Title: Understanding the Illinois Agreement with Independent Contractor for Business Planning, Organization, and Management Consulting Services Keywords: Illinois agreement, independent contractor, consulting services, business planning, organization, management Introduction: In the state of Illinois, businesses often rely on the expertise of independent contractors to provide consulting services for various aspects of their operations. This article will provide a detailed description of the Illinois Agreement with Independent Contractor to Provide Consulting Services for Business Planning, Organization, and Management. We will explore the key elements and objectives of this agreement, outlining its relevance to businesses in Illinois seeking professional assistance in their planning, organization, and management efforts. Types of Illinois Agreements with Independent Contractors for Consulting Services: 1. Agreement for Business Planning Consulting Services: This type of agreement focuses on engaging an independent contractor to provide specialized advice and guidance to businesses regarding their strategic business planning. The contractor assists in developing comprehensive plans to achieve specific goals, analyzing market trends, assessing competition, and identifying opportunities for growth and expansion. 2. Agreement for Organization Consulting Services: In this type of agreement, independent contractors offer their expertise in streamlining and enhancing the organizational structure of a business. They assess the existing systems and processes, provide recommendations for improving efficiency, enhancing communication channels, and creating an optimal workflow. The contractor plays a vital role in helping businesses adapt to changing market dynamics and increase their overall productivity. 3. Agreement for Management Consulting Services: This category of agreement focuses on engaging independent contractors to provide expert guidance on managerial aspects. The contractor assists businesses in creating effective management strategies, improving operational efficiency, implementing performance evaluation systems, and optimizing resource allocation. They work closely with the business owners and managers to enhance decision-making processes and foster leadership development. Key Elements of the Agreement: 1. Scope of Services: This section defines the specific services the independent contractor will offer to the business. It includes a detailed description of the tasks, responsibilities, and deliverables expected from the contractor within the agreed-upon timeframe. 2. Compensation: This section outlines the compensation structure, including the payment terms, frequency, and the total amount to be paid to the independent contractor for their services. It may include provisions for reimbursements, bonuses, and incentives based on performance or achieved milestones. 3. Duration and Termination: This section specifies the duration of the agreement and outlines the terms and conditions for termination by either party. It may include clauses related to notice periods, termination fees, and procedures for early termination. 4. Confidentiality and Non-Disclosure: To protect sensitive business information, this section enforces confidentiality obligations on the independent contractor, ensuring they do not disclose any confidential data, trade secrets, or intellectual property shared during the engagement. Conclusion: The Illinois Agreement with Independent Contractor to Provide Consulting Services for Business Planning, Organization, and Management offers businesses in the state access to professional expertise and guidance in critical areas of their operations. By engaging independent contractors specializing in business planning, organization, and management, businesses can enhance their overall efficiency, productivity, and competitiveness in the market.

Illinois Agreement with Independent Contractor to Provide Consulting Services for Business Planning, Organization and Management

Description

How to fill out Illinois Agreement With Independent Contractor To Provide Consulting Services For Business Planning, Organization And Management?

Discovering the right lawful papers template can be quite a battle. Naturally, there are a variety of layouts accessible on the Internet, but how would you obtain the lawful kind you need? Use the US Legal Forms internet site. The support gives a large number of layouts, including the Illinois Agreement with Independent Contractor to Provide Consulting Services for Business Planning, Organization and Management, that you can use for organization and personal demands. Each of the kinds are checked out by pros and meet federal and state demands.

If you are currently listed, log in to the bank account and click the Obtain option to have the Illinois Agreement with Independent Contractor to Provide Consulting Services for Business Planning, Organization and Management. Use your bank account to search through the lawful kinds you might have bought in the past. Proceed to the My Forms tab of your bank account and have an additional version from the papers you need.

If you are a new consumer of US Legal Forms, listed below are simple recommendations that you can comply with:

- Very first, make certain you have selected the proper kind for your personal metropolis/state. You are able to look through the shape utilizing the Preview option and browse the shape information to make certain it will be the best for you.

