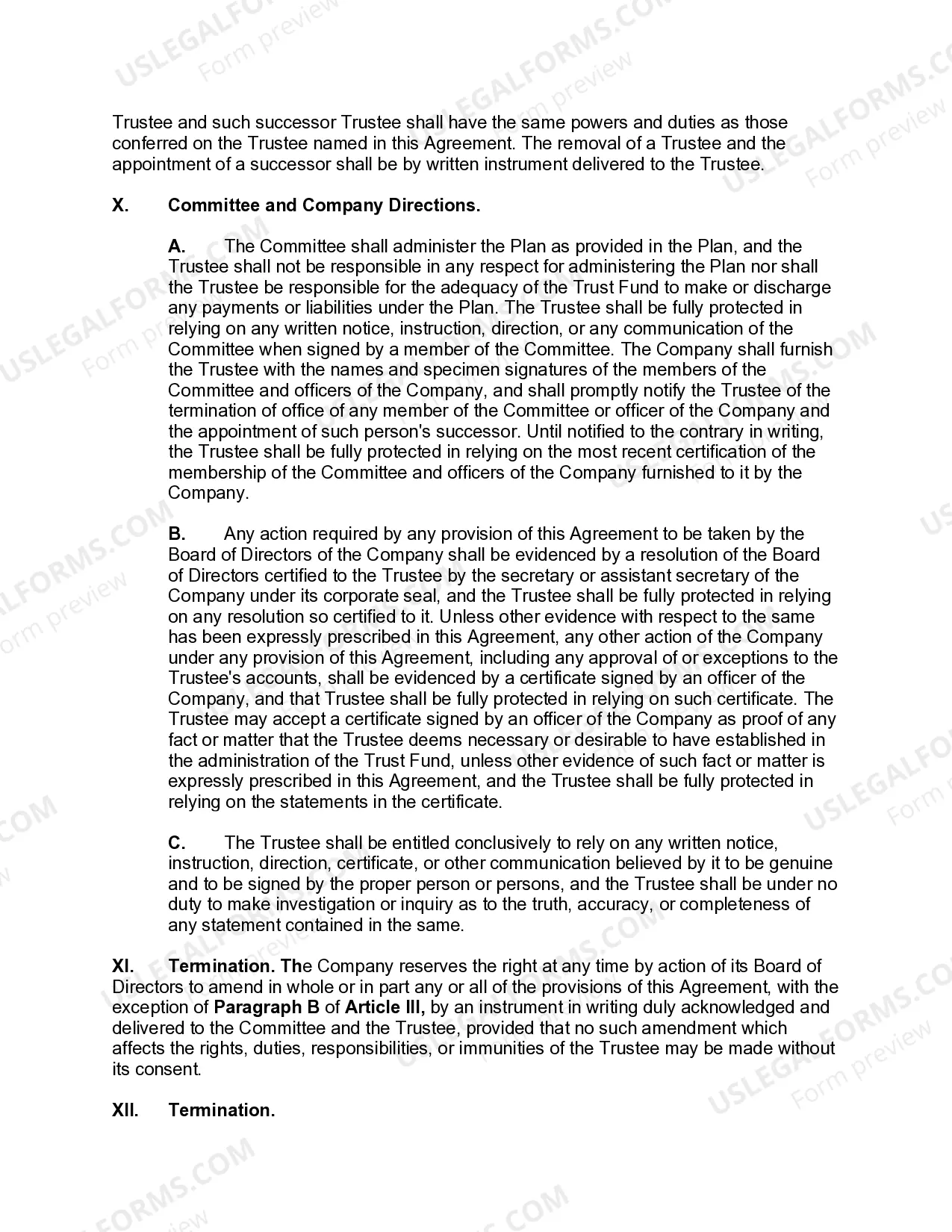

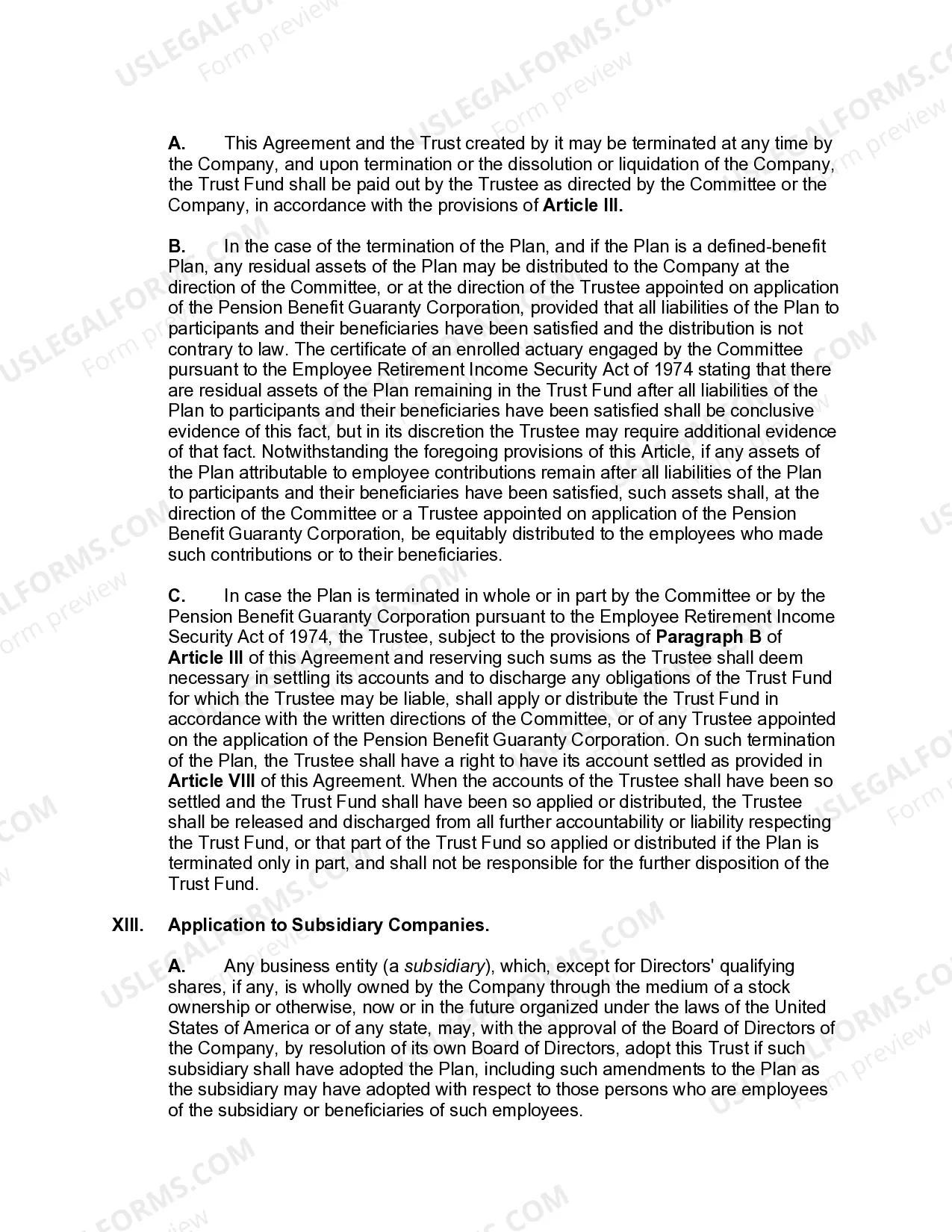

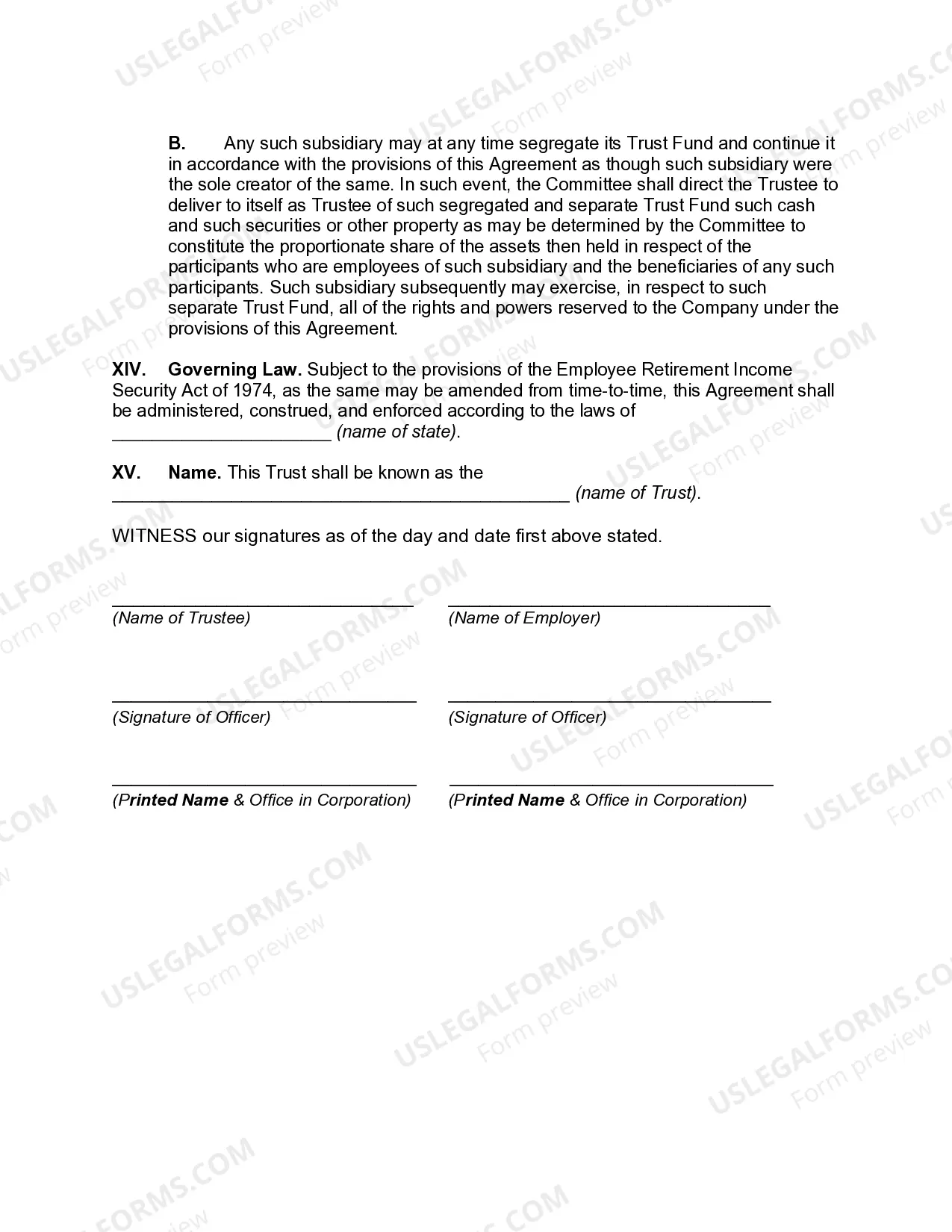

Illinois Trust Agreement for Pension Plan with Corporate Trustee

Description

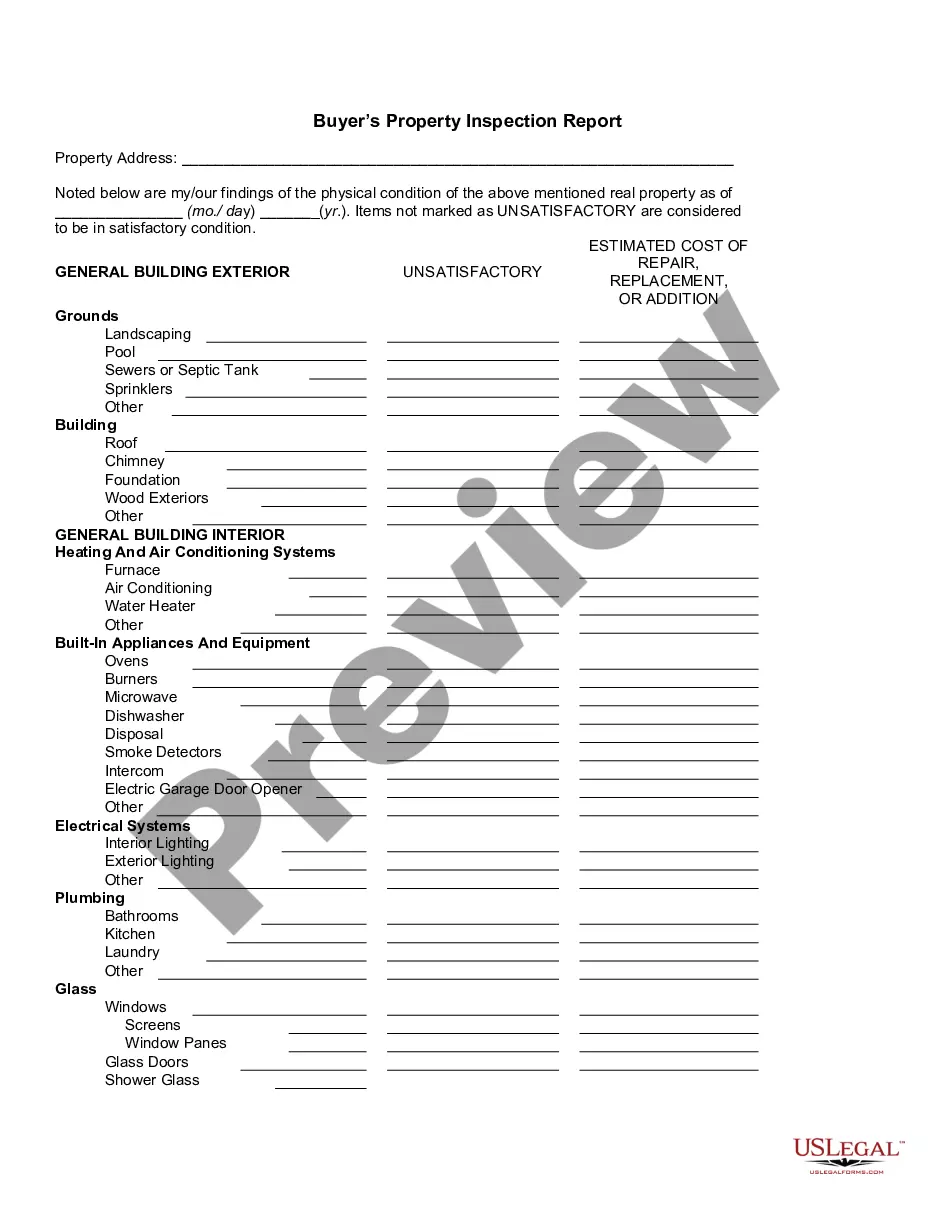

How to fill out Trust Agreement For Pension Plan With Corporate Trustee?

Are you currently in a place where you need to have files for sometimes company or person functions nearly every day? There are plenty of lawful document web templates available on the net, but discovering ones you can trust is not simple. US Legal Forms offers a large number of develop web templates, such as the Illinois Trust Agreement for Pension Plan with Corporate Trustee, which are published to meet federal and state requirements.

When you are already informed about US Legal Forms website and possess an account, basically log in. Afterward, it is possible to down load the Illinois Trust Agreement for Pension Plan with Corporate Trustee format.

Should you not come with an bank account and wish to begin using US Legal Forms, abide by these steps:

- Get the develop you need and ensure it is for your appropriate town/region.

