Illinois Net Lease of Equipment (Personal Property Net Lease) with No Warranties by Lessor and Option to Purchase: The Illinois Net Lease of Equipment with no warranties by Lessor and Option to Purchase is a legal agreement that defines the terms and conditions for leasing personal property in the state of Illinois. This particular type of lease provides lessees with the option to purchase the equipment at the end of the lease term. Under this net lease arrangement, the lessor (the owner of the equipment) is not responsible for providing any warranties or guarantees related to the leased equipment. This means that the lessee assumes all risks and liabilities associated with the equipment's performance, maintenance, and repair during the lease period. Keywords: Illinois Net Lease, Equipment Lease, Personal Property Net Lease, Option to Purchase, No Warranties, Lessor, Lessee, Lease Agreement, Equipment Performance, Maintenance, Repair, Legal Agreement. Different types of Illinois Net Lease of Equipment (Personal Property Net Lease) with No Warranties by Lessor and Option to Purchase include: 1. Fixed-Term Net Lease with Option to Purchase: This type of lease agreement specifies a predetermined lease duration, typically ranging from one to five years, during which the lessee has the option to purchase the equipment at the end of the term. 2. Month-to-Month Net Lease with Option to Purchase: In this lease arrangement, the lessee has the flexibility of leasing the equipment on a month-to-month basis, with the option to purchase at any time during the lease period, subject to the terms agreed upon in the contract. 3. Closed-End Net Lease with Option to Purchase: A closed-end net lease is a fixed-term agreement where the lessee has the option to purchase the equipment at the end of the lease term for a predetermined price. This type of lease provides certainty regarding the purchase price, making it suitable for lessees who plan to exercise the option to buy. 4. Open-End Net Lease with Option to Purchase: Unlike the closed-end net lease, an open-end net lease does not specify a predetermined purchase price. Instead, the lessee has the option to purchase the equipment at fair market value upon lease termination. This type of lease gives lessees the opportunity to negotiate a purchase price based on the equipment's market value at the end of the lease term. In any of these Illinois Net Lease of Equipment types with no warranties by Lessor and Option to Purchase, it is vital for both parties to clearly define their rights, responsibilities, payment terms, and conditions to ensure a smooth leasing process and protect their respective interests in the equipment.