- In the event the kind will not meet your requirements, make use of the Seach discipline to obtain the correct kind.

- When you are certain that the shape is proper, click on the Acquire now option to have the kind.

- Choose the pricing strategy you desire and enter in the required information and facts. Create your bank account and buy your order making use of your PayPal bank account or bank card.

- Select the data file formatting and obtain the lawful papers template to the system.

- Full, revise and produce and indication the attained Illinois Agreement with Independent Contractor to Provide Consulting Services for Business Planning, Organization and Management.

US Legal Forms is the largest local library of lawful kinds in which you will find various papers layouts. Use the company to obtain skillfully-created documents that comply with condition demands.

Form popularity

FAQ

Consultants are typically self-employed. If you are transitioning from an employed position, keep in mind that you will be working with a new tax form, IRS Form 1099-MISC. This form will be provided to you at the end of the year by those clients who are paying you for your services.

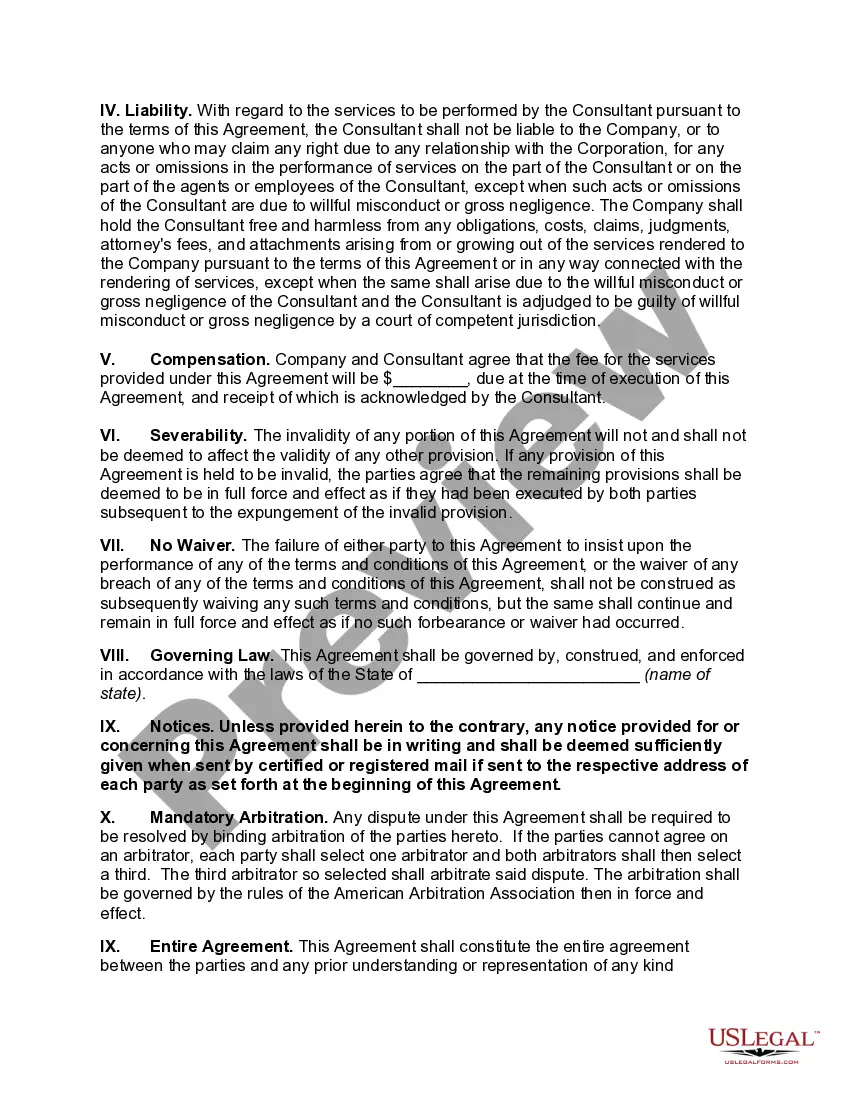

The consulting agreement is an agreement between a consultant and a client who wishes to retain certain specified services of the consultant for a specified time at a specified rate of compensation.