- Use the Preview switch to check the shape.

- Look at the explanation to actually have chosen the right develop.

- In case the develop is not what you are searching for, make use of the Search discipline to get the develop that suits you and requirements.

- Whenever you obtain the appropriate develop, simply click Purchase now.

- Select the pricing plan you need, fill in the required information and facts to generate your bank account, and pay money for the order making use of your PayPal or charge card.

- Select a convenient data file format and down load your copy.

Discover each of the document web templates you might have purchased in the My Forms menu. You can aquire a extra copy of Illinois Trust Agreement for Pension Plan with Corporate Trustee any time, if possible. Just click on the essential develop to down load or print out the document format.

Use US Legal Forms, the most considerable assortment of lawful kinds, to save lots of some time and steer clear of mistakes. The service offers appropriately created lawful document web templates which can be used for a selection of functions. Generate an account on US Legal Forms and commence generating your way of life easier.

Form popularity

FAQ

The trustee's role is to administer and distribute the assets in the trust according to your wishes, as expressed in the trust document. Trustees have the fiduciary duty, legal authority, and responsibility to manage your assets held in trust and handle day-to-day financial matters on your behalf.

There are two main types of trustees: individuals or institutions. You could choose a relative or friend, a trusted advisor such as a lawyer, or a bank/trust company as the trustee of your trust.

There are generally three parties to a trust; the grantor, trustee, and beneficiaries. The Grantor or Settlor is the person that creates the trust. This person will discuss with their attorney their wishes for the trust and the terms that will be drafted into the trust. This is the person that executes the trust.

Illinois has adopted its version of the Uniform Trust Code, effective January 1, 2020.

In a trust, the necessary parties include the beneficiaries and any other individuals who would be affected by the modification, termination, etc of the trust. As mentioned above, the fiduciary and/or trustee that manages the trust is also considered a necessary and indispensable party.

Can a co-trustee act alone? The answer to this is No unless the Trust document states otherwise.

What Is a 401(k) Trustee? The trustee (or trustees) of a plan is the individual that has the primary fiduciary responsibility to ensure the plan assets are being managed in the best interest of the participants and in line with the plan document. The trustee can be held personally liable for the misuse of plan asset.

A trustee is the person or entity entrusted to make investment decisions in the best interests of plan participants. A trustee is assigned by another fiduciary, such as the employer who sponsors the qualified retirement plan, and should be named in the plan documents. Additional restrictions apply for a trustee.

There will always be three parties involved in a trust arrangement, the settlor, the trustee(s) and the beneficiaries.1 The settlor. This is the person who creates the trust.2 The trustees.3 Beneficiaries.

Trustee to execute trust. 12. Trustee to inform himself of state of trust-property.