Illinois Checking Log

Description

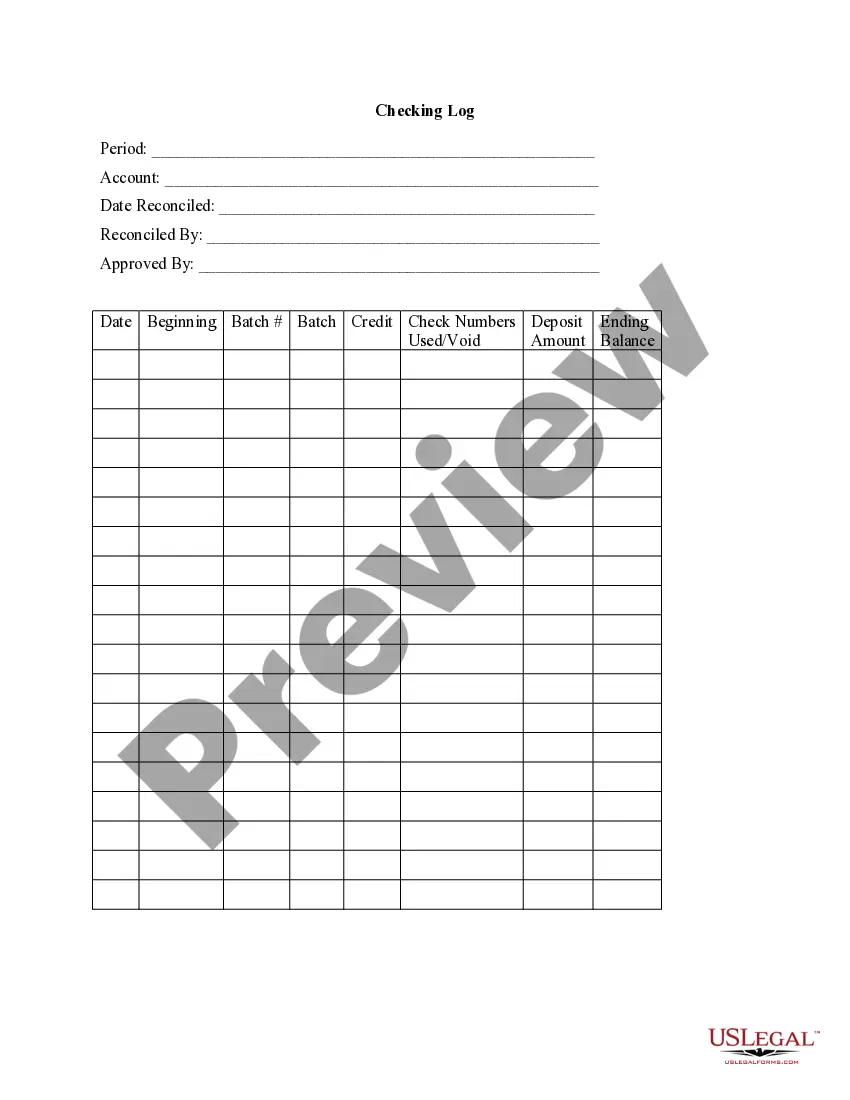

How to fill out Checking Log?

Locating the appropriate sanctioned document template can be a challenge. Naturally, there are numerous designs available online, but how do you access the sanctioned form you need? Utilize the US Legal Forms platform. The service provides a vast collection of designs, including the Illinois Checking Log, which can be employed for both business and personal purposes. All forms are evaluated by experts and comply with state and federal regulations.

If you are already authorized, Log In to your account and click the Download button to retrieve the Illinois Checking Log. Use your account to search through the authenticated forms you may have acquired previously. Navigate to the My documents section of your account to obtain an additional copy of the document you require.

If you are a new user of US Legal Forms, here are simple guidelines you should follow: First, ensure you have selected the correct form for your city/area. You can view the form using the Preview button and review the form details to verify it is suitable for your needs. If the form does not satisfy your requirements, utilize the Search field to find the appropriate form. Once you are confident that the form is correct, click the Purchase now button to acquire the form. Choose the payment plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the authorized document template to your device. Finally, complete, modify, print, and sign the acquired Illinois Checking Log.

US Legal Forms is the ultimate repository of sanctioned forms, offering various document templates. Leverage the service to obtain professionally crafted documents that adhere to state standards.

- Find the right template.

- Access multiple layouts online.

- Use US Legal Forms for your needs.

- Log in to retrieve forms.

- Search for appropriate forms if needed.

- Complete your purchase securely.

Form popularity

FAQ

Filing statuses in Illinois mirror the federal classifications: single, married filing jointly, married filing separately, and head of household. Each status influences your tax obligations and available deductions. If you're unsure which status to choose, the Illinois Checking Log offers resources to assist you in making an informed decision.

Use MyTax Illinois to electronically file your original Individual Income Tax Return. It's easy, free, and you will get your refund faster.

Individuals can file their IL-1040, Individual Income Tax Return, after creating a MyTax Illinois account, and pay their tax without creating a MyTax Illinois account.

MyTax Illinois is a free online account management program that offers a centralized location, provided by the Illinois Department of Revenue, for businesses to register for taxes, file returns, make payments, and manage their tax accounts.

Make your check payable to the Illinois Department of Revenue. Write your Social Security number, your spouse's Social Security number if filing jointly, and the tax year in the lower left-hand corner of your payment. Note: You may electronically pay your taxes no matter how you file.

How do I register with the Illinois Department of Revenue?Register electronically using MyTax Illinois.Complete and mail Form REG-1, Illinois Business Registration Application.Visit a regional office.

MyTax is a government run service offered by the ATO that can be accessed through a myGov account. First of all, you will need to register for a myGov account, if you don't already have one. Then you go ahead and do your tax return yourself via the portal, without any direct support.

Setting up access to your MyTax Illinois account is easy!Go to MyTax Illinois. Individuals will need to obtain a Letter ID.Click on the "Sign up" link.Enter all required fields. The information required during the MyTax Illinois activation varies based on the tax types for which you sign up.

MyTax Illinois was developed, with your security in mind, to file your tax returns, make payments, and view your account information in a safe and secure manner.