While your clients do not take taxes out of your pay, they do report your 1099 earnings to the IRS. Your clients are required to send you a 1099 when you earn $600 or more in a year.

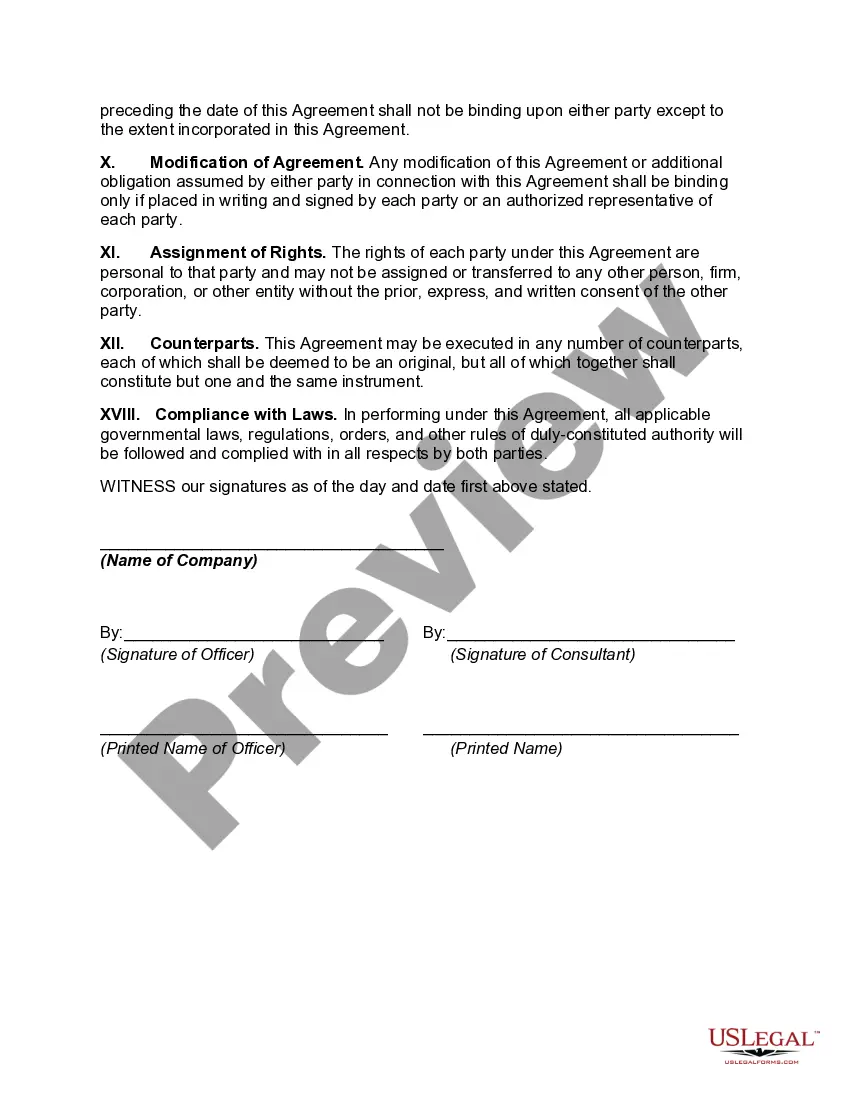

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

What should you include in a consulting contract?Receitals and Background. The recital clause is the opening section of the consulting agreement.Scope of Services.Ownership of Intellectual Property.Compensation, Expenses, and Schedules.Dispute Resolution.Termination of Services.Methods of Communication.Confidentiality.More items...?

A contract for services between an independent contractor (a self-employed individual) and the client company for the provision of consultancy services.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

A Consulting Agreement, also known as a service agreement or independent contractor agreement, is what a consultant and client use to describe the terms of a professional relationship.