Illinois Checklist of Matters to be Considered in Drafting a Verification of an Account: A comprehensive guide to ensuring accuracy and legality in account verifications. In the state of Illinois, there are certain guidelines and considerations that must be followed while drafting a verification of an account. This checklist aims to assist individuals and organizations in complying with these requirements and helps in drafting a legally sound verification document. By adhering to this checklist, parties can ensure that their account verifications are thorough, reliable, and stand up to legal scrutiny. The Illinois Checklist of Matters to be Considered in Drafting a Verification of an Account covers a wide range of crucial points and relevant considerations. Some key matters addressed include: 1. Identity Verification: It is essential to accurately identify the parties involved in the account verification process. This includes providing clear and specific details about the verifying party and the individual or account being verified. 2. Documentation: The checklist emphasizes the importance of obtaining and attaching all relevant supporting documentation. This may include account statements, records of transactions, invoices, receipts, or any other documentation necessary to substantiate the account's accuracy. 3. Accuracy and Completeness: The verification should be detailed, accurate, and comprehensive. Any discrepancies or missing information should be highlighted and rectified to ensure an error-free account verification. 4. Legal Compliance: The checklist serves as a reminder to comply with all relevant federal, state, and local laws and regulations pertaining to account verifications. It ensures that the verification process adheres to Illinois-specific legal requirements and properly addresses any legal issues that may arise. 5. Methodology and Review: The checklist encourages the inclusion of a clear methodology for reviewing and verifying the account. This may involve cross-checking with external sources, using standard accounting principles, or employing other methodologies suitable for the particular account being verified. 6. Signatures and Notarization: The checklist addresses the necessity of obtaining appropriate signatures and notarization to validate the account verification. This ensures that the document carries legal weight and can serve as valid evidence if required. Different Types of Illinois Checklist of Matters to be Considered in Drafting a Verification of an Account: 1. Personal Account Verification: This checklist specifically caters to individuals or small businesses that need to verify personal accounts such as bank accounts, investment portfolios, or credit card statements. 2. Business Account Verification: This checklist is designed for organizations verifying corporate accounts, including financial statements, vendor accounts, or other business-related transactions. 3. Legal Proceedings Account Verification: This checklist focuses on verification requirements in legal settings, where account verifications are necessary for court proceedings, settlement negotiations, or dispute resolutions. By utilizing the Illinois Checklist of Matters to be Considered in Drafting a Verification of an Account, individuals, businesses, and legal professionals can enhance the accuracy, credibility, and legal compliance of their account verifications, ensuring a smooth and effective verification process.

Illinois Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out Illinois Checklist Of Matters To Be Considered In Drafting A Verification Of An Account?

US Legal Forms - among the greatest libraries of legitimate types in America - gives an array of legitimate document themes you may obtain or print. Using the website, you may get 1000s of types for company and personal functions, sorted by groups, claims, or keywords and phrases.You can find the newest models of types just like the Illinois Checklist of Matters to be Considered in Drafting a Verification of an Account in seconds.

If you already have a subscription, log in and obtain Illinois Checklist of Matters to be Considered in Drafting a Verification of an Account from your US Legal Forms catalogue. The Download option can look on each and every type you perspective. You get access to all formerly saved types from the My Forms tab of your own accounts.

If you want to use US Legal Forms the very first time, allow me to share basic directions to help you get started off:

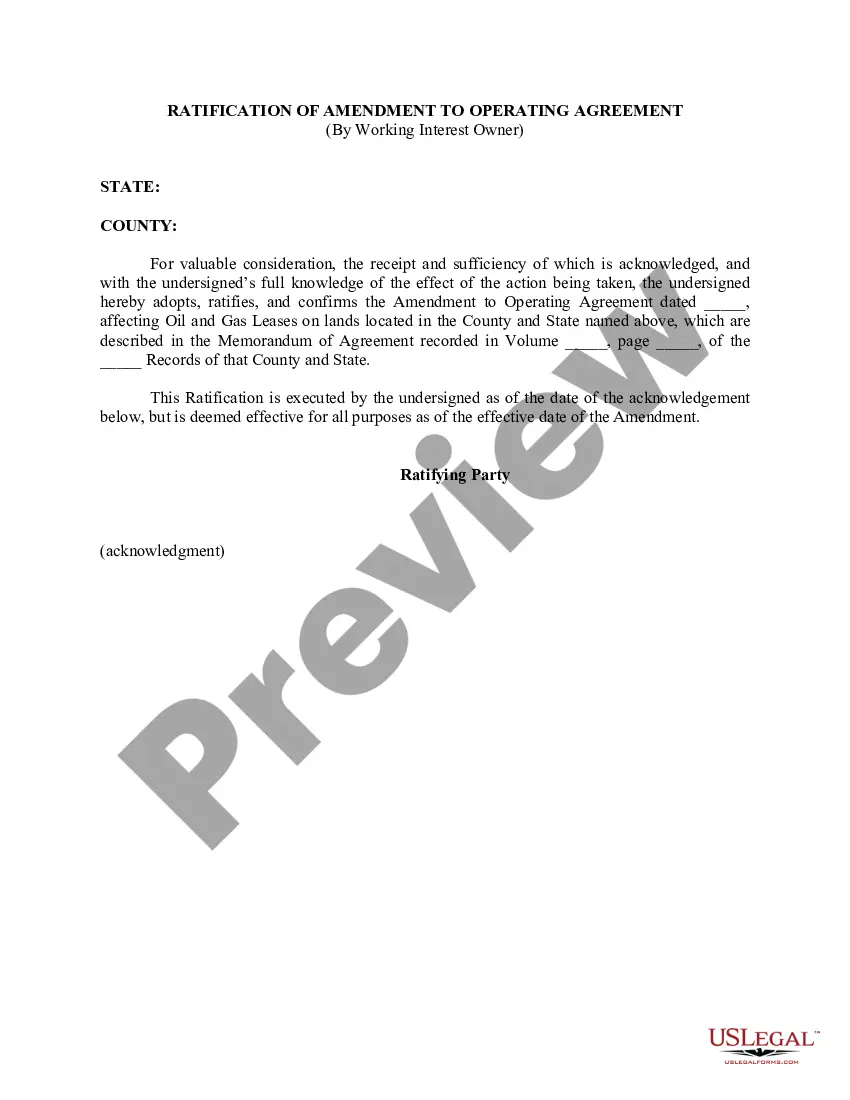

- Make sure you have chosen the right type for the metropolis/area. Select the Review option to check the form`s information. Read the type information to ensure that you have selected the proper type.

- If the type does not satisfy your specifications, utilize the Search industry near the top of the screen to obtain the one that does.

- Should you be satisfied with the shape, affirm your choice by simply clicking the Buy now option. Then, select the rates plan you want and offer your credentials to sign up for the accounts.

- Process the financial transaction. Make use of your Visa or Mastercard or PayPal accounts to accomplish the financial transaction.

- Choose the formatting and obtain the shape on your system.

- Make alterations. Fill out, revise and print and sign the saved Illinois Checklist of Matters to be Considered in Drafting a Verification of an Account.

Each template you included in your money does not have an expiration day which is yours forever. So, if you wish to obtain or print another duplicate, just visit the My Forms portion and click on around the type you will need.

Get access to the Illinois Checklist of Matters to be Considered in Drafting a Verification of an Account with US Legal Forms, the most substantial catalogue of legitimate document themes. Use 1000s of specialist and express-specific themes that fulfill your business or personal requires and specifications.