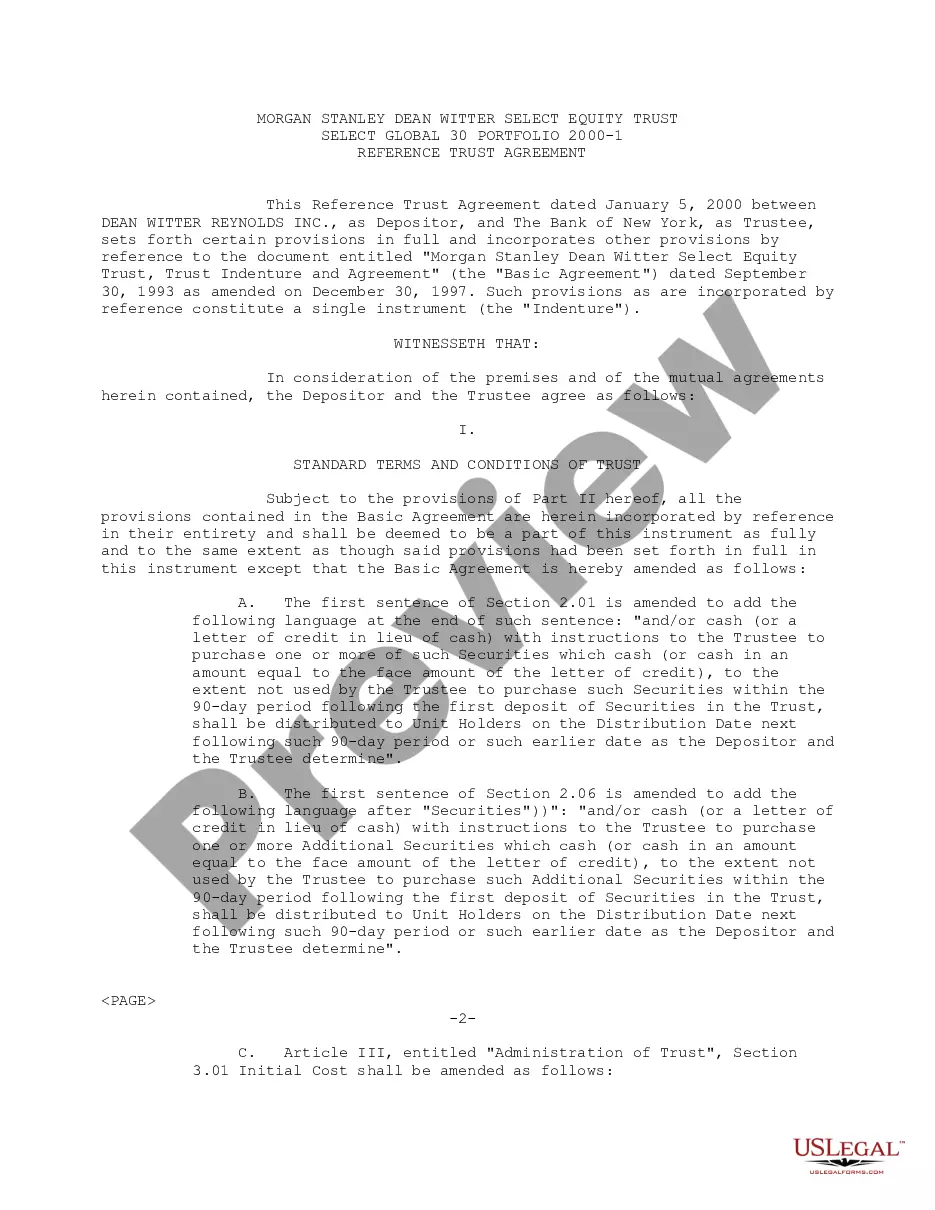

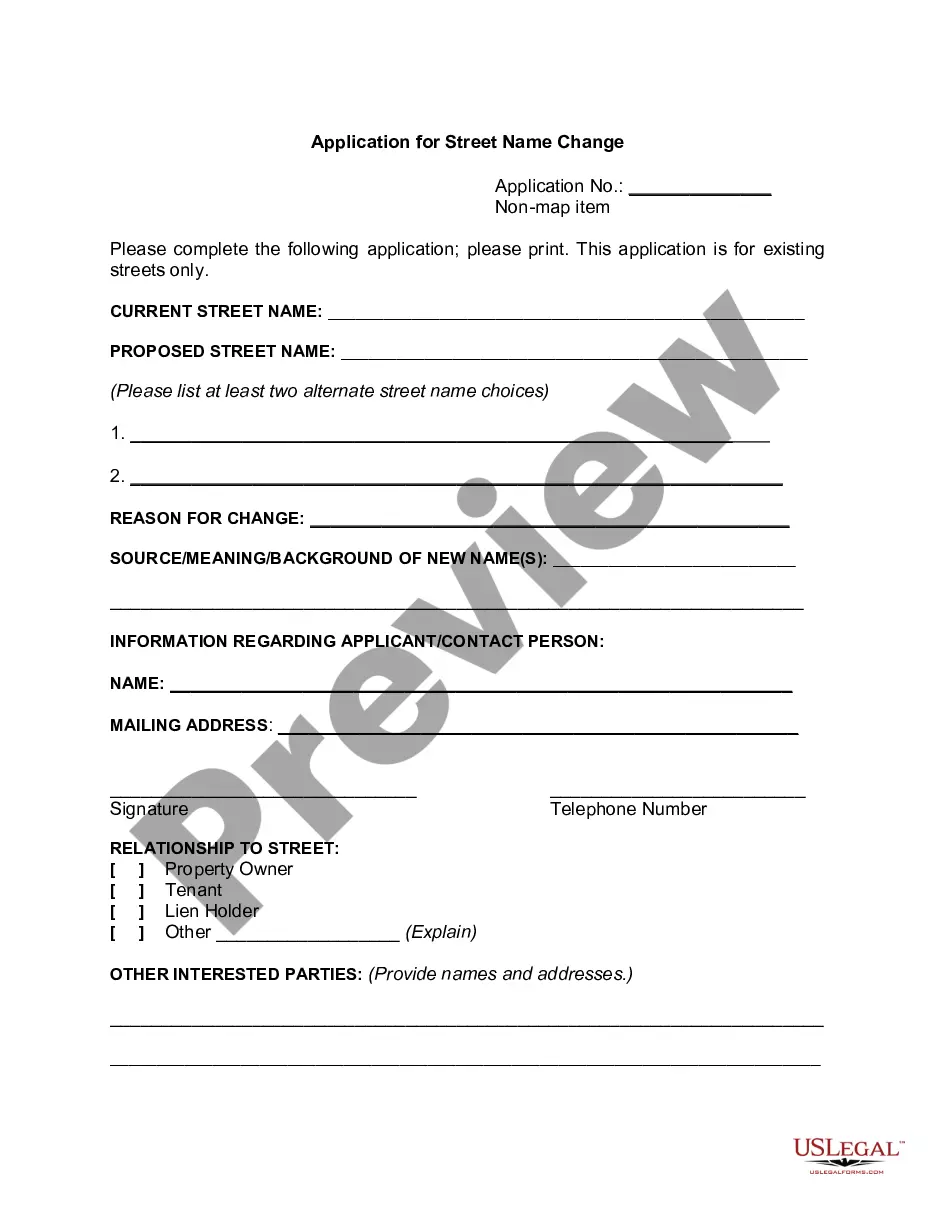

How to fill out Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder?

If you need to complete, down load, or print out lawful file themes, use US Legal Forms, the largest selection of lawful types, that can be found online. Use the site`s simple and easy practical search to obtain the paperwork you require. Different themes for company and personal purposes are sorted by types and says, or keywords. Use US Legal Forms to obtain the Illinois Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder within a few click throughs.

In case you are previously a US Legal Forms client, log in for your account and click on the Acquire key to have the Illinois Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder. You may also access types you in the past downloaded within the My Forms tab of your respective account.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Ensure you have selected the form for your proper metropolis/land.

- Step 2. Make use of the Review choice to look through the form`s articles. Don`t forget to see the explanation.

- Step 3. In case you are unsatisfied together with the type, make use of the Search area at the top of the monitor to discover other models from the lawful type design.

- Step 4. When you have found the form you require, click the Buy now key. Pick the pricing strategy you like and include your references to register for an account.

- Step 5. Approach the deal. You can use your bank card or PayPal account to accomplish the deal.

- Step 6. Select the format from the lawful type and down load it in your gadget.

- Step 7. Comprehensive, modify and print out or signal the Illinois Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder.

