Illinois Liquidation of Partnership with Sale and Proportional Distribution of Assets is a legal process that occurs when a partnership decides to dissolve its operations and distribute its assets among partners. It involves selling the partnership's assets and using the proceeds to settle any outstanding debts and obligations before distributing the remaining funds proportionally among the partners according to their ownership interests. There are several types of Illinois Liquidation of Partnership with Sale and Proportional Distribution of Assets, including: 1. Voluntary Liquidation: This occurs when partners decide by mutual consent to dissolve the partnership and distribute its assets. It may happen due to various reasons, such as retirement, disagreements, or a change in business strategy. 2. Involuntary Liquidation: This type of liquidation is forced upon the partnership by external factors. It may be initiated by creditors, government entities, or a court order due to bankruptcy, non-compliance with legal requirements, or financial difficulties. 3. Dissolution through Court Order: In some cases, partners may seek court intervention to dissolve a partnership when disputes arise, or there is a deadlock in decision-making. The court can order the liquidation of assets to settle outstanding debts and distribute the proceeds among partners. The process of Illinois Liquidation of Partnership with Sale and Proportional Distribution of Assets typically follows these steps: 1. Partnership Agreement Review: Partners review the terms and conditions of the partnership agreement to ensure compliance with the dissolution process outlined. The agreement may have specific provisions relating to liquidation and distribution of assets. 2. Asset Valuation: An independent valuation of all partnership assets is conducted to determine their fair market value. This process ensures a fair and equitable distribution of assets among partners. 3. Debt Settlement: The partnership's outstanding debts, loans, and obligations are settled before any distribution of assets takes place. Creditors are paid using the sale proceeds of assets, and any remaining funds are used for partner distribution. 4. Asset Sale: The partnership's assets, including real estate, equipment, inventory, and goodwill, are liquidated through a sale. The sale can be done via public auction, private sale, or negotiation with potential buyers. 5. Proportional Distribution of Assets: Once all debts are settled, the remaining funds from the asset sale are distributed proportionally among the partners based on their ownership interests. The partnership agreement typically dictates the distribution percentages for each partner. 6. Dissolution and Legal Compliance: After the asset distribution, the partnership is officially dissolved. Partners must ensure compliance with all legal requirements, including filing appropriate documents with the Illinois Secretary of State and notifying relevant government agencies. Illinois Liquidation of Partnership with Sale and Proportional Distribution of Assets can be a complex process, involving legal, financial, and administrative tasks. Seeking legal advice from a qualified attorney experienced in partnership law is highly recommended ensuring compliance with Illinois laws and to protect the partners' interests throughout the liquidation process.

Illinois Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Illinois Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

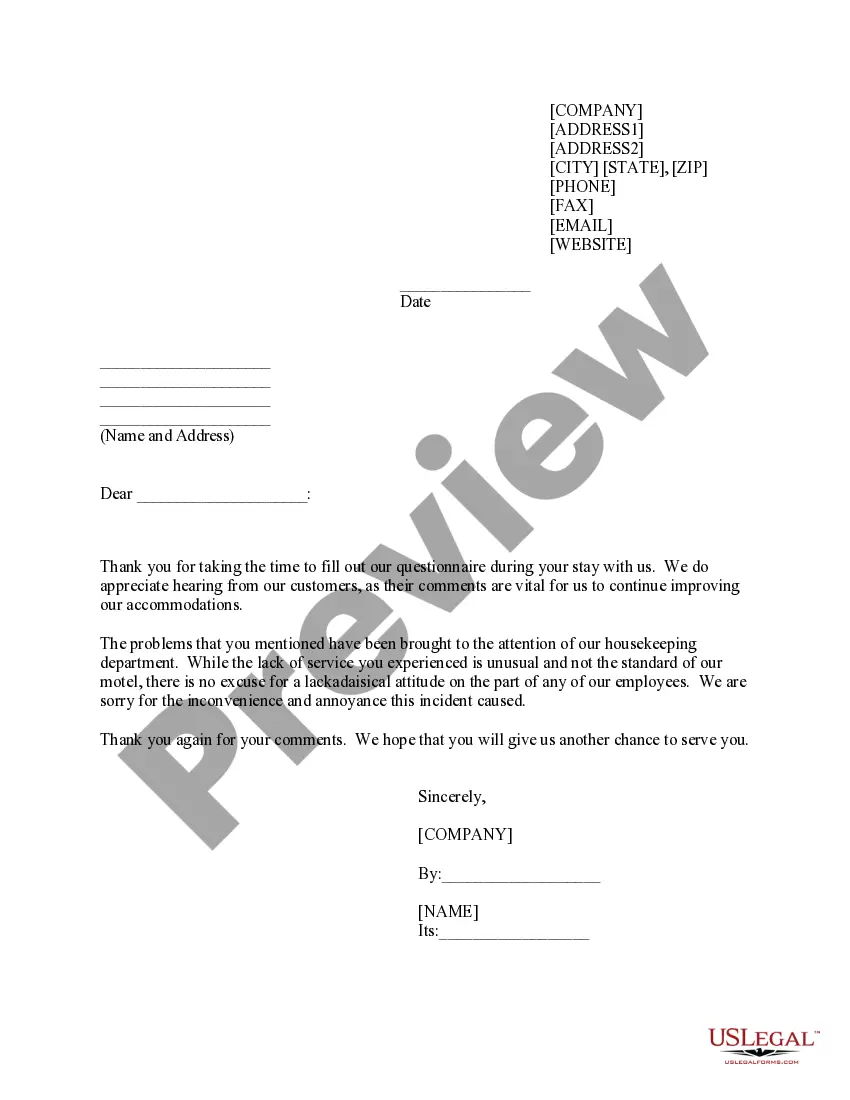

Finding the right legitimate file design could be a battle. Needless to say, there are tons of web templates available online, but how would you discover the legitimate form you want? Utilize the US Legal Forms web site. The support provides thousands of web templates, including the Illinois Liquidation of Partnership with Sale and Proportional Distribution of Assets, which you can use for company and personal requirements. All of the forms are inspected by specialists and satisfy federal and state demands.

Should you be presently listed, log in to your account and click the Download switch to find the Illinois Liquidation of Partnership with Sale and Proportional Distribution of Assets. Utilize your account to appear through the legitimate forms you possess purchased in the past. Visit the My Forms tab of your respective account and acquire an additional duplicate from the file you want.

Should you be a fresh customer of US Legal Forms, allow me to share straightforward directions that you can stick to:

- Initially, make sure you have selected the right form for your personal town/region. It is possible to examine the form using the Review switch and read the form explanation to make certain this is basically the best for you.

- In case the form will not satisfy your needs, use the Seach industry to get the right form.

- When you are certain that the form is proper, click on the Purchase now switch to find the form.

- Select the costs program you need and enter the essential information and facts. Design your account and pay money for your order using your PayPal account or credit card.

- Choose the data file format and acquire the legitimate file design to your device.

- Comprehensive, modify and produce and indication the received Illinois Liquidation of Partnership with Sale and Proportional Distribution of Assets.

US Legal Forms is definitely the biggest collection of legitimate forms for which you will find numerous file web templates. Utilize the service to acquire skillfully-manufactured paperwork that stick to express demands.