Illinois Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase

Description

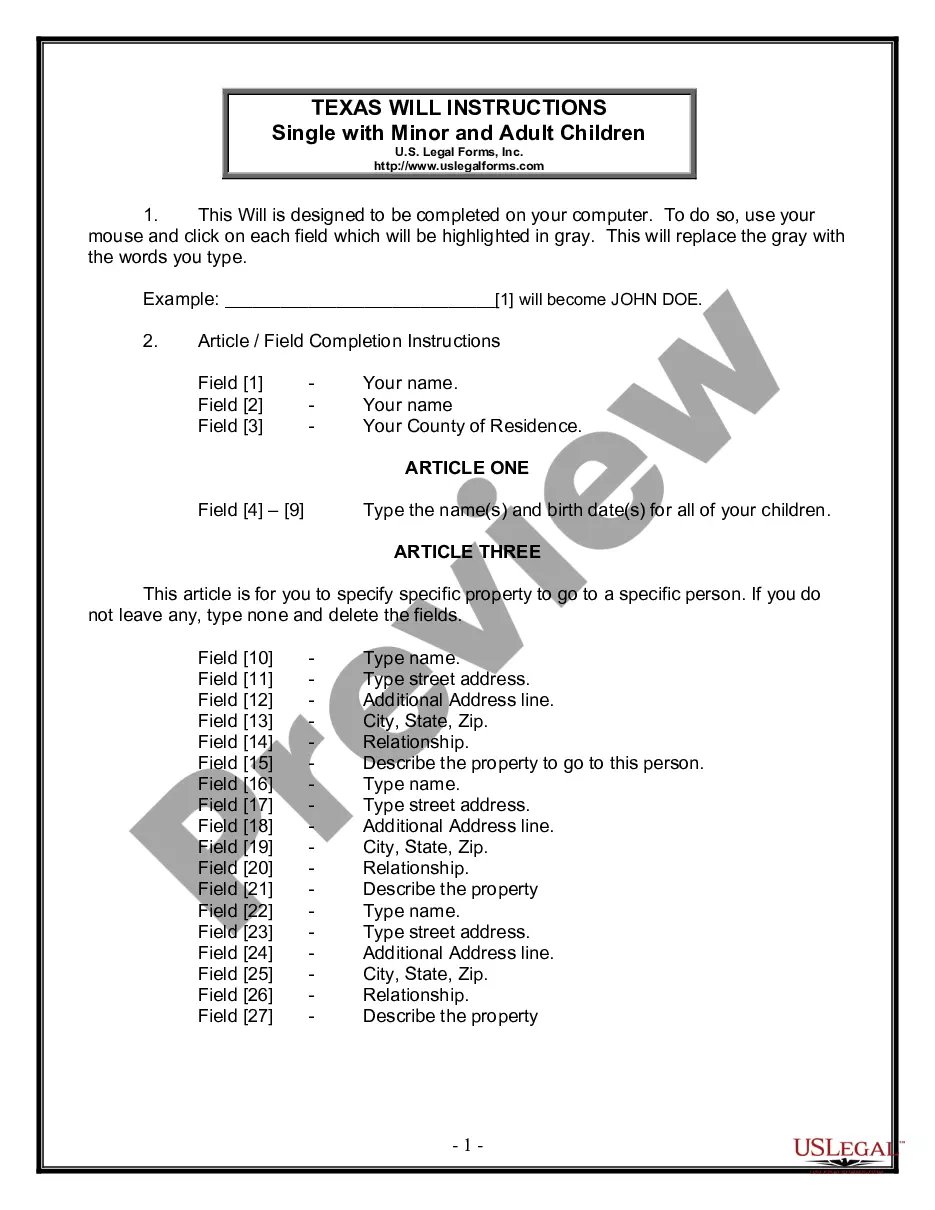

How to fill out Illinois Net Lease Of Equipment (personal Propety Net Lease) With No Warranties By Lessor And Option To Purchase?

If you want to comprehensive, obtain, or printing lawful record layouts, use US Legal Forms, the largest assortment of lawful forms, that can be found on-line. Make use of the site`s easy and practical lookup to find the documents you want. Different layouts for organization and specific reasons are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to find the Illinois Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase in a handful of click throughs.

Should you be already a US Legal Forms client, log in in your accounts and click the Down load button to obtain the Illinois Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase. You can even entry forms you in the past delivered electronically in the My Forms tab of your own accounts.

Should you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for your right metropolis/country.

- Step 2. Use the Preview choice to check out the form`s articles. Never overlook to learn the outline.

- Step 3. Should you be unsatisfied together with the develop, make use of the Lookup field on top of the screen to find other versions in the lawful develop design.

- Step 4. Upon having found the shape you want, click on the Get now button. Select the costs program you choose and add your accreditations to sign up on an accounts.

- Step 5. Process the purchase. You may use your credit card or PayPal accounts to finish the purchase.

- Step 6. Select the formatting in the lawful develop and obtain it on the device.

- Step 7. Complete, modify and printing or indication the Illinois Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase.

Every single lawful record design you acquire is yours eternally. You might have acces to each develop you delivered electronically with your acccount. Go through the My Forms section and select a develop to printing or obtain once more.

Contend and obtain, and printing the Illinois Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase with US Legal Forms. There are millions of skilled and express-certain forms you can utilize to your organization or specific needs.

Form popularity

FAQ

There are three main types of net leases: single net leases, double net leases, and triple net leases. When a tenant signs a single net lease, they pay one of the three expense categories: taxes, maintenance, and insurance fees.

For tax purposes, in a true lease, the lessor is the end user and must pay use tax on its cost price of the tangible personal property. Lessees do not have a tax liability under a true lease. A conditional sales agreement usually has a nominal or "one dollar" purchase option at the close of the lease term.

Net leases generally include property taxes, property insurance premiums, or maintenance costs, and are often used in commercial real estate. In addition to triple net leases, the other types of net leases are single net leases and double net leases.

Most financial leases are "net" leases, meaning that the lessee is responsible for maintaining and insuring the asset and paying all property taxes, if applicable. Financial leases are often used by businesses for expensive capital equipment.

No. Despite Illinois' imposition of use tax on the lessor, and that lessees are not subject to tax on the lease receipts, a lessor can recoup its tax costs through private reimbursement with its lessee.

The term net lease refers to a contractual agreement where a lessee pays a portion or all of the taxes, insurance fees, and maintenance costs for a property in addition to rent. Net leases are commonly used in commercial real estate.

If your business leases equipment under a typical lease, you generally are entitled to currently deduct your rental payments as long as you are using the leased property in your business.

The term "net lease" is distinguished from the term "gross lease". In a net lease, the property owner receives the rent "net" after the expenses that are to be passed through to tenants are paid.

Gross leases are commonly used for commercial properties, such as office buildings and retail spaces. Modified leases and fully service leases are the two types of gross leases. Gross leases are different from net leases, which require the tenant to pay one or more of the costs associated with the property.

The three most common types of leases are gross leases, net leases, and modified gross leases....3 Types of Leases Business Owners Should UnderstandThe Gross Lease. The gross lease tends to favor the tenant.The Net Lease. The net lease, however, tends to favor the landlord.The Modified Gross Lease.