Every single lawful file design you buy is yours eternally. You possess acces to each type you downloaded within your acccount. Select the My Forms segment and select a type to print out or down load again.

Be competitive and down load, and print out the Illinois Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder with US Legal Forms. There are millions of professional and status-particular types you may use to your company or personal requires.

Form popularity

FAQ

Illinois Pattern Jury Instruction (I.P.I.) 30.04. 02 defines loss of a normal life, as ?When I use the expression ?loss of a normal life,? I mean the temporary or permanent diminished ability to enjoy life. This includes a person's inability to pursue the pleasurable aspects of life.?

Nature, Extent, and Duration of Injury Rather, any award for one of the various elements of damages (such as disability, pain and suffering, lost wages, etc.) must involve, and be based upon, an assessment of the nature, extent, and duration of the claimant's injuries. Powers v. Illinois C. G. R.

This term specifically relates to personal injury cases, when a defendant's negligence or reckless behavior causes the victim's family to lose a connection with the victim. Loss of consortium cases happen when a partner or family lose the joys of companionship, affection, love, comfort, or sexual intimacy.

30.04.02 Loss of a Normal Life--Definition This includes a person's inability to pursue the pleasurable aspects of life.

Undue Influence Influence is ?undue? when it ?prevents the testator from exercising his own will in the disposition of his estate? such that the testator's will is rendered more the will of another. Id., 69 Ill. Dec. at 963.